Question

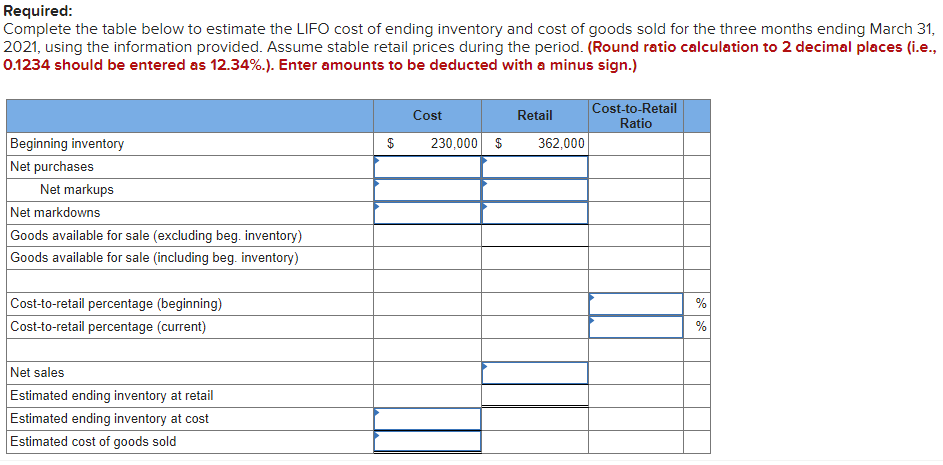

Required: Complete the table below to estimate the LIFO cost of ending inventory and cost of goods sold for the three months ending March 31,

Required: Complete the table below to estimate the LIFO cost of ending inventory and cost of goods sold for the three months ending March 31, 2021, using the information provided. Assume stable retail prices during the period. (Round ratio calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34%.). Enter amounts to be deducted with a minus sign.)

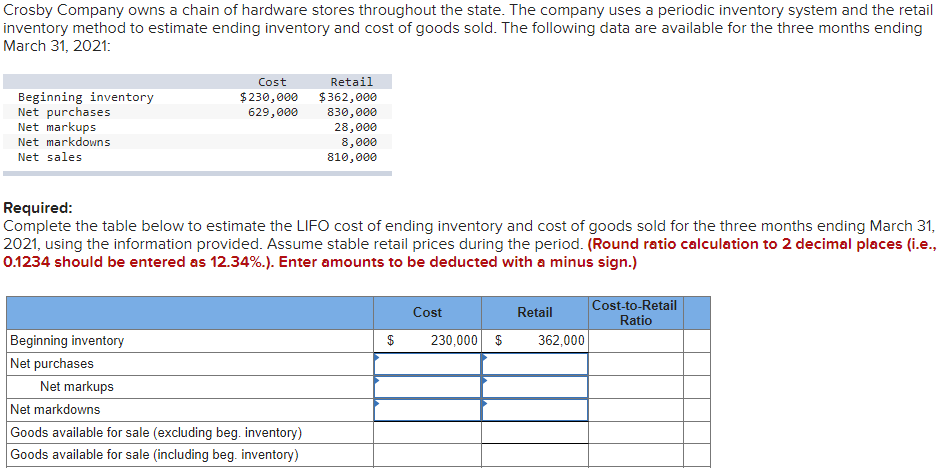

Information: Crosby Company owns a chain of hardware stores throughout the state. The company uses a periodic inventory system and the retail inventory method to estimate ending inventory and cost of goods sold. The following data are available for the three months ending March 31, 2021:

| Cost | Retail | |||||

| Beginning inventory | $ | 230,000 | $ | 362,000 | ||

| Net purchases | 629,000 | 830,000 | ||||

| Net markups | 28,000 | |||||

| Net markdowns | 8,000 | |||||

| Net sales | 810,000 | |||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started