Answered step by step

Verified Expert Solution

Question

1 Approved Answer

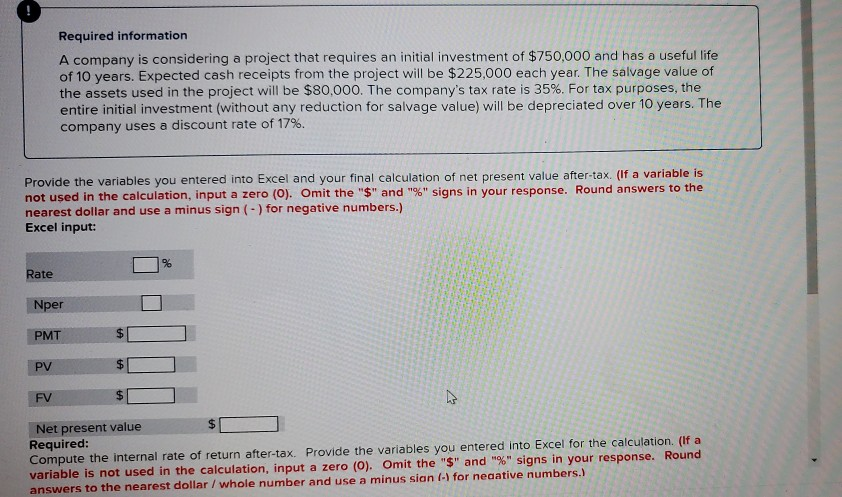

Required information A company is considering a project that requires an initial investment of $750,000 and has a useful life of 10 years. Expected cash

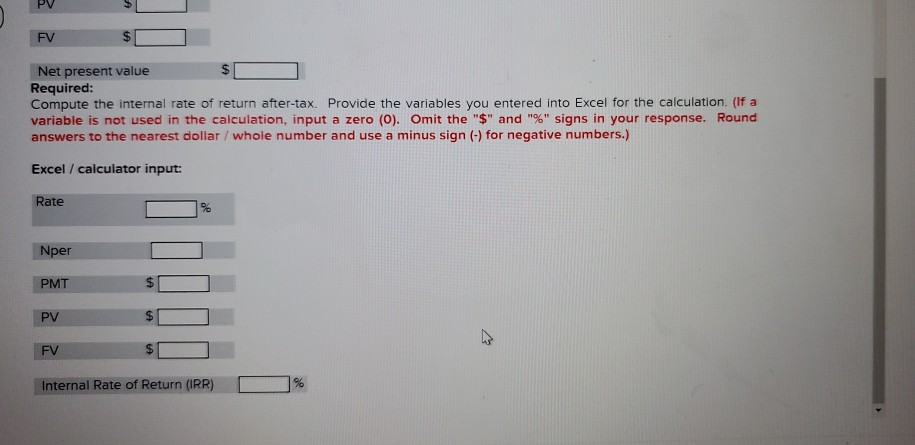

Required information A company is considering a project that requires an initial investment of $750,000 and has a useful life of 10 years. Expected cash receipts from the project will be $225,000 each year. The salvage value of the assets used in the project will be $80,000. The company's tax rate is 35%. For tax purposes, the entire initial investment (without any reduction for salvage value) will be depreciated over 10 years. The company uses a discount rate of 17%. Provide the variables you entered into Excel and your final calculation of net present value after-tax. (If a variable is not used in the calculation, input a zero (O). Omit the "$" and "%" signs in your response. Round answers to the nearest dollar and use a minus sign (-) for negative numbers.) Excel input: Rate Nper PMT $ PVO FV $0 Net present value Required: Compute the internal rate of return after-tax. Provide the variables you entered into Excel for the calculation. (If a variable is not used in the calculation, input a zero (O). Omit the "$" and "%" signs in your response. Round answers to the nearest dollar / whole number and use a minus sian (-) for negative numbers.) PV FV $ Net present value $ Required: Compute the internal rate of return after-tax. Provide the variables you entered into Excel for the calculation. (If a variable is not used in the calculation, input a zero (0). Omit the "$" and "%" signs in your response. Round answers to the nearest dollar/whole number and use a minus sign (-) for negative numbers.) Excel / calculator input: Rate Nper . O $ PMT PV $ FV $ Internal Rate of Return (IRR) 0 % Required information A company is considering a project that requires an initial investment of $750,000 and has a useful life of 10 years. Expected cash receipts from the project will be $225,000 each year. The salvage value of the assets used in the project will be $80,000. The company's tax rate is 35%. For tax purposes, the entire initial investment (without any reduction for salvage value) will be depreciated over 10 years. The company uses a discount rate of 17%. Provide the variables you entered into Excel and your final calculation of net present value after-tax. (If a variable is not used in the calculation, input a zero (O). Omit the "$" and "%" signs in your response. Round answers to the nearest dollar and use a minus sign (-) for negative numbers.) Excel input: Rate Nper PMT $ PVO FV $0 Net present value Required: Compute the internal rate of return after-tax. Provide the variables you entered into Excel for the calculation. (If a variable is not used in the calculation, input a zero (O). Omit the "$" and "%" signs in your response. Round answers to the nearest dollar / whole number and use a minus sian (-) for negative numbers.) PV FV $ Net present value $ Required: Compute the internal rate of return after-tax. Provide the variables you entered into Excel for the calculation. (If a variable is not used in the calculation, input a zero (0). Omit the "$" and "%" signs in your response. Round answers to the nearest dollar/whole number and use a minus sign (-) for negative numbers.) Excel / calculator input: Rate Nper . O $ PMT PV $ FV $ Internal Rate of Return (IRR) 0 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started