Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine how Yuki, the lessor, and Zion, the lessee, should classify the lease. Make all required journal entries for the Lessee on July 1 st

- Determine how Yuki, the lessor, and Zion, the lessee, should classify the lease.

- Make all required journal entries for the Lessee on July 1st, 20X4.

- Prepare the required journal entries for the Lessee on December 31st, 20X4 (assuming a December 31st Fiscal Year End).

- Prepare the required journal entries for the Lessee on July 1st, 20X5

- Prepare the required journal entries for the Lessee on December 31st, 20X5 (assuming a December 31st Fiscal Year End).

- Assume that when the DVD's are returned to Yuki at the end of the lease term, the residual value of each DVD is only $70. Prepare the journal entry to record the return of the machines by Zion.

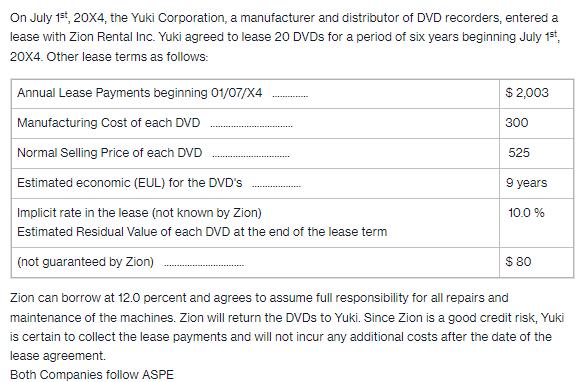

On July 1st, 20X4, the Yuki Corporation, a manufacturer and distributor of DVD recorders, entered a lease with Zion Rental Inc. Yuki agreed to lease 20 DVDs for a period of six years beginning July 1st, 20X4. Other lease terms as follows: Annual Lease Payments beginning 01/07/X4 Manufacturing Cost of each DVD Normal Selling Price of each DVD Estimated economic (EUL) for the DVD's Implicit rate in the lease (not known by Zion) Estimated Residual Value of each DVD at the end of the lease term (not guaranteed by Zion) $2,003 300 525 9 years 10.0 % $80 Zion can borrow at 12.0 percent and agrees to assume full responsibility for all repairs and maintenance of the machines. Zion will return the DVDs to Yuki. Since Zion is a good credit risk, Yuki is certain to collect the lease payments and will not incur any additional costs after the date of the lease agreement. Both Companies follow ASPE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the given information lets address each requirement step by step 1 Classification of the Lease To determine the lease classification we need to compare the lease term 6 years with the economi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started