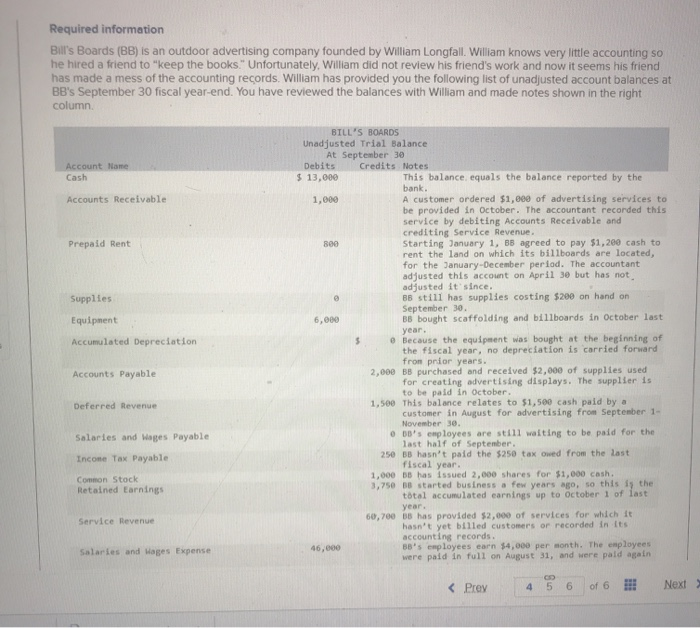

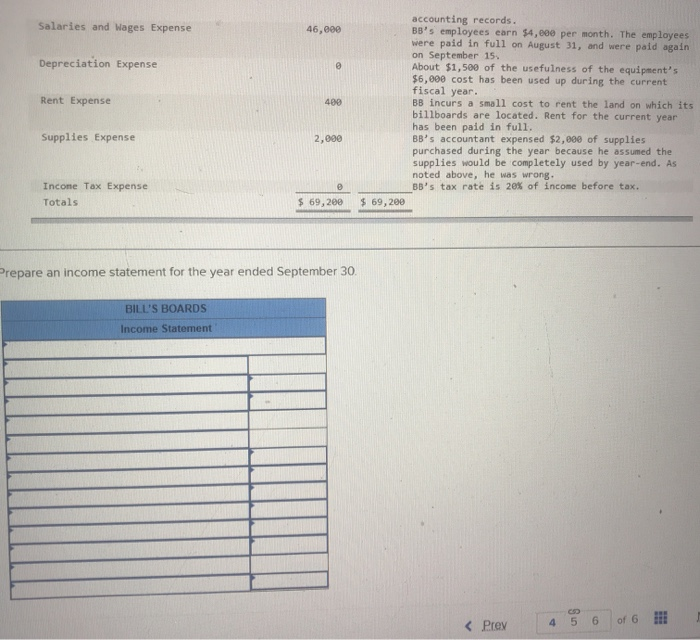

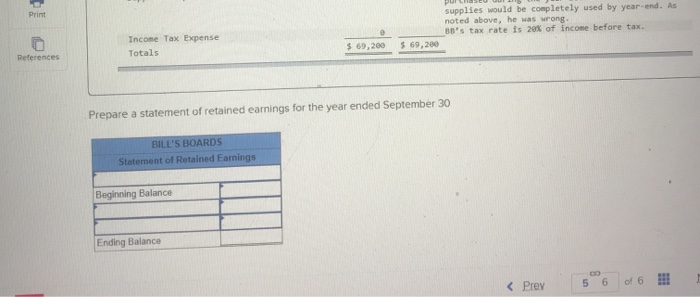

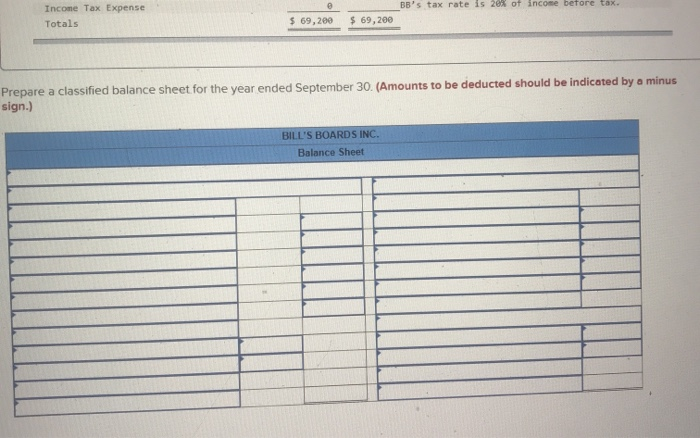

Required information Bill's Boards (BB) is an outdoor advertising company founded by William Longfall. William knows very little accounting so he hired a friend to "keep the books." Unfortunately, William did not review his friend's work and now it seems his friend has made a mess of the accounting records. William has provided you the following list of unadjusted account balances at BB's September 30 fiscal year-end. You have reviewed the balances with William and made notes shown in the right column Account Name Cash Accounts Receivable Prepaid Rent Supplies Equipment Accumulated Depreciation BILL'S BOARDS Unadjusted Trial Balance At September 30 Debits Credits Notes $ 13,000 This balance, equals the balance reported by the bank. 1.000 A customer ordered $1,800 of advertising services to be provided in October. The accountant recorded this service by debiting Accounts Receivable and crediting Service Revenue 800 Starting January 1, BB agreed to pay $1,200 cash to rent the land on which its billboards are located, for the January-December period. The accountant adjusted this account on April 30 but has not adjusted it since. BB still has supplies costing $200 on hand on September 30 6,000 BB bought scaffolding and billboards in October last year. $ @ Because the equipment was bought at the beginning of the fiscal year, no depreciation is carried forward fron prior years. 2,000 BB purchased and received $2,000 of supplies used for creating advertising displays. The supplier is to be paid in October. 1,500 This balance relates to $1,500 cash paid by a customer in August for advertising from September 1- November 30 ob's employees are still waiting to be paid for the last half of September, 250 BB hasn't paid the $250 tax Owed from the last fiscal year. 1,000 B has issued 2,000 shares for $1,000 cash. 3,750 BB started business a few years ago, so this is the total accumulated earnings up to October 1 of last year. 60,700 BB has provided $2,000 of services for which it hasn't yet billed customers or recorded in its accounting records. 46,000 BB's employees earn $4,000 per month. The employees were paid in full on August 31, and were paid again Accounts Payable Deferred Revenue Salaries and Wages Payable Income Tax Payable Common stock Retained Earnings Service Revenue Salaries and Wages Expense