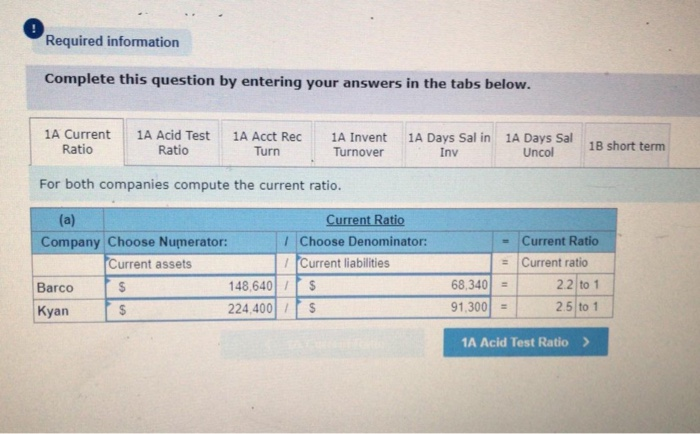

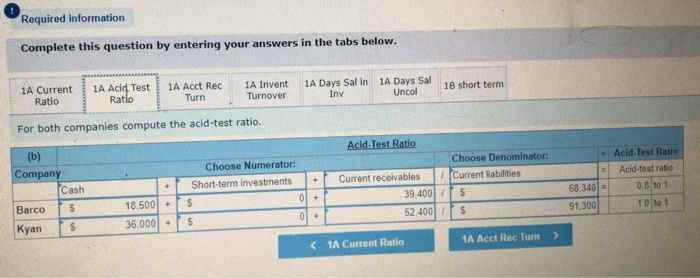

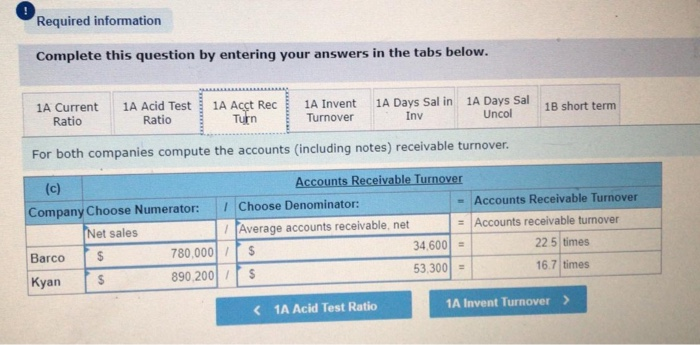

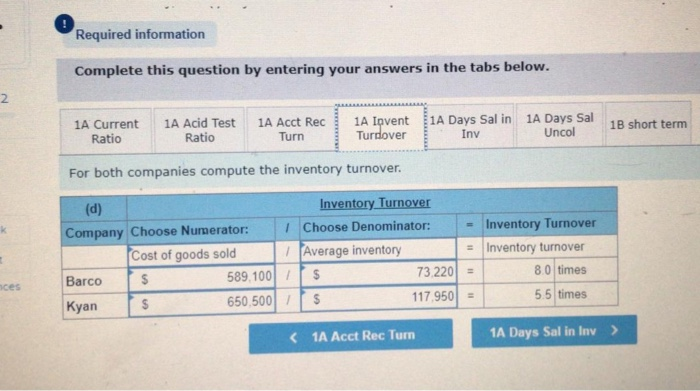

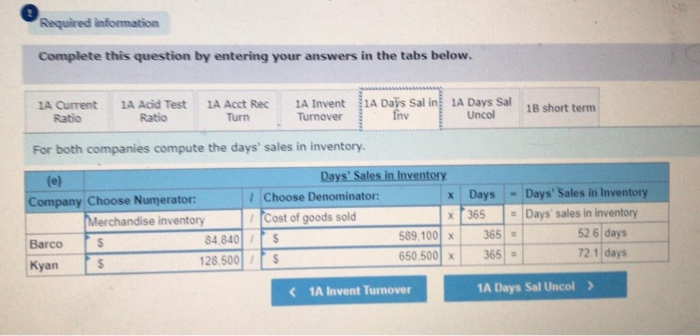

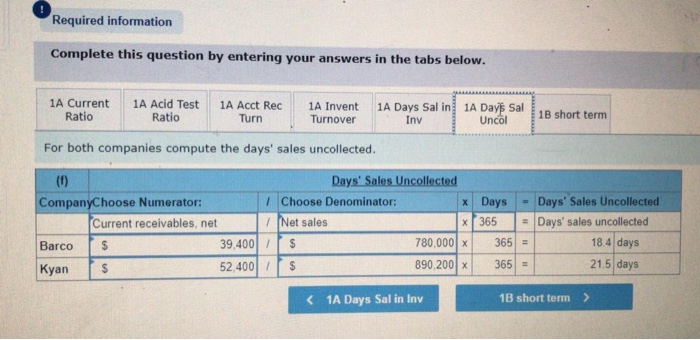

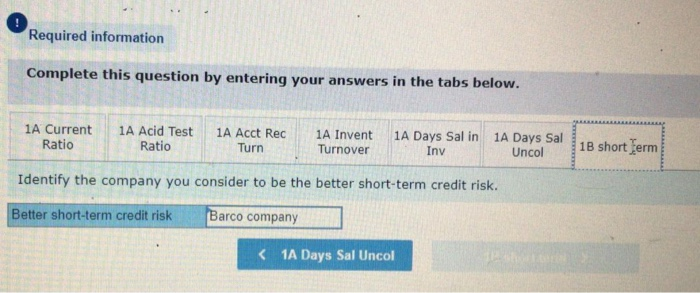

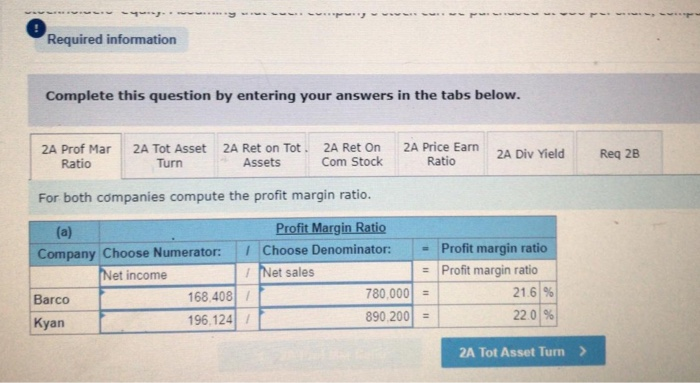

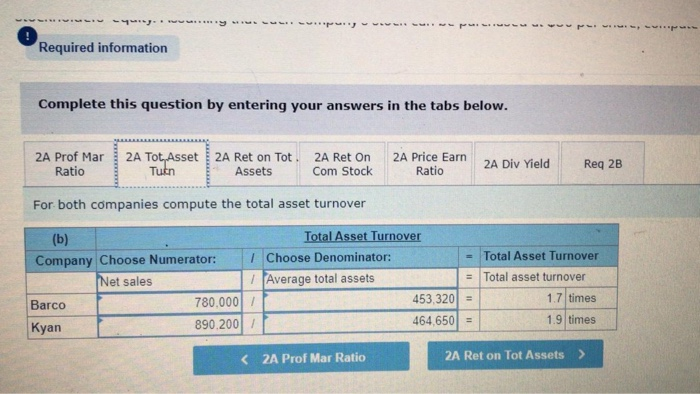

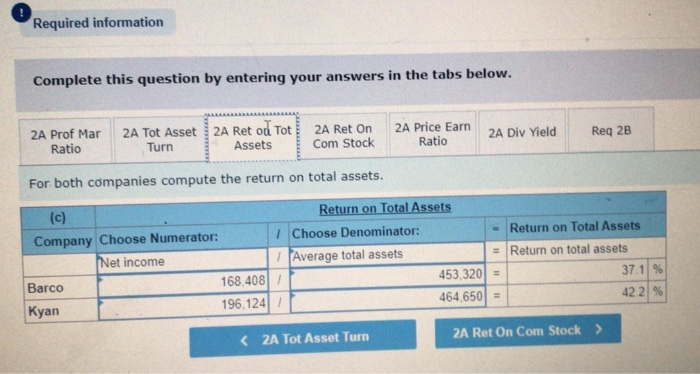

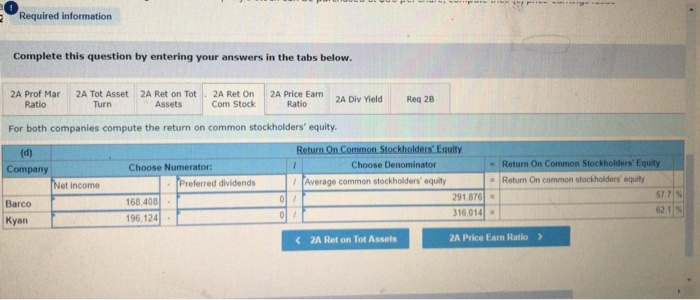

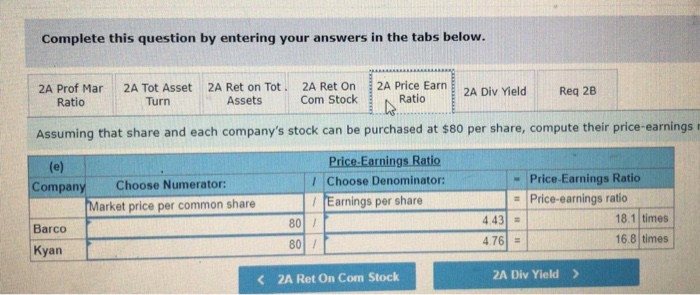

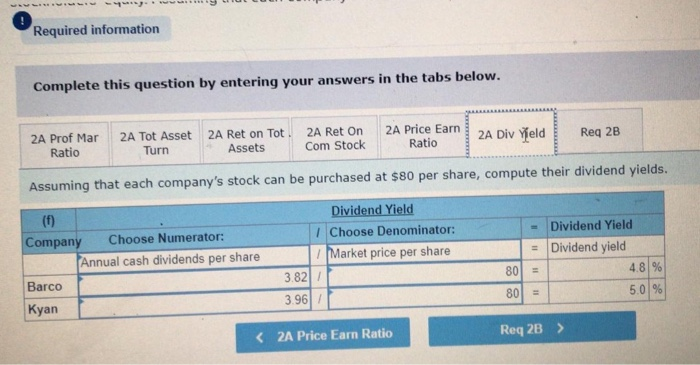

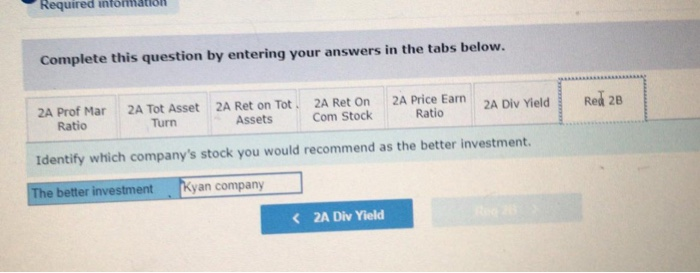

Required information Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Acid Test Ratio 1A Acct Rec Turn 1A Invent Turnover 1A Days Sal in 1A Days Sal Inv Uncol 1B short term For both companies compute the current ratio. Current Ratio 11 (a) Company Choose Numerator: Current assets Barco 148,640 Kyan $ 224.400 Current Ratio 1 Choose Denominator: Current liabilities $ $ $ 68,340= 91,300 = Current ratio 22 to 1 2.5 to 1 1A Acid Test Ratio > Required information Complete this question by entering your answers in the tabs below. 1A Current Ratio 1B short term 1A Acid Test Ratlo 1A Acct Rec Turn 1A Invent Turnover 1A Days Sal in 1A Days Sal Inv Uncol For both companies compute the acid-test ratio. Acid.Test Ratio (b) Company Cash Barco $ Choose Numerator: Short-term investments $ ol + $ ol + Choose Denominator: Current liabilities $ Current receivables 39.400 52.400 + - Acid-Test Ratio Acid-test ratio 0.8 to 1 10 to 1 68 340 91,300 18,500 - 36.000 + $ Kyan $ Required information Complete this question by entering your answers in the tabs below. 1B short term 1A Current 1A Acid Test 1A Act Rec 1A Invent 1A Days Sal in 1A Days Sal Ratio Ratio Turn Turnover Inv Uncol For both companies compute the accounts (including notes) receivable turnover. (c) Accounts Receivable Turnover Company Choose Numerator: I Choose Denominator: - Accounts Receivable Turnover Net sales Average accounts receivable net = Accounts receivable turnover Barco $ 780,000/ $ 34,600 = 22 5 times Kyan $ 890 200 / $ 53,300] = 16.7 times 1A Acid Test Ratio 1A Invent Turnover > Required information Complete this question by entering your answers in the tabs below. 2 1A Days Sal in 1A Days Sal Inv Uncol 1B short term 1A Current 1A Acid Test 1A Acct Rec 1A Invent Ratio Ratio Turn Turdover For both companies compute the inventory turnover. (d) Company Choose Numerator: Cost of goods sold Barco $ 589.100 Kyan $ 650.500 Inventory Turnover 1 Choose Denominator: Inventory Turnover Average inventory = Inventory turnover $ 73.220= 80 times $ 117.950 = 5.5 times nces ( 1A Acct Rec Tum 1A Days Sal in Inv> Required information Complete this question by entering your answers in the tabs below. 1A Current Ratio IA Acid Test Ratio IA Acct Rec Turn 1A Invent Turnover 1A Days Sal in 1A Days Sal Inv Uncol 1B short term For both companies compute the days' sales in inventory. (e) Days' Sales in Inventory Company Choose Numerator: Choose Denominator: x Days Days' Sales in Inventory Merchandise inventory Cost of goods sold 365 = Days' sales in inventory Barco $ 84 840 S 589.100 x 365 = 52 6 days Kyan $ 128.500 S 650,500 x 365 = 72. 1 days ( 1A Invent Turnover 1A Days Sal Uncol > Required information Complete this question by entering your answers in the tabs below. 1A Current 1A Acid Test 1A Acct Rec 1A Invent 1A Days Sal in 1A Days Sal Ratio Ratio Turn Turnover 1B short term Inv Uncol For both companies compute the days' sales uncollected. (f) Days' Sales Uncollected CompanyChoose Numerator: Choose Denominator: x Days Days' Sales Uncollected Current receivables, net / Net sales x365 = Days' sales uncollected Barco $ 39,400 $ 780,000 X 365 = 18. 4 days Kyan $ 52.400 S 890,200 x 365 = 21.5 days 4. wwwy Required information Complete this question by entering your answers in the tabs below. 2A Prof Mar Ratio 2A Tot Asset 2A Ret on Tot. 2A Ret On Tuin Assets Com Stock 2A Price Earn Ratio 2A Div Yield Reg 2B For both companies compute the total asset turnover (b) Total Asset Turnover Company Choose Numerator: 1 Choose Denominator: Total Asset Turnover Net sales Average total assets = Total asset turnover 780,000/ Barco 453,320) = 1.7 times 890,200/ Kyan 464.650= 1.9 times Required information Complete this question by entering your answers in the tabs below. 2A Prof Mar Ratio 2A Tot Asset 2A Ret od Tot Turn Assets 2A Ret On Com Stock 2A Price Earn Ratio 2A Div Yield Req 2B For both companies compute the return on total assets. (c) Return on Total Assets Company Choose Numerator: Choose Denominator: Return on Total Assets Net income Average total assets = Return on total assets Barco 168.408/ 453,320 = 37.1% 196.1247 Kyan 464.650= 422 % Required information Complete this question by entering your answers in the tabs below. 2A Prof Mar Ratio 2A Tot Asset 2A Ret on Tot Turn Assets 2A Ret On Com Stock 2A Price Earn Ratio 2A Div Yield Reg 28 For both companies compute the return on common stockholders' equity. Return On Common Stockholders' Equity Company Choose Numerator: 1 Choose Denominator Return On Common Stockholders' Equity Net income Preferred dividends Average common stockholders' equity - Return On common stockholders' equity Barco 577 168.408 - ol 291,876 - ol 316,014 621 196.124 Kyan Complete this question by entering your answers in the tabs below. 2A Prof Mar 2A Tot Asset 2A Ret on Tot 2A Ret On 2A Price Earn 2A Div Yield Reg 2B Ratio Turn Assets Com Stock Ratio ! Assuming that share and each company's stock can be purchased at $80 per share, compute their price-earnings (e) Company Choose Numerator: Market price per common share Barco Kyan Price Earnings Ratio 1 Choose Denominator: 1 Earnings per share 80/ Price-Earnings Ratio = Price-earnings ratio 4.43 = 18.1 times 4.76] = 16.8 times 801/ Required information Complete this question by entering your answers in the tabs below. 2A Tot Asset Turn 2A Prof Mar Ratio Req 2B 2A Ret on Tot Assets 2A Ret On Com Stock 2A Price Earn Ratio 2A Div Yield Assuming that each company's stock can be purchased at $80 per share, compute their dividend yields. (f) Company Choose Numerator: Annual cash dividends per share Barco Kyan Dividend Yield 1 Choose Denominator: Market price per share 3.821 / 3.967 Dividend Yield = Dividend yield 4.8% 5.0 % 80 11 80 Required intona Complete this question by entering your answers in the tabs below. 2A Div Yield Red 2B 2A Prof Mar Ratio 2A Ret On Com Stock 2A Price Earn Ratio 2A Tot Asset 2A Ret on Tot Turn Assets Identify which company's stock you would recommend as the better investment. The better investment Kyan company