Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: Assume that on October 31, 2017, Pear purchases 100% of Apples outstanding common shares. However, in this instance, Pear acquired Apple for only $100,000

Required: Assume that on October 31, 2017, Pear purchases 100% of Apples outstanding common shares. However, in this instance, Pear acquired Apple for only $100,000 cash.

1. Calculate goodwill.

2. Prepare necessary working paper journal entry(ies) to facilitate the preparation of Consolidated Financial Statements at acquisition date, October 31, 2017. NOTE: You are not required to prepare a consolidated balance sheet at acquisition date

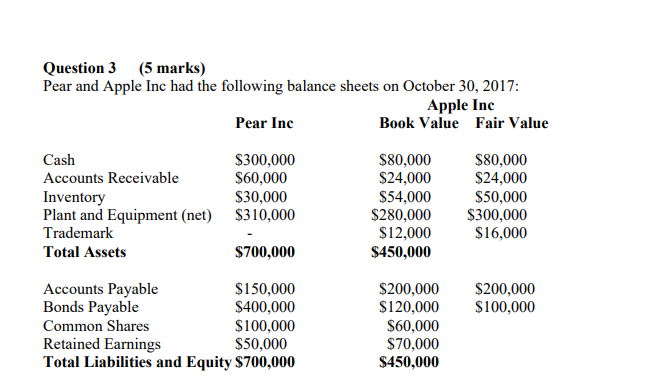

Question 3 (5 marks) Pear and Apple Inc had the following balance sheets on October 30, 2017: Apple Inc Pear Inc Book Value Fair Value Cash Accounts Receivable Inventory Plant and Equipment (net) Trademark Total Assets $300,000 $60,000 $30,000 $310,000 $80,000 $24,000 $54,000 $280,000 $12,000 $450,000 $80,000 $24,000 $50,000 $300,000 $16,000 $700,000 $200,000 $100,000 Accounts Payable $150,000 Bonds Payable $400,000 Common Shares $100,000 Retained Earnings $50,000 Total Liabilities and Equity $700,000 $200,000 $120,000 $60,000 $70,000 $450,000 Question 3 (5 marks) Pear and Apple Inc had the following balance sheets on October 30, 2017: Apple Inc Pear Inc Book Value Fair Value Cash Accounts Receivable Inventory Plant and Equipment (net) Trademark Total Assets $300,000 $60,000 $30,000 $310,000 $80,000 $24,000 $54,000 $280,000 $12,000 $450,000 $80,000 $24,000 $50,000 $300,000 $16,000 $700,000 $200,000 $100,000 Accounts Payable $150,000 Bonds Payable $400,000 Common Shares $100,000 Retained Earnings $50,000 Total Liabilities and Equity $700,000 $200,000 $120,000 $60,000 $70,000 $450,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started