DF is a manufacturer of sports equipment. All of the shares of DF are held by the Wong family. The company has recently won

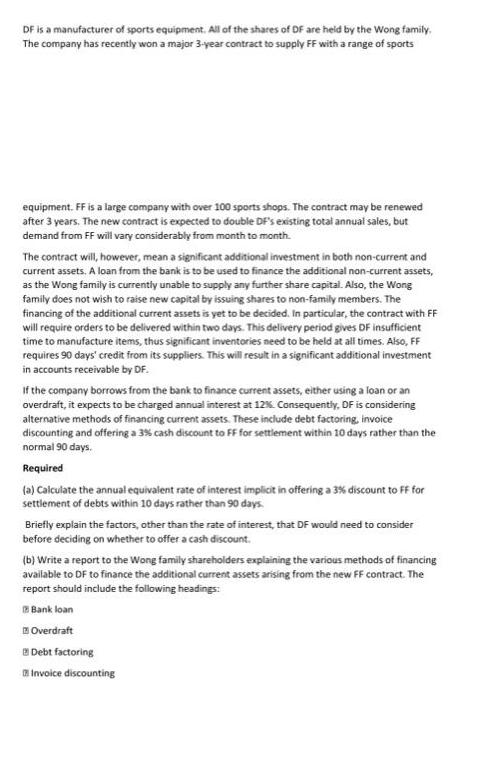

DF is a manufacturer of sports equipment. All of the shares of DF are held by the Wong family. The company has recently won a major 3-year contract to supply FF with a range of sports equipment. FF is a large company with over 100 sports shops. The contract may be renewed after 3 years. The new contract is expected to double DF's existing total annual sales, but demand from FF will vary considerably from month to month. The contract will, however, mean a significant additional investment in both non-current and current assets. A loan from the bank is to be used to finance the additional non-current assets, as the Wong family is currently unable to supply any further share capital. Also, the Wong family does not wish to raise new capital by issuing shares to non-family members. The financing of the additional current assets is yet to be decided. In particular, the contract with FF will require orders to be delivered within two days. This delivery period gives DF insufficient time to manufacture items, thus significant inventories need to be held at all times. Also, FF requires 90 days' credit from its suppliers. This will result in a significant additional investment in accounts receivable by DF. If the company borrows from the bank to finance current assets, either using a loan or an overdraft, it expects to be charged annual interest at 12%. Consequently, DF is considering alternative methods of financing current assets. These include debt factoring, invoice discounting and offering a 3% cash discount to FF for settlement within 10 days rather than the normal 90 days. Required (a) Calculate the annual equivalent rate of interest implicit in offering a 3% discount to FF for settlement of debts within 10 days rather than 90 days. Briefly explain the factors, other than the rate of interest, that DF would need to consider before deciding on whether to offer a cash discount. (b) Write a report to the Wong family shareholders explaining the various methods of financing available to DF to finance the additional current assets arising from the new FF contract. The report should include the following headings: Bank loan Overdraft Debt factoring Invoice discounting

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION STEP ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started