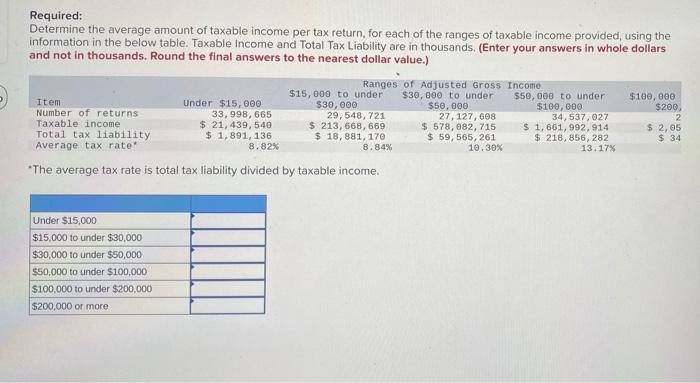

Required: Determine the average amount of taxable income per tax return, for each of the ranges of taxable income provided, using the information in

Required: Determine the average amount of taxable income per tax return, for each of the ranges of taxable income provided, using the information in the below table. Taxable Income and Total Tax Liability are in thousands. (Enter your answers in whole dollars and not in thousands. Round the final answers to the nearest dollar value.) Item Number of returns Taxable income Under $15,000 33,998,665 Total tax liability Average tax rate" $ 21,439, 540 $ 1,891, 136 8.82% Ranges of Adjusted Gross Income $15,000 to under $30,000 to under $30,000 29,548,721 $ 213, 668, 669 $ 18,881, 170 8.84% *The average tax rate is total tax liability divided by taxable income. $50,000 27,127,608 $ 578, 082, 715 $ 59,565,261 10.30% $50,000 to under $100,000 34,537,027 $ 1,661, 992, 914 $ 218,856,282 13.17% $100,000 $200, 2 $ 2,05 $ 34 Under $15,000 $15,000 to under $30,000 $30,000 to under $50,000 $50,000 to under $100,000 $100,000 to under $200,000 $200,000 or more

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the average amount of taxable income per tax return for each range divide the total tax...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started