Required:

Consider the disclosure note on provisions, and answer the following questions relating to 2019.

- What are the utilizations (i.e., settlement of liabilities) in each category?

- What are the reclassifications that are related directly to assets-held-for-sale?

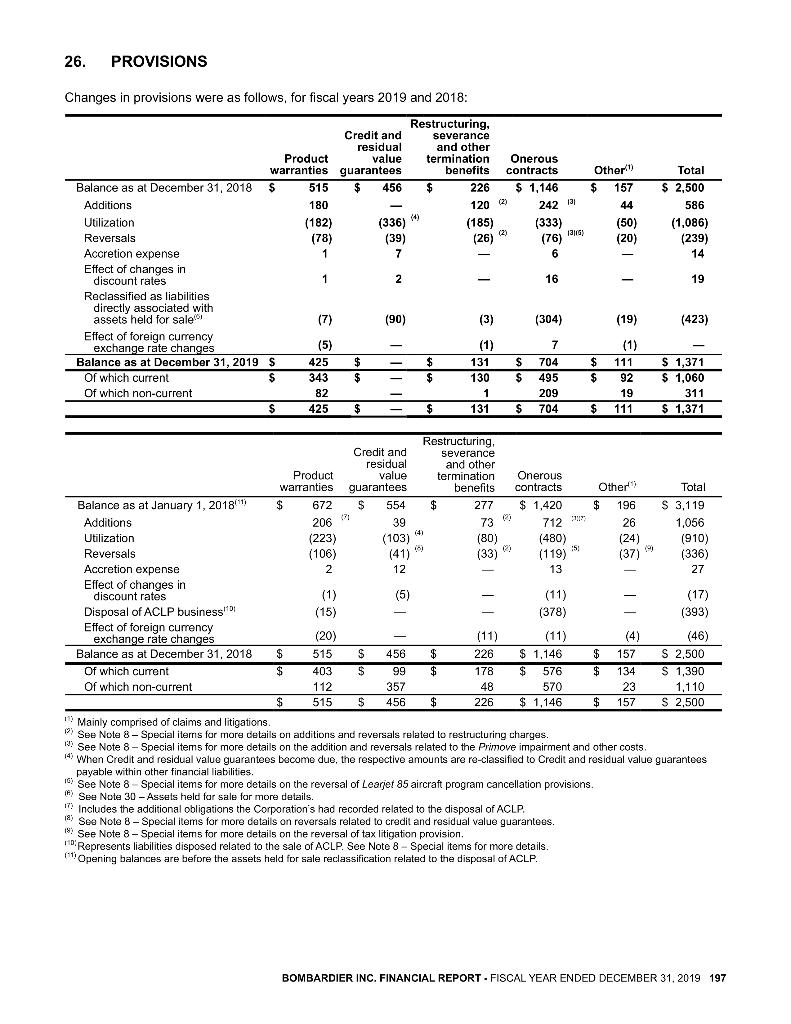

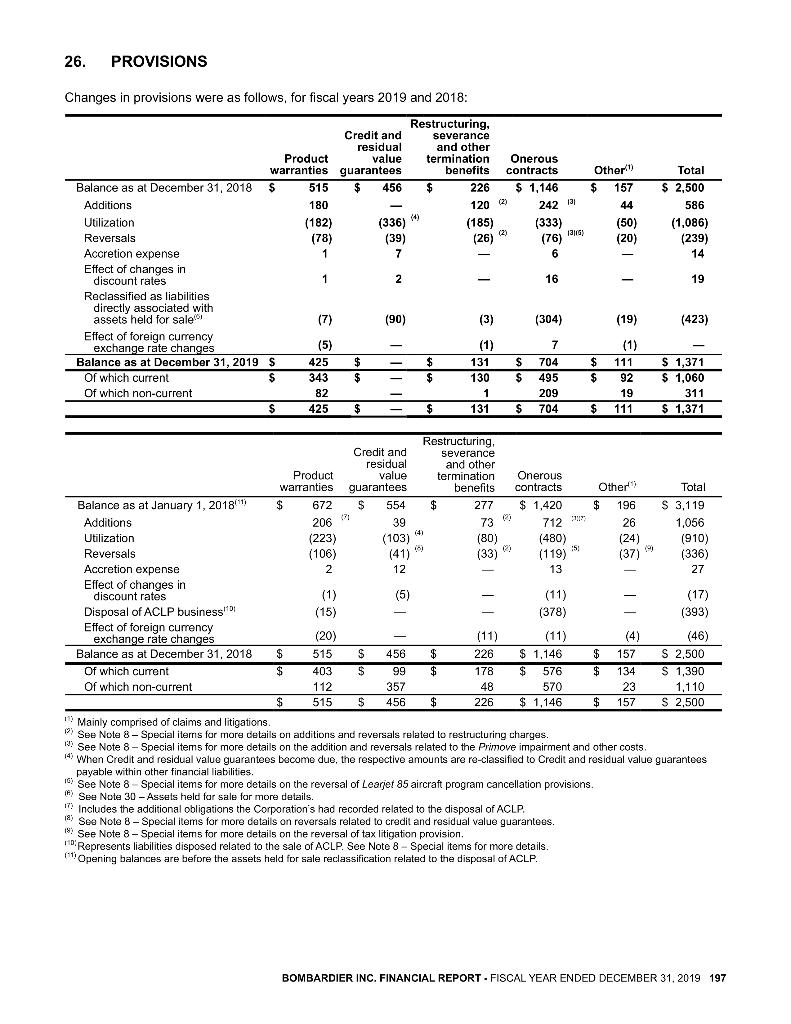

26. PROVISIONS Changes in provisions were as follows, for fiscal years 2019 and 2018: Restructuring, severance and other termination benefits 226 Onerous contracts $ 1,146 120 (2) 242 131 Other) $ 157 44 (50) (20) Total $ 2,500 586 (1,086) (239) 14 (6) (185) (26) (2) 1316) (333) (76) 6 Credit and residual Product value warranties guarantees Balance as at December 31, 2018 $ 515 $ 456 Additions 180 Utilization (182) (336) Reversals (78) (39) Accretion expense 1 1 7 Effect of changes in discount rates 1 1 2 Reclassified as liabilities directly associated with assets held for sale! (7) (90) Effect of foreign currency exchange rate changes (5) Balance as at December 31, 2019 S 425 $ of which current $ 343 $ Of which non-current 82 $ 425 $ $ 16 19 (3) (304) (19) (423) $ $ (1) 131 130 1 131 $ $ $ 7 704 495 209 704 $ $ (1) 111 92 19 111 $ 1,371 $ 1,060 311 $ 1,371 $ $ $ value 712 Restructuring Credit and severance residual and other Product termination Onerous warranties guarantees benefits contracts Other Total Balance as at January 1, 2018" $ 672 $ 554 $ 277 $ 1,420 $ 196 S 3,119 Additions 206 71 39 73 26 1,056 (4) Utilization (223) (103) (80) (480) (24) (910) Reversals 10) (106) 15 (41) (33) ! (119) (37) (336) Accretion expense 2 12 13 27 Effect of changes in discount rates (1) (5) (11) (17) Disposal of ACLP business (15) (378) (393) Effect of foreign currency exchange rate changes ( (20) (11) (11) (4) (46) Balance as at December 31, 2018 $ 515 S 456 $ 226 $ 1.146 $ 157 S 2.500 Of which current $ 403 $ 99 $ 178 $ 576 $ 134 S 1,390 Of which non-current 112 357 48 570 23 1,110 $ 515 $ 456 $ 226 $ 1,146 $ 157 $ 2,500 Mainly comprised of claims and litigations 12) See Note 8 - Special iterns for more details on additions and reversals related to restructuring charges See Note 8 - Special items for more details on the addition and reversals related to the Primove impairment and other costs When Credit and residual value guarantees become due, the respective amounts are re-classified to Credit and residual value guarantees payable within other financial liabilities. See Note 8 Special items for more details on the reversal of Learjet 85 aircraft program cancellation provisions. See Note 30 - Assets held for sale for more details. Includes the additional obligations the Corporation's had recorded related to the disposal of ACLP. 18 See Note 8 - Special items for more details on reversals related to credit and residual value guarantees. 19 See Note 8 - Special items for more details on the reversal of tax litigation provision D. Represents liabilities disposed related to the sale of ACLP. See Note 8 - Special items for more details. (Opening balances are before the assets held for sale reclassification related to the disposal of ACLP. BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2019 197 26. PROVISIONS Changes in provisions were as follows, for fiscal years 2019 and 2018: Restructuring, severance and other termination benefits 226 Onerous contracts $ 1,146 120 (2) 242 131 Other) $ 157 44 (50) (20) Total $ 2,500 586 (1,086) (239) 14 (6) (185) (26) (2) 1316) (333) (76) 6 Credit and residual Product value warranties guarantees Balance as at December 31, 2018 $ 515 $ 456 Additions 180 Utilization (182) (336) Reversals (78) (39) Accretion expense 1 1 7 Effect of changes in discount rates 1 1 2 Reclassified as liabilities directly associated with assets held for sale! (7) (90) Effect of foreign currency exchange rate changes (5) Balance as at December 31, 2019 S 425 $ of which current $ 343 $ Of which non-current 82 $ 425 $ $ 16 19 (3) (304) (19) (423) $ $ (1) 131 130 1 131 $ $ $ 7 704 495 209 704 $ $ (1) 111 92 19 111 $ 1,371 $ 1,060 311 $ 1,371 $ $ $ value 712 Restructuring Credit and severance residual and other Product termination Onerous warranties guarantees benefits contracts Other Total Balance as at January 1, 2018" $ 672 $ 554 $ 277 $ 1,420 $ 196 S 3,119 Additions 206 71 39 73 26 1,056 (4) Utilization (223) (103) (80) (480) (24) (910) Reversals 10) (106) 15 (41) (33) ! (119) (37) (336) Accretion expense 2 12 13 27 Effect of changes in discount rates (1) (5) (11) (17) Disposal of ACLP business (15) (378) (393) Effect of foreign currency exchange rate changes ( (20) (11) (11) (4) (46) Balance as at December 31, 2018 $ 515 S 456 $ 226 $ 1.146 $ 157 S 2.500 Of which current $ 403 $ 99 $ 178 $ 576 $ 134 S 1,390 Of which non-current 112 357 48 570 23 1,110 $ 515 $ 456 $ 226 $ 1,146 $ 157 $ 2,500 Mainly comprised of claims and litigations 12) See Note 8 - Special iterns for more details on additions and reversals related to restructuring charges See Note 8 - Special items for more details on the addition and reversals related to the Primove impairment and other costs When Credit and residual value guarantees become due, the respective amounts are re-classified to Credit and residual value guarantees payable within other financial liabilities. See Note 8 Special items for more details on the reversal of Learjet 85 aircraft program cancellation provisions. See Note 30 - Assets held for sale for more details. Includes the additional obligations the Corporation's had recorded related to the disposal of ACLP. 18 See Note 8 - Special items for more details on reversals related to credit and residual value guarantees. 19 See Note 8 - Special items for more details on the reversal of tax litigation provision D. Represents liabilities disposed related to the sale of ACLP. See Note 8 - Special items for more details. (Opening balances are before the assets held for sale reclassification related to the disposal of ACLP. BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2019 197