Question

Required Determine the financial accounting (book) income for 2021 Determine the tax expense for 2021. Determine Collard's effective tax rate for 2021 Collard Company had

Required

Required

Determine the financial accounting (book) income for 2021

Determine the tax expense for 2021.

Determine Collard's effective tax rate for 2021

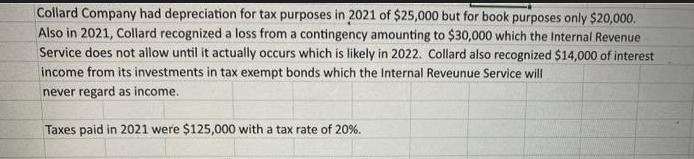

Collard Company had depreciation for tax purposes in 2021 of $25,000 but for book purposes only $20,000. Also in 2021, Collard recognized a loss from a contingency amounting to $30,000 which the Internal Revenue Service does not allow until it actually occurs which is likely in 2022. Collard also recognized $14,000 of interest income from its investments in tax exempt bonds which the Internal Reveunue Service will never regard as income. Taxes paid in 2021 were $125,000 with a tax rate of 20%.

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A To determine the financial accounting book income for 2021 we need to start with the pretax income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

9th Edition

125972266X, 9781259722660

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App