Answered step by step

Verified Expert Solution

Question

1 Approved Answer

required Info AGE: 23 last number in student number to use a interest rate earned 9% please show calculations for how you got your answer.

required Info

AGE: 23

last number in student number to use a interest rate earned 9%

please show calculations for how you got your answer. thanks

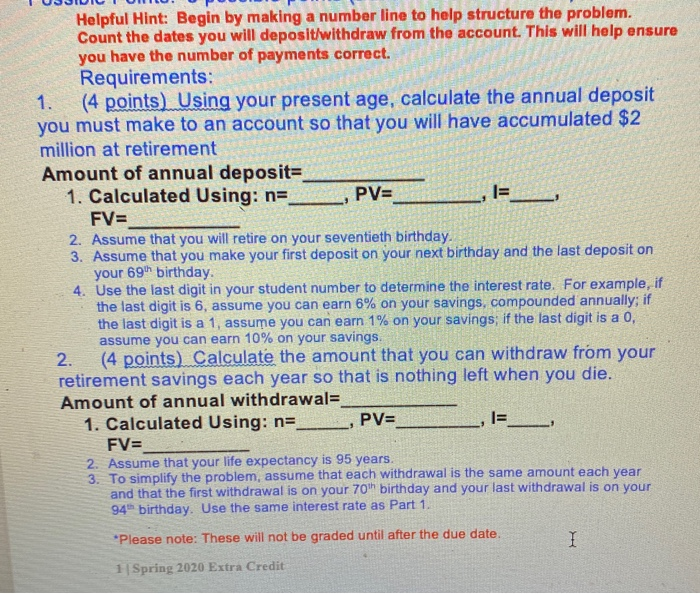

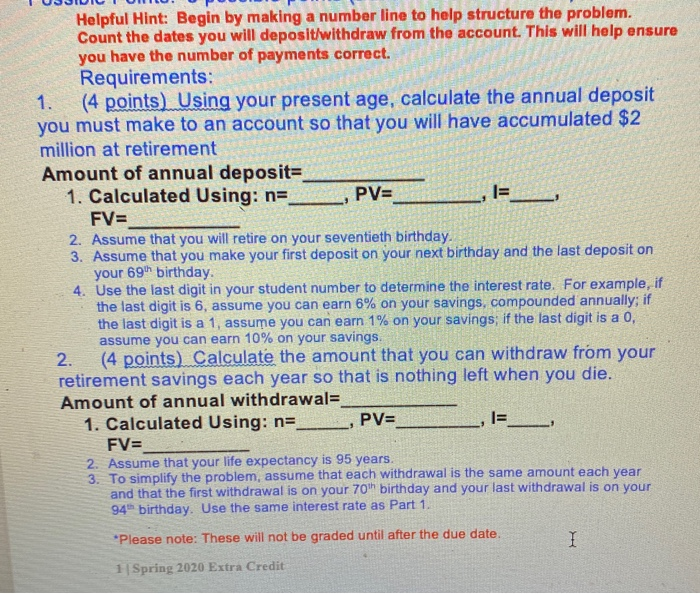

Helpful Hint: Begin by making a number line to help structure the problem. Count the dates you will deposit/withdraw from the account. This will help ensure you have the number of payments correct. Requirements: 1. (4 points). Using your present age, calculate the annual deposit you must make to an account so that you will have accumulated $2 million at retirement Amount of annual deposit 1. Calculated Using: n= , PV= FV= 2. Assume that you will retire on your seventieth birthday. 3. Assume that you make your first deposit on your next birthday and the last deposit on your 69h birthday. 4. Use the last digit in your student number to determine the interest rate. For example, if the last digit is 6, assume you can earn 6% on your savings, compounded annually, if the last digit is a 1, assume you can earn 1% on your savings; if the last digit is a 0, assume you can earn 10% on your savings. 2. (4 points) Calculate the amount that you can withdraw from your retirement savings each year so that is nothing left when you die. Amount of annual withdrawal= 1. Calculated Using: n= PV= FV= 2. Assume that your life expectancy is 95 years. 3. To simplify the problem, assume that each withdrawal is the same amount each year and that the first withdrawal is on your 70 h birthday and your last withdrawal is on your 94th birthday. Use the same interest rate as Part 1 *Please note: These will not be graded until after the due date. 1 | Spring 2020 Extra Credit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started