Question

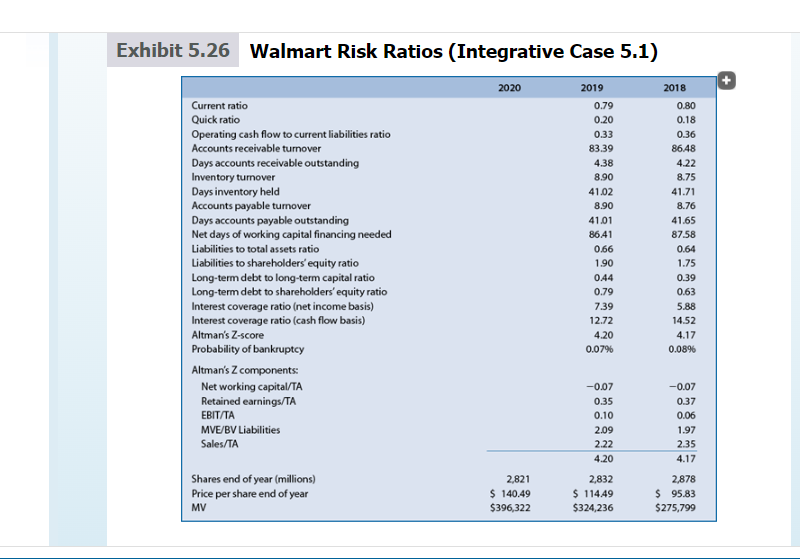

Required Compute the values of each of the ratios in Exhibit 5.26 for Walmart for 2020. Walmart had 2,821 million common shares outstanding at the

Required

-

Compute the values of each of the ratios in Exhibit 5.26 for Walmart for 2020. Walmart had 2,821 million common shares outstanding at the end of fiscal 2020, and the market price per share was $140.49. For 2019, the comparable shares and price per share were 2,832 million and $114.49, and for 2018, they were 2,878 million and $95.83, respectively. Notes: For days accounts receivable outstanding, use total revenues in your calculations. For computations with interest expense, exclude interest income but include imputed interest expense on average operating lease liabilities (current and long-term); Walmart discloses an implicit interest rate of 6.1% on operating leases. For the interest coverage ratio (cash flow basis), ignore imputed interest for operating leases (as done in the text). For earnings before interest and taxes in the Altmans Z calculation, include interest income in earnings before interest and taxes.

-

Interpret the changes in Walmarts risk ratios during the three-year period, indicating any areas of concern.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started