Answered step by step

Verified Expert Solution

Question

1 Approved Answer

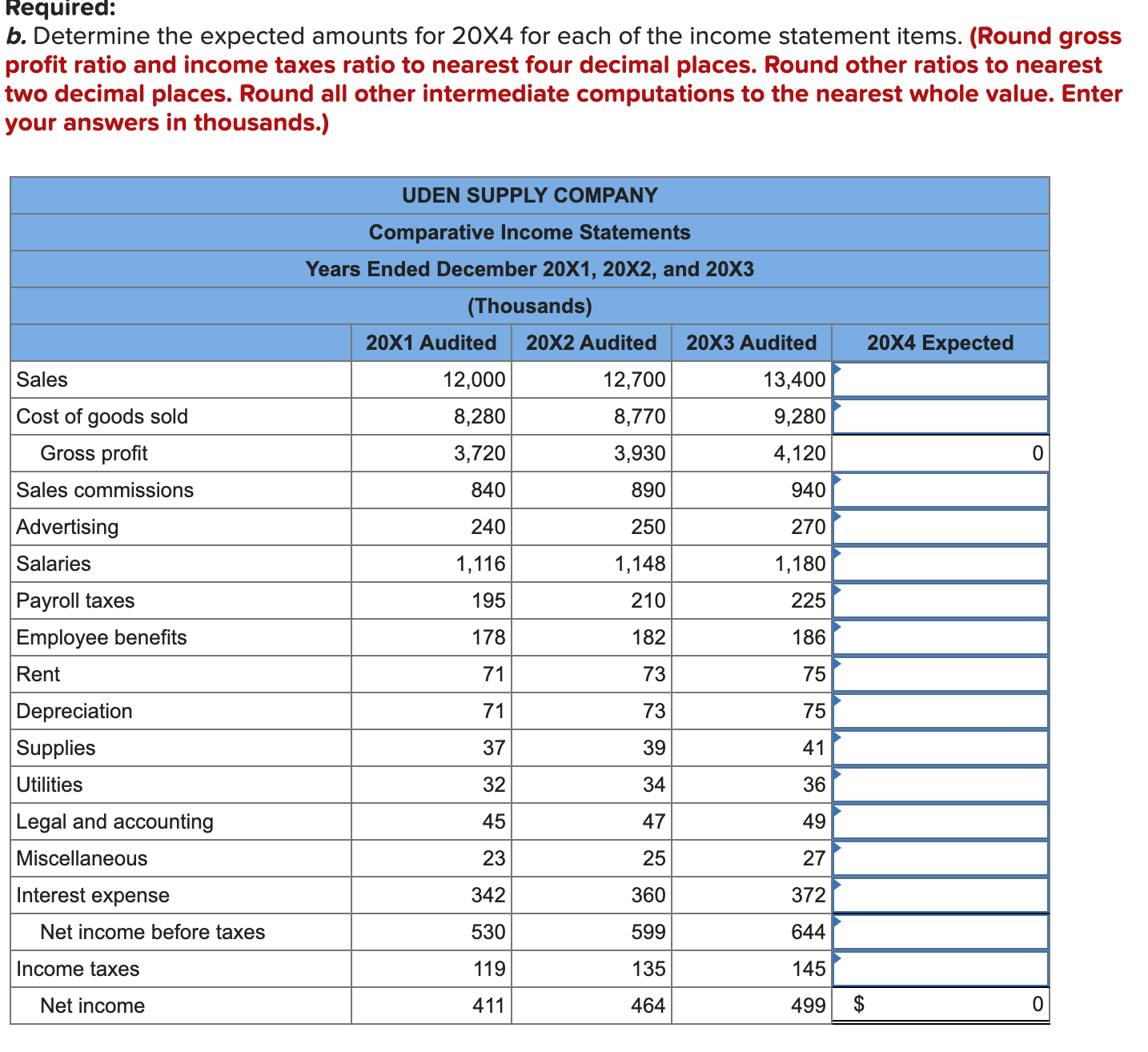

Required: b. Determine the expected amounts for 20X4 for each of the income statement items. (Round gross profit ratio and income taxes ratio to

Required: b. Determine the expected amounts for 20X4 for each of the income statement items. (Round gross profit ratio and income taxes ratio to nearest four decimal places. Round other ratios to nearest two decimal places. Round all other intermediate computations to the nearest whole value. Enter your answers in thousands.) UDEN SUPPLY COMPANY Comparative Income Statements Years Ended December 20X1, 20X2, and 20X3 (Thousands) 20X1 Audited 20X2 Audited 20X3 Audited 20X4 Expected Sales Cost of goods sold Gross profit Sales commissions Advertising 12,000 12,700 13,400 8,280 8,770 9,280 3,720 3,930 4,120 0 840 890 940 240 250 270 Salaries 1,116 1,148 1,180 Payroll taxes 195 210 225 Employee benefits 178 Rent 77 182 186 71 73 Depreciation 71 73 55 75 75 Supplies 37 39 41 Utilities 32 34 36 Legal and accounting 45 47 49 Miscellaneous 23 25 27 Interest expense 342 360 372 Net income before taxes 530 599 644 Income taxes 119 135 145 Net income 411 464 499 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started