Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: Complete Johns federal tax return for 2021. Use Form 1040, Schedule 1, Schedule A, and Schedule D as needed to complete this tax return

Required: Complete Johns federal tax return for 2021. Use Form 1040, Schedule 1, Schedule A, and Schedule D as needed to complete this tax return

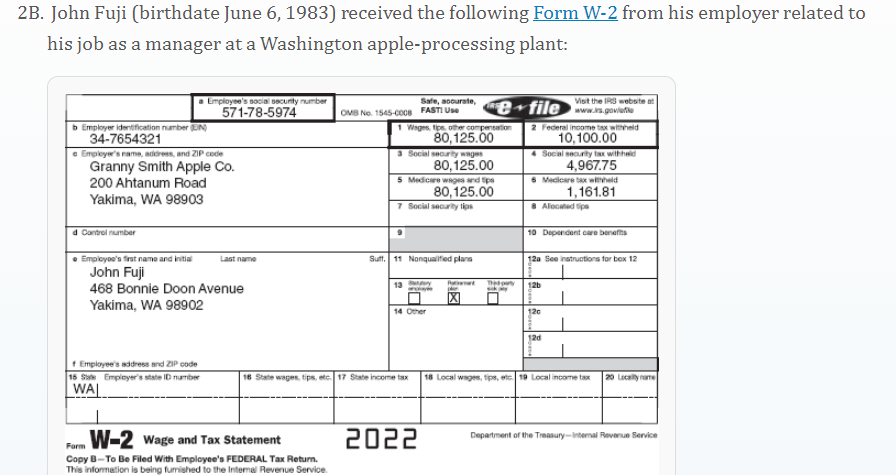

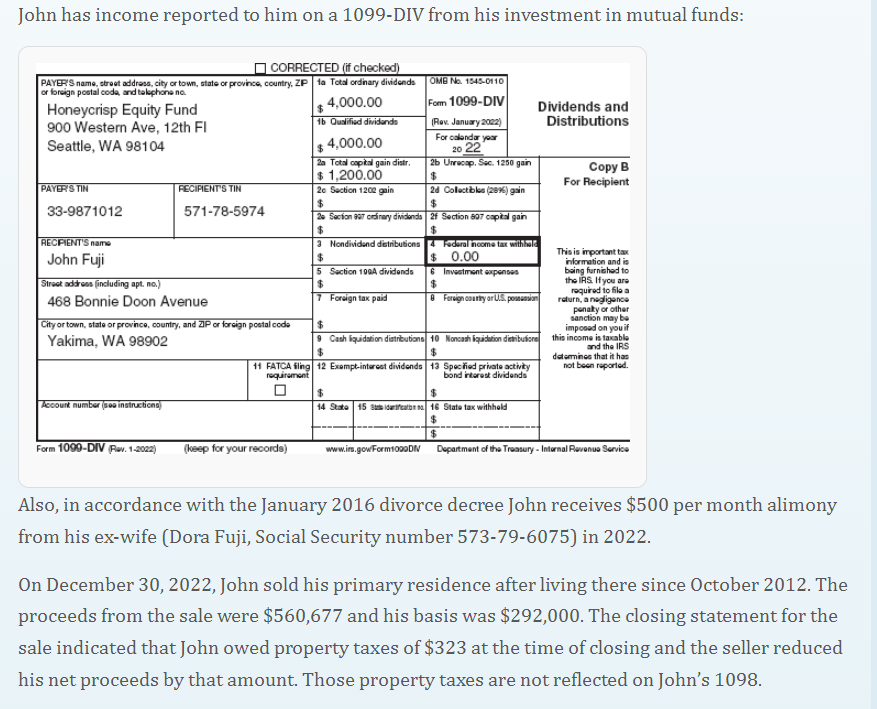

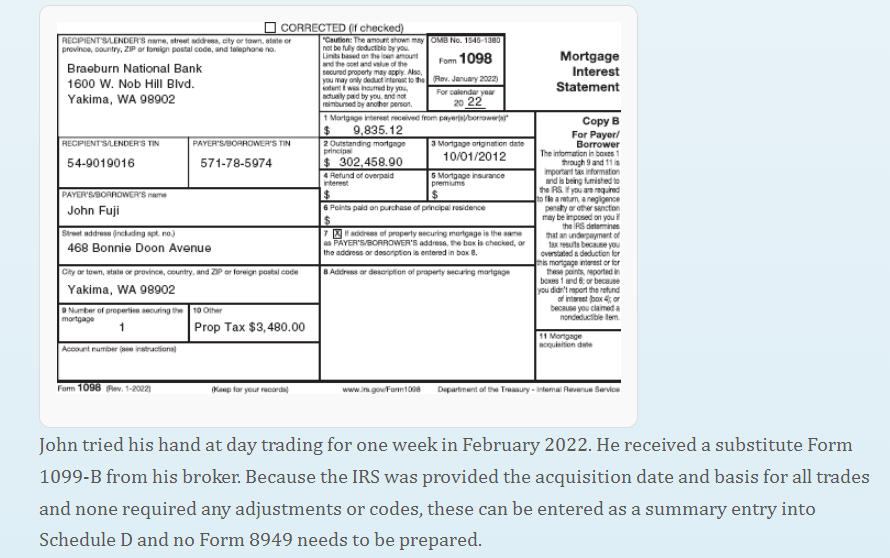

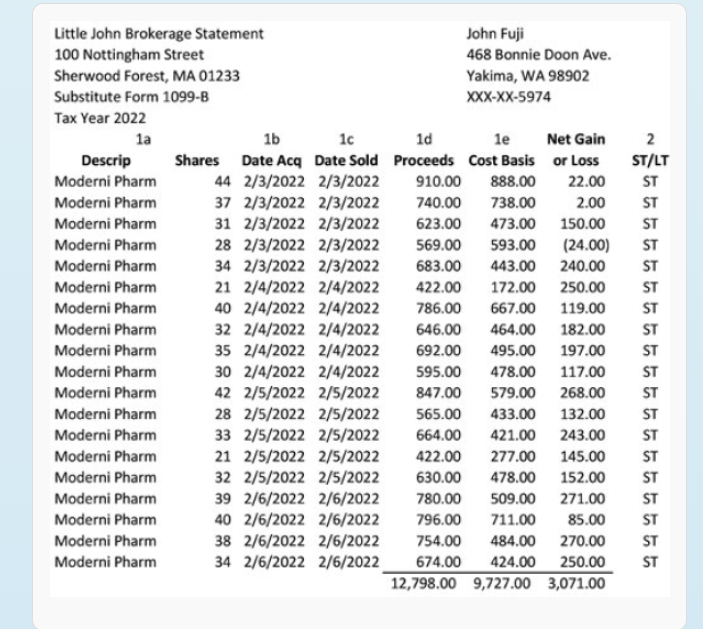

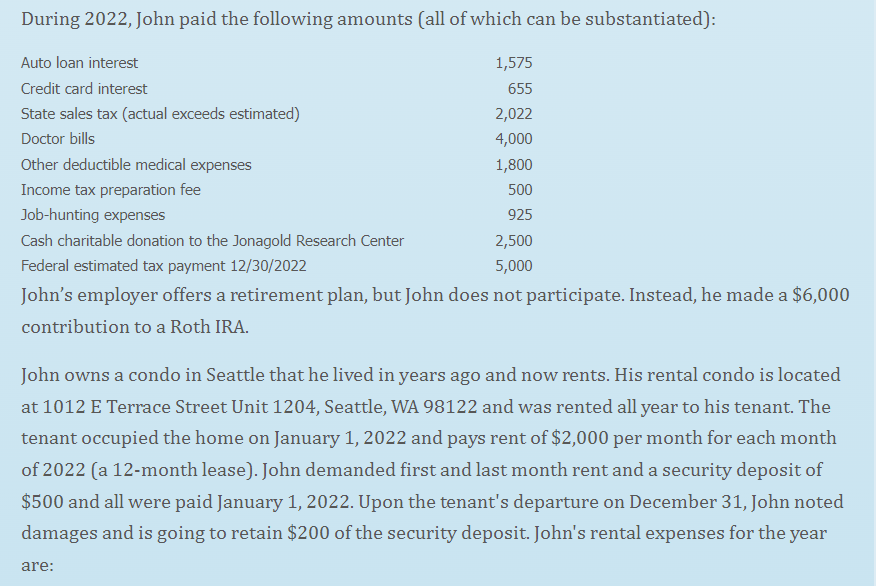

John has income reported to him on a 1099-DIV from his investment in mutual funds: Also, in accordance with the January 2016 divorce decree John receives $500 per month alimony from his ex-wife (Dora Fuji, Social Security number 573-79-6075) in 2022. On December 30, 2022, John sold his primary residence after living there since October 2012. The proceeds from the sale were $560,677 and his basis was $292,000. The closing statement for the sale indicated that John owed property taxes of $323 at the time of closing and the seller reduced his net proceeds by that amount. Those property taxes are not reflected on John's 1098. B. John Fuji (birthdate June 6, 1983) received the following Form W-2 from his employer related to his job as a manager at a Washington apple-processing plant: Form UN= Wage and Tax Statement Copy B-To Be Filed With Empleyee's FEDCRAL Tax Retum. During 2022, John paid the following amounts (all of which can be substantiated): John's employer offers a retirement plan, but John does not participate. Instead, he made a $6,000 contribution to a Roth IRA. John owns a condo in Seattle that he lived in years ago and now rents. His rental condo is located at 1012 E Terrace Street Unit 1204, Seattle, WA 98122 and was rented all year to his tenant. The tenant occupied the home on January 1, 2022 and pays rent of $2,000 per month for each month of 2022 (a 12-month lease). John demanded first and last month rent and a security deposit of $500 and all were paid January 1, 2022. Upon the tenant's departure on December 31, John noted damages and is going to retain $200 of the security deposit. John's rental expenses for the year are: \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Little John Brokerage Statement } & \multicolumn{3}{|l|}{ John Fuji } \\ \hline \multicolumn{5}{|c|}{100 Nottingham Street } & \multicolumn{3}{|c|}{468 Bonnie Doon Ave. } \\ \hline \multicolumn{5}{|c|}{ Sherwood Forest, MA 01233} & \multicolumn{3}{|c|}{ Yakima, WA 98902} \\ \hline \multicolumn{5}{|c|}{ Substitute Form 1099-B } & \multicolumn{3}{|c|}{xXXXX5974} \\ \hline \multicolumn{8}{|l|}{ Tax Year 2022} \\ \hline \multicolumn{2}{|l|}{ 1a } & \multirow{2}{*}{1bDateAcq} & \multirow{2}{*}{1cDateSold} & \multirow{2}{*}{1dProceeds} & \multirow{2}{*}{1eCostBasis} & \multirow{2}{*}{NetGainorLoss} & \multirow{2}{*}{2ST/LT} \\ \hline Descrip & Shares & & & & & & \\ \hline Moderni Pharm & 44 & 2/3/2022 & 2/3/2022 & 910.00 & 888.00 & 22.00 & ST \\ \hline Moderni Pharm & 37 & 2/3/2022 & 2/3/2022 & 740.00 & 738.00 & 2.00 & ST \\ \hline Moderni Pharm & 31 & 2/3/2022 & 2/3/2022 & 623.00 & 473.00 & 150.00 & ST \\ \hline Moderni Pharm & 28 & 2/3/2022 & 2/3/2022 & 569.00 & 593.00 & (24.00) & ST \\ \hline Moderni Pharm & 34 & 2/3/2022 & 2/3/2022 & 683.00 & 443.00 & 240.00 & ST \\ \hline Moderni Pharm & 21 & 2/4/2022 & 2/4/2022 & 422.00 & 172.00 & 250.00 & ST \\ \hline Moderni Pharm & 40 & 2/4/2022 & 2/4/2022 & 786.00 & 667.00 & 119.00 & ST \\ \hline Moderni Pharm & 32 & 2/4/2022 & 2/4/2022 & 646.00 & 464.00 & 182.00 & ST \\ \hline Moderni Pharm & 35 & 2/4/2022 & 2/4/2022 & 692.00 & 495.00 & 197.00 & ST \\ \hline Moderni Pharm & 30 & 2/4/2022 & 2/4/2022 & 595.00 & 478.00 & 117.00 & ST \\ \hline Moderni Pharm & 42 & 2/5/2022 & 2/5/2022 & 847.00 & 579.00 & 268.00 & ST \\ \hline Moderni Pharm & 28 & 2/5/2022 & 2/5/2022 & 565.00 & 433.00 & 132.00 & ST \\ \hline Moderni Pharm & 33 & 2/5/2022 & 2/5/2022 & 664.00 & 421.00 & 243.00 & ST \\ \hline Moderni Pharm & 21 & 2/5/2022 & 2/5/2022 & 422.00 & 277.00 & 145.00 & ST \\ \hline Moderni Pharm & 32 & 2/5/2022 & 2/5/2022 & 630.00 & 478.00 & 152.00 & ST \\ \hline Moderni Pharm & 39 & 2/6/2022 & 2/6/2022 & 780.00 & 509.00 & 271.00 & ST \\ \hline Moderni Pharm & 40 & 2/6/2022 & 2/6/2022 & 796.00 & 711.00 & 85.00 & ST \\ \hline Moderni Pharm & 38 & 2/6/2022 & 2/6/2022 & 754.00 & 484.00 & 270.00 & ST \\ \hline \multirow[t]{2}{*}{ Moderni Pharm } & 34 & 2/6/2022 & 2/6/2022 & 674.00 & 424.00 & 250.00 & ST \\ \hline & & & & 12,798.00 & 9,727.00 & 3,071.00 & \\ \hline \end{tabular} John actively manages the rental home. He probably spends about seven hours per month on the rental. Required: Complete John's federal tax return for 2021. Use Form 1040, Schedule 1, Schedule A, and Schedule D as needed to complete this tax return. John tried his hand at day trading for one week in February 2022. He received a substitute Form 1099-B from his broker. Because the IRS was provided the acquisition date and basis for all trades and none required any adjustments or codes, these can be entered as a summary entry into Schedule D and no Form 8949 needs to be prepared. John has income reported to him on a 1099-DIV from his investment in mutual funds: Also, in accordance with the January 2016 divorce decree John receives $500 per month alimony from his ex-wife (Dora Fuji, Social Security number 573-79-6075) in 2022. On December 30, 2022, John sold his primary residence after living there since October 2012. The proceeds from the sale were $560,677 and his basis was $292,000. The closing statement for the sale indicated that John owed property taxes of $323 at the time of closing and the seller reduced his net proceeds by that amount. Those property taxes are not reflected on John's 1098. B. John Fuji (birthdate June 6, 1983) received the following Form W-2 from his employer related to his job as a manager at a Washington apple-processing plant: Form UN= Wage and Tax Statement Copy B-To Be Filed With Empleyee's FEDCRAL Tax Retum. During 2022, John paid the following amounts (all of which can be substantiated): John's employer offers a retirement plan, but John does not participate. Instead, he made a $6,000 contribution to a Roth IRA. John owns a condo in Seattle that he lived in years ago and now rents. His rental condo is located at 1012 E Terrace Street Unit 1204, Seattle, WA 98122 and was rented all year to his tenant. The tenant occupied the home on January 1, 2022 and pays rent of $2,000 per month for each month of 2022 (a 12-month lease). John demanded first and last month rent and a security deposit of $500 and all were paid January 1, 2022. Upon the tenant's departure on December 31, John noted damages and is going to retain $200 of the security deposit. John's rental expenses for the year are: \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Little John Brokerage Statement } & \multicolumn{3}{|l|}{ John Fuji } \\ \hline \multicolumn{5}{|c|}{100 Nottingham Street } & \multicolumn{3}{|c|}{468 Bonnie Doon Ave. } \\ \hline \multicolumn{5}{|c|}{ Sherwood Forest, MA 01233} & \multicolumn{3}{|c|}{ Yakima, WA 98902} \\ \hline \multicolumn{5}{|c|}{ Substitute Form 1099-B } & \multicolumn{3}{|c|}{xXXXX5974} \\ \hline \multicolumn{8}{|l|}{ Tax Year 2022} \\ \hline \multicolumn{2}{|l|}{ 1a } & \multirow{2}{*}{1bDateAcq} & \multirow{2}{*}{1cDateSold} & \multirow{2}{*}{1dProceeds} & \multirow{2}{*}{1eCostBasis} & \multirow{2}{*}{NetGainorLoss} & \multirow{2}{*}{2ST/LT} \\ \hline Descrip & Shares & & & & & & \\ \hline Moderni Pharm & 44 & 2/3/2022 & 2/3/2022 & 910.00 & 888.00 & 22.00 & ST \\ \hline Moderni Pharm & 37 & 2/3/2022 & 2/3/2022 & 740.00 & 738.00 & 2.00 & ST \\ \hline Moderni Pharm & 31 & 2/3/2022 & 2/3/2022 & 623.00 & 473.00 & 150.00 & ST \\ \hline Moderni Pharm & 28 & 2/3/2022 & 2/3/2022 & 569.00 & 593.00 & (24.00) & ST \\ \hline Moderni Pharm & 34 & 2/3/2022 & 2/3/2022 & 683.00 & 443.00 & 240.00 & ST \\ \hline Moderni Pharm & 21 & 2/4/2022 & 2/4/2022 & 422.00 & 172.00 & 250.00 & ST \\ \hline Moderni Pharm & 40 & 2/4/2022 & 2/4/2022 & 786.00 & 667.00 & 119.00 & ST \\ \hline Moderni Pharm & 32 & 2/4/2022 & 2/4/2022 & 646.00 & 464.00 & 182.00 & ST \\ \hline Moderni Pharm & 35 & 2/4/2022 & 2/4/2022 & 692.00 & 495.00 & 197.00 & ST \\ \hline Moderni Pharm & 30 & 2/4/2022 & 2/4/2022 & 595.00 & 478.00 & 117.00 & ST \\ \hline Moderni Pharm & 42 & 2/5/2022 & 2/5/2022 & 847.00 & 579.00 & 268.00 & ST \\ \hline Moderni Pharm & 28 & 2/5/2022 & 2/5/2022 & 565.00 & 433.00 & 132.00 & ST \\ \hline Moderni Pharm & 33 & 2/5/2022 & 2/5/2022 & 664.00 & 421.00 & 243.00 & ST \\ \hline Moderni Pharm & 21 & 2/5/2022 & 2/5/2022 & 422.00 & 277.00 & 145.00 & ST \\ \hline Moderni Pharm & 32 & 2/5/2022 & 2/5/2022 & 630.00 & 478.00 & 152.00 & ST \\ \hline Moderni Pharm & 39 & 2/6/2022 & 2/6/2022 & 780.00 & 509.00 & 271.00 & ST \\ \hline Moderni Pharm & 40 & 2/6/2022 & 2/6/2022 & 796.00 & 711.00 & 85.00 & ST \\ \hline Moderni Pharm & 38 & 2/6/2022 & 2/6/2022 & 754.00 & 484.00 & 270.00 & ST \\ \hline \multirow[t]{2}{*}{ Moderni Pharm } & 34 & 2/6/2022 & 2/6/2022 & 674.00 & 424.00 & 250.00 & ST \\ \hline & & & & 12,798.00 & 9,727.00 & 3,071.00 & \\ \hline \end{tabular} John actively manages the rental home. He probably spends about seven hours per month on the rental. Required: Complete John's federal tax return for 2021. Use Form 1040, Schedule 1, Schedule A, and Schedule D as needed to complete this tax return. John tried his hand at day trading for one week in February 2022. He received a substitute Form 1099-B from his broker. Because the IRS was provided the acquisition date and basis for all trades and none required any adjustments or codes, these can be entered as a summary entry into Schedule D and no Form 8949 needs to be prepared

John has income reported to him on a 1099-DIV from his investment in mutual funds: Also, in accordance with the January 2016 divorce decree John receives $500 per month alimony from his ex-wife (Dora Fuji, Social Security number 573-79-6075) in 2022. On December 30, 2022, John sold his primary residence after living there since October 2012. The proceeds from the sale were $560,677 and his basis was $292,000. The closing statement for the sale indicated that John owed property taxes of $323 at the time of closing and the seller reduced his net proceeds by that amount. Those property taxes are not reflected on John's 1098. B. John Fuji (birthdate June 6, 1983) received the following Form W-2 from his employer related to his job as a manager at a Washington apple-processing plant: Form UN= Wage and Tax Statement Copy B-To Be Filed With Empleyee's FEDCRAL Tax Retum. During 2022, John paid the following amounts (all of which can be substantiated): John's employer offers a retirement plan, but John does not participate. Instead, he made a $6,000 contribution to a Roth IRA. John owns a condo in Seattle that he lived in years ago and now rents. His rental condo is located at 1012 E Terrace Street Unit 1204, Seattle, WA 98122 and was rented all year to his tenant. The tenant occupied the home on January 1, 2022 and pays rent of $2,000 per month for each month of 2022 (a 12-month lease). John demanded first and last month rent and a security deposit of $500 and all were paid January 1, 2022. Upon the tenant's departure on December 31, John noted damages and is going to retain $200 of the security deposit. John's rental expenses for the year are: \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Little John Brokerage Statement } & \multicolumn{3}{|l|}{ John Fuji } \\ \hline \multicolumn{5}{|c|}{100 Nottingham Street } & \multicolumn{3}{|c|}{468 Bonnie Doon Ave. } \\ \hline \multicolumn{5}{|c|}{ Sherwood Forest, MA 01233} & \multicolumn{3}{|c|}{ Yakima, WA 98902} \\ \hline \multicolumn{5}{|c|}{ Substitute Form 1099-B } & \multicolumn{3}{|c|}{xXXXX5974} \\ \hline \multicolumn{8}{|l|}{ Tax Year 2022} \\ \hline \multicolumn{2}{|l|}{ 1a } & \multirow{2}{*}{1bDateAcq} & \multirow{2}{*}{1cDateSold} & \multirow{2}{*}{1dProceeds} & \multirow{2}{*}{1eCostBasis} & \multirow{2}{*}{NetGainorLoss} & \multirow{2}{*}{2ST/LT} \\ \hline Descrip & Shares & & & & & & \\ \hline Moderni Pharm & 44 & 2/3/2022 & 2/3/2022 & 910.00 & 888.00 & 22.00 & ST \\ \hline Moderni Pharm & 37 & 2/3/2022 & 2/3/2022 & 740.00 & 738.00 & 2.00 & ST \\ \hline Moderni Pharm & 31 & 2/3/2022 & 2/3/2022 & 623.00 & 473.00 & 150.00 & ST \\ \hline Moderni Pharm & 28 & 2/3/2022 & 2/3/2022 & 569.00 & 593.00 & (24.00) & ST \\ \hline Moderni Pharm & 34 & 2/3/2022 & 2/3/2022 & 683.00 & 443.00 & 240.00 & ST \\ \hline Moderni Pharm & 21 & 2/4/2022 & 2/4/2022 & 422.00 & 172.00 & 250.00 & ST \\ \hline Moderni Pharm & 40 & 2/4/2022 & 2/4/2022 & 786.00 & 667.00 & 119.00 & ST \\ \hline Moderni Pharm & 32 & 2/4/2022 & 2/4/2022 & 646.00 & 464.00 & 182.00 & ST \\ \hline Moderni Pharm & 35 & 2/4/2022 & 2/4/2022 & 692.00 & 495.00 & 197.00 & ST \\ \hline Moderni Pharm & 30 & 2/4/2022 & 2/4/2022 & 595.00 & 478.00 & 117.00 & ST \\ \hline Moderni Pharm & 42 & 2/5/2022 & 2/5/2022 & 847.00 & 579.00 & 268.00 & ST \\ \hline Moderni Pharm & 28 & 2/5/2022 & 2/5/2022 & 565.00 & 433.00 & 132.00 & ST \\ \hline Moderni Pharm & 33 & 2/5/2022 & 2/5/2022 & 664.00 & 421.00 & 243.00 & ST \\ \hline Moderni Pharm & 21 & 2/5/2022 & 2/5/2022 & 422.00 & 277.00 & 145.00 & ST \\ \hline Moderni Pharm & 32 & 2/5/2022 & 2/5/2022 & 630.00 & 478.00 & 152.00 & ST \\ \hline Moderni Pharm & 39 & 2/6/2022 & 2/6/2022 & 780.00 & 509.00 & 271.00 & ST \\ \hline Moderni Pharm & 40 & 2/6/2022 & 2/6/2022 & 796.00 & 711.00 & 85.00 & ST \\ \hline Moderni Pharm & 38 & 2/6/2022 & 2/6/2022 & 754.00 & 484.00 & 270.00 & ST \\ \hline \multirow[t]{2}{*}{ Moderni Pharm } & 34 & 2/6/2022 & 2/6/2022 & 674.00 & 424.00 & 250.00 & ST \\ \hline & & & & 12,798.00 & 9,727.00 & 3,071.00 & \\ \hline \end{tabular} John actively manages the rental home. He probably spends about seven hours per month on the rental. Required: Complete John's federal tax return for 2021. Use Form 1040, Schedule 1, Schedule A, and Schedule D as needed to complete this tax return. John tried his hand at day trading for one week in February 2022. He received a substitute Form 1099-B from his broker. Because the IRS was provided the acquisition date and basis for all trades and none required any adjustments or codes, these can be entered as a summary entry into Schedule D and no Form 8949 needs to be prepared. John has income reported to him on a 1099-DIV from his investment in mutual funds: Also, in accordance with the January 2016 divorce decree John receives $500 per month alimony from his ex-wife (Dora Fuji, Social Security number 573-79-6075) in 2022. On December 30, 2022, John sold his primary residence after living there since October 2012. The proceeds from the sale were $560,677 and his basis was $292,000. The closing statement for the sale indicated that John owed property taxes of $323 at the time of closing and the seller reduced his net proceeds by that amount. Those property taxes are not reflected on John's 1098. B. John Fuji (birthdate June 6, 1983) received the following Form W-2 from his employer related to his job as a manager at a Washington apple-processing plant: Form UN= Wage and Tax Statement Copy B-To Be Filed With Empleyee's FEDCRAL Tax Retum. During 2022, John paid the following amounts (all of which can be substantiated): John's employer offers a retirement plan, but John does not participate. Instead, he made a $6,000 contribution to a Roth IRA. John owns a condo in Seattle that he lived in years ago and now rents. His rental condo is located at 1012 E Terrace Street Unit 1204, Seattle, WA 98122 and was rented all year to his tenant. The tenant occupied the home on January 1, 2022 and pays rent of $2,000 per month for each month of 2022 (a 12-month lease). John demanded first and last month rent and a security deposit of $500 and all were paid January 1, 2022. Upon the tenant's departure on December 31, John noted damages and is going to retain $200 of the security deposit. John's rental expenses for the year are: \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Little John Brokerage Statement } & \multicolumn{3}{|l|}{ John Fuji } \\ \hline \multicolumn{5}{|c|}{100 Nottingham Street } & \multicolumn{3}{|c|}{468 Bonnie Doon Ave. } \\ \hline \multicolumn{5}{|c|}{ Sherwood Forest, MA 01233} & \multicolumn{3}{|c|}{ Yakima, WA 98902} \\ \hline \multicolumn{5}{|c|}{ Substitute Form 1099-B } & \multicolumn{3}{|c|}{xXXXX5974} \\ \hline \multicolumn{8}{|l|}{ Tax Year 2022} \\ \hline \multicolumn{2}{|l|}{ 1a } & \multirow{2}{*}{1bDateAcq} & \multirow{2}{*}{1cDateSold} & \multirow{2}{*}{1dProceeds} & \multirow{2}{*}{1eCostBasis} & \multirow{2}{*}{NetGainorLoss} & \multirow{2}{*}{2ST/LT} \\ \hline Descrip & Shares & & & & & & \\ \hline Moderni Pharm & 44 & 2/3/2022 & 2/3/2022 & 910.00 & 888.00 & 22.00 & ST \\ \hline Moderni Pharm & 37 & 2/3/2022 & 2/3/2022 & 740.00 & 738.00 & 2.00 & ST \\ \hline Moderni Pharm & 31 & 2/3/2022 & 2/3/2022 & 623.00 & 473.00 & 150.00 & ST \\ \hline Moderni Pharm & 28 & 2/3/2022 & 2/3/2022 & 569.00 & 593.00 & (24.00) & ST \\ \hline Moderni Pharm & 34 & 2/3/2022 & 2/3/2022 & 683.00 & 443.00 & 240.00 & ST \\ \hline Moderni Pharm & 21 & 2/4/2022 & 2/4/2022 & 422.00 & 172.00 & 250.00 & ST \\ \hline Moderni Pharm & 40 & 2/4/2022 & 2/4/2022 & 786.00 & 667.00 & 119.00 & ST \\ \hline Moderni Pharm & 32 & 2/4/2022 & 2/4/2022 & 646.00 & 464.00 & 182.00 & ST \\ \hline Moderni Pharm & 35 & 2/4/2022 & 2/4/2022 & 692.00 & 495.00 & 197.00 & ST \\ \hline Moderni Pharm & 30 & 2/4/2022 & 2/4/2022 & 595.00 & 478.00 & 117.00 & ST \\ \hline Moderni Pharm & 42 & 2/5/2022 & 2/5/2022 & 847.00 & 579.00 & 268.00 & ST \\ \hline Moderni Pharm & 28 & 2/5/2022 & 2/5/2022 & 565.00 & 433.00 & 132.00 & ST \\ \hline Moderni Pharm & 33 & 2/5/2022 & 2/5/2022 & 664.00 & 421.00 & 243.00 & ST \\ \hline Moderni Pharm & 21 & 2/5/2022 & 2/5/2022 & 422.00 & 277.00 & 145.00 & ST \\ \hline Moderni Pharm & 32 & 2/5/2022 & 2/5/2022 & 630.00 & 478.00 & 152.00 & ST \\ \hline Moderni Pharm & 39 & 2/6/2022 & 2/6/2022 & 780.00 & 509.00 & 271.00 & ST \\ \hline Moderni Pharm & 40 & 2/6/2022 & 2/6/2022 & 796.00 & 711.00 & 85.00 & ST \\ \hline Moderni Pharm & 38 & 2/6/2022 & 2/6/2022 & 754.00 & 484.00 & 270.00 & ST \\ \hline \multirow[t]{2}{*}{ Moderni Pharm } & 34 & 2/6/2022 & 2/6/2022 & 674.00 & 424.00 & 250.00 & ST \\ \hline & & & & 12,798.00 & 9,727.00 & 3,071.00 & \\ \hline \end{tabular} John actively manages the rental home. He probably spends about seven hours per month on the rental. Required: Complete John's federal tax return for 2021. Use Form 1040, Schedule 1, Schedule A, and Schedule D as needed to complete this tax return. John tried his hand at day trading for one week in February 2022. He received a substitute Form 1099-B from his broker. Because the IRS was provided the acquisition date and basis for all trades and none required any adjustments or codes, these can be entered as a summary entry into Schedule D and no Form 8949 needs to be prepared Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started