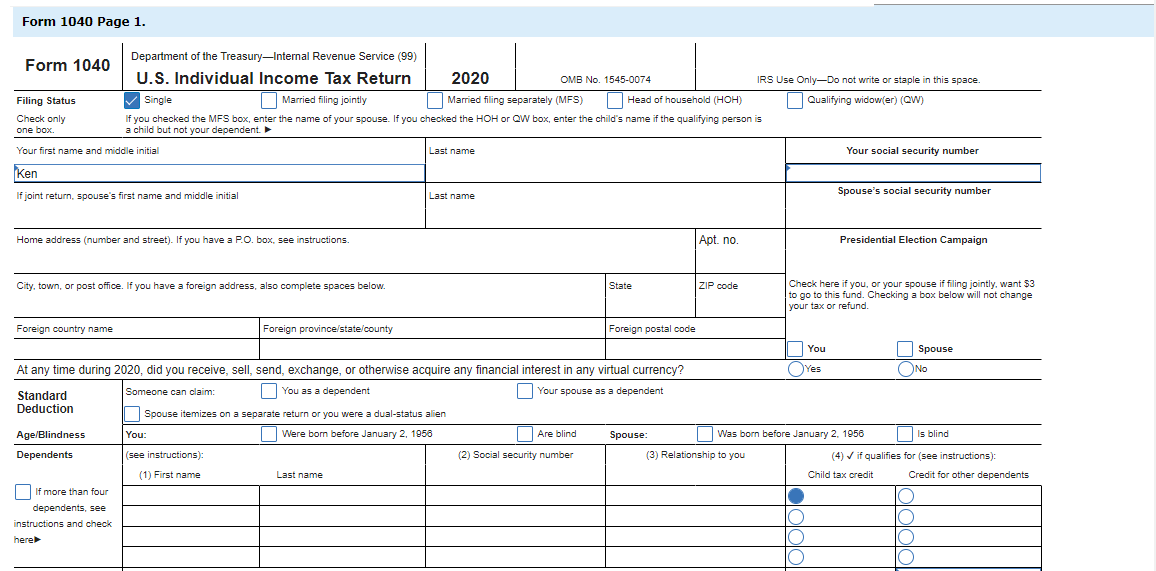

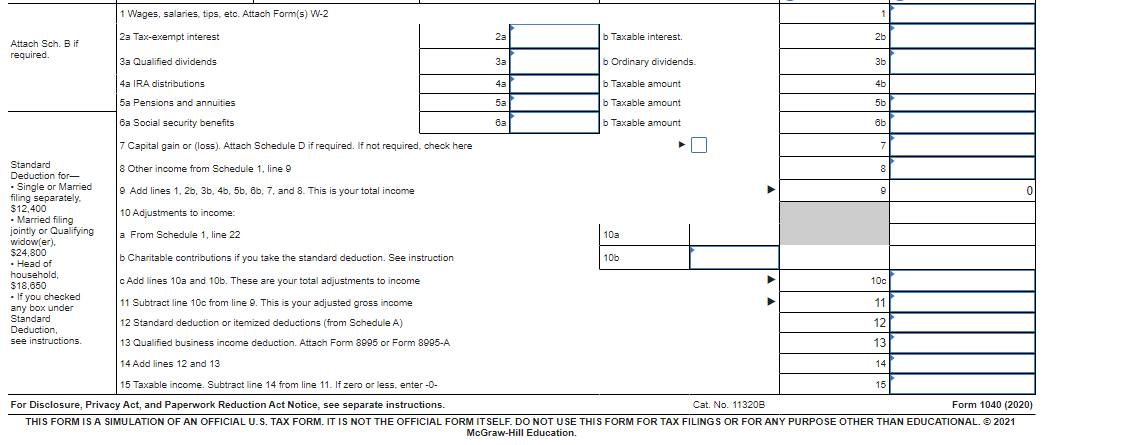

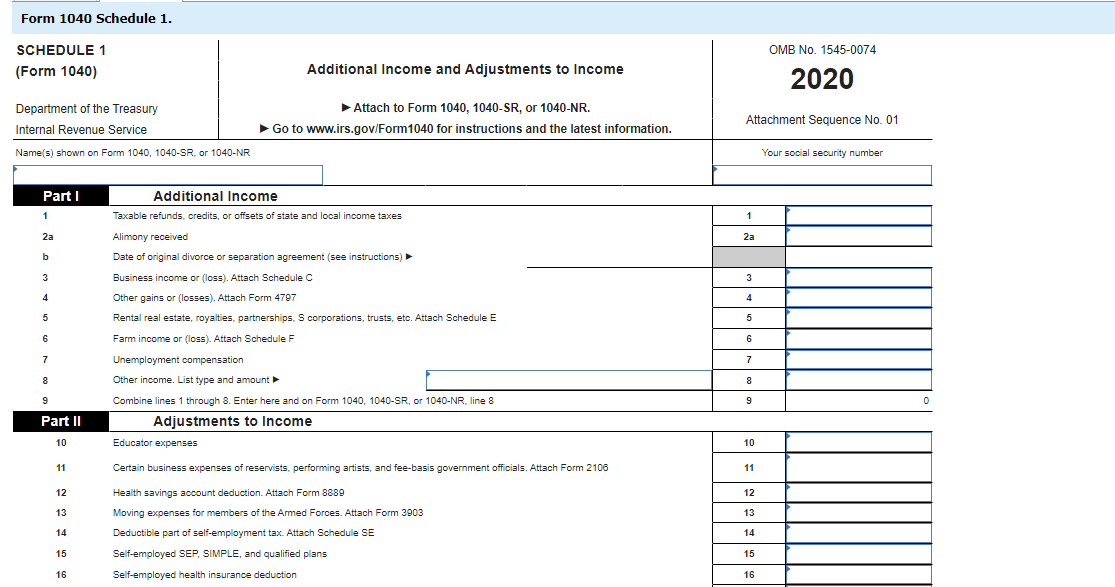

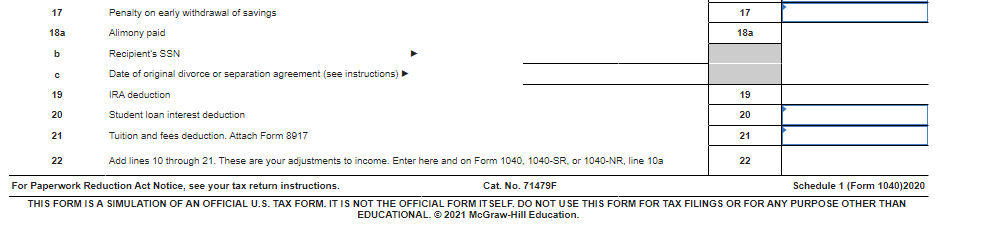

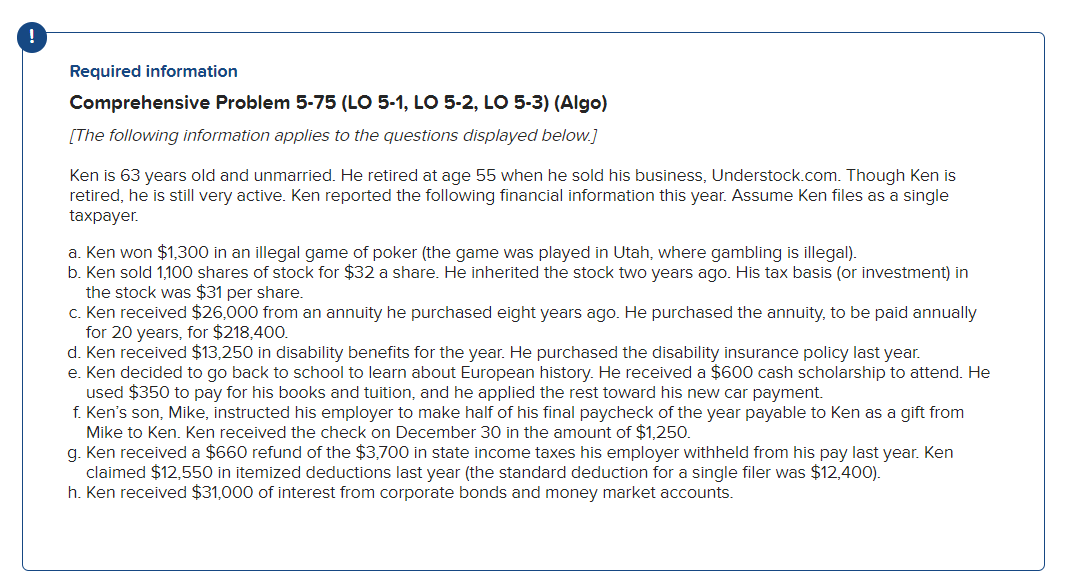

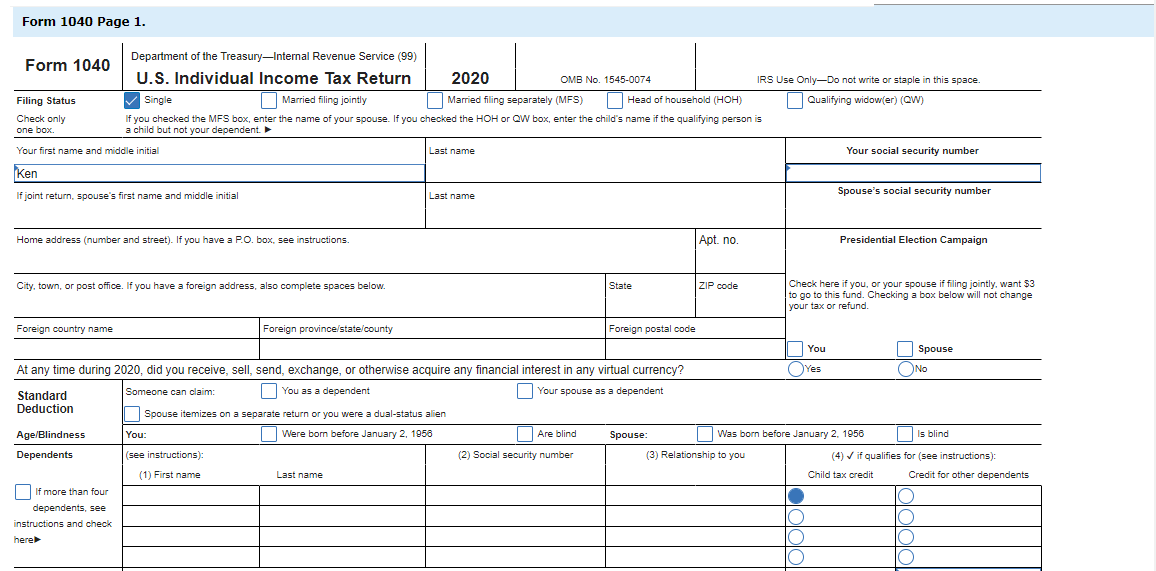

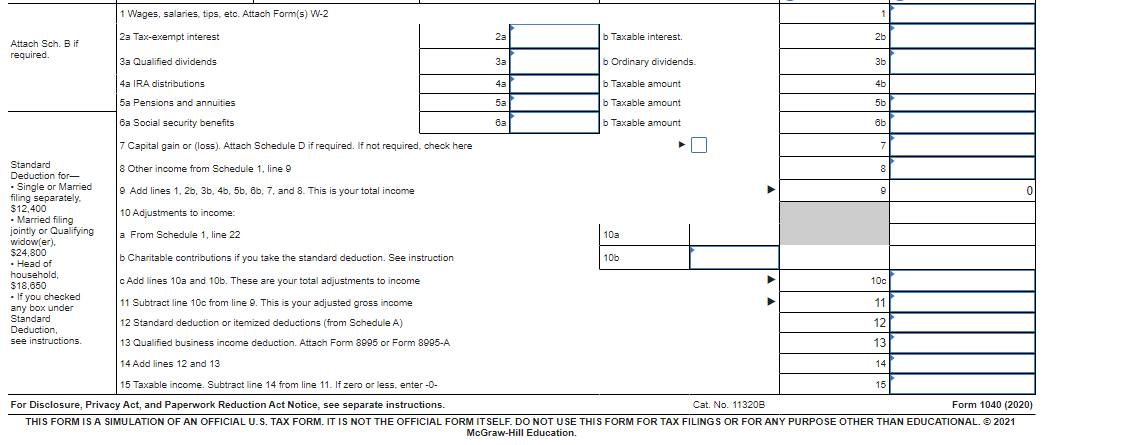

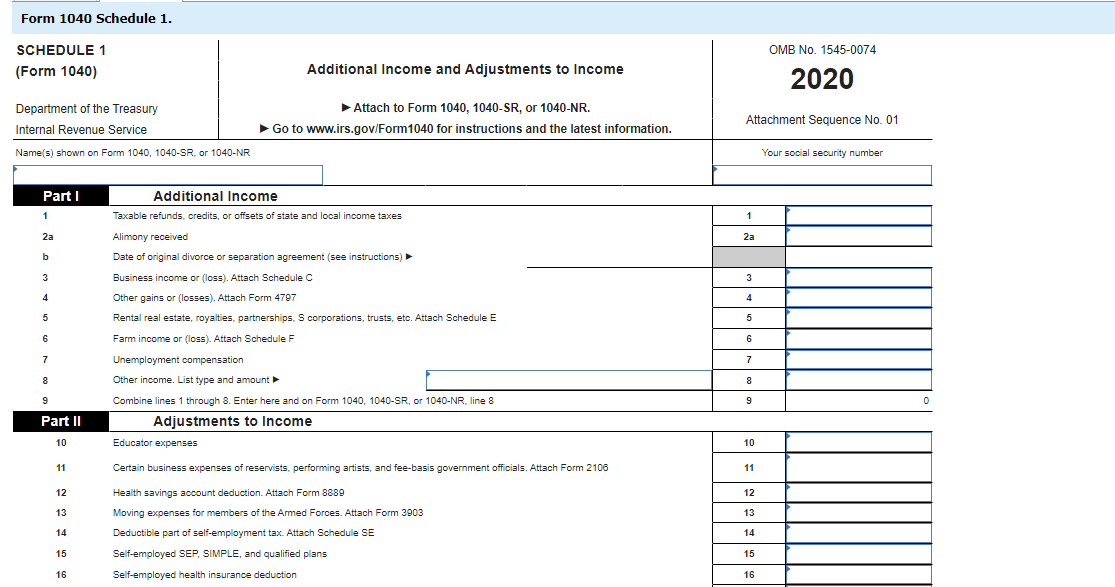

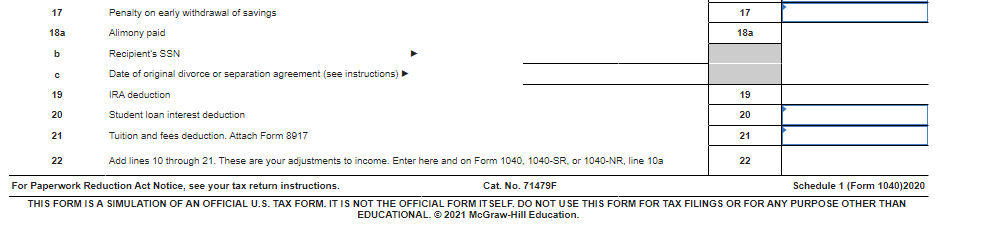

Required information Comprehensive Problem 5-75 (LO 5-1, LO 5-2, LO 5-3) (Algo) (The following information applies to the questions displayed below.] Ken is 63 years old and unmarried. He retired at age 55 when he sold his business, Understock.com. Though Ken is retired, he is still very active. Ken reported the following financial information this year. Assume Ken files as a single taxpayer a. Ken won $1,300 in an illegal game of poker (the game was played in Utah, where gambling is illegal). b. Ken sold 1,100 shares of stock for $32 a share. He inherited the stock two years ago. His tax basis (or investment) in the stock was $31 per share. c. Ken received $26,000 from an annuity he purchased eight years ago. He purchased the annuity, to be paid annually for 20 years, for $218,400. d. Ken received $13,250 in disability benefits for the year. He purchased the disability insurance policy last year. e. Ken decided to go back to school to learn about European history. He received a $600 cash scholarship to attend. He used $350 to pay for his books and tuition, and he applied the rest toward his new car payment. f. Ken's son, Mike, instructed his employer to make half of his final paycheck of the year payable to Ken as a gift from Mike to Ken. Ken received the check on December 30 in the amount of $1,250. g. Ken received a $660 refund of the $3,700 in state income taxes his employer withheld from his pay last year. Ken claimed $12,550 in itemized deductions last year (the standard deduction for a single filer was $12,400). h. Ken received $31,000 of interest from corporate bonds and money market accounts. Form 1040 Page 1. Form 1040 Department of the TreasuryInternal Revenue Service (99) U.S. Individual Income Tax Return 2020 OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space. Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) ( Qualifying widow(er) (@W) Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying person is one box a child but not your dependent Your first name and middle initial Last name Your social security number Ken If joint return, spouse's first name and middle initial Last name Spouse's social security number Home address (number and street). If you have a P.O. box, see instructions Apt. no. Presidential Election Campaign City, town, or post office. If you have a foreign address, also complete spaces below. State ZIP code Check here if you, or your spouse if filing jointly, want 53 to go to this fund. Checking a box below will not change your tax or refund. Foreign country name Foreign province/state/county Foreign postal code You Spouse At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? ) Yes No Someone can claim: Standard You as a dependent | Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness were born before January 2, 1956 Are blind Spouse: Was born before January 2, 1956 Is blind Dependents see instructions): (2) Social security number (3) Relationship to you (4) Vif qualifies for (see instructions): (1) First name Last name Child tax credit Credit for other dependents If more than four dependents, see instructions and check here You: Form 1040 Schedule 1. OMB No 1545-0074 SCHEDULE 1 (Form 1040) Additional Income and Adjustments to Income 2020 Department of the Treasury Internal Revenue Service Name(s) shown on Form 1040, 1040-SR, or 1040-NR ) , Attach to Form 1040, 1040-SR, or 1040-NR. Go to www.irs.gov/Form 1040 for instructions and the latest information. Attachment Sequence No. 01 Your social security number Parti 1 1 1 2a 2a b b 3 3 4 4 Additional Income Taxable refunds, credits, or offsets of state and local income taxes Alimony received Date of original divorce or separation agreement (see instructions) Business income or loss). Attach Schedule C . Other gains or losses). Attach Form 4797 Rental real estate, royalties, partnerships. S corporations, trusts, etc. Attach Schedule E , S , Farm income or (loss). Attach Schedule F . Unemployment compensation Other income. List type and amount Combine lines 1 through 8. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 8 Adjustments to Income 5 5 5 6 6 7 7 8 8 8 9 9 9 Part II 10 Educator expenses 10 11 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2108 11 12 12 13 Health savings account deduction. Attach Form 8889 Moving expenses for members of the Armed Forces. Attach Form 3903 Deductible part of self-employment tax. Attach Schedule SE 13 14 14 15 Self-employed SEP, SIMPLE, and qualified plans 15 16 Self-employed health insurance deduction 16 17 17 18a 18a Penalty on early withdrawal of savings Alimony paid Recipient's SSN Date of original divorce or separation agreement (see instructions) b 19 IRA deduction 19 20 Student loan interest deduction 20 21 Tuition and fees deduction. Attach Form 8917 21 22 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 10a 22 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F Schedule 1 (Form 1040)2020 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 2021 McGraw-Hill Education. Required information Comprehensive Problem 5-75 (LO 5-1, LO 5-2, LO 5-3) (Algo) (The following information applies to the questions displayed below.] Ken is 63 years old and unmarried. He retired at age 55 when he sold his business, Understock.com. Though Ken is retired, he is still very active. Ken reported the following financial information this year. Assume Ken files as a single taxpayer a. Ken won $1,300 in an illegal game of poker (the game was played in Utah, where gambling is illegal). b. Ken sold 1,100 shares of stock for $32 a share. He inherited the stock two years ago. His tax basis (or investment) in the stock was $31 per share. c. Ken received $26,000 from an annuity he purchased eight years ago. He purchased the annuity, to be paid annually for 20 years, for $218,400. d. Ken received $13,250 in disability benefits for the year. He purchased the disability insurance policy last year. e. Ken decided to go back to school to learn about European history. He received a $600 cash scholarship to attend. He used $350 to pay for his books and tuition, and he applied the rest toward his new car payment. f. Ken's son, Mike, instructed his employer to make half of his final paycheck of the year payable to Ken as a gift from Mike to Ken. Ken received the check on December 30 in the amount of $1,250. g. Ken received a $660 refund of the $3,700 in state income taxes his employer withheld from his pay last year. Ken claimed $12,550 in itemized deductions last year (the standard deduction for a single filer was $12,400). h. Ken received $31,000 of interest from corporate bonds and money market accounts. Form 1040 Page 1. Form 1040 Department of the TreasuryInternal Revenue Service (99) U.S. Individual Income Tax Return 2020 OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space. Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) ( Qualifying widow(er) (@W) Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying person is one box a child but not your dependent Your first name and middle initial Last name Your social security number Ken If joint return, spouse's first name and middle initial Last name Spouse's social security number Home address (number and street). If you have a P.O. box, see instructions Apt. no. Presidential Election Campaign City, town, or post office. If you have a foreign address, also complete spaces below. State ZIP code Check here if you, or your spouse if filing jointly, want 53 to go to this fund. Checking a box below will not change your tax or refund. Foreign country name Foreign province/state/county Foreign postal code You Spouse At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? ) Yes No Someone can claim: Standard You as a dependent | Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness were born before January 2, 1956 Are blind Spouse: Was born before January 2, 1956 Is blind Dependents see instructions): (2) Social security number (3) Relationship to you (4) Vif qualifies for (see instructions): (1) First name Last name Child tax credit Credit for other dependents If more than four dependents, see instructions and check here You: Form 1040 Schedule 1. OMB No 1545-0074 SCHEDULE 1 (Form 1040) Additional Income and Adjustments to Income 2020 Department of the Treasury Internal Revenue Service Name(s) shown on Form 1040, 1040-SR, or 1040-NR ) , Attach to Form 1040, 1040-SR, or 1040-NR. Go to www.irs.gov/Form 1040 for instructions and the latest information. Attachment Sequence No. 01 Your social security number Parti 1 1 1 2a 2a b b 3 3 4 4 Additional Income Taxable refunds, credits, or offsets of state and local income taxes Alimony received Date of original divorce or separation agreement (see instructions) Business income or loss). Attach Schedule C . Other gains or losses). Attach Form 4797 Rental real estate, royalties, partnerships. S corporations, trusts, etc. Attach Schedule E , S , Farm income or (loss). Attach Schedule F . Unemployment compensation Other income. List type and amount Combine lines 1 through 8. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 8 Adjustments to Income 5 5 5 6 6 7 7 8 8 8 9 9 9 Part II 10 Educator expenses 10 11 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2108 11 12 12 13 Health savings account deduction. Attach Form 8889 Moving expenses for members of the Armed Forces. Attach Form 3903 Deductible part of self-employment tax. Attach Schedule SE 13 14 14 15 Self-employed SEP, SIMPLE, and qualified plans 15 16 Self-employed health insurance deduction 16 17 17 18a 18a Penalty on early withdrawal of savings Alimony paid Recipient's SSN Date of original divorce or separation agreement (see instructions) b 19 IRA deduction 19 20 Student loan interest deduction 20 21 Tuition and fees deduction. Attach Form 8917 21 22 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 10a 22 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F Schedule 1 (Form 1040)2020 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 2021 McGraw-Hill Education