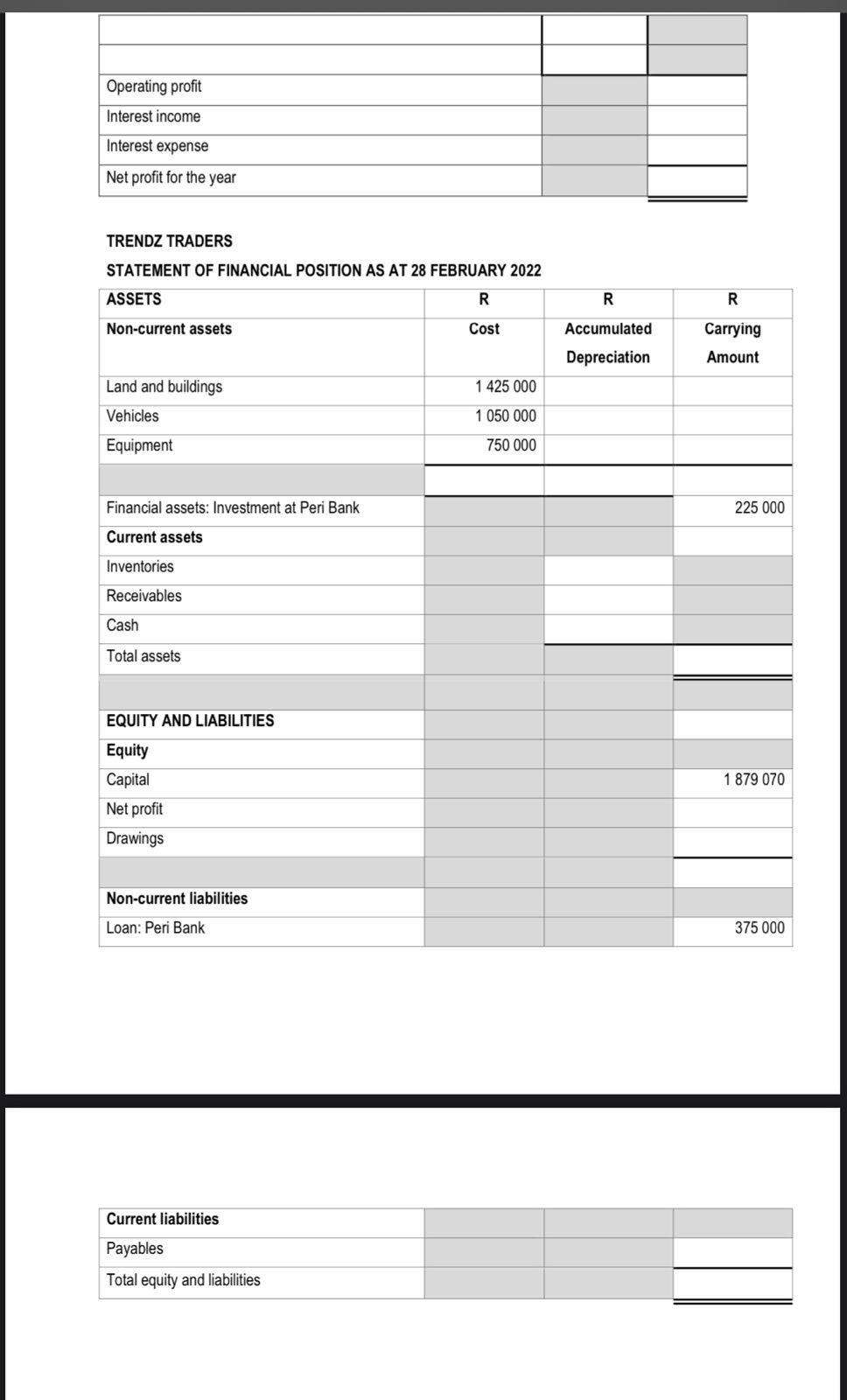

REQUIRED: Complete the financial statements with the missing amounts and details. The entire statements must be submitted. Where applicable, show your workings in brackets. You may highlight your answers for the missing amounts or show them in bold print. The notes to the financial statements and Statement of Changes in Equity are not required. Do not type in the shaded areas.

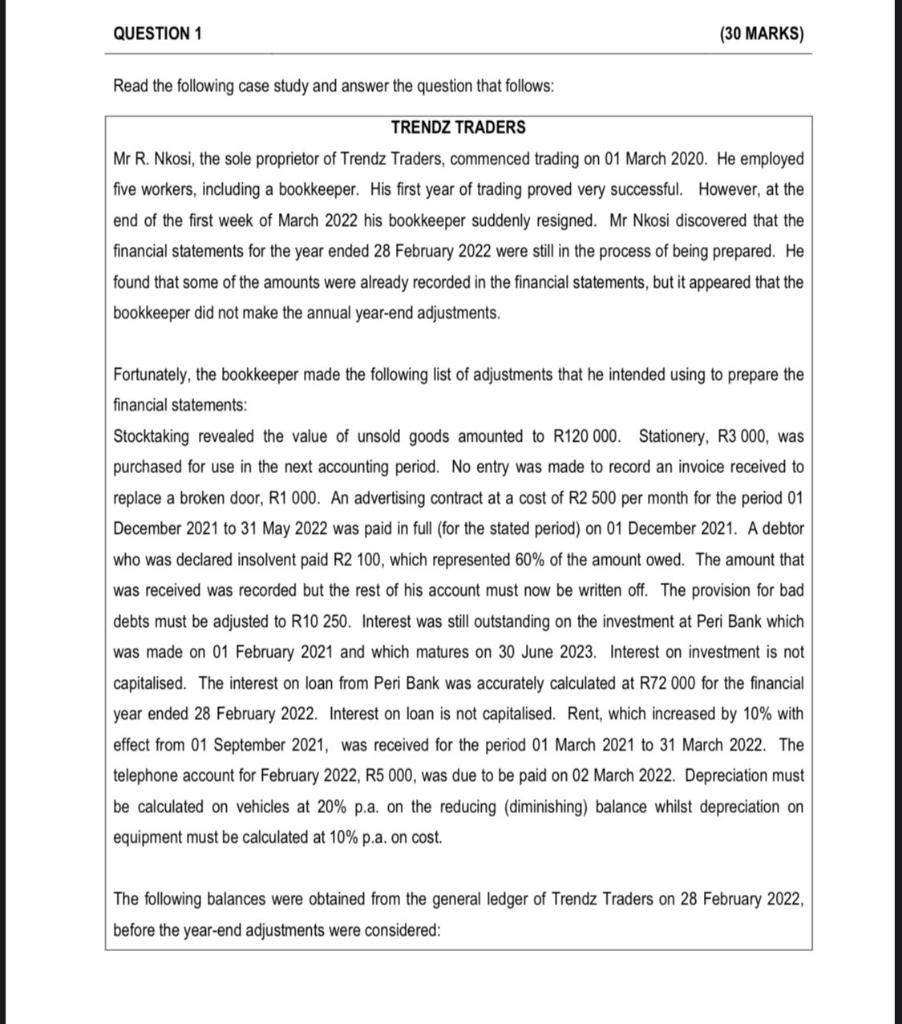

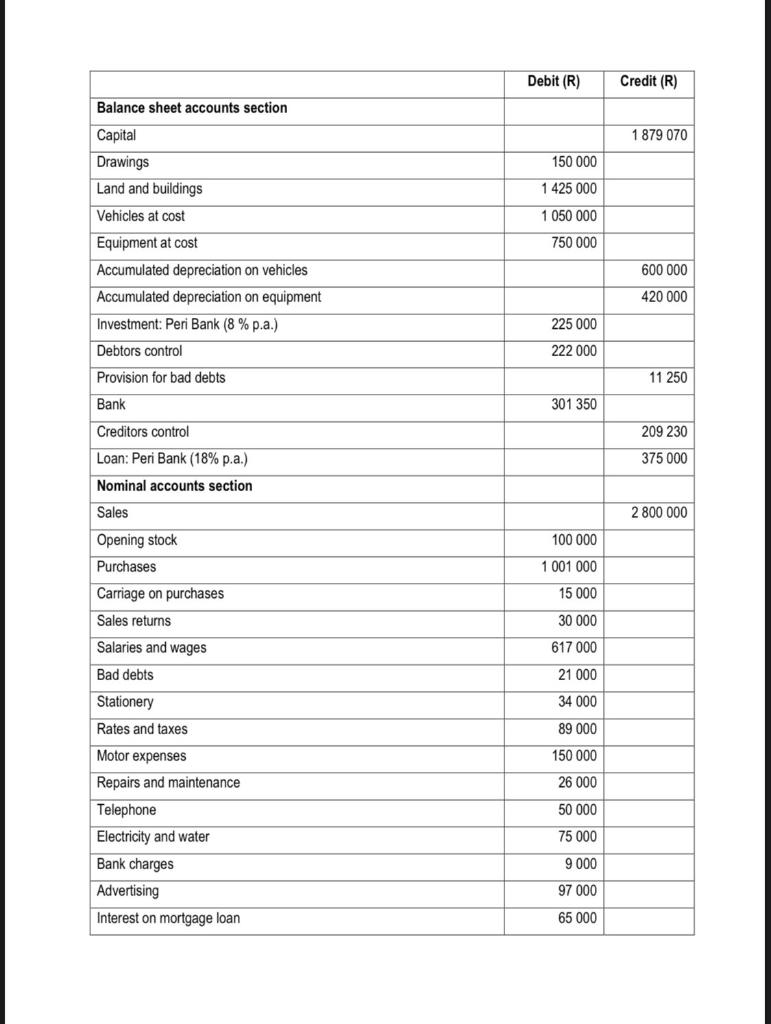

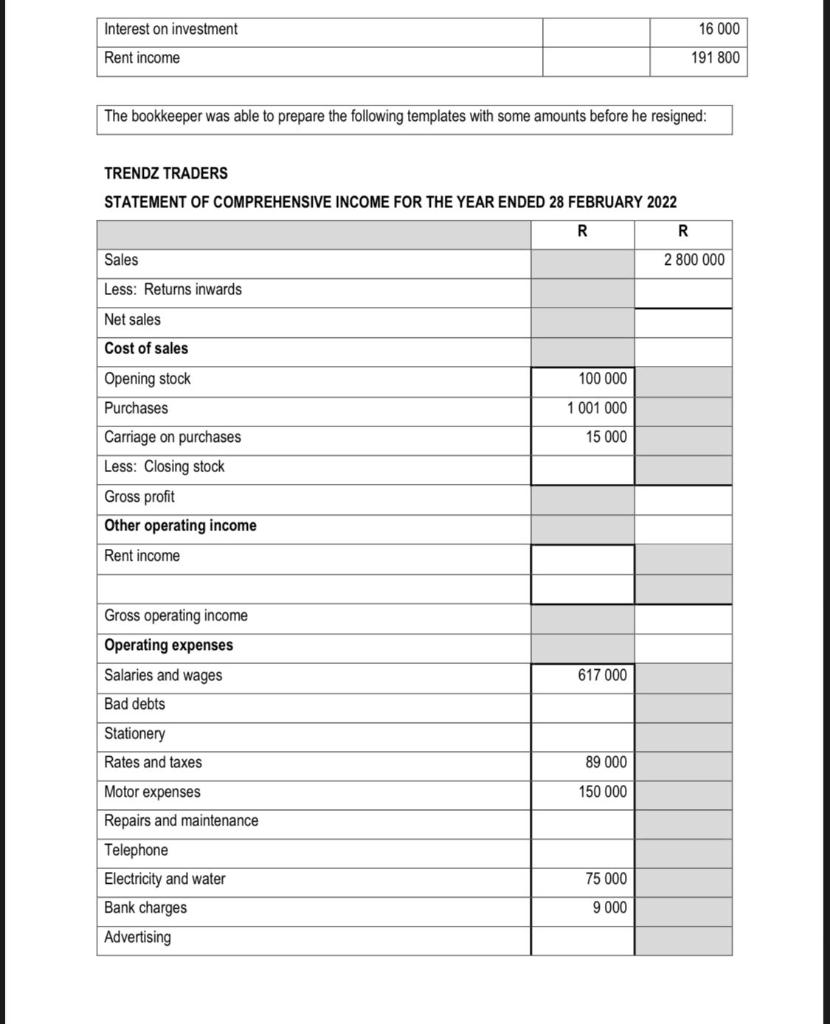

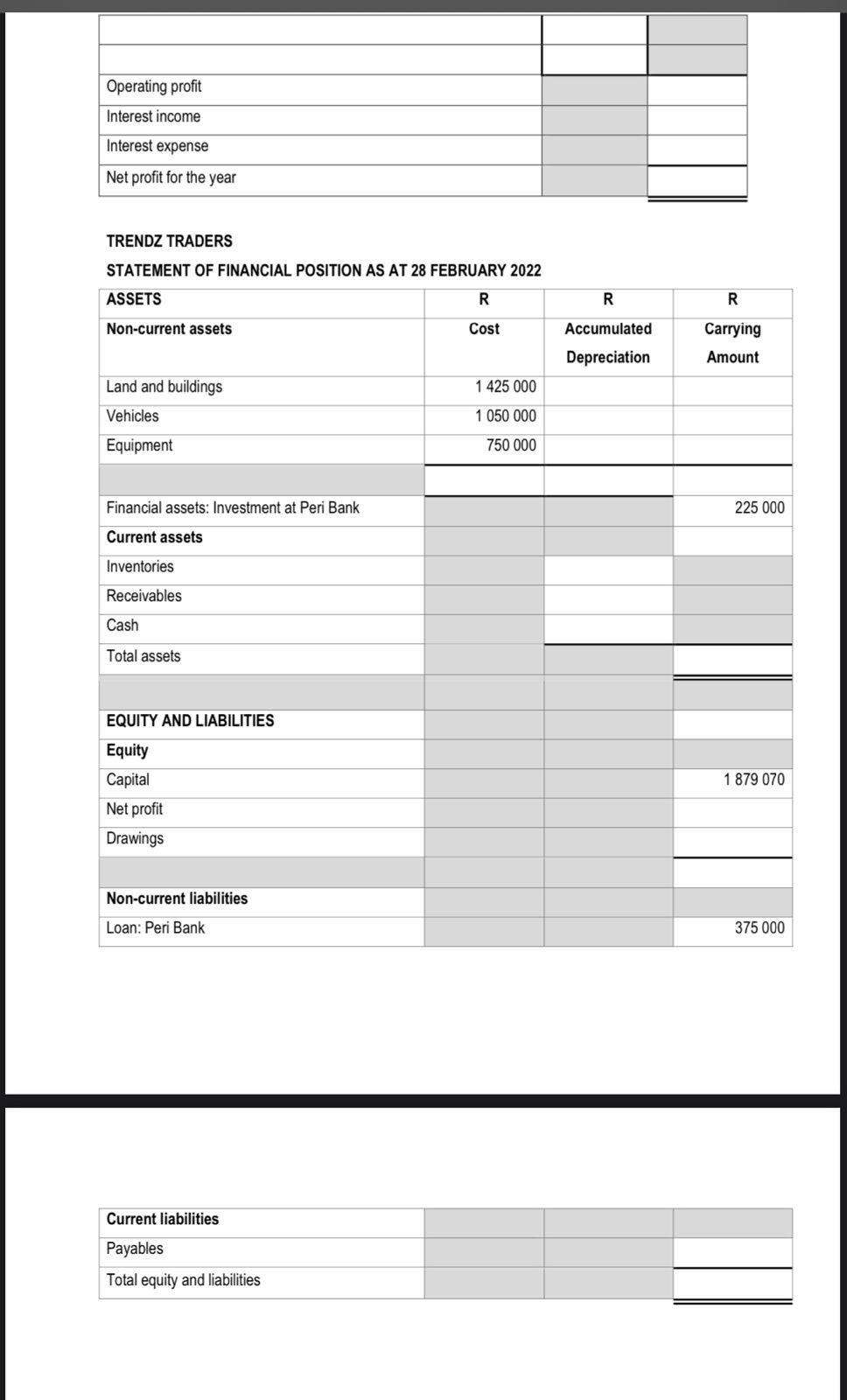

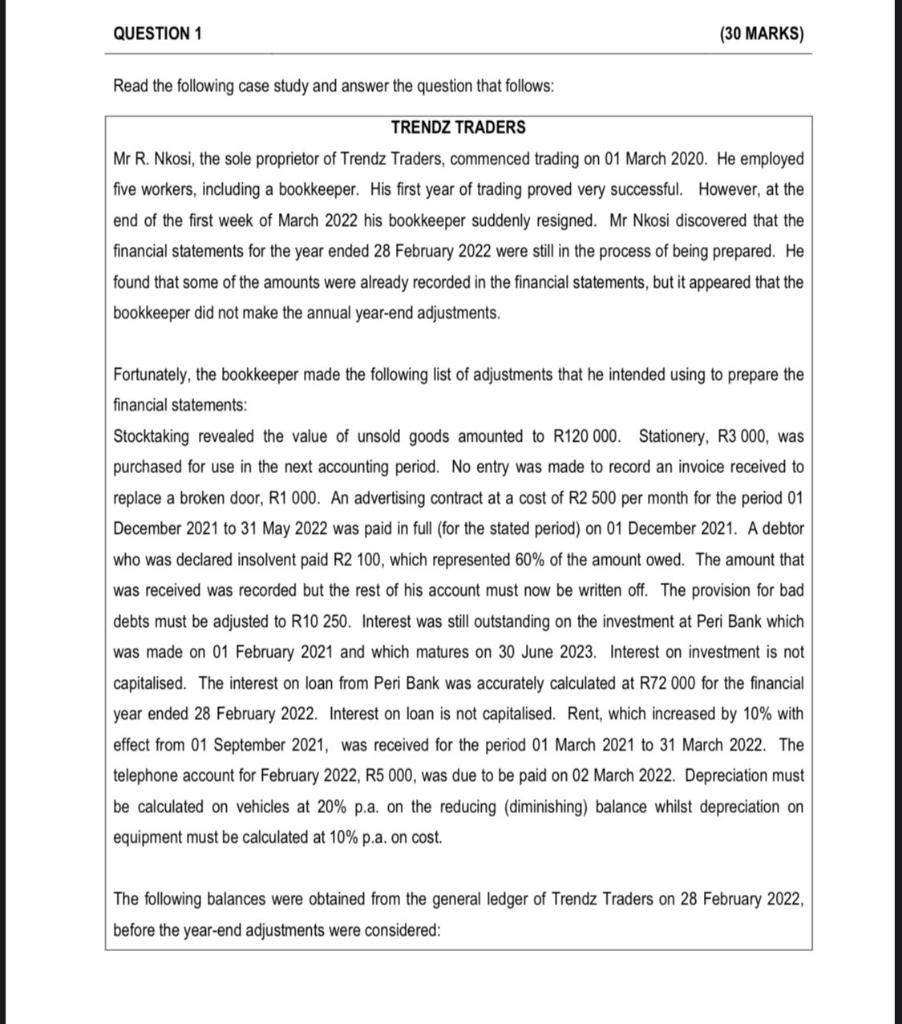

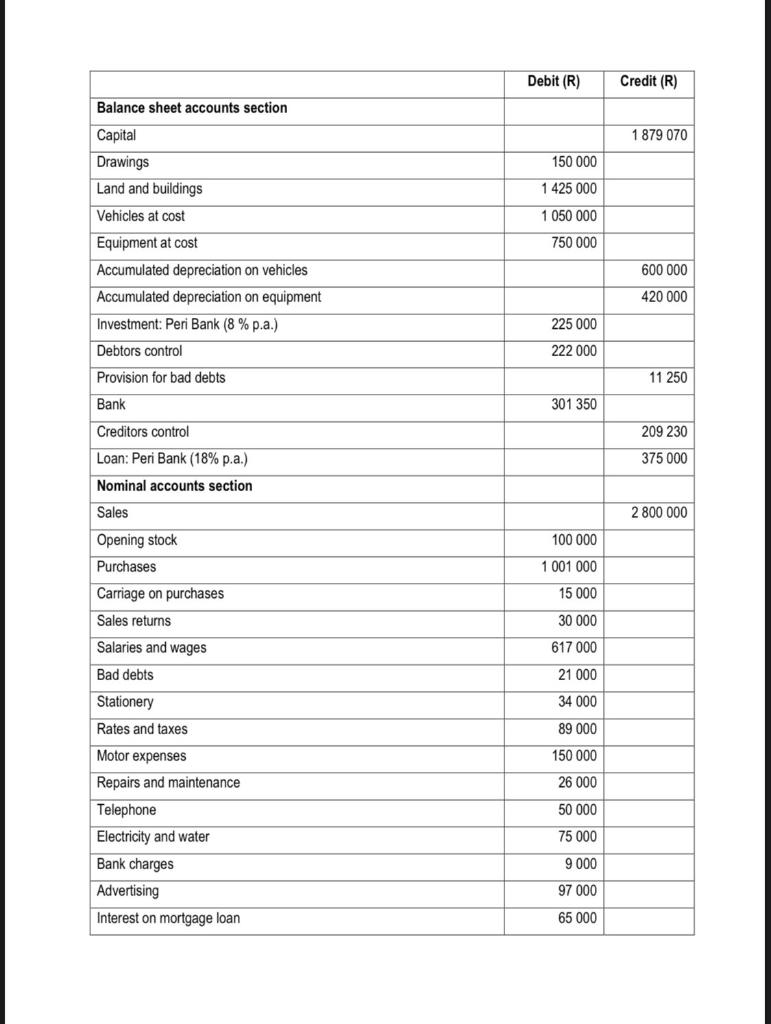

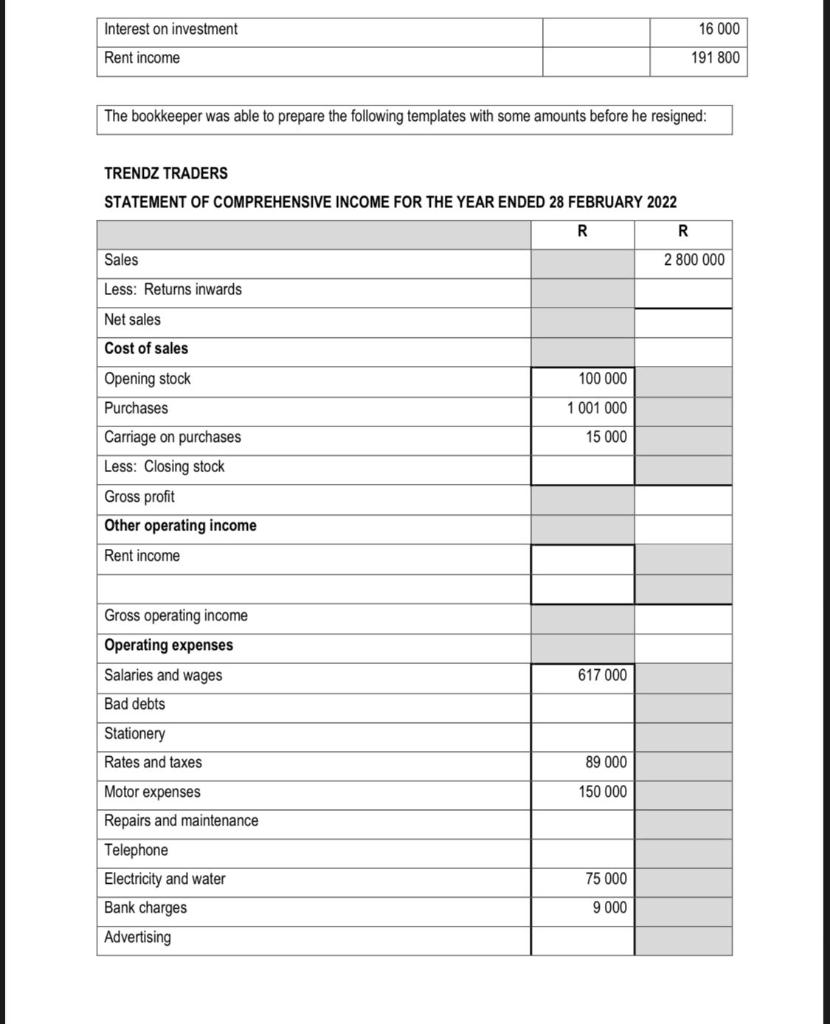

QUESTION 1 (30 MARKS) Read the following case study and answer the question that follows: TRENDZ TRADERS Mr R. Nkosi, the sole proprietor of Trendz Traders, commenced trading on 01 March 2020. He employed five workers, including a bookkeeper. His first year of trading proved very successful. However, at the end of the first week of March 2022 his bookkeeper suddenly resigned. Mr Nkosi discovered that the financial statements for the year ended 28 February 2022 were still in the process of being prepared. He found that some of the amounts were already recorded in the financial statements, but it appeared that the bookkeeper did not make the annual year-end adjustments. Fortunately, the bookkeeper made the following list of adjustments that he intended using to prepare the financial statements: Stocktaking revealed the value of unsold goods amounted to R120 000. Stationery, R3 000, was purchased for use in the next accounting period. No entry was made to record an invoice received to replace a broken door, R1 000. An advertising contract at a cost of R2 500 per month for the period 01 December 2021 to 31 May 2022 was paid in full (for the stated period) on 01 December 2021. A debtor who was declared insolvent paid R2 100, which represented 60% of the amount owed. The amount that was received was recorded but the rest of his account must now be written off. The provision for bad debts must be adjusted to R10 250. Interest was still outstanding on the investment at Peri Bank which was made on 01 February 2021 and which matures on 30 June 2023. Interest on investment is not capitalised. The interest on loan from Peri Bank was accurately calculated at R72 000 for the financial year ended 28 February 2022. Interest on loan is not capitalised. Rent, which increased by 10% with effect from 01 September 2021, was received for the period 01 March 2021 to 31 March 2022. The telephone account for February 2022, R5 000, was due to be paid on 02 March 2022. Depreciation must be calculated on vehicles at 20% p.a. on the reducing (diminishing) balance whilst depreciation on equipment must be calculated at 10% p.a. on cost. The following balances were obtained from the general ledger of Trendz Traders on 28 February 2022, before the year-end adjustments were considered: Debit (R) Credit (R) Balance sheet accounts section Capital 1 879 070 150 000 Drawings Land and buildings Vehicles at cost 1 425 000 1 050 000 750 000 600 000 420 000 Equipment at cost Accumulated depreciation on vehicles Accumulated depreciation on equipment Investment: Peri Bank (8 % p.a.) Debtors control Provision for bad debts 225 000 222 000 11 250 Bank 301 350 209 230 Creditors control Loan: Peri Bank (18% p.a.) Nominal accounts section 375 000 Sales 2 800 000 100 000 1 001 000 Opening stock Purchases Carriage on purchases Sales returns 15 000 30 000 Salaries and wages 617 000 Bad debts 21 000 Stationery 34 000 Rates and taxes 89 000 Motor expenses 150 000 26 000 50 000 75 000 Repairs and maintenance Telephone Electricity and water Bank charges Advertising Interest on mortgage loan 9000 97 000 65 000 Interest on investment 16 000 Rent income 191 800 The bookkeeper was able to prepare the following templates with some amounts before he resigned: TRENDZ TRADERS STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 28 FEBRUARY 2022 R R Sales 2 800 000 Less: Returns inwards Net sales Cost of sales 100 000 1 001 000 15 000 Opening stock Purchases Carriage on purchases Less: Closing stock Gross profit Other operating income Rent income Gross operating income Operating expenses Salaries and wages Bad debts 617 000 Stationery Rates and taxes 89 000 Motor expenses 150 000 Repairs and maintenance 75 000 Telephone Electricity and water Bank charges Advertising 9 000 Operating profit Interest income Interest expense Net profit for the year TRENDZ TRADERS STATEMENT OF FINANCIAL POSITION AS AT 28 FEBRUARY 2022 ASSETS R R R Non-current assets Cost Accumulated Depreciation Carrying Amount Land and buildings 1 425 000 Vehicles 1 050 000 Equipment 750 000 Financial assets: Investment at Peri Bank 225 000 Current assets Inventories Receivables Cash Total assets EQUITY AND LIABILITIES 1 879 070 Equity Capital Net profit Drawings Non-current liabilities Loan: Peri Bank 375 000 Current liabilities Payables Total equity and liabilities QUESTION 1 (30 MARKS) Read the following case study and answer the question that follows: TRENDZ TRADERS Mr R. Nkosi, the sole proprietor of Trendz Traders, commenced trading on 01 March 2020. He employed five workers, including a bookkeeper. His first year of trading proved very successful. However, at the end of the first week of March 2022 his bookkeeper suddenly resigned. Mr Nkosi discovered that the financial statements for the year ended 28 February 2022 were still in the process of being prepared. He found that some of the amounts were already recorded in the financial statements, but it appeared that the bookkeeper did not make the annual year-end adjustments. Fortunately, the bookkeeper made the following list of adjustments that he intended using to prepare the financial statements: Stocktaking revealed the value of unsold goods amounted to R120 000. Stationery, R3 000, was purchased for use in the next accounting period. No entry was made to record an invoice received to replace a broken door, R1 000. An advertising contract at a cost of R2 500 per month for the period 01 December 2021 to 31 May 2022 was paid in full (for the stated period) on 01 December 2021. A debtor who was declared insolvent paid R2 100, which represented 60% of the amount owed. The amount that was received was recorded but the rest of his account must now be written off. The provision for bad debts must be adjusted to R10 250. Interest was still outstanding on the investment at Peri Bank which was made on 01 February 2021 and which matures on 30 June 2023. Interest on investment is not capitalised. The interest on loan from Peri Bank was accurately calculated at R72 000 for the financial year ended 28 February 2022. Interest on loan is not capitalised. Rent, which increased by 10% with effect from 01 September 2021, was received for the period 01 March 2021 to 31 March 2022. The telephone account for February 2022, R5 000, was due to be paid on 02 March 2022. Depreciation must be calculated on vehicles at 20% p.a. on the reducing (diminishing) balance whilst depreciation on equipment must be calculated at 10% p.a. on cost. The following balances were obtained from the general ledger of Trendz Traders on 28 February 2022, before the year-end adjustments were considered: Debit (R) Credit (R) Balance sheet accounts section Capital 1 879 070 150 000 Drawings Land and buildings Vehicles at cost 1 425 000 1 050 000 750 000 600 000 420 000 Equipment at cost Accumulated depreciation on vehicles Accumulated depreciation on equipment Investment: Peri Bank (8 % p.a.) Debtors control Provision for bad debts 225 000 222 000 11 250 Bank 301 350 209 230 Creditors control Loan: Peri Bank (18% p.a.) Nominal accounts section 375 000 Sales 2 800 000 100 000 1 001 000 Opening stock Purchases Carriage on purchases Sales returns 15 000 30 000 Salaries and wages 617 000 Bad debts 21 000 Stationery 34 000 Rates and taxes 89 000 Motor expenses 150 000 26 000 50 000 75 000 Repairs and maintenance Telephone Electricity and water Bank charges Advertising Interest on mortgage loan 9000 97 000 65 000 Interest on investment 16 000 Rent income 191 800 The bookkeeper was able to prepare the following templates with some amounts before he resigned: TRENDZ TRADERS STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 28 FEBRUARY 2022 R R Sales 2 800 000 Less: Returns inwards Net sales Cost of sales 100 000 1 001 000 15 000 Opening stock Purchases Carriage on purchases Less: Closing stock Gross profit Other operating income Rent income Gross operating income Operating expenses Salaries and wages Bad debts 617 000 Stationery Rates and taxes 89 000 Motor expenses 150 000 Repairs and maintenance 75 000 Telephone Electricity and water Bank charges Advertising 9 000 Operating profit Interest income Interest expense Net profit for the year TRENDZ TRADERS STATEMENT OF FINANCIAL POSITION AS AT 28 FEBRUARY 2022 ASSETS R R R Non-current assets Cost Accumulated Depreciation Carrying Amount Land and buildings 1 425 000 Vehicles 1 050 000 Equipment 750 000 Financial assets: Investment at Peri Bank 225 000 Current assets Inventories Receivables Cash Total assets EQUITY AND LIABILITIES 1 879 070 Equity Capital Net profit Drawings Non-current liabilities Loan: Peri Bank 375 000 Current liabilities Payables Total equity and liabilities