Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: Complete Davids federal tax return for 2022. Use Form 1040, Schedule 1, Schedule 3, Form 886 and Form 8963. David attended community college full-time

Required: Complete Davids federal tax return for 2022. Use Form 1040, Schedule 1, Schedule 3, Form 886 and Form 8963.

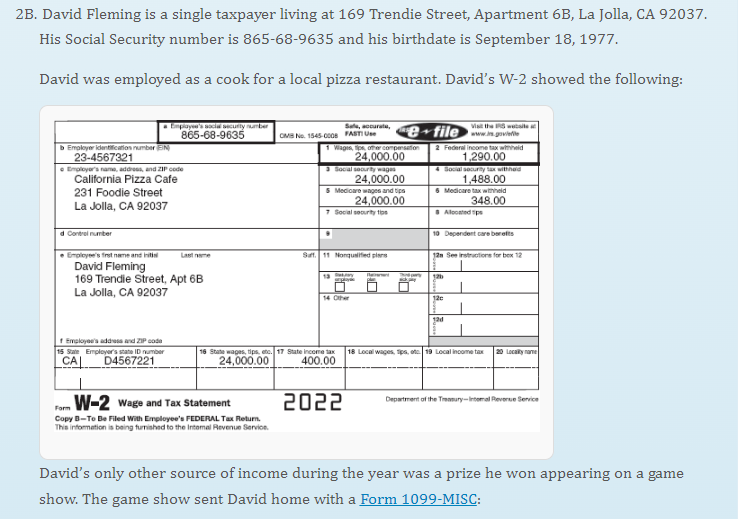

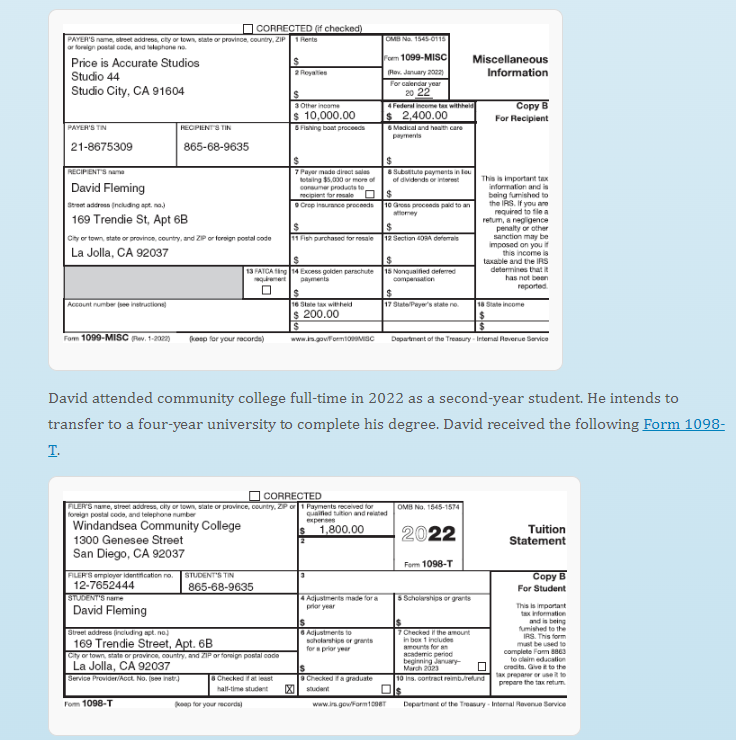

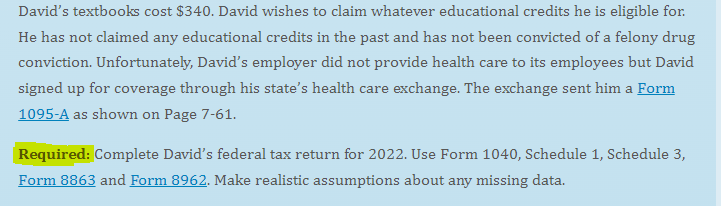

David attended community college full-time in 2022 as a second-year student. He intends to transfer to a four-year university to complete his degree. David received the following Form 1098T. David's textbooks cost $340. David wishes to claim whatever educational credits he is eligible for. He has not claimed any educational credits in the past and has not been convicted of a felony drug conviction. Unfortunately, David's employer did not provide health care to its employees but David signed up for coverage through his state's health care exchange. The exchange sent him a Form 1095-A as shown on Page 7-61. Required: Complete David's federal tax return for 2022. Use Form 1040, Schedule 1, Schedule 3, Form 8863 and Form 8962 . Make realistic assumptions about any missing data. B. David Fleming is a single taxpayer living at 169 Trendie Street, Apartment 6B, La Jolla, CA 92037. His Social Security number is 865-68-9635 and his birthdate is September 18, 1977. David was employed as a cook for a local pizza restaurant. David's W-2 showed the following: David's only other source of income during the year was a prize he won appearing on a game show. The game show sent David home with a Form 1099-MISC: David attended community college full-time in 2022 as a second-year student. He intends to transfer to a four-year university to complete his degree. David received the following Form 1098T. David's textbooks cost $340. David wishes to claim whatever educational credits he is eligible for. He has not claimed any educational credits in the past and has not been convicted of a felony drug conviction. Unfortunately, David's employer did not provide health care to its employees but David signed up for coverage through his state's health care exchange. The exchange sent him a Form 1095-A as shown on Page 7-61. Required: Complete David's federal tax return for 2022. Use Form 1040, Schedule 1, Schedule 3, Form 8863 and Form 8962 . Make realistic assumptions about any missing data. B. David Fleming is a single taxpayer living at 169 Trendie Street, Apartment 6B, La Jolla, CA 92037. His Social Security number is 865-68-9635 and his birthdate is September 18, 1977. David was employed as a cook for a local pizza restaurant. David's W-2 showed the following: David's only other source of income during the year was a prize he won appearing on a game show. The game show sent David home with a Form 1099-MISC

David attended community college full-time in 2022 as a second-year student. He intends to transfer to a four-year university to complete his degree. David received the following Form 1098T. David's textbooks cost $340. David wishes to claim whatever educational credits he is eligible for. He has not claimed any educational credits in the past and has not been convicted of a felony drug conviction. Unfortunately, David's employer did not provide health care to its employees but David signed up for coverage through his state's health care exchange. The exchange sent him a Form 1095-A as shown on Page 7-61. Required: Complete David's federal tax return for 2022. Use Form 1040, Schedule 1, Schedule 3, Form 8863 and Form 8962 . Make realistic assumptions about any missing data. B. David Fleming is a single taxpayer living at 169 Trendie Street, Apartment 6B, La Jolla, CA 92037. His Social Security number is 865-68-9635 and his birthdate is September 18, 1977. David was employed as a cook for a local pizza restaurant. David's W-2 showed the following: David's only other source of income during the year was a prize he won appearing on a game show. The game show sent David home with a Form 1099-MISC: David attended community college full-time in 2022 as a second-year student. He intends to transfer to a four-year university to complete his degree. David received the following Form 1098T. David's textbooks cost $340. David wishes to claim whatever educational credits he is eligible for. He has not claimed any educational credits in the past and has not been convicted of a felony drug conviction. Unfortunately, David's employer did not provide health care to its employees but David signed up for coverage through his state's health care exchange. The exchange sent him a Form 1095-A as shown on Page 7-61. Required: Complete David's federal tax return for 2022. Use Form 1040, Schedule 1, Schedule 3, Form 8863 and Form 8962 . Make realistic assumptions about any missing data. B. David Fleming is a single taxpayer living at 169 Trendie Street, Apartment 6B, La Jolla, CA 92037. His Social Security number is 865-68-9635 and his birthdate is September 18, 1977. David was employed as a cook for a local pizza restaurant. David's W-2 showed the following: David's only other source of income during the year was a prize he won appearing on a game show. The game show sent David home with a Form 1099-MISC Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started