Answered step by step

Verified Expert Solution

Question

1 Approved Answer

required full answer Double Flop Inc., a sporting goods retailer, recently completed its 2020 operations. Double Flop Inc.'s balance sheet information and income statement follow.

required full answer

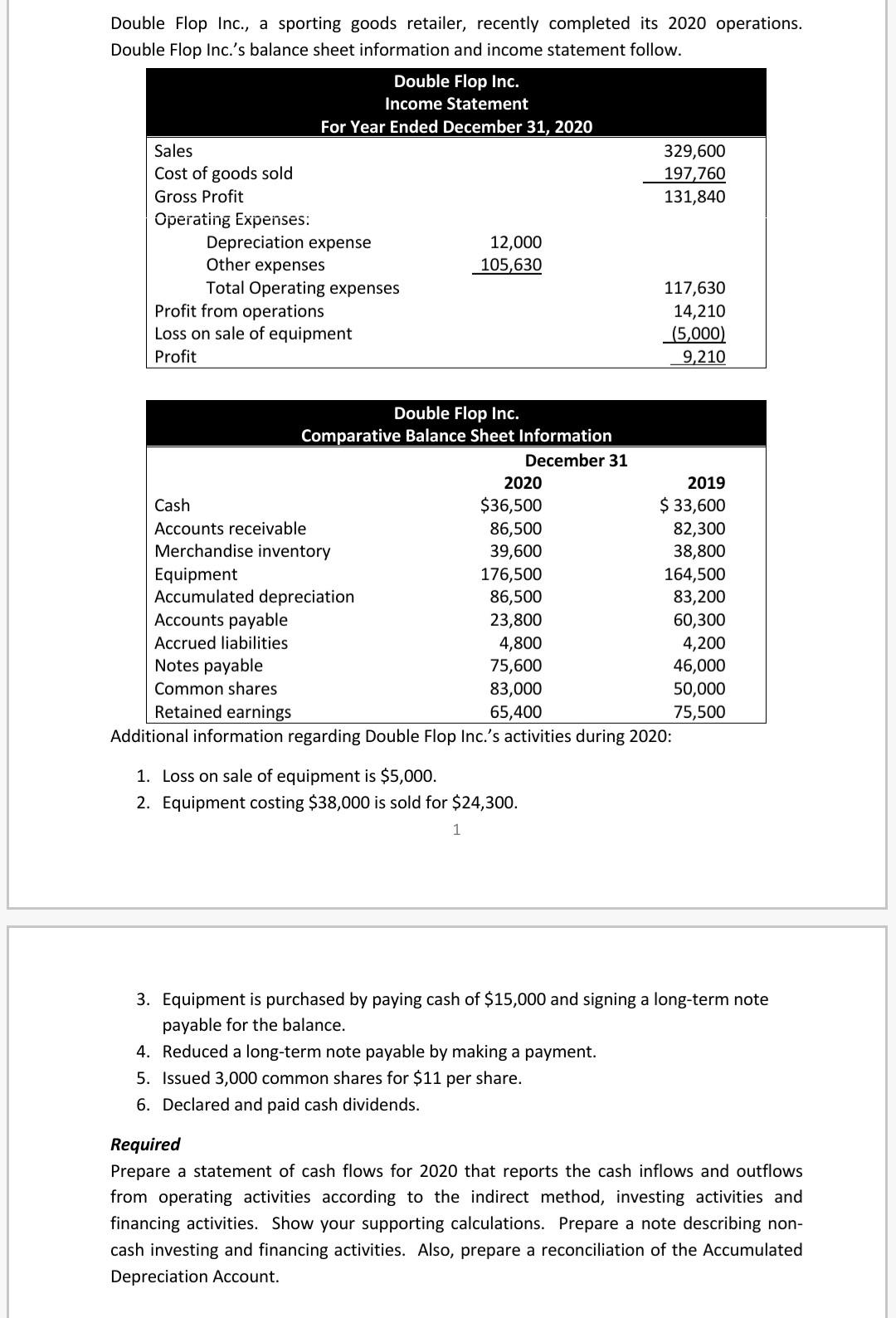

Double Flop Inc., a sporting goods retailer, recently completed its 2020 operations. Double Flop Inc.'s balance sheet information and income statement follow. Double Flop Inc. Income Statement For Year Ended December 31, 2020 Sales 329,600 Cost of goods sold 197,760 Gross Profit 131,840 Operating Expenses: Depreciation expense 12,000 Other expenses 105,630 Total Operating expenses 117,630 Profit from operations 14,210 Loss on sale of equipment (5,000) Profit 9,210 Double Flop Inc. Comparative Balance Sheet Information December 31 2020 2019 Cash $36,500 $ 33,600 Accounts receivable 86,500 82,300 Merchandise inventory 39,600 38,800 Equipment 176,500 164,500 Accumulated depreciation 86,500 83,200 Accounts payable 23,800 60,300 Accrued liabilities 4,800 4,200 Notes payable 75,600 46,000 Common shares 83,000 50,000 Retained earnings 65,400 75,500 Additional information regarding Double Flop Inc.'s activities during 2020: 1. Loss on sale of equipment is $5,000. 2. Equipment costing $38,000 is sold for $24,300. 3. Equipment is purchased by paying cash of $15,000 and signing a long-term note payable for the balance. 4. Reduced a long-term note payable by making a payment. 5. Issued 3,000 common shares for $11 per share. 6. Declared and paid cash dividends. Required Prepare a statement of cash flows for 2020 that reports the cash inflows and outflows from operating activities according to the indirect method, investing activities and financing activities. Show your supporting calculations. Prepare a note describing non- cash investing and financing activities. Also, prepare a reconciliation of the Accumulated Depreciation AccountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started