Answered step by step

Verified Expert Solution

Question

1 Approved Answer

required: computation of Palesa's taxable income and tax liability compute Palesa's taxable income and tax liability using the Botswana Tax system Palesa has a retail

required: computation of Palesa's taxable income and tax liability

compute Palesa's taxable income and tax liability using the Botswana Tax system

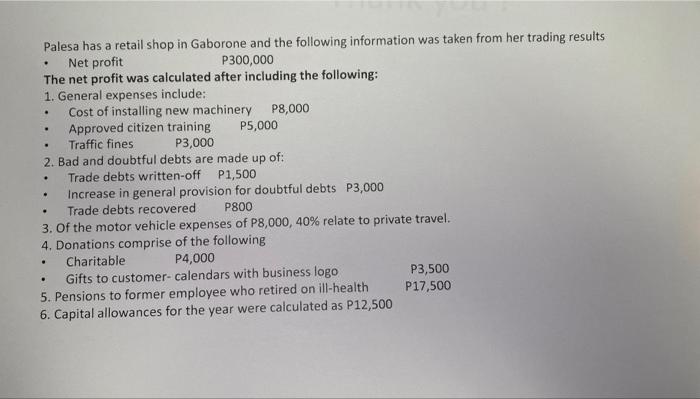

Palesa has a retail shop in Gaborone and the following information was taken from her trading results - Net profit P300,000 The net profit was calculated after including the following: 1. General expenses include: - Cost of installing new machinery 98,000 - Approved citizen training P5,000 - Traffic fines P3,000 2. Bad and doubtful debts are made up of: - Trade debts written-off P1,500 - Increase in general provision for doubtful debts P3,000 - Trade debts recovered P800 3. Of the motor vehicle expenses of P8,000,40% relate to private travel. 4. Donations comprise of the following - Charitable P4,000 - Gifts to customer- calendars with business logo P3,500 5. Pensions to former employee who retired on ill-health P17,500 6. Capital allowances for the year were calculated as P12,500 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started