Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information E 8 - 7 ( Algo ) Recording Depreciation and Repairs ( Straight - Line Depreciation ) L 0 8 - 2 ,

Required information

EAlgo Recording Depreciation and Repairs StraightLine Depreciation L

The following information applies to the questions displayed below.

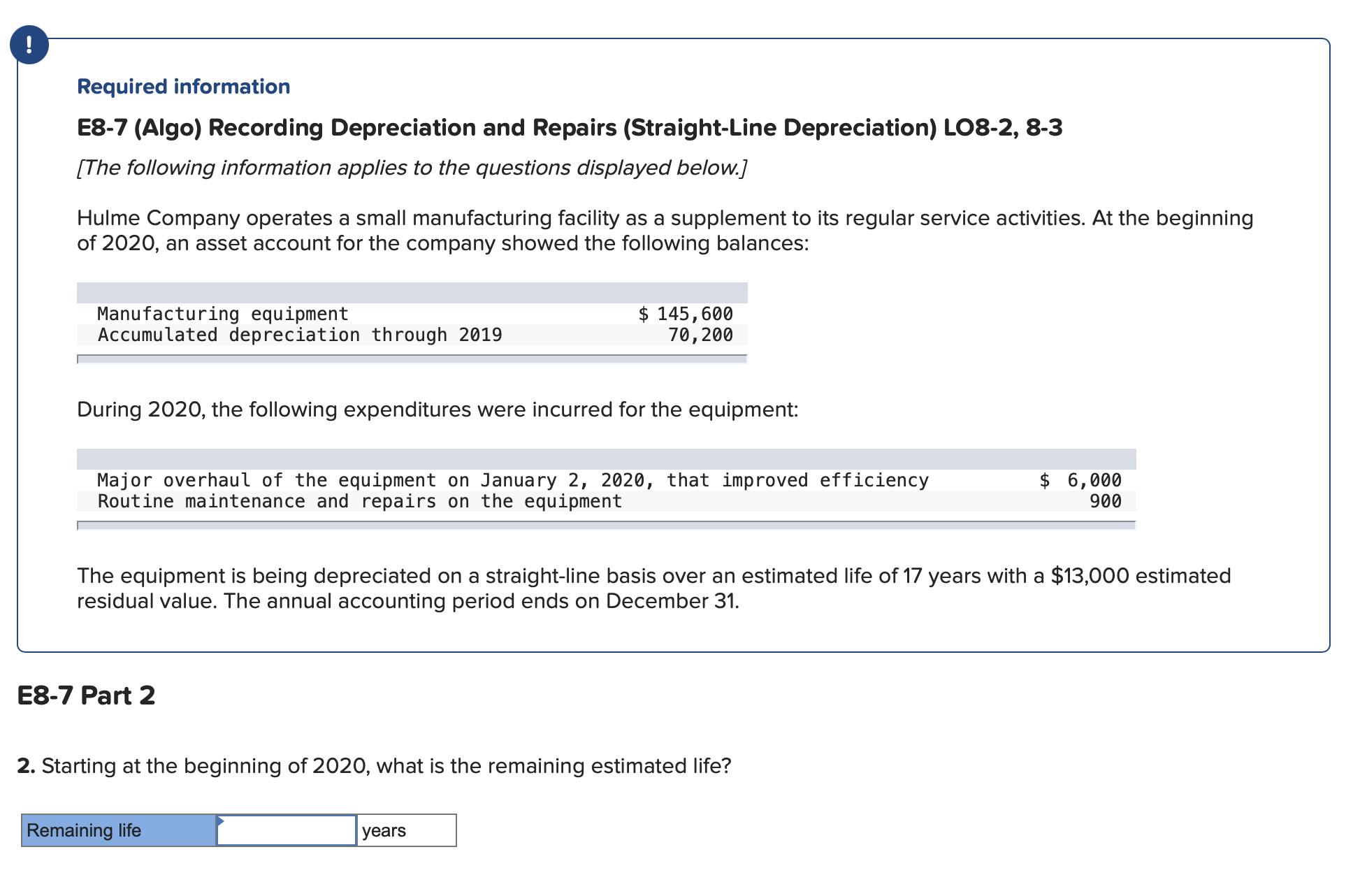

Hulme Company operates a small manufacturing facility as a supplement to its regular service activities. At the beginning

of an asset account for the company showed the following balances:

Manufacturing equipment

Accumulated depreciation through

During the following expenditures were incurred for the equipment:

Major overhaul of the equipment on January that improved efficiency

The equipment is being depreciated on a straightline basis over an estimated life of years with a $ estimated

residual value. The annual accounting period ends on December

E Part

Starting at the beginning of what is the remaining estimated life?Required information

EAlgo Recording Depreciation and Repairs StraightLine Depreciation L

The following information applies to the questions displayed below.

Hulme Company operates a small manufacturing facility as a supplement to its regular service activities. At the beginning

of an asset account for the company showed the following balances:

Manufacturing equipment

Accumulated depreciation through

$

During the following expenditures were incurred for the equipment:

Major overhaul of the equipment on January that improved efficiency

Routine maintenance and repairs on the equipment

The equipment is being depreciated on a straightline basis over an estimated life of years with a $ estimated

residual value. The annual accounting period ends on December

E Part

Required:

Prepare the adjusting entry that was made at the end of for depreciation on the manufacturing equipment. Do not round your

intermediate calculations. If no entry is required for a transactionevent select No journal entry required" in the first account

field.

Journal entry worksheet

Record the adjusting entry for depreciation on the manufacturing equipment

during

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started