Answered step by step

Verified Expert Solution

Question

1 Approved Answer

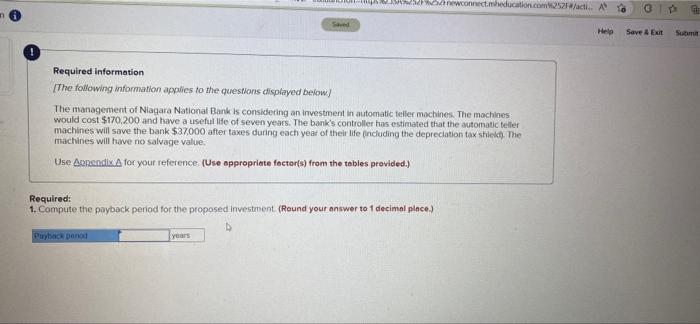

Required information 50.3%252Fnewconnect.mheducation.com%252F#/acti.. A Saved Help Save & Exit Submit [The following information applies to the questions displayed below) The management of Niagara National

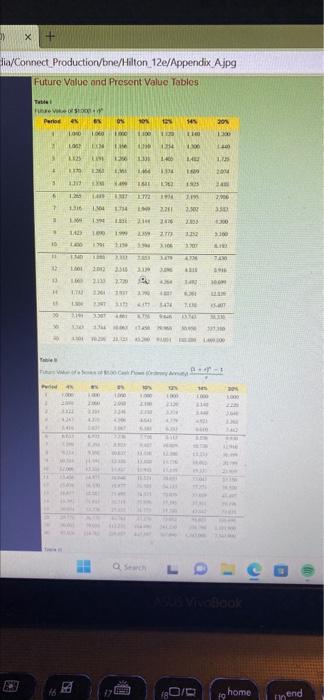

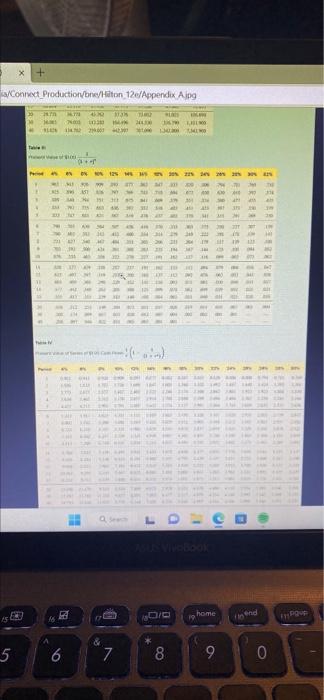

Required information 50.3%252Fnewconnect.mheducation.com%252F#/acti.. A Saved Help Save & Exit Submit [The following information applies to the questions displayed below) The management of Niagara National Bank is considering an investment in automatic teller machines. The machines. would cost $170,200 and have a useful life of seven years. The bank's controller has estimated that the automatic teller machines will save the bank $37,000 after taxes during each year of their life (including the depreciation tax shield). The machines will have no salvage value. Use Appendix.A for your reference. (Use appropriate factor(s) from the tables provided.) Required: 1. Compute the payback period for the proposed investment. (Round your answer to 1 decimal place.) Payback penod years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started