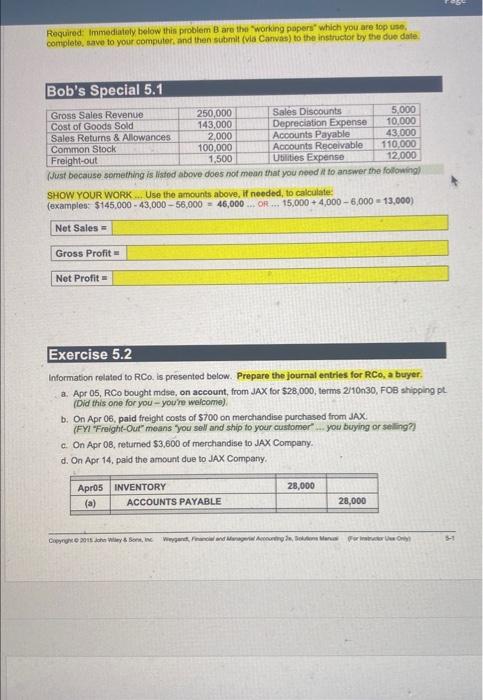

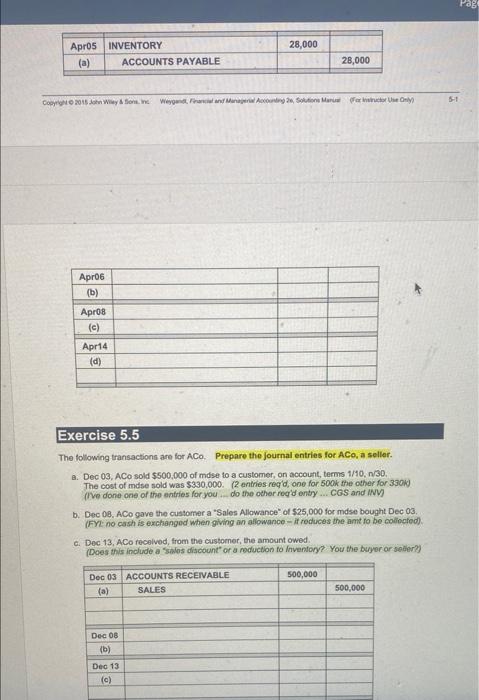

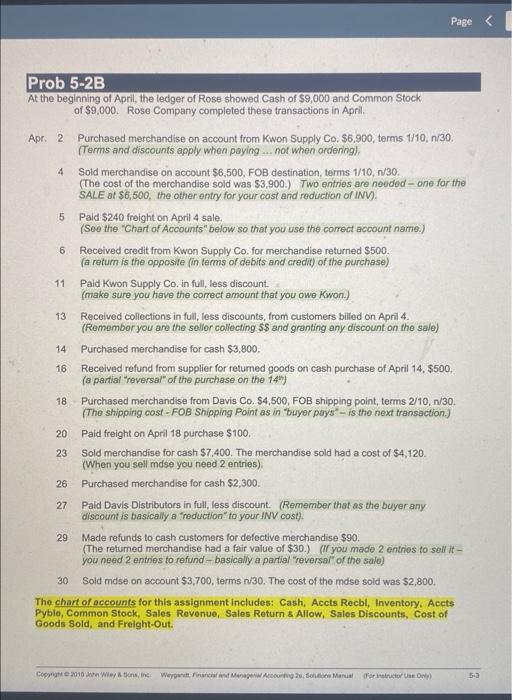

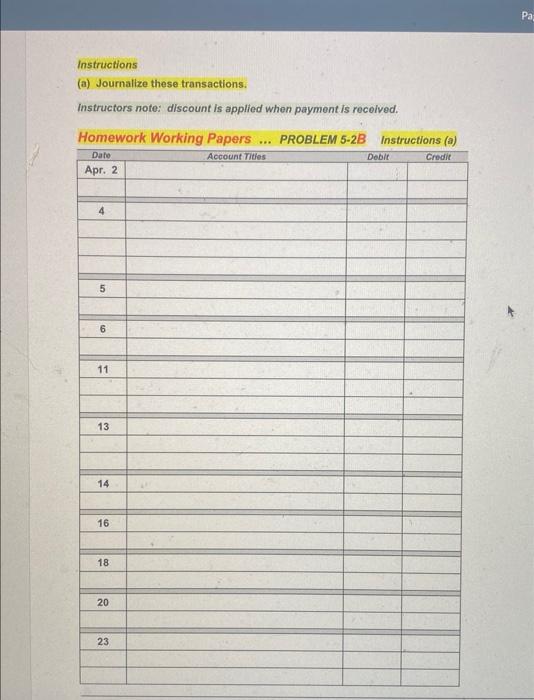

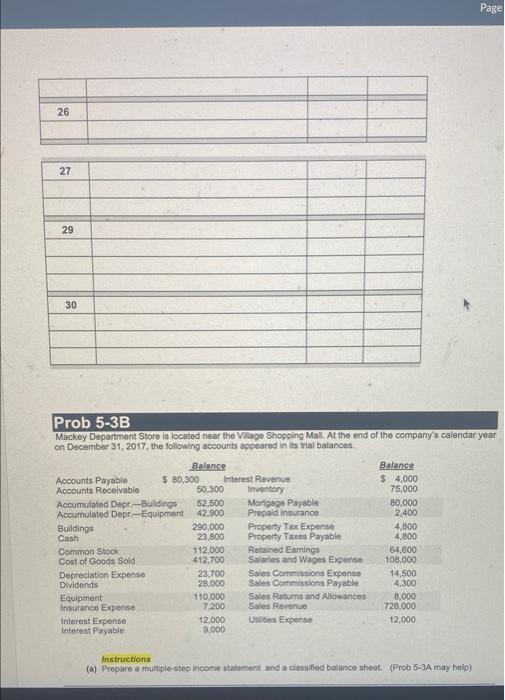

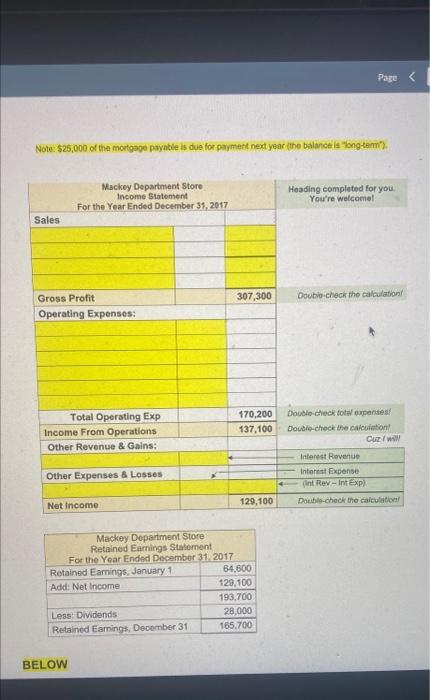

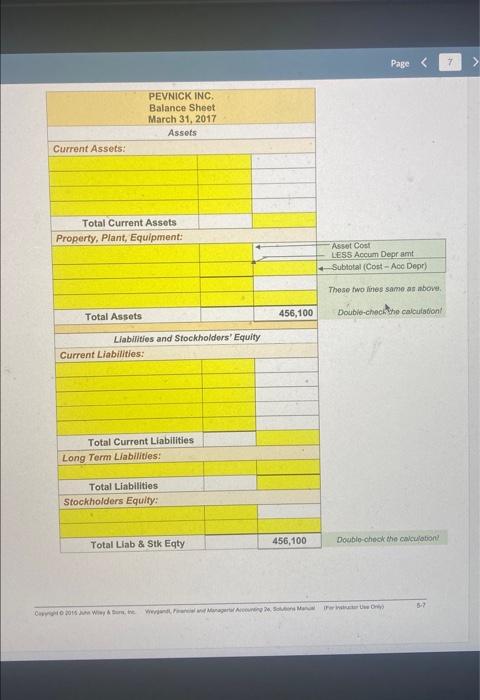

Required: Immediately below this problem are the working papers which you are top use, completo, save to your computer, and then submit (Via Canvas) to the instructor by the due date Bob's Special 5.1 Gross Sales Revenue 250,000 Sales Discounts 5,000 Cost of Goods Sold 143,000 Depreciation Expense 10.000 Sales Returns & Allowances 2,000 Accounts Payable 43.000 Common Stock 100,000 Accounts Receivable 110.000 Freight-out 1,500 Ubilities Expense 12,000 (Just because something is listed above does not mean that you need it to answer the following SHOW YOUR WORK... Use the amounts above, if needed, to calculate (examples: $145,000 - 43,000 - 56,000 46,000 OR... 15,000 +4,000 -6,000 - 13.000) Net Sales Gross Profit Net Profit Exercise 5.2 Information related to RCo. is presented below. Prepare the journal entries for RCo, a buyer. a. Apr 05, RCo bought mdse, on account, from JAX for $28,000, terms 2/10n30, FOB shipping pt (Did this one for you - you're welcome) b. On Apr 06, paid freight costs of $700 on merchandise purchased from JAX. (FYI "Freight-Out" means you sell and ship to your customer"...you buying or selling c. On Apr 08, returned $3,600 of merchandise to JAX Company. d. On Apr 14, paid the amount due to JAX Company 28,000 Apr05 INVENTORY (a) ACCOUNTS PAYABLE 28,000 DO 15. Wyson, Wagnetico e continuar ag 28,000 Apros INVENTORY (a) ACCOUNTS PAYABLE 28,000 CON 2015 Wayne Weygalow and Manager in Maribor Use Only 5-1 (b) Apr08 (c) Apr14 (d) Exercise 5.5 The following transactions are for AC. Prepare the journal entries for Aco, a seller. a. Dec 03, ACO sold $500,000 of mdse to a customer, on account, terms 1/10, 1/30. The cost of mdse sold was $330,000. (2 entries regd, one for 500k the other for 3301) (Ive done one of the entries for you..do the other rood entry... CGS and IN b. Dec 08, ACo gave the customer a "Sales Allowance of $25,000 for mdse bought Dec 03, (FYE no cash is exchanged when giving an allowance it reduces the amt to be collected). c. Dec 13, ACo received from the customer, the amount owed. (Does this include a sales discount or a reduction to inventory? You the buyer or seer) 500,000 Dec 03 ACCOUNTS RECEIVABLE (a) SALES 500,000 Dec 08 (b) Dec 13 (c) Page