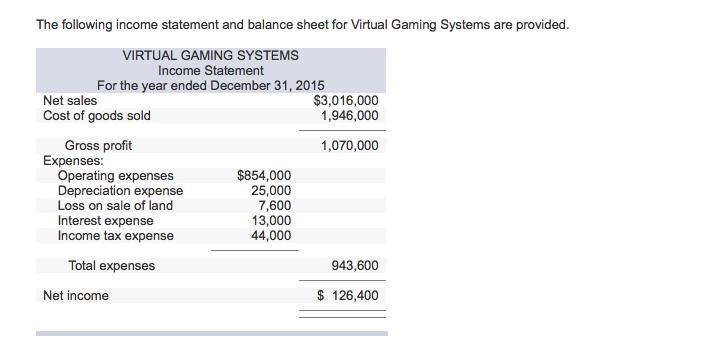

The following income statement and balance sheet for Virtual Gaming Systems are provided. VIRTUAL GAMING SYSTEMS Income Statement For the year ended December 31,

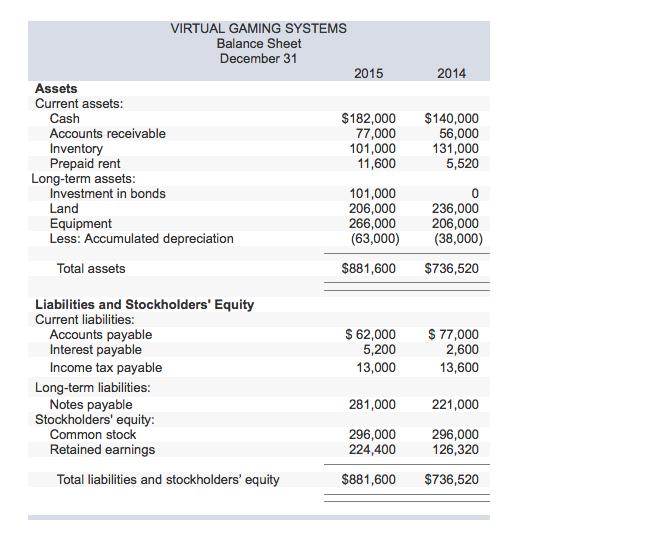

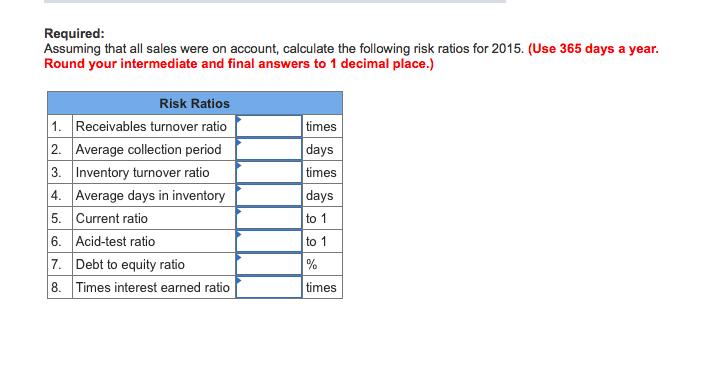

The following income statement and balance sheet for Virtual Gaming Systems are provided. VIRTUAL GAMING SYSTEMS Income Statement For the year ended December 31, 2015 Net sales $3,016,000 1,946,000 Cost of goods sold Gross profit Expenses: Operating expenses Depreciation expense Loss on sale of land 1,070,000 $854,000 25,000 7,600 13,000 44,000 Interest expense Income tax expense Total expenses 943,600 Net income $ 126,400 VIRTUAL GAMING SYSTEMS Balance Sheet December 31 2015 2014 Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds $182,000 77,000 101,000 11,600 $140,000 56,000 131,000 5,520 101,000 206,000 266,000 (63,000) Land Equipment Less: Accumulated depreciation 236,000 206,000 (38,000) Total assets $881,600 $736,520 Liabilities and Stockholders' Equity Current liabilities: $ 77,000 2,600 13,600 Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings $62,000 5,200 13,000 281,000 221,000 296,000 224,400 296,000 126,320 Total liabilities and stockholders' equity $881,600 $736,520 Required: Assuming that all sales were on account, calculate the following risk ratios for 2015. (Use 365 days a year. Round your intermediate and final answers to 1 decimal place.) Risk Ratios 1. Receivables turnover ratio 2. Average collection period 3. Inventory turnover ratio 4. Average days in inventory 5. Current ratio 6. Acid-test ratio 7. Debt to equity ratio 8. Times interest earned ratio times days times days to 1 to 1 % times

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Receiable turn over ratio Net credit sales Average accounts receiv...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started