Answered step by step

Verified Expert Solution

Question

1 Approved Answer

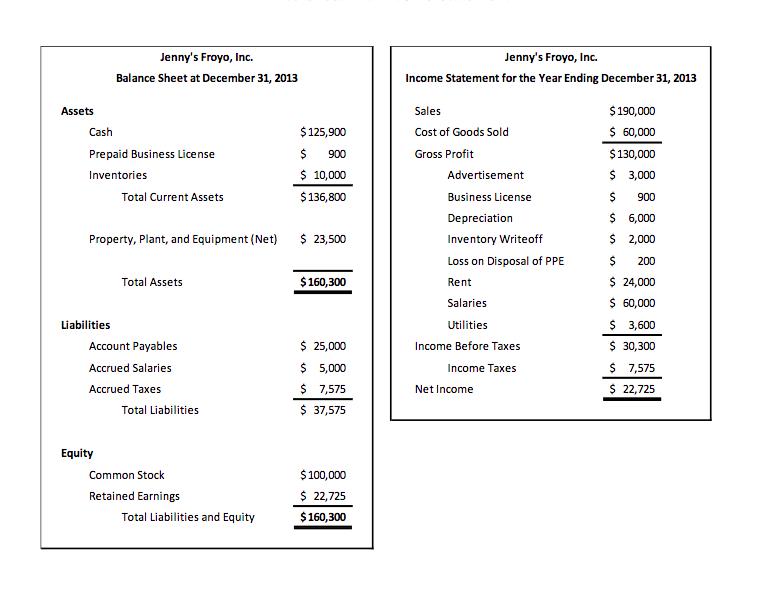

Required Create a balance sheet and income statement for 2014. As a starting point, Branon retrieved the Balance Sheet and Income Statement for the year

Required

Create a balance sheet and income statement for 2014.

As a starting point, Branon retrieved the Balance Sheet and Income Statement for the year ending. December 31, 2013 (Exhibit 1). He could only vaguely remember the events that had taken place during the last two years but jotted them down as follows: Events that took place in 2013: 1. Jennifer invested $60,000 in the business. Antonio and Branon invested $20,000 each. 2. Cash sales during the year amounted to $190,000. 3. The raw materials (milk, cream, yogurt, etc.) were purchased entirely on account from a trusted supplier. 4. During the year, approximately $2,000 worth of milk went bad due to poor refrigeration and had to be written off. 5. The $25,000 machine (Model FZ-1000) required to make the yogurt was purchased with cash on January 1. It was estimated that the FZ-1000 should last the business five years and that the cost should be allocated equally over that period. 6. The original refrigerator the business used was purchased for $2,000 cash on January 1. By July 1, however, Antonio realized that it was insufficient to keep the milk properly cooled, so he sold it for $1,300 cash. The fridge had a book value of $1,500 at the point of sale. Page 3 of 6

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started