Answered step by step

Verified Expert Solution

Question

1 Approved Answer

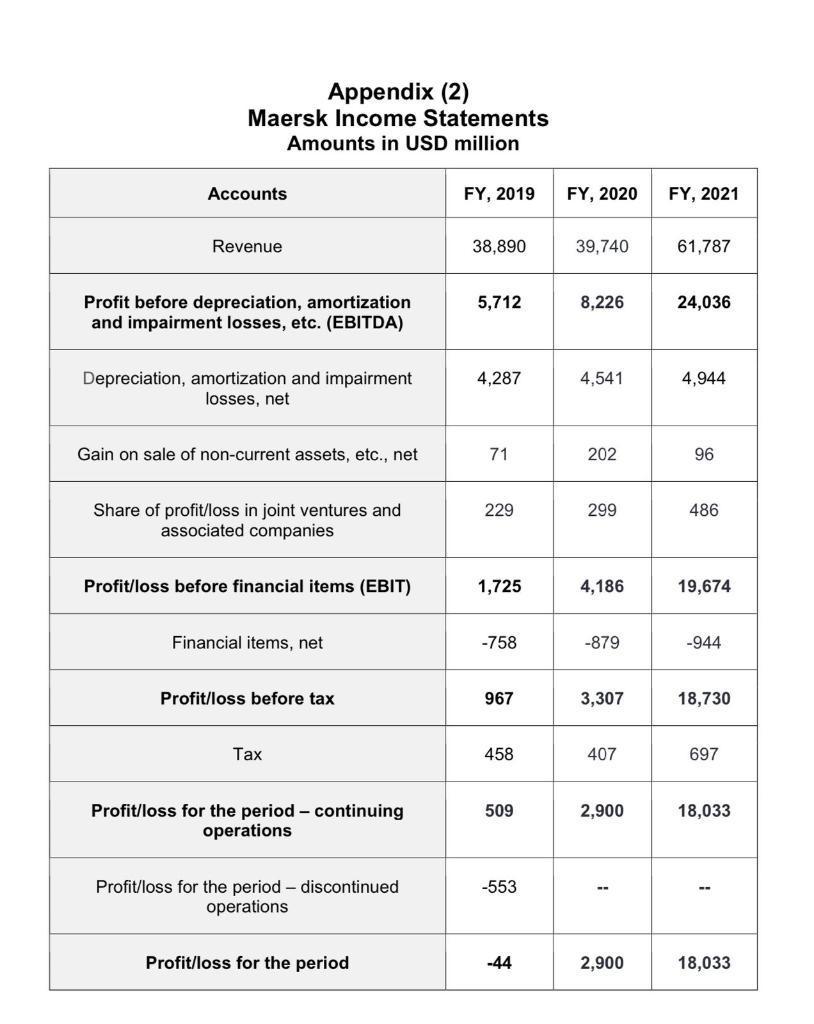

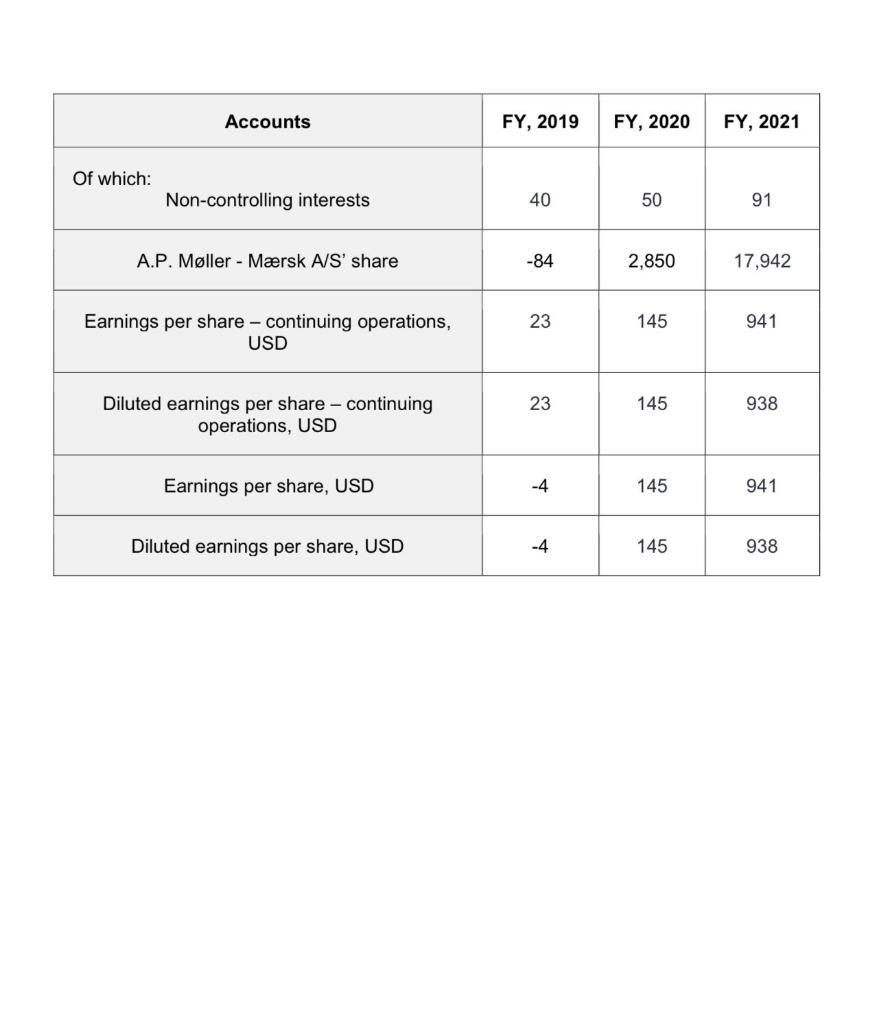

Required: Find Maersks Financial Statements over three years from 2019 till 2021. Analyse its financial performance from all dimensions (Profitability, Activity, Liquidity, Solvency) and make

Required:

Find Maersk’s Financial Statements over three years from 2019 till 2021.

Analyse its financial performance from all dimensions (Profitability, Activity, Liquidity, Solvency) and make relevant comments regarding your expectations of the trend of this performance in the subsequent years. ?

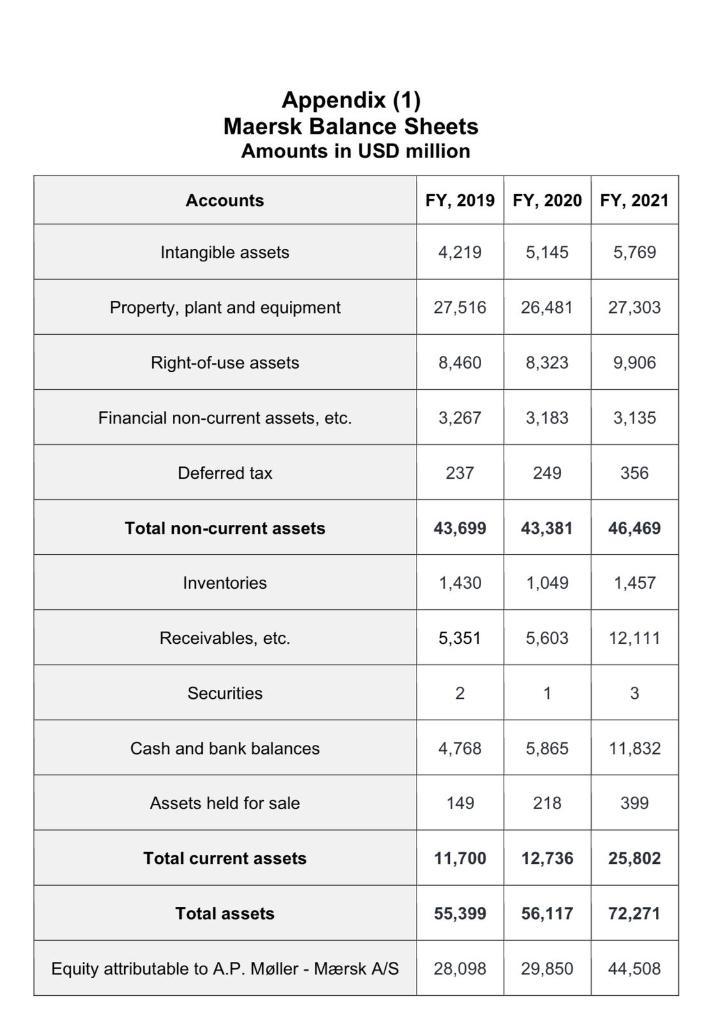

Appendix (1) Maersk Balance Sheets Amounts in USD million Accounts Intangible assets Property, plant and equipment Right-of-use assets Financial non-current assets, etc. Deferred tax Total non-current assets Inventories Receivables, etc. Securities Cash and bank balances Assets held for sale Total current assets Total assets Equity attributable to A.P. Mller - Mrsk A/S FY, 2019 FY, 2020 FY, 2021 4,219 27,516 8,460 3,267 237 43,699 1,430 5,351 2 4,768 149 5,145 26,481 8,323 3,183 249 43,381 1,049 5,603 1 5,865 218 11,700 12,736 55,399 56,117 5,769 27,303 9,906 3,135 356 46,469 1,457 12,111 3 11,832 399 25,802 72,271 28,098 29,850 44,508

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer and Explanation Profitability ratios Using data from a specific point in time profitability ratios are a class of financial metrics that are used to evaluate a companys capacity to generate ear...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started