Answered step by step

Verified Expert Solution

Question

1 Approved Answer

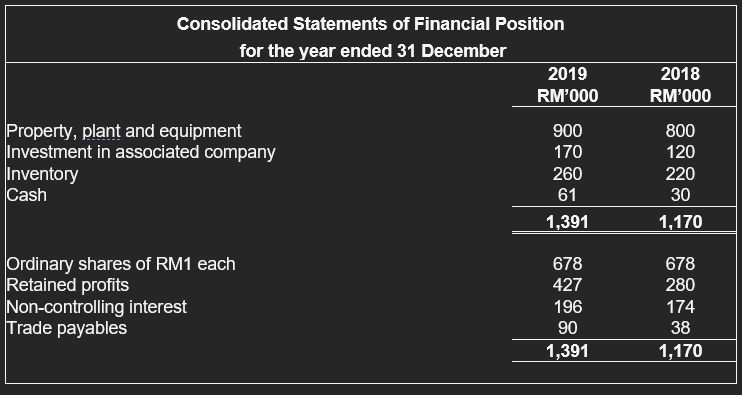

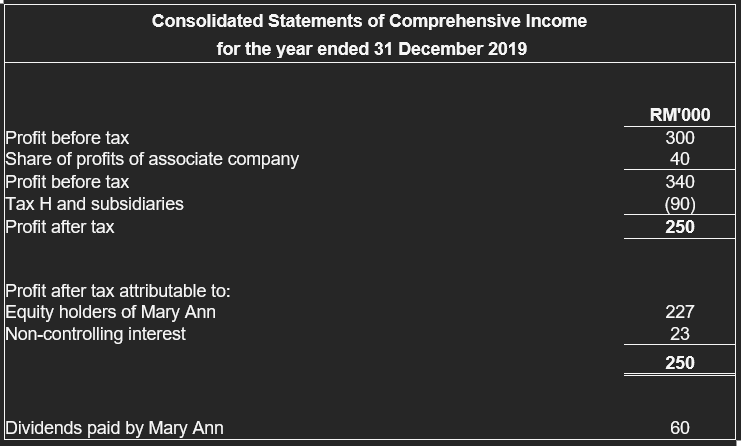

Required: Given below are the consolidated statements of financial position and the consolidated statement of comprehensive income for Marry Ann Bhd. Additional information: The tax

Required:

Given below are the consolidated statements of financial position and the consolidated statement of comprehensive income for Marry Ann Bhd.

Additional information:

- The tax charge for the year and the dividends declared have all been paid.

- Group depreciation is RM40,000 and there was no disposal of non-current assets during the year.

- The holdings interest in the subsidiary and associate remains unchanged.

QUESTION

- Prepare the group consolidated statement of cash flow for Mary Ann for 31 December 2019.

(20 marks)

2018 RM'000 Consolidated Statements of Financial Position for the year ended 31 December 2019 RM'000 Property, plant and equipment 900 Investment in associated company 170 Inventory 260 Cash 61 1,391 800 120 220 30 1,170 Ordinary shares of RM1 each Retained profits Non-controlling interest Trade payables 678 427 196 90 1,391 678 280 174 38 1,170 Consolidated Statements of Comprehensive Income for the year ended 31 December 2019 Profit before tax Share of profits of associate company Profit before tax Tax H and subsidiaries Profit after tax RM'000 300 40 340 (90) 250 Profit after tax attributable to: Equity holders of Mary Ann Non-controlling interest 227 23 250 Dividends paid by Mary Ann 60Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started