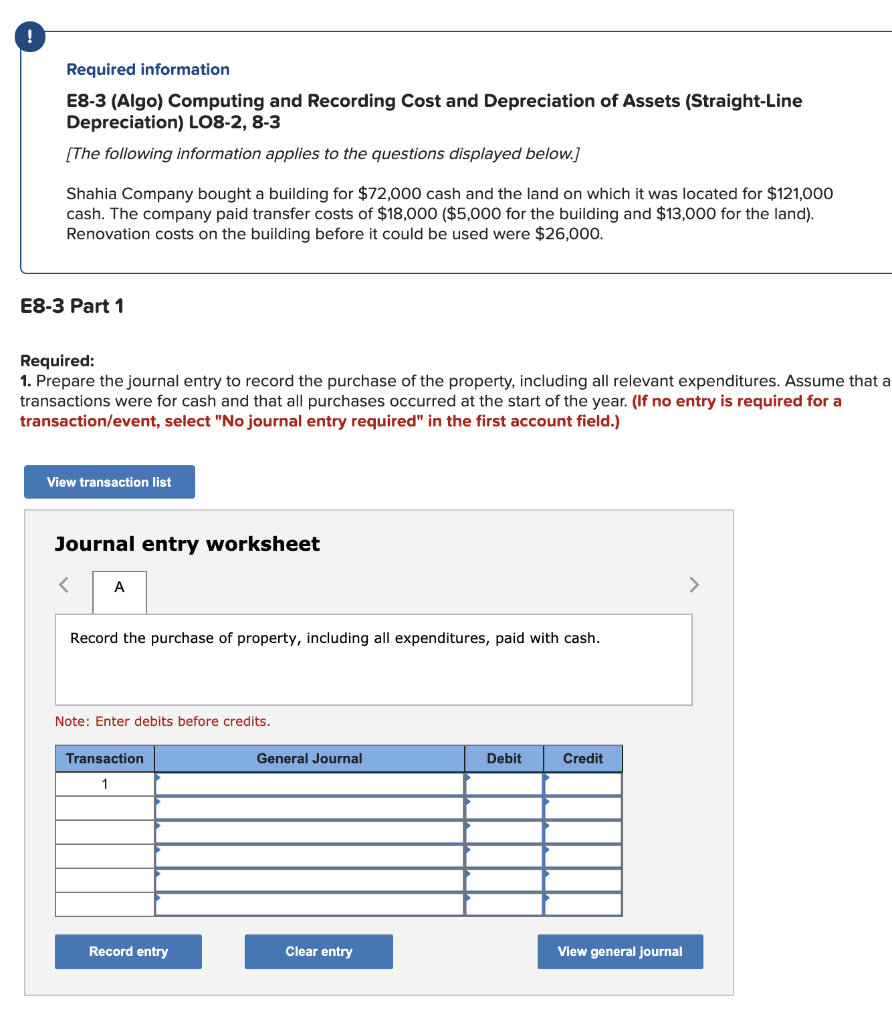

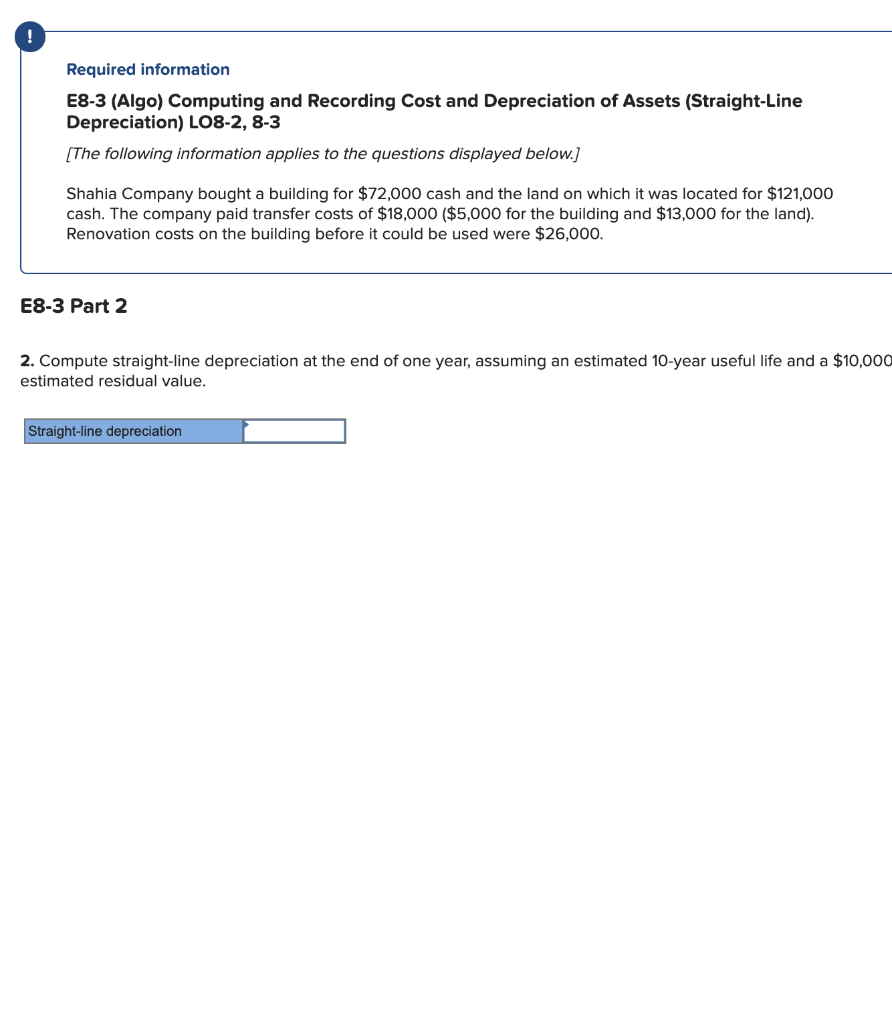

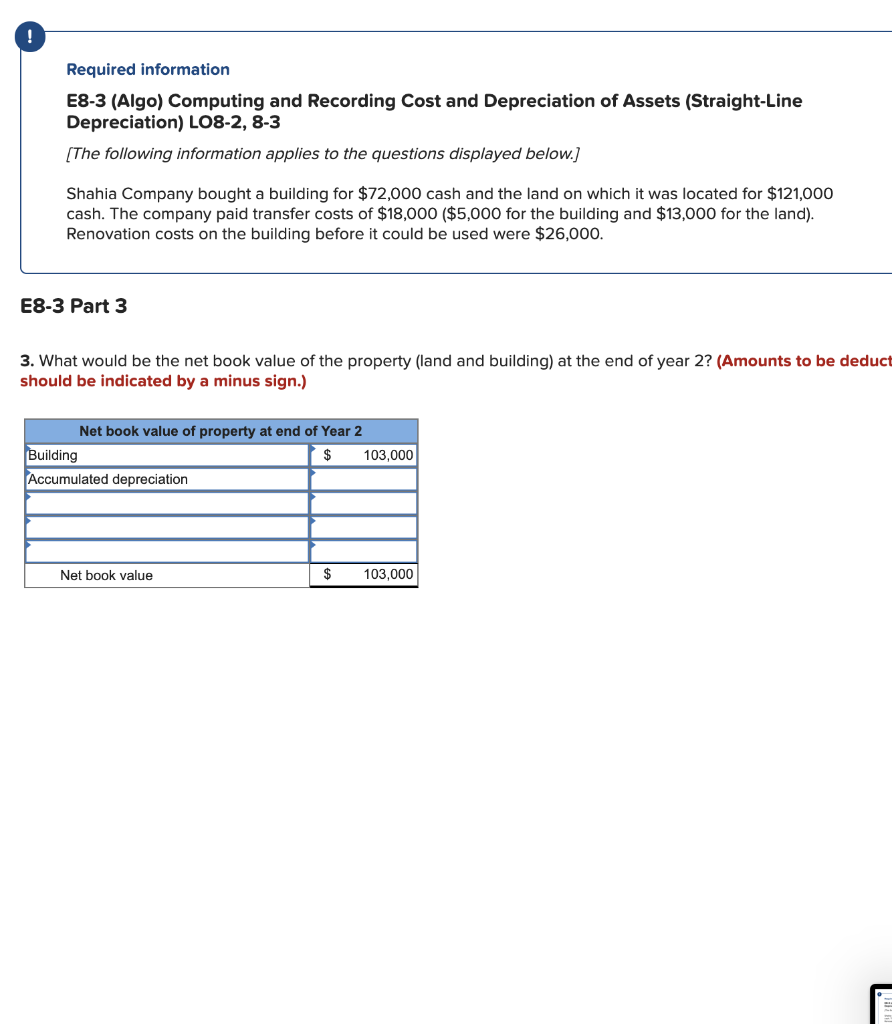

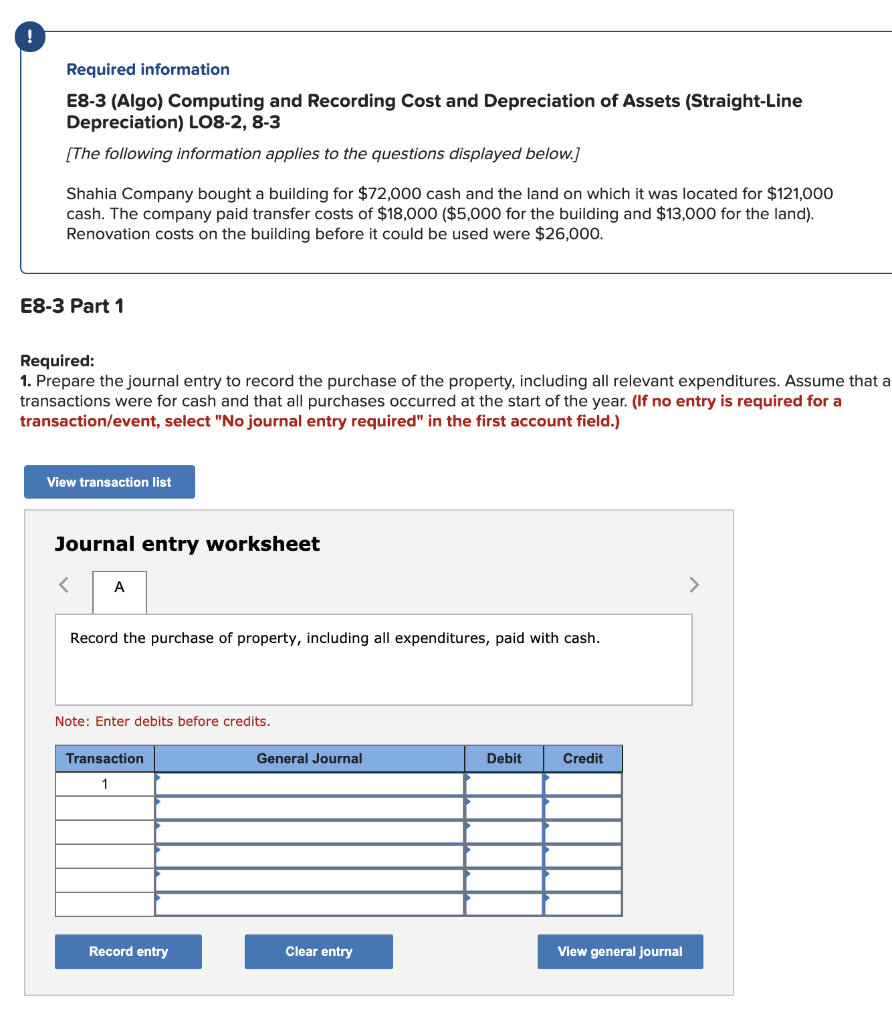

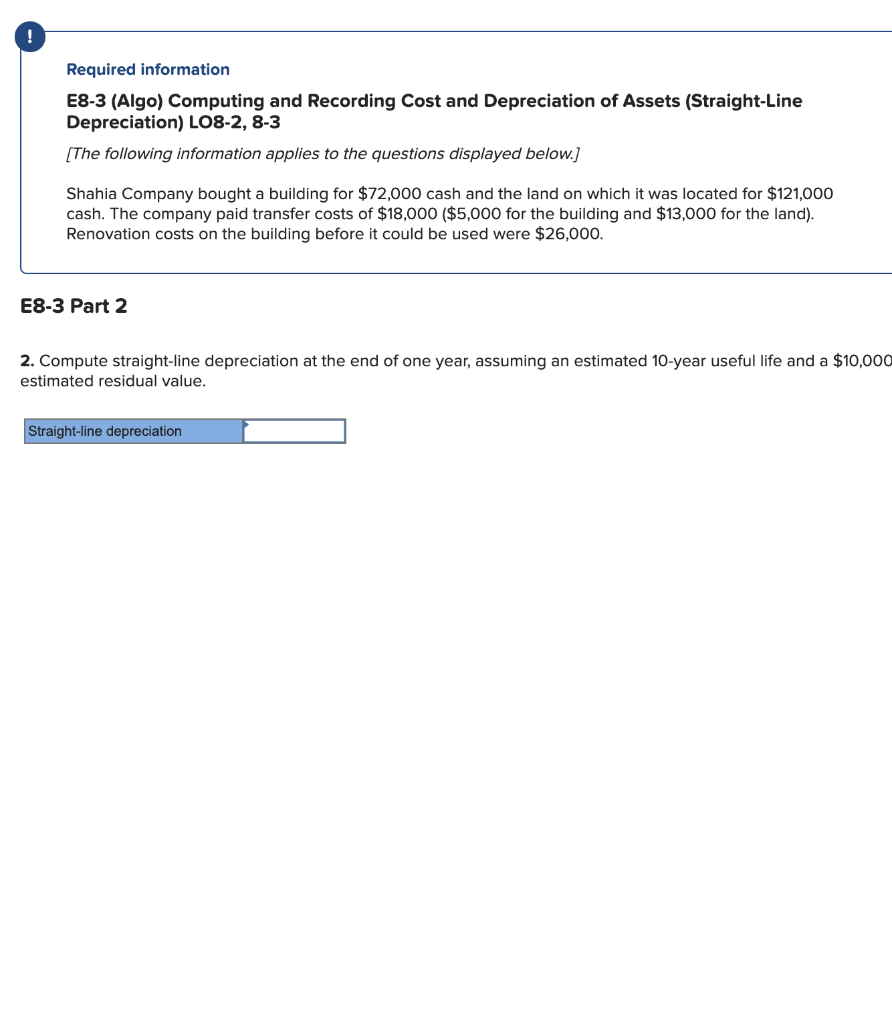

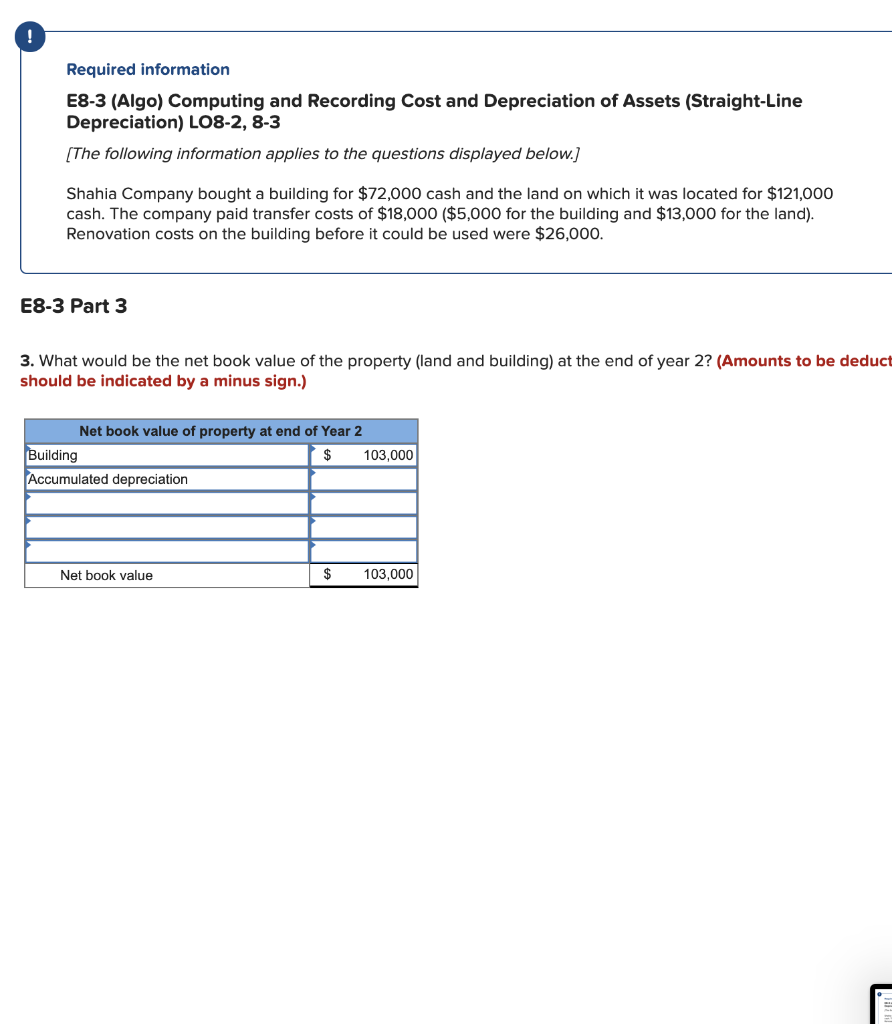

! Required information E8-3 (Algo) Computing and Recording Cost and Depreciation of Assets (Straight-Line Depreciation) LO8-2, 8-3 [The following information applies to the questions displayed below.) Shahia Company bought a building for $72,000 cash and the land on which it was located for $121,000 cash. The company paid transfer costs of $18,000 ($5,000 for the building and $13,000 for the land). Renovation costs on the building before it could be used were $26,000. E8-3 Part 1 Required: 1. Prepare the journal entry to record the purchase of the property, including all relevant expenditures. Assume that a transactions were for cash and that all purchases occurred at the start of the year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the purchase of property, including all expenditures, paid with cash. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal ! Required information E8-3 (Algo) Computing and Recording Cost and Depreciation of Assets (Straight-Line Depreciation) LO8-2, 8-3 [The following information applies to the questions displayed below.) Shahia Company bought a building for $72,000 cash and the land on which it was located for $121,000 cash. The company paid transfer costs of $18,000 ($5,000 for the building and $13,000 for the land). Renovation costs on the building before it could be used were $26,000. E8-3 Part 2 2. Compute straight-line depreciation at the end of one year, assuming an estimated 10-year useful life and a $10,000 estimated residual value. Straight-line depreciation ! Required information E8-3 (Algo) Computing and Recording Cost and Depreciation of Assets (Straight-Line Depreciation) LO8-2, 8-3 [The following information applies to the questions displayed below.) Shahia Company bought a building for $72,000 cash and the land on which it was located for $121,000 cash. The company paid transfer costs of $18,000 ($5,000 for the building and $13,000 for the land). Renovation costs on the building before it could be used were $26,000. E8-3 Part 3 3. What would be the net book value of the property (land and building) at the end of year 2? (Amounts to be deduct should be indicated by a minus sign.) Net book value of property at end of Year 2 Building $ 103,000 Accumulated depreciation Net book value 103,000