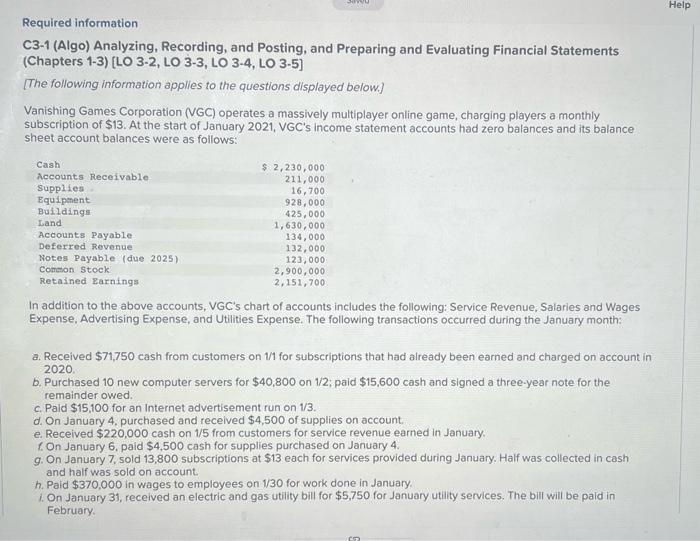

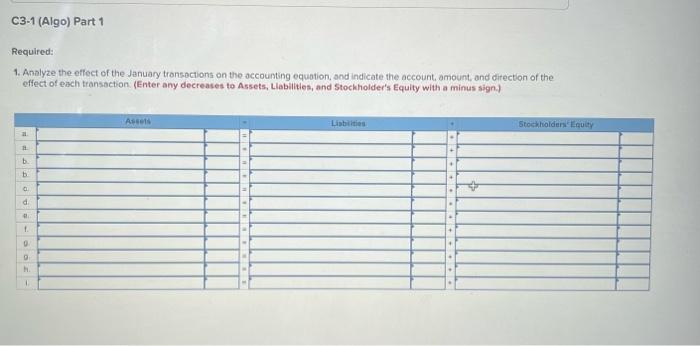

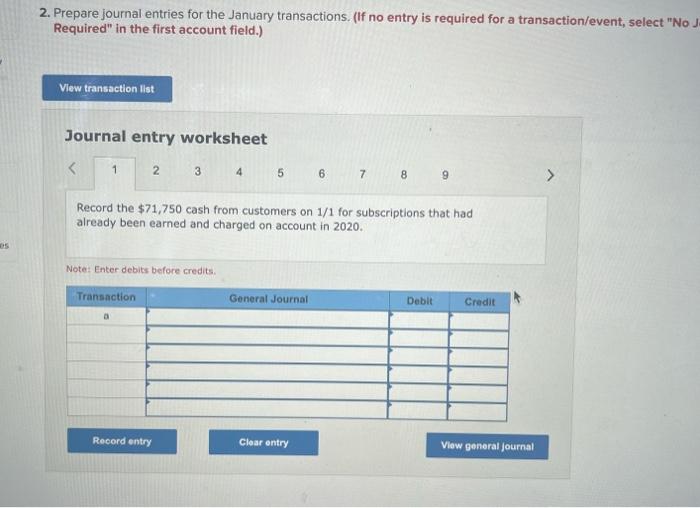

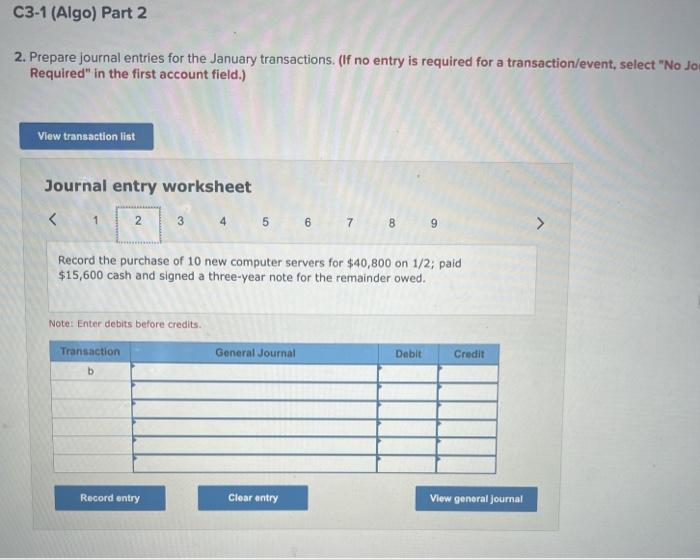

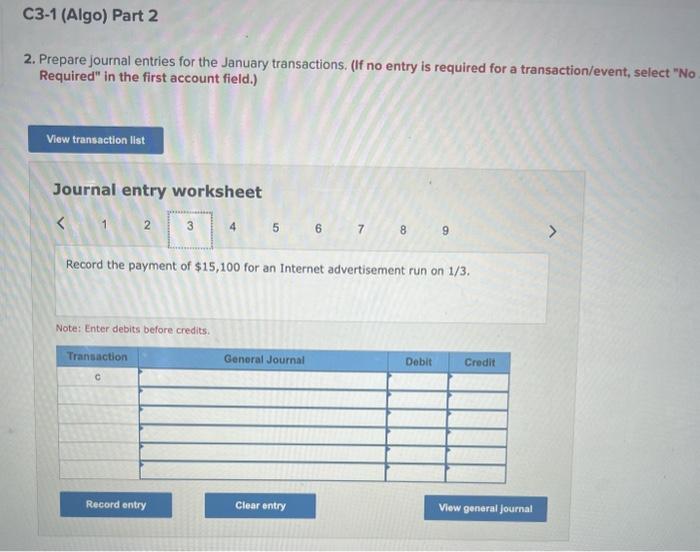

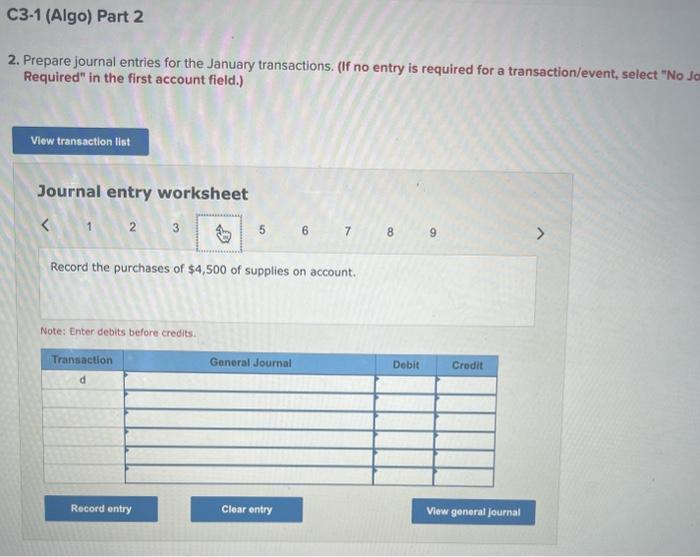

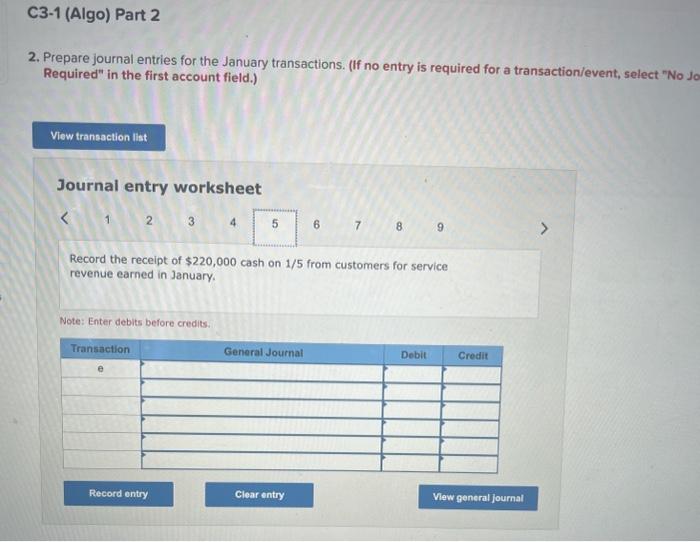

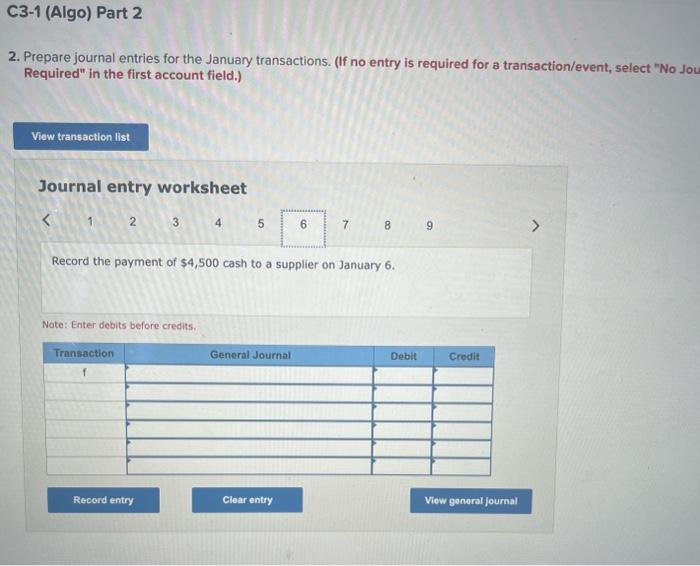

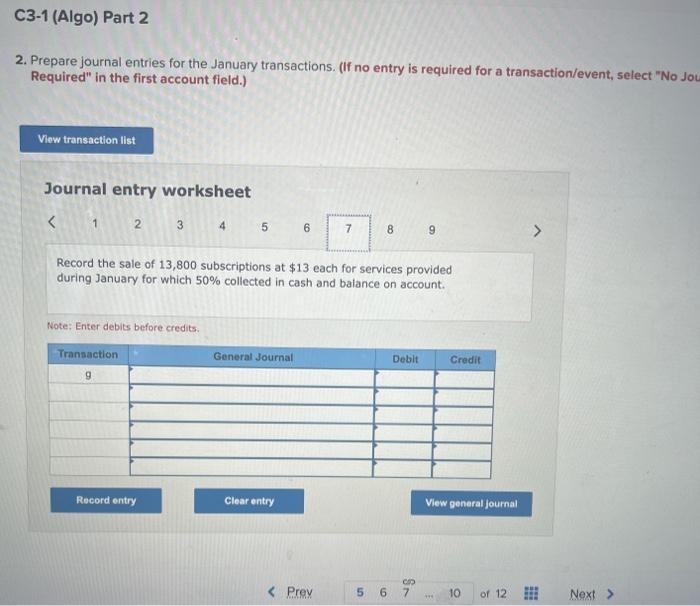

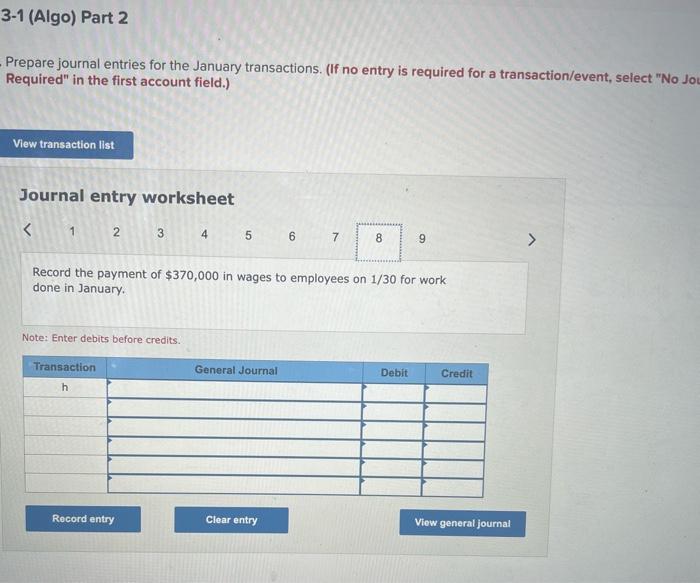

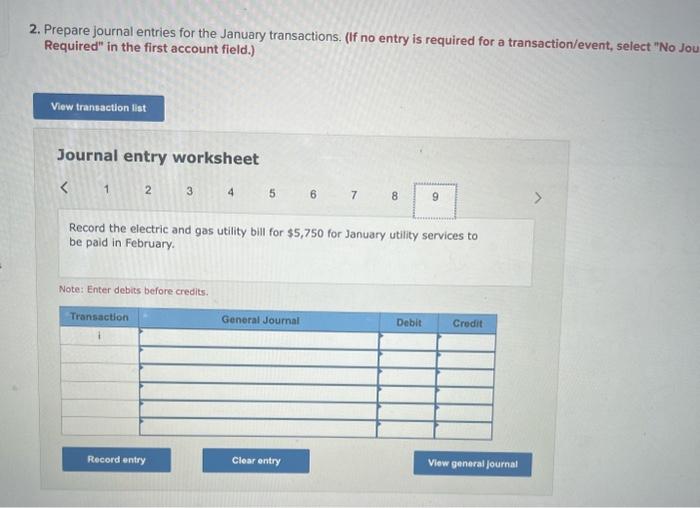

Required information C3-1 (Algo) Analyzing, Recording, and Posting, and Preparing and Evaluating Financial Statements (Chapters 1-3) [LO 3-2, LO 3-3, LO 3-4, LO 3-5] [The following information applies to the questions displayed below.] Vanishing Games Corporation (VGC) operates a massively multiplayer online game, charging players a monthly subscription of $13. At the start of January 2021, VGC's income statement accounts had zero balances and its balance sheet account balances were as follows: In addition to the above accounts, VGC's chart of accounts includes the following: Service Revenue, Salaries and Wages Expense, Advertising Expense, and Utilities Expense. The following transactions occurred during the January month: a. Received $71,750 cash from customers on 1/1 for subscriptions that had already been earned and charged on account in 2020. b. Purchased 10 new computer servers for $40,800 on 1/2; paid $15,600 cash and signed a three-year note for the remainder owed. c. Paid $15,100 for an Internet advertisement run on 1/3. d. On January 4 . purchased and received $4,500 of supplies on account. e. Received $220,000 cash on 1/5 from customers for service revenue earned in January. f. On January 6, paid $4,500 cash for supplies purchased on January 4 . g. On January 7, sold 13,800 subscriptions at $13 each for services provided during January. Half was collected in cash and half was sold on account. h. Paid $370,000 in wages to employees on 1/30 for work done in January. i. On January 31, received an electric and gas utility bill for $5,750 for January utility services. The bill will be pald in February. 1. Analyze the effect of the Jenuary transoctions on the accounting equation, and indicate the account, amount, and direction of the effect of each transoction. (Enter any decreases to Assets, Llabilities, and Stockholder's Equity with a minus sign.) 2. Prepare journal entries for the January transactions. (If no entry is required for a transaction/event, select "No J Required" in the first account field.) Journal entry worksheet 3456789 Record the $71,750 cash from customers on 1/1 for subscriptions that had already been earned and charged on account in 2020 . Note: Enter debits before credits. 2. Prepare journal entries for the January transactions. (If no entry is required for a transaction/event, select "No Jo Required" in the first account field.) Journal entry worksheet Record the purchase of 10 new computer servers for $40,800 on 1/2; paid $15,600 cash and signed a three-year note for the remainder owed. Note: Enter debits before credits. Prepare journal entries for the January transactions. (If no entry is required for a transaction/event, select "No Required" in the first account field.) Journal entry worksheet 6789 Record the payment of $15,100 for an Internet advertisement run on 1/3. Note: Enter debits before credits. 2. Prepare journal entries for the January transactions. (If no entry is required for a transaction/event, select "No Jc Required" in the first account field.) Journal entry worksheet Record the purchases of $4,500 of supplies on account. Note: Enter debits before credits. 2. Prepare journal entries for the January transactions. (If no entry is required for a transaction/event, select "No Jo Required" in the first account field.) Journal entry worksheet Record the receipt of $220,000 cash on 1/5 from customers for service revenue earned in January. Note: Enter debits before credits. 2. Prepare journal entries for the January transactions. (If no entry is required for a transaction/event, select "No Jou Required" in the first account field.) Journal entry worksheet 123489 Record the payment of $4,500 cash to a supplier on January 6. Note: Enter debits before credits. 2. Prepare journal entries for the January transactions. (If no entry is required for a transaction/event, select "No Jo Required" in the first account field.) Journal entry worksheet \begin{tabular}{|lllll} L & 2 & 3 & 4 & 6 \\ \hline \end{tabular} during January for which 50% collected in cash and balance on account. Note: Enter debits before credits. Prepare journal entries for the January transactions. (If no entry is required for a transaction/event, select "No Jol Required" in the first account field.) Journal entry worksheet Record the payment of $370,000 in wages to employees on 1/30 for work done in January. Note: Enter debits before credits. 2. Prepare journal entries for the January transactions. (If no entry is required for a transaction/event, select "No Jou Required" in the first account field.) Journal entry worksheet Record the electric and gas utility bill for $5,750 for January utility services to be paid in February. Note: Enter debits before credits