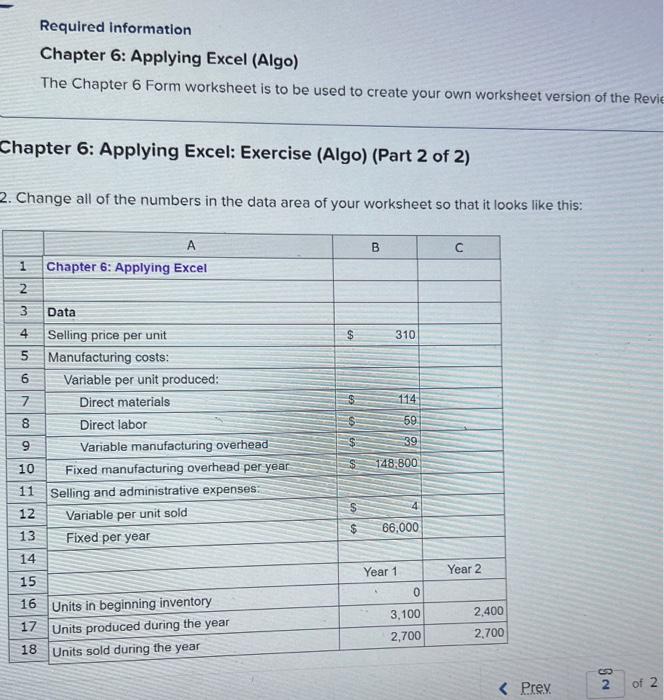

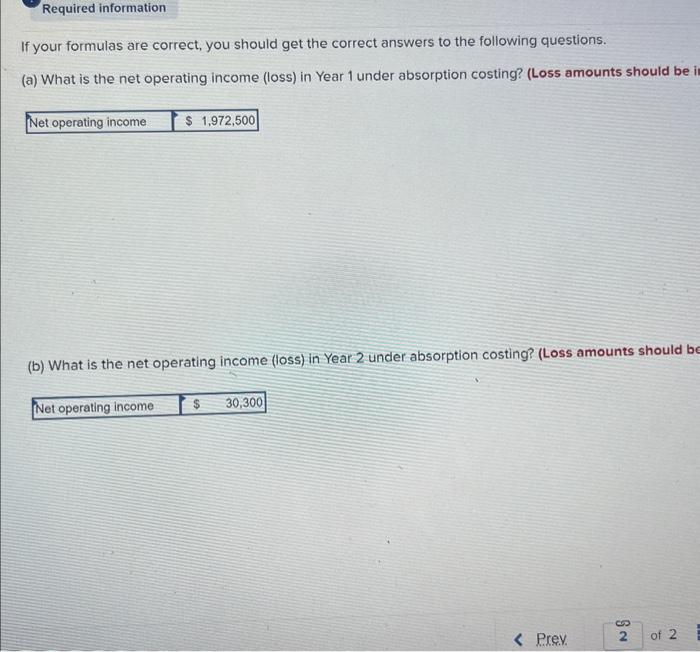

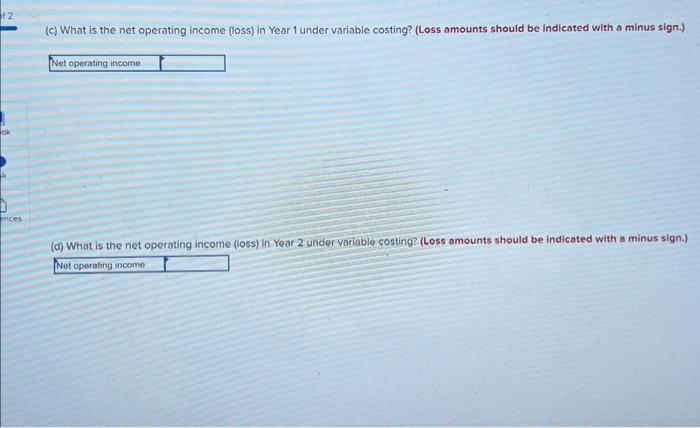

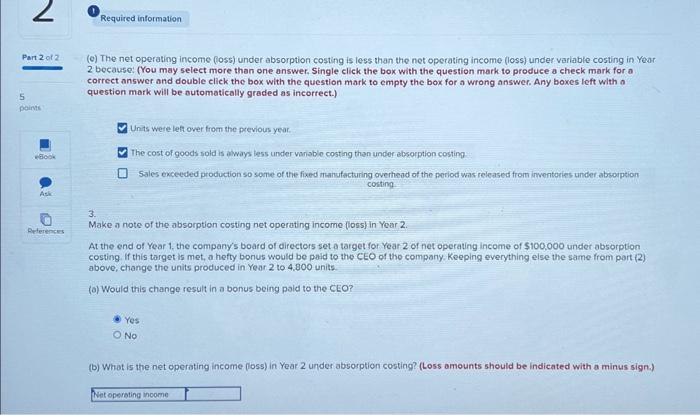

Required information Chapter 6: Applying Excel (Algo) The Chapter 6 Form worksheet is to be used to create your own worksheet version of the Rev Chapter 6: Applying Excel: Exercise (Algo) (Part 2 of 2) Change all of the numbers in the data area of your worksheet so that it looks like this: If your formulas are correct, you should get the correct answers to the following questions. (a) What is the net operating income (loss) in Year 1 under absorption costing? (Loss amounts should be (b) What is the net operating income (loss) in Year 2 under absorption costing? (Loss amounts should be (c) What is the net operating income (loss) in Year 1 under variable costing? (Loss amounts should be indieated with a minus sign.) (d) What is the net operating income (loss) in Year 2 under varlable costing? (Loss amounts should be indicated with a minus sign.) (c) The net operating income (oss) under absorption costing is less than the net operating income (loss) under variable costing in Year 2 because: (You may select more than one answer, Single click the box with the question mark to produce a check mark for a correct answer and double elick the box with the question mark to cmpty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Units were lef over from the previous ysar. The cost of goods sold is always less under variable costing than under absorption costing Sales exceeded production so some of the fixed manufactaring overhead of the period was released from inventories under absorption costing 3. Make a note of the absorption costing net operating income (loss) in Year 2. At the end of Year 1, the company's board of directors set a target for Year 2 of net operating income of $100.000 under absorption costing. If this target is met, a hefty bonus would be paid to the CEO of the company. Keeping everything else the same from port (2) above, change the units produced in Year 2 to 4,800 units (a) Would this change result in a bonus being pold to the CEO? Yes No Required information Chapter 6: Applying Excel (Algo) The Chapter 6 Form worksheet is to be used to create your own worksheet version of the Rev Chapter 6: Applying Excel: Exercise (Algo) (Part 2 of 2) Change all of the numbers in the data area of your worksheet so that it looks like this: If your formulas are correct, you should get the correct answers to the following questions. (a) What is the net operating income (loss) in Year 1 under absorption costing? (Loss amounts should be (b) What is the net operating income (loss) in Year 2 under absorption costing? (Loss amounts should be (c) What is the net operating income (loss) in Year 1 under variable costing? (Loss amounts should be indieated with a minus sign.) (d) What is the net operating income (loss) in Year 2 under varlable costing? (Loss amounts should be indicated with a minus sign.) (c) The net operating income (oss) under absorption costing is less than the net operating income (loss) under variable costing in Year 2 because: (You may select more than one answer, Single click the box with the question mark to produce a check mark for a correct answer and double elick the box with the question mark to cmpty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Units were lef over from the previous ysar. The cost of goods sold is always less under variable costing than under absorption costing Sales exceeded production so some of the fixed manufactaring overhead of the period was released from inventories under absorption costing 3. Make a note of the absorption costing net operating income (loss) in Year 2. At the end of Year 1, the company's board of directors set a target for Year 2 of net operating income of $100.000 under absorption costing. If this target is met, a hefty bonus would be paid to the CEO of the company. Keeping everything else the same from port (2) above, change the units produced in Year 2 to 4,800 units (a) Would this change result in a bonus being pold to the CEO? Yes No