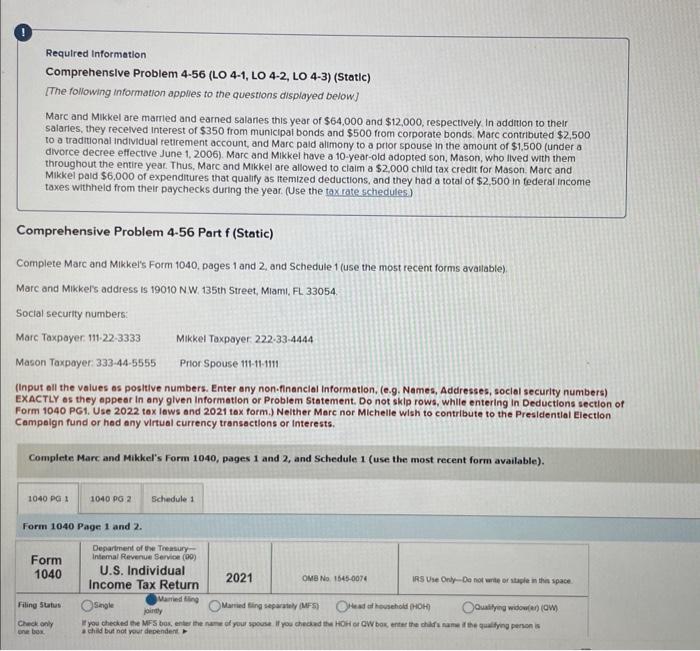

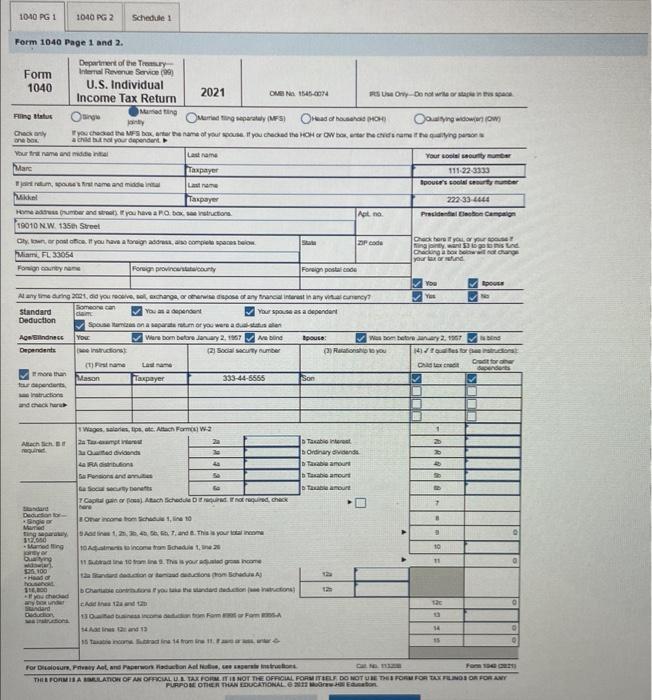

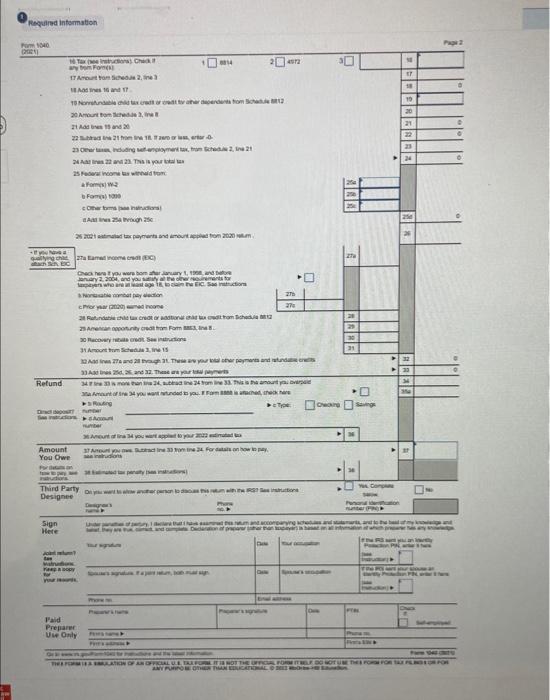

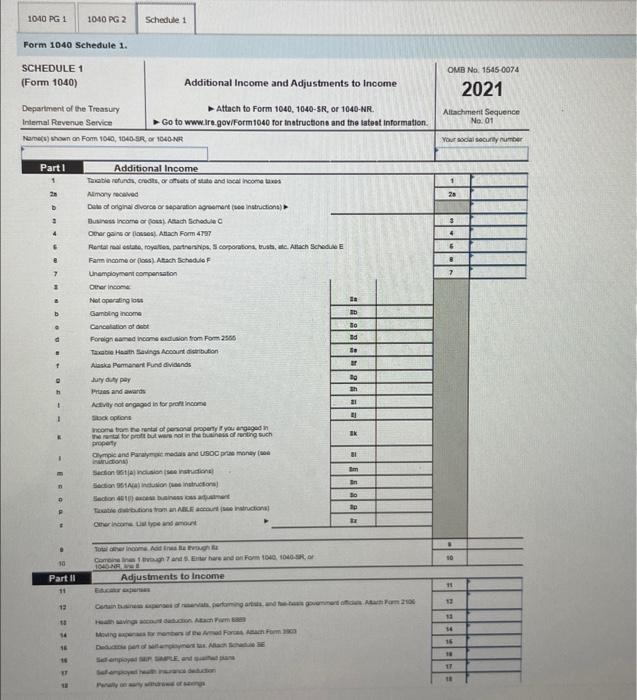

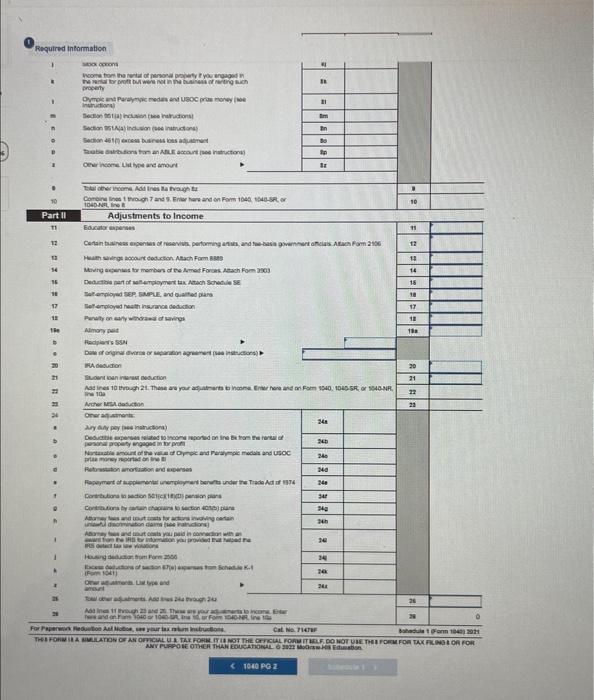

Required Information Comprehenslve Problem 4-56 (LO 4-1, LO 4-2, LO 4-3) (Static) [The following information apples to the questions displayed below] Marc and Mikkel are marrled and earned salarles this yeor of $64,000 and $12,000, respectively in addition to their salaries, they recelved interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to a traditional individual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2006). Marc and Mikkel have a to-year-old adopted son, Mason, who lived with them throughout the entire yeat. Thus, Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel pald $6,000 of expenditures that qualify as itemized deductions, and they had a total of $2,500 in federal income taxes withheld from their paychecks during the year. (Use the tax rate schedules) Comprehensive Problem 4-56 Part f (Static) Complete Marc and Mikkel's Form 1040, pages 1 and 2 , and Schedule 1 (use the most recent forms avallable). Marc and Mikkels address is 19010 N. W. 135th Street, Miami, FL 33054. Input all the values as posltive numbers. Enter any non.financlal Information, (e.g. Names, Addresses, social security numbers) EXACTLY as they appear in any given Informetion or Problem Statement. Do not sklp rows, while entering in Deductions section of Form 1040 PG1. Use 2022 tox laws and 2021 tox form.) Neither Mare nor Michelle wish to contribute to the Presliential Election Campeign fund or had any virtual currency transactlons or interests. Complete Marc and Mikkel's Form 1040, pages 1 and 2 , and Schedule 1 (use the most recent form available). Form 1040 Page 1 and 2. \begin{tabular}{l|l|} 1040 PG 1 & 1040 PG 2 Scheode 1 \end{tabular} Form 1040 Page 1 and 2. (1) Reguled intermation Sign Mere Form 1040 Schedule 1. (1) Required intormation Required Information Comprehenslve Problem 4-56 (LO 4-1, LO 4-2, LO 4-3) (Static) [The following information apples to the questions displayed below] Marc and Mikkel are marrled and earned salarles this yeor of $64,000 and $12,000, respectively in addition to their salaries, they recelved interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to a traditional individual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2006). Marc and Mikkel have a to-year-old adopted son, Mason, who lived with them throughout the entire yeat. Thus, Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel pald $6,000 of expenditures that qualify as itemized deductions, and they had a total of $2,500 in federal income taxes withheld from their paychecks during the year. (Use the tax rate schedules) Comprehensive Problem 4-56 Part f (Static) Complete Marc and Mikkel's Form 1040, pages 1 and 2 , and Schedule 1 (use the most recent forms avallable). Marc and Mikkels address is 19010 N. W. 135th Street, Miami, FL 33054. Input all the values as posltive numbers. Enter any non.financlal Information, (e.g. Names, Addresses, social security numbers) EXACTLY as they appear in any given Informetion or Problem Statement. Do not sklp rows, while entering in Deductions section of Form 1040 PG1. Use 2022 tox laws and 2021 tox form.) Neither Mare nor Michelle wish to contribute to the Presliential Election Campeign fund or had any virtual currency transactlons or interests. Complete Marc and Mikkel's Form 1040, pages 1 and 2 , and Schedule 1 (use the most recent form available). Form 1040 Page 1 and 2. \begin{tabular}{l|l|} 1040 PG 1 & 1040 PG 2 Scheode 1 \end{tabular} Form 1040 Page 1 and 2. (1) Reguled intermation Sign Mere Form 1040 Schedule 1. (1) Required intormation