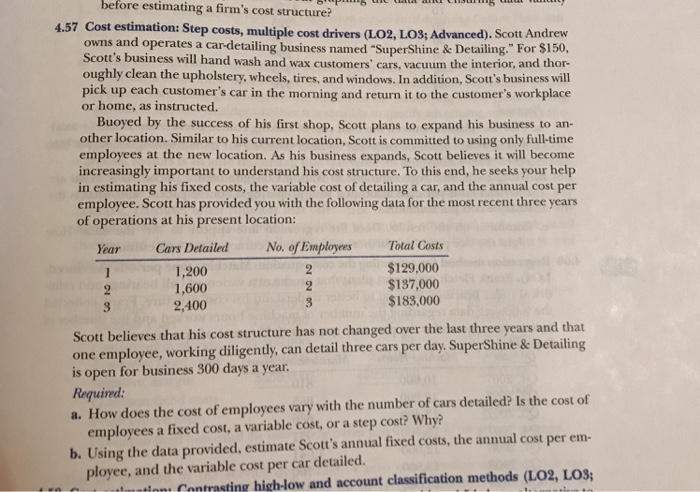

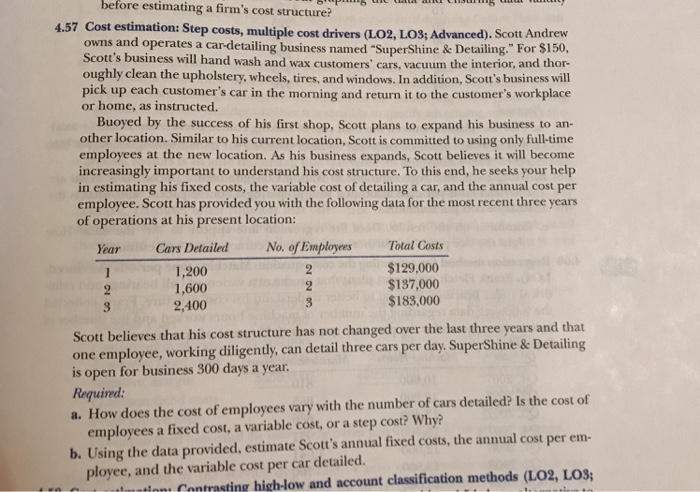

Required: Classify each cost as per the cost hierarchy (i.e., classify each cost as being a unit, batch, products, or facility-level cost). Provide a brief rationale for each classification. 2.45/Hierarchical cost structures cost classifications (L04). Sun and Sand Hotels (S&S). an exclusive beach resort, offers all-inclusive vacations--the package price includes suicos the room, food, and access to all facilities. However, alcoholic beverages and special a snorkeling services (e.g., boat tours) are extra. S&S offers many attractions such as an enclosed lagoon within which guests may pet dolphins. The resort also offers snorkeling and diving tours at a nearby coral reef. Sun and Sand is interested in calculating its cost to host a typical member. Customers usually are couples, and the average couple stays for three nights and four days. Required: Treating the number of couples as a unit of activity, identify a unit-, batch-product-and facility level cost for Sun and Sand. 54pm C C C C 115 L ILY before estimating a firm's cost structure? 4.57 Cost estimation: Step costs, multiple cost drivers (LO2, LO3; Advanced). Scott Andrew owns and operates a car detailing business named "SuperShine & Detailing. For Scott's business will hand wash and wax customers' cars, vacuum the interior, and thor- oughly clean the upholstery, wheels, tires, and windows. In addition, Scott's business will pick up each customer's car in the morning and return it to the customer's workplace or home, as instructed. Buoyed by the success of his first shop. Scott plans to expand his business to an- other location. Similar to his current location, Scott is committed to using only full-time employees at the new location. As his business expands, Scott believes it will become increasingly important to understand his cost structure. To this end, he seeks your help og his fixed costs, the variable cost of detailing a car, and the annual cost per employee. Scott has provided you with the following data for the most recent three years of operations at his present location: Year Cars Detailed No. of Employees Total Costs 1,200 $129.000 $187,000 9 2,400 $183,000 1,600 Scott believes that his cost structure has not changed over the last three years and that one employee, working diligently, can detail three cars per day. SuperShine & Detailing is open for business 300 days a year. Required: a. How does the cost of employees vary with the number of cars detailed? Is the cost of employees a fixed cost, a variable cost, or a step cost? Why?! b. Using the data provided, estimate Scott's annual fixed costs, the annual cost per em ployee, and the variable cost per car detailed. t ion. Contrasting high-low and account classification methods (LO2, LO3; 1 Required: Classify each cost as per the cost hierarchy (i.e., classify each cost as being a unit, batch, products, or facility-level cost). Provide a brief rationale for each classification. 2.45/Hierarchical cost structures cost classifications (L04). Sun and Sand Hotels (S&S). an exclusive beach resort, offers all-inclusive vacations--the package price includes suicos the room, food, and access to all facilities. However, alcoholic beverages and special a snorkeling services (e.g., boat tours) are extra. S&S offers many attractions such as an enclosed lagoon within which guests may pet dolphins. The resort also offers snorkeling and diving tours at a nearby coral reef. Sun and Sand is interested in calculating its cost to host a typical member. Customers usually are couples, and the average couple stays for three nights and four days. Required: Treating the number of couples as a unit of activity, identify a unit-, batch-product-and facility level cost for Sun and Sand. 54pm C C C C 115 L ILY before estimating a firm's cost structure? 4.57 Cost estimation: Step costs, multiple cost drivers (LO2, LO3; Advanced). Scott Andrew owns and operates a car detailing business named "SuperShine & Detailing. For Scott's business will hand wash and wax customers' cars, vacuum the interior, and thor- oughly clean the upholstery, wheels, tires, and windows. In addition, Scott's business will pick up each customer's car in the morning and return it to the customer's workplace or home, as instructed. Buoyed by the success of his first shop. Scott plans to expand his business to an- other location. Similar to his current location, Scott is committed to using only full-time employees at the new location. As his business expands, Scott believes it will become increasingly important to understand his cost structure. To this end, he seeks your help og his fixed costs, the variable cost of detailing a car, and the annual cost per employee. Scott has provided you with the following data for the most recent three years of operations at his present location: Year Cars Detailed No. of Employees Total Costs 1,200 $129.000 $187,000 9 2,400 $183,000 1,600 Scott believes that his cost structure has not changed over the last three years and that one employee, working diligently, can detail three cars per day. SuperShine & Detailing is open for business 300 days a year. Required: a. How does the cost of employees vary with the number of cars detailed? Is the cost of employees a fixed cost, a variable cost, or a step cost? Why?! b. Using the data provided, estimate Scott's annual fixed costs, the annual cost per em ployee, and the variable cost per car detailed. t ion. Contrasting high-low and account classification methods (LO2, LO3; 1