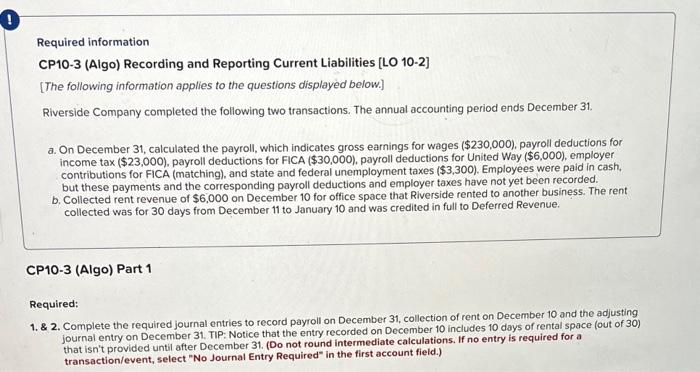

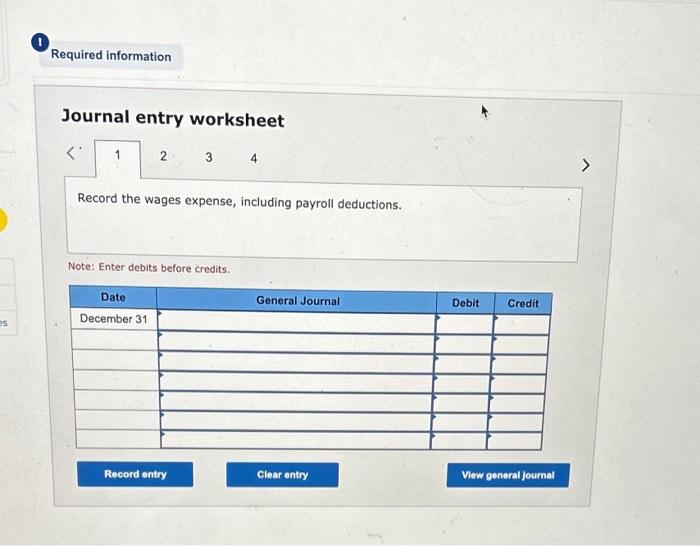

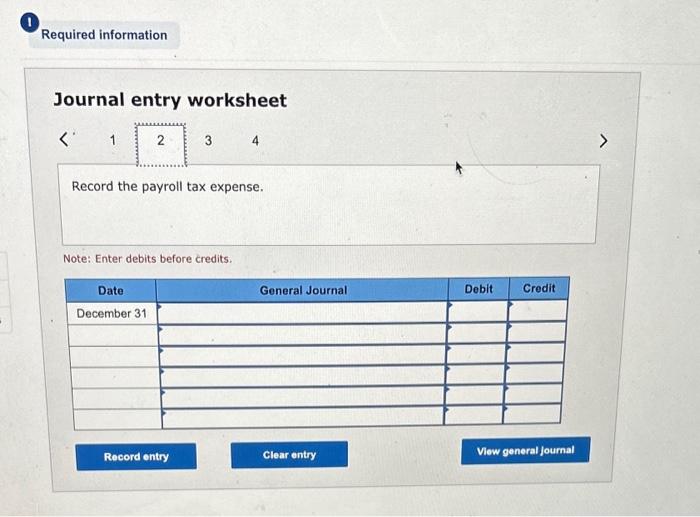

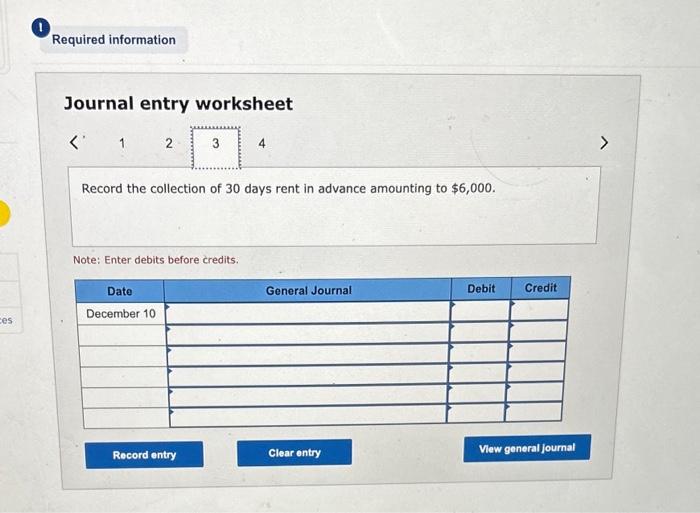

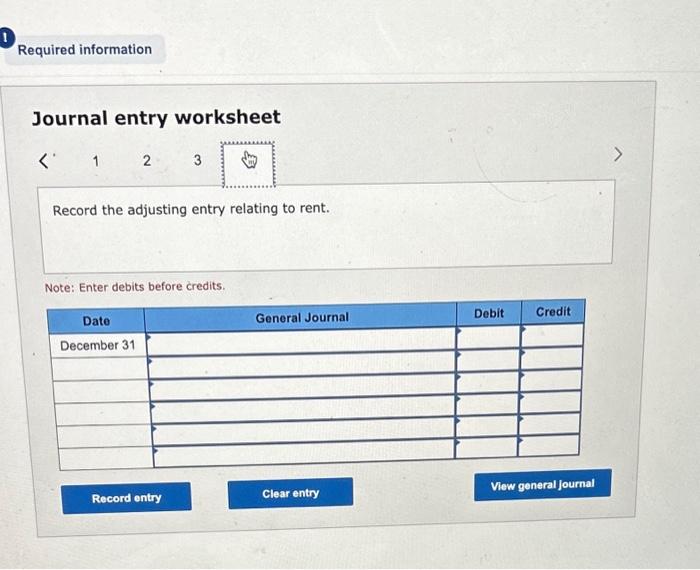

Required information CP10-3 (Algo) Recording and Reporting Current Liabilities [LO 10-2] [The following information applies to the questions displayed below.] Riverside Company completed the following two transactions. The annual accounting period ends December 31 . a. On December 31, calculated the payroll, which indicates gross earnings for wages ($230,000), payroll deductions for income tax ($23,000), payroll deductions for FICA ($30,000), payroll deductions for United Way ($6,000), employer contributions for FICA (matching), and state and federal unemployment taxes ($3,300). Employees were paid in cash, but these payments and the corresponding payroll deductions and employer taxes have not yet been recorded. b. Collected rent revenue of $6,000 on December 10 for office space that Riverside rented to another business. The rent collected was for 30 days from December 11 to January 10 and was credited in full to Deferred Revenue. CP10-3 (Algo) Part 1 Required: 1. \& 2. Complete the required journal entries to record payroll on December 31 , collection of rent on December 10 and the adjusting journal entry on December 31. TIP: Notice that the entry recorded on December 10 includes 10 days of rental space (out of 30 ) that isn't provided until after December 31. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 2.4 Record the wages expense, including payroll deductions. Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record the collection of 30 days rent in advance amounting to $6,000. Note: Enter debits before credits. Journal entry worksheet 12 Record the adjusting entry relating to rent. Note: Enter debits before credits. Required information CP10-3 (Algo) Recording and Reporting Current Liabilities [LO 10-2] [The following information applies to the questions displayed below.] Riverside Company completed the following two transactions. The annual accounting period ends December 31 . a. On December 31, calculated the payroll, which indicates gross earnings for wages ($230,000), payroll deductions for income tax ($23,000), payroll deductions for FICA ($30,000), payroll deductions for United Way ($6,000), employer contributions for FICA (matching), and state and federal unemployment taxes ($3,300). Employees were paid in cash, but these payments and the corresponding payroll deductions and employer taxes have not yet been recorded. b. Collected rent revenue of $6,000 on December 10 for office space that Riverside rented to another business. The rent collected was for 30 days from December 11 to January 10 and was credited in full to Deferred Revenue. CP10-3 (Algo) Part 1 Required: 1. \& 2. Complete the required journal entries to record payroll on December 31 , collection of rent on December 10 and the adjusting journal entry on December 31. TIP: Notice that the entry recorded on December 10 includes 10 days of rental space (out of 30 ) that isn't provided until after December 31. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 2.4 Record the wages expense, including payroll deductions. Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record the collection of 30 days rent in advance amounting to $6,000. Note: Enter debits before credits. Journal entry worksheet 12 Record the adjusting entry relating to rent. Note: Enter debits before credits