Question

Required information (Algo) Change in estimate; useful life and residual value of equipment Wardell Company purchased a minicomputer on January 1, 2022, at a cost

Required information (Algo) Change in estimate; useful life and residual value of equipment

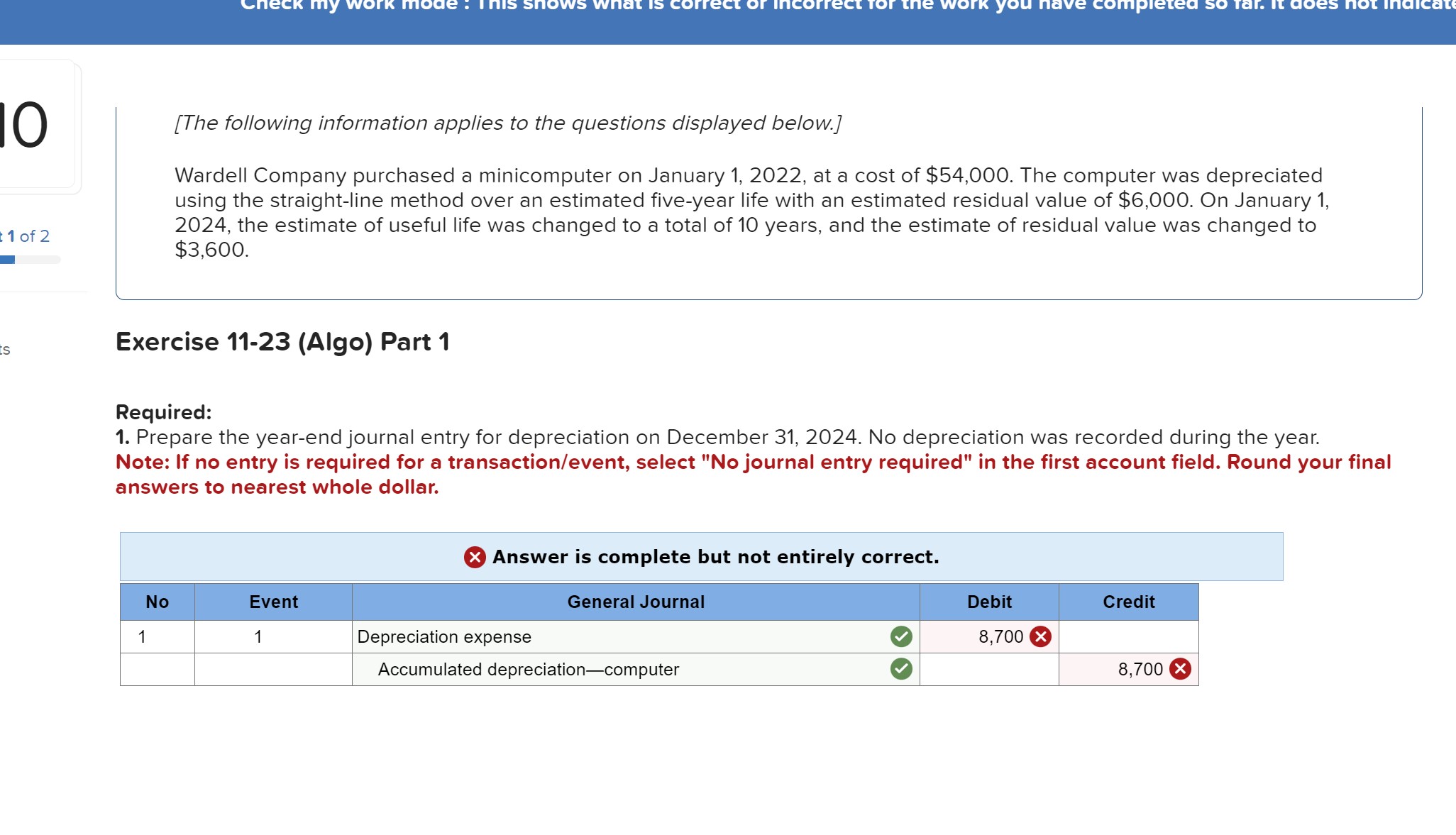

Wardell Company purchased a minicomputer on January 1, 2022, at a cost of $54,000. The computer was depreciated using the straight-line method over an estimated five-year life with an estimated residual value of $6,000. On January 1, 2024, the estimate of useful life was changed to a total of 10 years, and the estimate of residual value was changed to $3,600.

2.Prepare the year-end journal entry for depreciation on December 31, 2024. Assume that the company uses the double-declining-balance method instead of the straight-line method.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your final answers to nearest whole dollar.

Answer

Report this answer

| Date | Accounts | Debit | Credit |

| Dec 31, 2024 | Depreciation Expense | $ 8,700.00 | |

Accumulated Depreciation - computer | $ 8,700.00 |

Explanation:

Change in depreciation method is a change in accounting estimate hence the effect is treated PROSPECTIVELY.

my work mode: This shows what is correct or for the you ha completed so far. It does not indicate 10 [The following information applies to the questions displayed below.] 1 of 2 Wardell Company purchased a minicomputer on January 1, 2022, at a cost of $54,000. The computer was depreciated using the straight-line method over an estimated five-year life with an estimated residual value of $6,000. On January 1, 2024, the estimate of useful life was changed to a total of 10 years, and the estimate of residual value was changed to $3,600. Es Exercise 11-23 (Algo) Part 1 Required: 1. Prepare the year-end journal entry for depreciation on December 31, 2024. No depreciation was recorded during the year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to nearest whole dollar. Answer is complete but not entirely correct. No Event General Journal Debit Credit 1 Depreciation expense 8,700 Accumulated depreciation-computer 8,700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started