Answered step by step

Verified Expert Solution

Question

1 Approved Answer

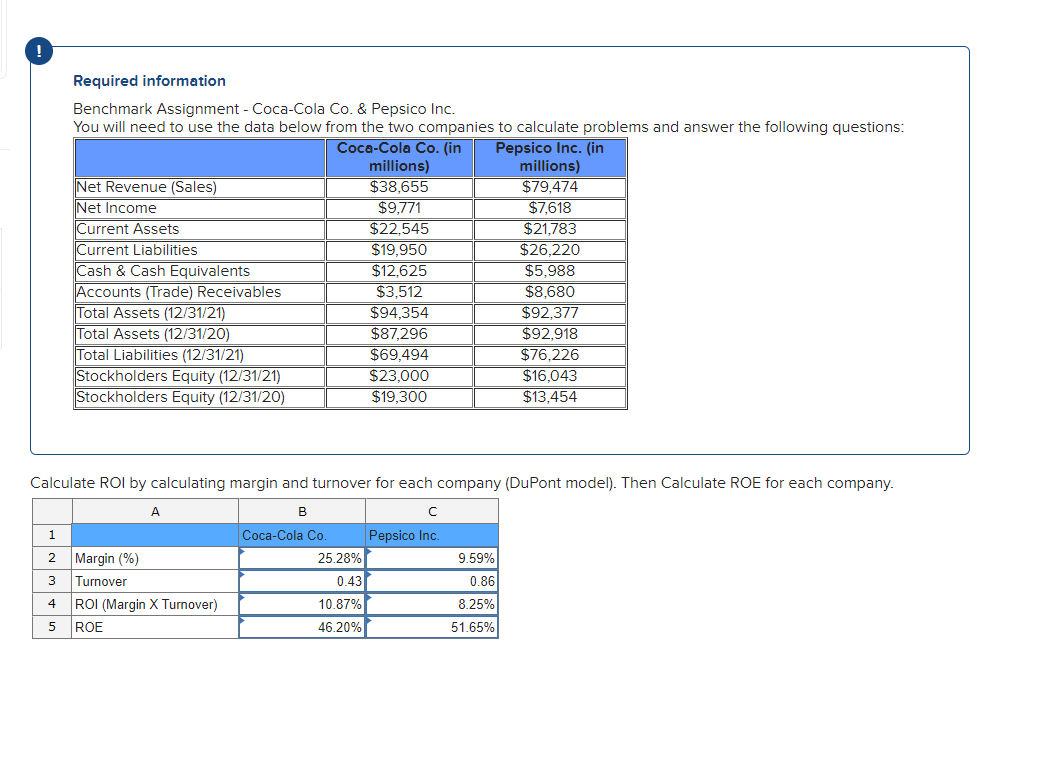

Required information Benchmark Assignment - Coca-Cola Co. & Pepsico Inc. You will need to use the data below from the two companies to calculate

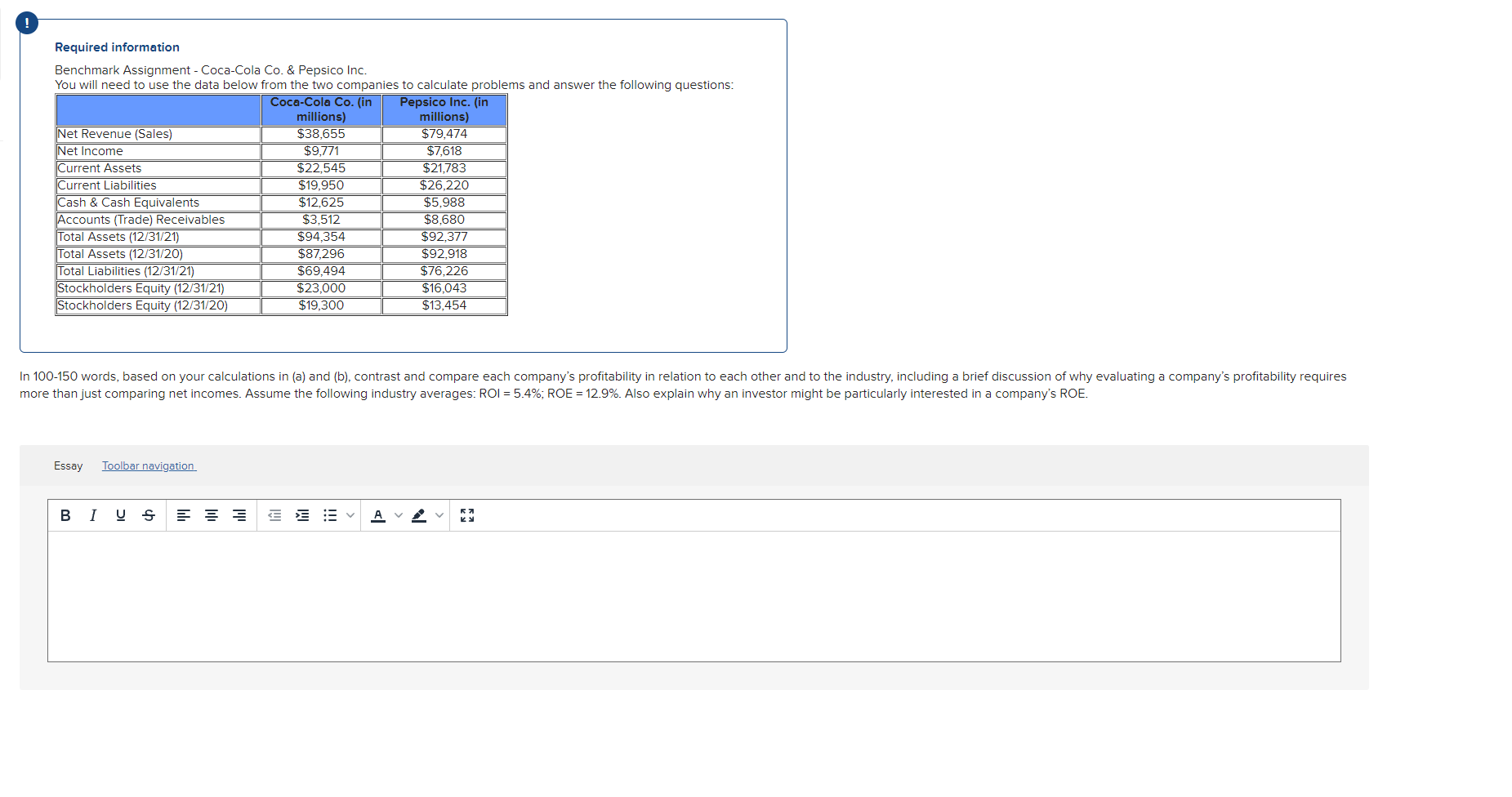

Required information Benchmark Assignment - Coca-Cola Co. & Pepsico Inc. You will need to use the data below from the two companies to calculate problems and answer the following questions: Net Revenue (Sales) Coca-Cola Co. (in millions) $38,655 Pepsico Inc. (in millions) $79,474 Net Income $9,771 $7,618 Current Assets $22,545 $21,783 Current Liabilities $19,950 $26,220 Cash & Cash Equivalents $12,625 $5,988 Accounts (Trade) Receivables $3,512 $8,680 Total Assets (12/31/21) $94,354 $92,377 Total Assets (12/31/20) $87,296 $92,918 Total Liabilities (12/31/21) $69,494 $76,226 Stockholders Equity (12/31/21) $23,000 $16,043 Stockholders Equity (12/31/20) $19,300 $13,454 Calculate ROI by calculating margin and turnover for each company (DuPont model). Then Calculate ROE for each company. A B 1 Coca-Cola Co. Pepsico Inc. 2 Margin (%) 3 Turnover 25.28% 0.43 9.59% 0.86 4 ROI (Margin X Turnover) 10.87% 8.25% 5 ROE 46.20% 51.65% ! Required information Benchmark Assignment - Coca-Cola Co. & Pepsico Inc. You will need to use the data below from the two companies to calculate problems and answer the following questions: Net Revenue (Sales) Coca-Cola Co. (in millions) $38,655 Pepsico Inc. (in millions) $79,474 Net Income $9,771 $7,618 Current Assets $22,545 $21,783 Current Liabilities $19,950 $26.220 Cash & Cash Equivalents $12,625 $5,988 Accounts (Trade) Receivables $3,512 $8,680 Total Assets (12/31/21) $94,354 $92,377 Total Assets (12/31/20) $87,296 $92,918 Total Liabilities (12/31/21) $69,494 $76,226 Stockholders Equity (12/31/21) $23,000 Stockholders Equity (12/31/20) $19,300 $16,043 $13,454 In 100-150 words, based on your calculations in (a) and (b), contrast and compare each company's profitability in relation to each other and to the industry, including a brief discussion of why evaluating a company's profitability requires more than just comparing net incomes. Assume the following industry averages: ROI = 5.4%; ROE = 12.9%. Also explain why an investor might be particularly interested in a company's ROE. Essay Toolbar navigation B I U S = = = A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started