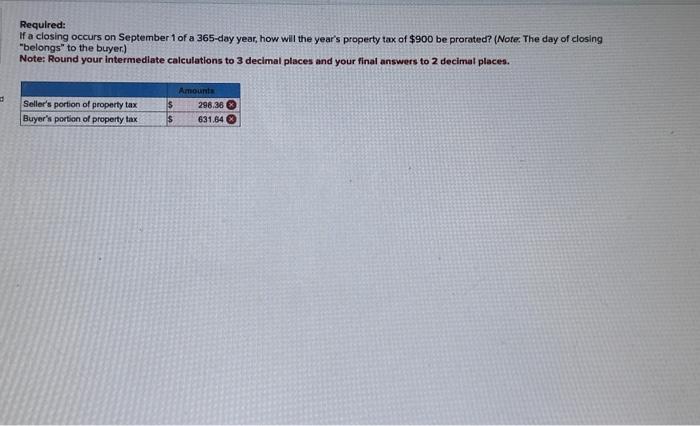

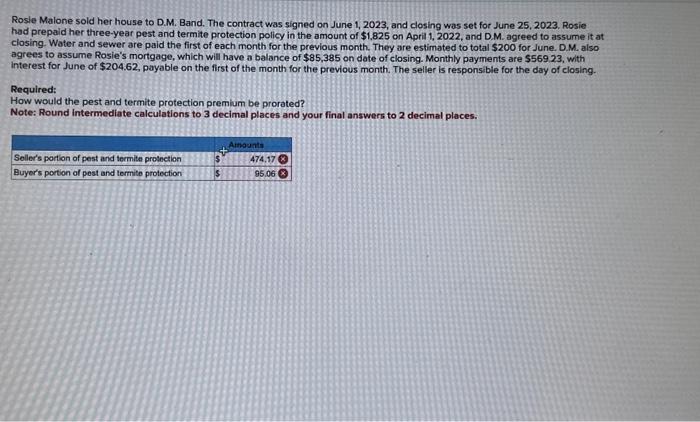

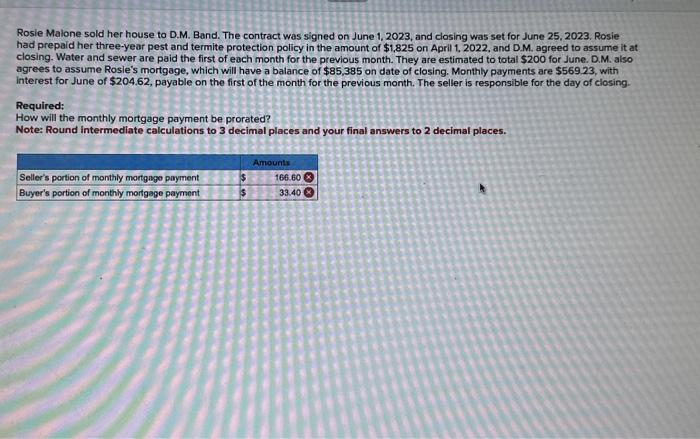

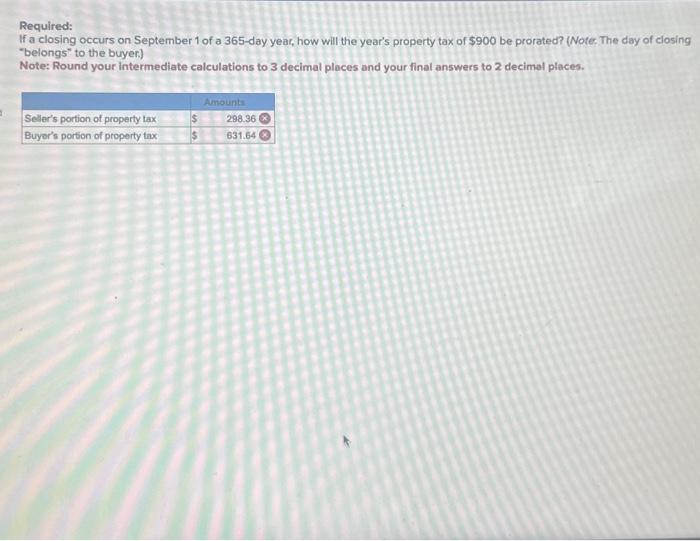

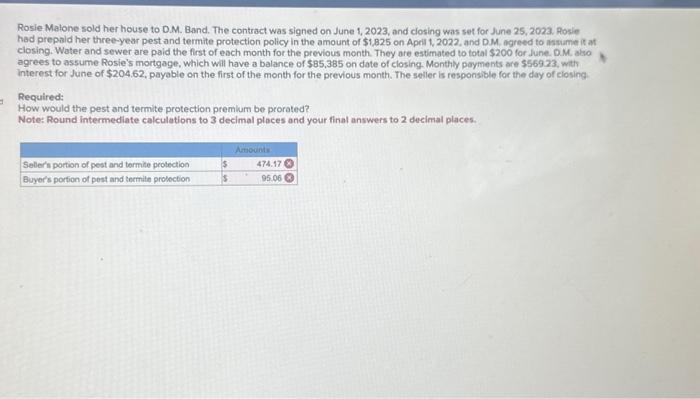

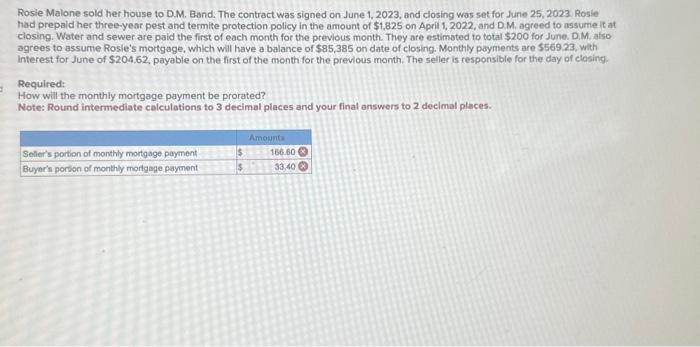

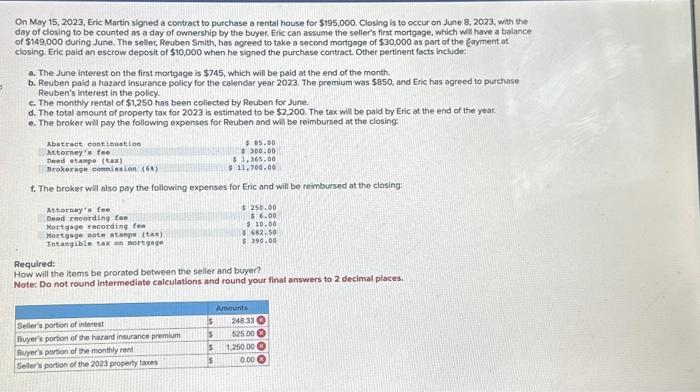

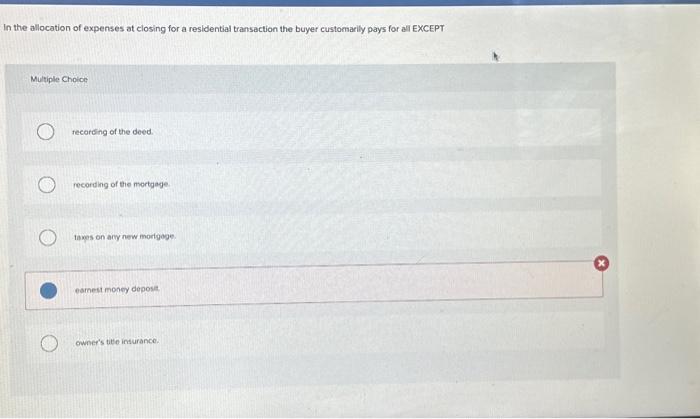

Required: If a closing occurs on September 1 of a 365 -day year, how will the year's property tax of $900 be prorated? (Note. The day of closing "belongs" to the buyer.) Note: Round your intermediate calculations to 3 decimal places and your final answers to 2 decimal places. Rosie Malone sold her house to D.M. Band. The contract was signed on June 1, 2023, and closing was set for June 25, 2023. Rosie had prepaid her three-year pest and termite protection policy in the amount of \$1,825 on April 1, 2022, and D.M. agreed to assume it at closing. Water and sewer are paid the first of each month for the previous month. They are estimated to total $200 for June. D.M. also agrees to assume Rosie's mortgage, which will have a balance of $85,385 on date of closing. Monthly payments are $56923, with interest for June of $204.62, payable on the first of the month for the previous month. The seller is responsible for the day of closing. Required: How would the pest and termite protection premlum be prorated? Note: Round intermediate calculations to 3 decimal places and your final answers to 2 decimal places. Rosie Malone sold her house to D.M. Band. The contract was signed on June 1, 2023, and closing was set for June 25, 2023, Rosie had prepaid her three-year pest and termite protection policy in the amount of $1,825 on April 1, 2022, and D.M. agreed to assume it at closing. Water and sewer are paid the first of each month for the previous month. They are estimated to total $200 for June. D.M. also agrees to assume Rosie's mortgage, which will have a balance of $85,385 on date of closing. Monthly payments are $569.23, with interest for June of $204.62, payable on the first of the month for the previous month. The seller is responsible for the day of closing. Required: How will the monthly mortgage payment be prorated? Note: Round intermedlate calculations to 3 decimal places and your final answers to 2 decimal places. Required: If a closing occurs on September 1 of a 365-day year, how will the year's property tax of $900 be prorated? (Note. The day of closing "belongs" to the buyer.) Note: Round your intermediate calculations to 3 decimal ploces and your final answers to 2 decimal places. Rosie Malone sold her house to D.M. Band. The contract was signed on June 1, 2023, and ciosing was set for June 25, 2023. Rosie had prepald her three-year pest and termite protection policy in the amount of \$1,825 on April 1,2022, and D.M. agreed to assume it at closing. Woter and sewer are paid the first of each month for the previous month. They are estimated to total $200 for lune. 0.M. also agrees to assume Rosie's mortgage, which will have a balance of $85.385 on date of closing Monthly payments are $569.23, with interest for June of $204.62, payable on the first of the month for the previous month. The seller is responsible for the day of closing Required How would the pest and termite protection premiur be prorated? Note: Round intermediate calculations to 3 decimal places and your final answers to 2 decimal places. Rosie Malone sold her house to D.M. Band. The contract was signed on June 1, 2023, and closing was set for June 25, 2023, Rosie had prepaid her three-year pest and termite protection policy in the amount of \$1,825 on April 1,2022, and DM, agreed to assume it at closing. Water and sewer are paid the first of each month for the previous month. They are estimated to total $200 for June. D.M, afso agrees to assume Rosle's mortgage, which will have a balance of $85,385 on date of closing. Monthly payments are 5569.23 , with interest for June of $204.62, payable on the first of the month for the previous month. The seller is responsible for the day of closing. Required: How will the monthly mortgage payment be prorated? Note: Round intermediate calculations to 3 decimal places and your final answers to 2 decimal places. On May 15, 2023, Eric Martin signed a contract to purchase a rental house for $195,000, Closing is to occur on June 8,2023 , with the day of closing to be counted as a day of ownership by the buyer. Eric can assume the seller's first mortgage, which wir have a balance of $149,000 during June. The seller, Reuben Smith, has ogreed to take a second mortgage of $30,000 as part of the jayment at closing. Eric paid an escrow deposit of $10,000 when he signed the purchase contract. Other pertinent facts include: a. The June interest on the first mortgage is $745, which will be paid at the end of the month. b. Reuben paid a hazard insurance policy for the calendar year 2023 . The premium was $850, and Eric has agreed to purchase Reuben's interest in the policy. c. The monthly rental of $1,250 has been collected by Reuben for June. d. The total amount of property tax for 2023 is estimated to be $2,200. The tax will be pald by Eric at the end of the yeat. e. The broker wal pay the following expenses for Reuben and will be reimburspd at the closing: f. The broker will aiso pay the following expenses for Eric and will be reimbursed at the closing: Required: How will the items be prorated between the seller and buyer? Note: Do not round intermediate calculations and round your final answers to 2 decimal places. In the allocation of expenses at closing for a residential transaction the buyer customarily pays for all EXCEPT Multiple Choice recorsing of the deed. recording of the mortgage. tawes on any new mortgoge. esrnest money depose. owner's tite insurance