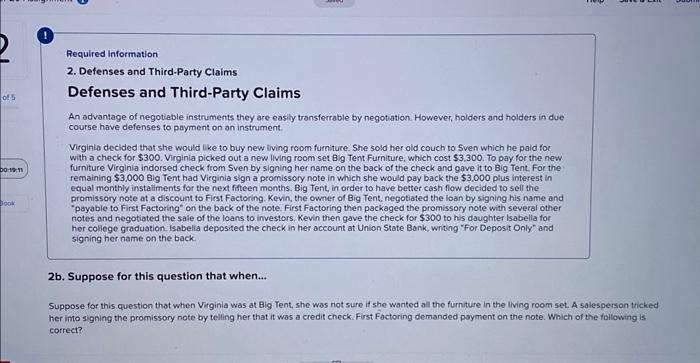

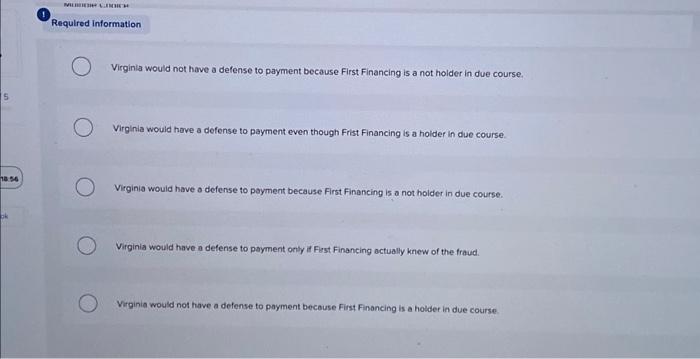

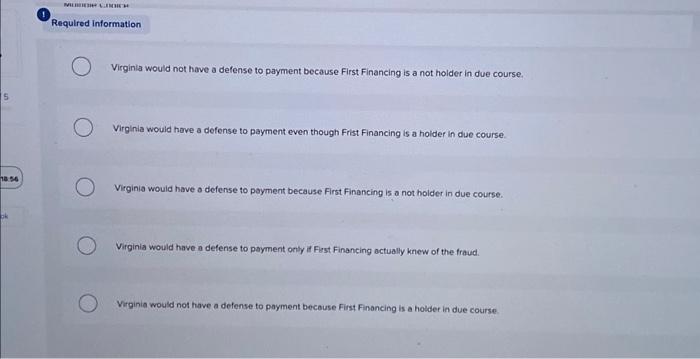

Required information 2. Defenses and Third-Party Claims Defenses and Third-Party Claims An advantage of negotiable instruments they are easily transferrable by negotiation. However, holders and holders in due course have defenses to payment on an instrument. Virginilo decided that she would like to buy new living room furniture. She sold her old couch to Sven which he paid for with a check for $300. Virginia picked out a new living room set Big Tent Furniture, which cost $3,300. To pay for the new furniture Virginia indorsed check from Sven by signing her name on the back of the check and gave it to Big Tent. For the remaining $3,000 Big Tent had Virginia sign a promissory note in which she would pay back the $3,000 plus interest in equal monthly instaliments for the next fifteen months. Big Tent, in order to have better cash flow decided to sell the promissory note at a discount to First Factoring. Kevin, the owner of Big Tent, negotiated the loan by signing his name and "payable to First Factoring" on the back of the note. First Factoring then packaged the promissory note with several other notes and negotiated the sale of the loans to investors. Kevin then gave the check for $300 to his daughter Isabella for. her college graduation, Isabelia deposited the check in her account at Union State Bank, writing "For Deposit Only" and signing her name on the back. 2b. Suppose for this question that when... Suppose for this question that when Virginia was at Big Tent, she was not sure if she wanted all the furniture in the living room set. A salesperson tricked her into signing the promissory note by telling her that it was a credit check. First Factoring demanded payment on the note. Which of the following is correct? Required information Virginia would not have a defense to payment because First Financing is a not holder in due course. Virginia would have a defense to payment even though Frist Financing is a holder in due course. Virginia would have o defense to payment because First financing is a not holder in due course. Virginia would have a defense to payment only if First Financing octually knew of the fraud. Virginia would not have a defense to payment because First Financing is a holder in due course