Answered step by step

Verified Expert Solution

Question

1 Approved Answer

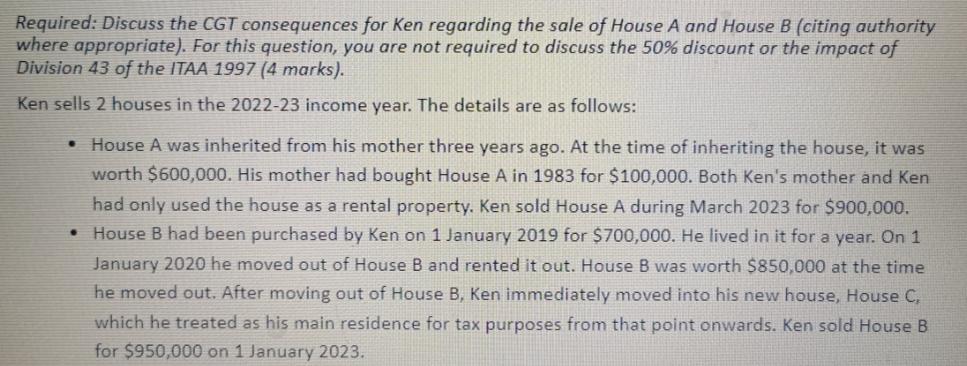

Required: Discuss the CGT consequences for Ken regarding the sale of House A and House B (citing authority where appropriate). For this question, you

Required: Discuss the CGT consequences for Ken regarding the sale of House A and House B (citing authority where appropriate). For this question, you are not required to discuss the 50% discount or the impact of Division 43 of the ITAA 1997 (4 marks). Ken sells 2 houses in the 2022-23 income year. The details are as follows: . House A was inherited from his mother three years ago. At the time of inheriting the house, it was worth $600,000. His mother had bought House A in 1983 for $100,000. Both Ken's mother and Ken had only used the house as a rental property. Ken sold House A during March 2023 for $900,000. House B had been purchased by Ken on 1 January 2019 for $700,000. He lived in it for a year. On 1 January 2020 he moved out of House B and rented it out. House B was worth $850,000 at the time he moved out. After moving out of House B, Ken immediately moved into his new house, House C, which he treated as his main residence for tax purposes from that point onwards. Ken sold House B for $950,000 on 1 January 2023.

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

I can discuss the Capital Gains Tax CGT consequences for Ken regarding the sale of House A and House B in the 202223 income year House A House A was i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started