REQUIRED:

Calculate the cost of capital to be used in evaluating the proposed introduction of clocks as a new product type on 1 April 2022.

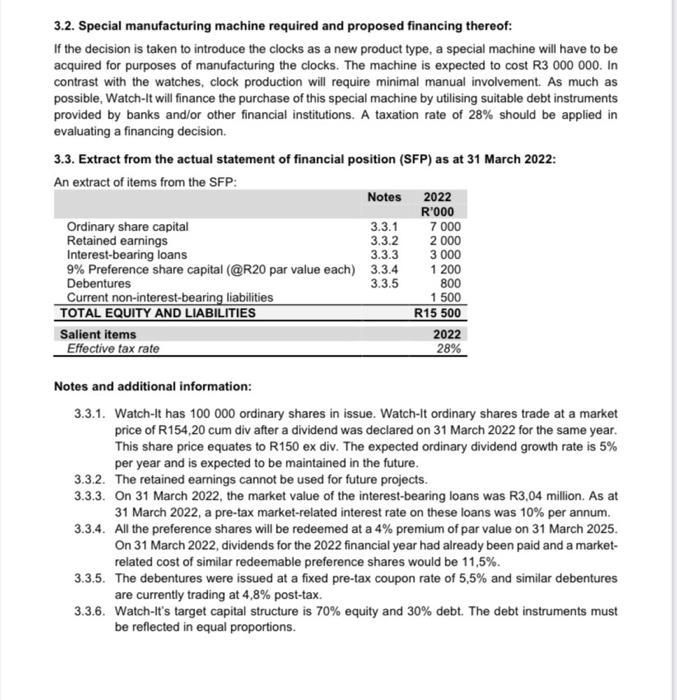

3. PROPOSED INTRODUCTION OF A NEW PRODUCT TYPE FOR THE 2023 FINANCIAL YEAR: "CLOCKS" 3.1. Some general product and cost information for Clocks: After the budget for watches was prepared for the 2023 financial year, Watch-It started considering the introduction of rechargeable bedside alarm clocks ("clocks") as a new product type from 1 April 2022. Each clock will have a limited lifespan of 15 000 hours, after which it will become unusable. Each clock will be packaged in a plastic bag and then in its own box. As with a number of plastic products, the plastic bag used to package a clock poses a safety hazard for small children. The most expensive component of this clock will be the rechargeable lithium-ion battery ("battery"). The cost price per battery will become significantly less as Watch-It buys more thereof from the supplier. Transporting these batteries is highly regulated as they can set alight. A universal USB charger is required to charge the battery but is not included with the clock. The batteries are hazardous to the environment if not disposed of correctly at the end of their useful life. No opening inventory and no closing inventory of clocks or batteries are budgeted for 3.2. Special manufacturing machine required and proposed financing thereof: If the decision is taken to introduce the clocks as a new product type, a special machine will have to be acquired for purposes of manufacturing the clocks. The machine is expected to cost R3 000 000. In contrast with the watches, clock production will require minimal manual involvement. As much as possible, Watch-It will finance the purchase of this special machine by utilising suitable debt instruments provided by banks and/or other financial institutions. A taxation rate of 28% should be applied in evaluating a financing decision. 3.3. Extract from the actual statement of financial position (SFP) as at 31 March 2022: An extract of items from the SFP: Notes 2022 R'000 Ordinary share capital 3.3.1 7000 Retained earnings 3.3.2 2 000 Interest-bearing loans 3.3.3 3 000 9% Preference share capital (@R20 par value each) 3.3.4 1 200 Debentures 3.3.5 800 Current non-interest-bearing liabilities 1 500 TOTAL EQUITY AND LIABILITIES R15 500 Salient items 2022 Effective tax rate 28% Notes and additional information: 3.3.1. Watch-It has 100 000 ordinary shares in issue. Watch-It ordinary shares trade at a market price of R154.20 cum div after a dividend was declared on 31 March 2022 for the same year. This share price equates to R150 ex div. The expected ordinary dividend growth rate is 5% per year and is expected to be maintained in the future. 3.3.2. The retained earnings cannot be used for future projects. 3.3.3. On 31 March 2022, the market value of the interest-bearing loans was R3,04 million. As at 31 March 2022, a pre-tax market-related interest rate on these loans was 10% per annum. 3.3.4. All the preference shares will be redeemed at a 4% premium of par value on 31 March 2025. On 31 March 2022, dividends for the 2022 financial year had already been paid and a market- related cost of similar redeemable preference shares would be 11,5%. 3.3.5. The debentures were issued at a fixed pre-tax coupon rate of 5,5% and similar debentures are currently trading at 4,8% post-tax. 3.3.6. Watch-it's target capital structure is 70% equity and 30% debt. The debt instruments must be reflected in equal proportions. 3. PROPOSED INTRODUCTION OF A NEW PRODUCT TYPE FOR THE 2023 FINANCIAL YEAR: "CLOCKS" 3.1. Some general product and cost information for Clocks: After the budget for watches was prepared for the 2023 financial year, Watch-It started considering the introduction of rechargeable bedside alarm clocks ("clocks") as a new product type from 1 April 2022. Each clock will have a limited lifespan of 15 000 hours, after which it will become unusable. Each clock will be packaged in a plastic bag and then in its own box. As with a number of plastic products, the plastic bag used to package a clock poses a safety hazard for small children. The most expensive component of this clock will be the rechargeable lithium-ion battery ("battery"). The cost price per battery will become significantly less as Watch-It buys more thereof from the supplier. Transporting these batteries is highly regulated as they can set alight. A universal USB charger is required to charge the battery but is not included with the clock. The batteries are hazardous to the environment if not disposed of correctly at the end of their useful life. No opening inventory and no closing inventory of clocks or batteries are budgeted for 3.2. Special manufacturing machine required and proposed financing thereof: If the decision is taken to introduce the clocks as a new product type, a special machine will have to be acquired for purposes of manufacturing the clocks. The machine is expected to cost R3 000 000. In contrast with the watches, clock production will require minimal manual involvement. As much as possible, Watch-It will finance the purchase of this special machine by utilising suitable debt instruments provided by banks and/or other financial institutions. A taxation rate of 28% should be applied in evaluating a financing decision. 3.3. Extract from the actual statement of financial position (SFP) as at 31 March 2022: An extract of items from the SFP: Notes 2022 R'000 Ordinary share capital 3.3.1 7000 Retained earnings 3.3.2 2 000 Interest-bearing loans 3.3.3 3 000 9% Preference share capital (@R20 par value each) 3.3.4 1 200 Debentures 3.3.5 800 Current non-interest-bearing liabilities 1 500 TOTAL EQUITY AND LIABILITIES R15 500 Salient items 2022 Effective tax rate 28% Notes and additional information: 3.3.1. Watch-It has 100 000 ordinary shares in issue. Watch-It ordinary shares trade at a market price of R154.20 cum div after a dividend was declared on 31 March 2022 for the same year. This share price equates to R150 ex div. The expected ordinary dividend growth rate is 5% per year and is expected to be maintained in the future. 3.3.2. The retained earnings cannot be used for future projects. 3.3.3. On 31 March 2022, the market value of the interest-bearing loans was R3,04 million. As at 31 March 2022, a pre-tax market-related interest rate on these loans was 10% per annum. 3.3.4. All the preference shares will be redeemed at a 4% premium of par value on 31 March 2025. On 31 March 2022, dividends for the 2022 financial year had already been paid and a market- related cost of similar redeemable preference shares would be 11,5%. 3.3.5. The debentures were issued at a fixed pre-tax coupon rate of 5,5% and similar debentures are currently trading at 4,8% post-tax. 3.3.6. Watch-it's target capital structure is 70% equity and 30% debt. The debt instruments must be reflected in equal proportions