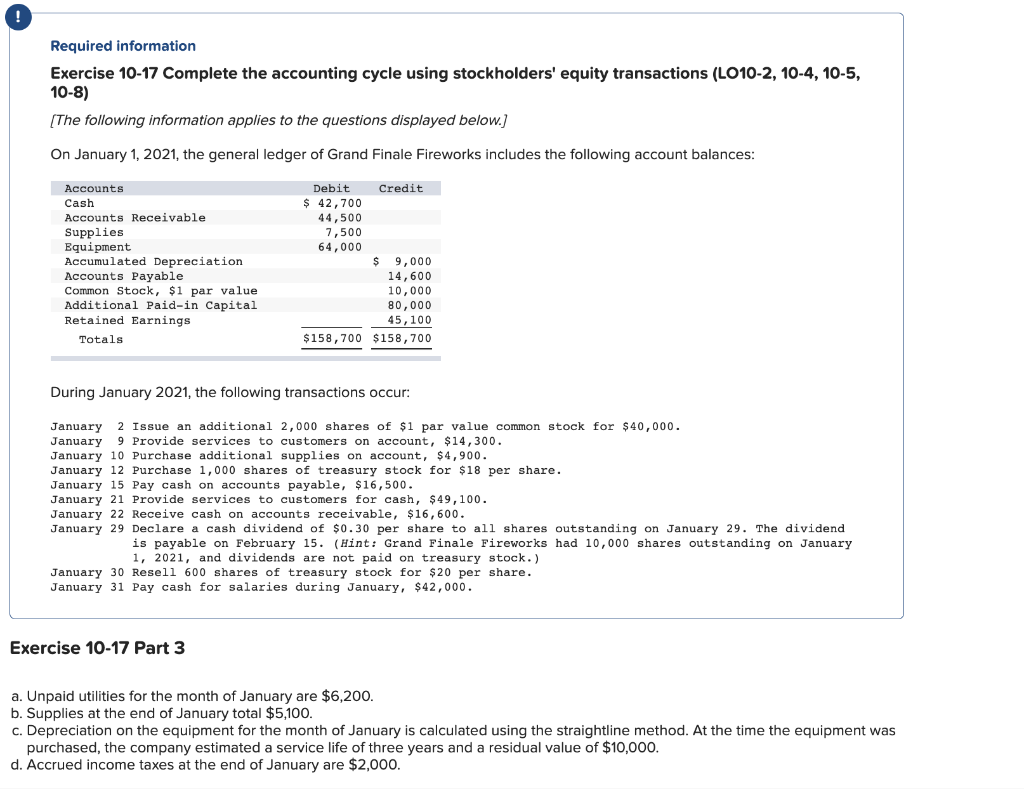

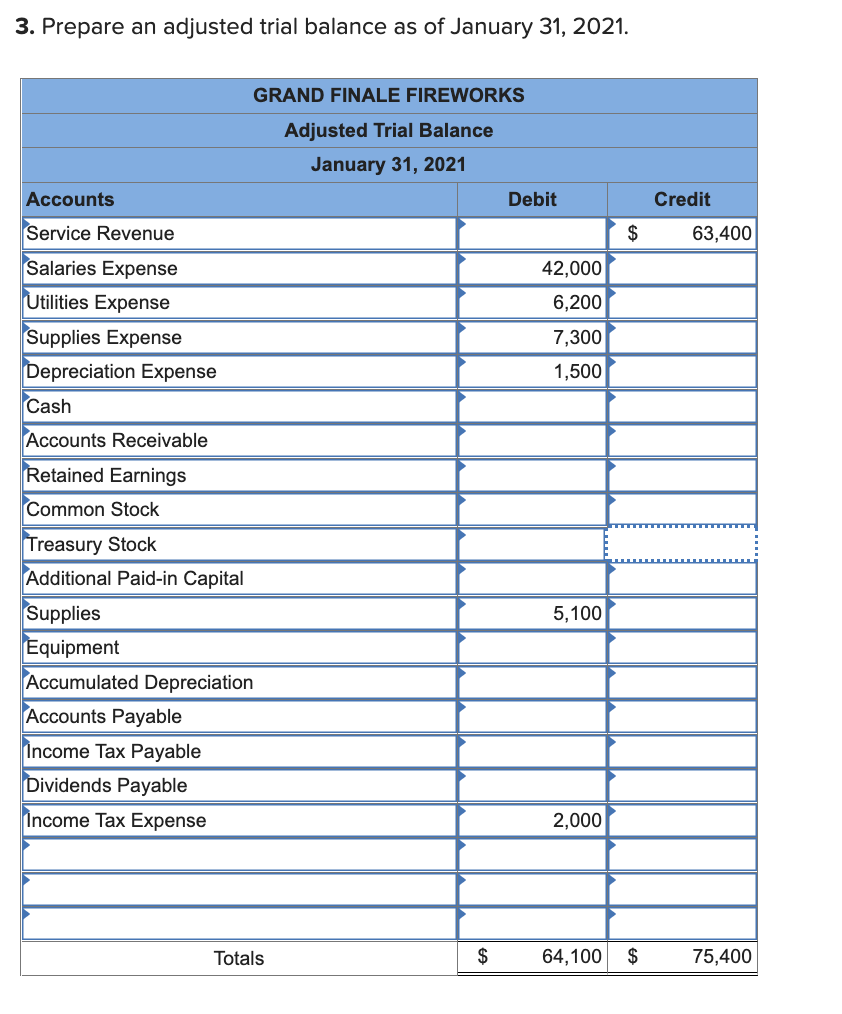

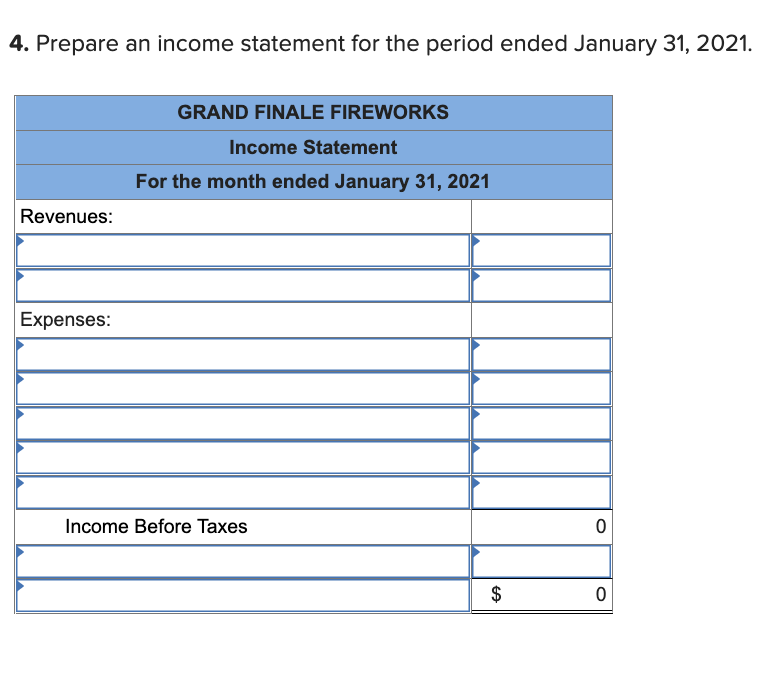

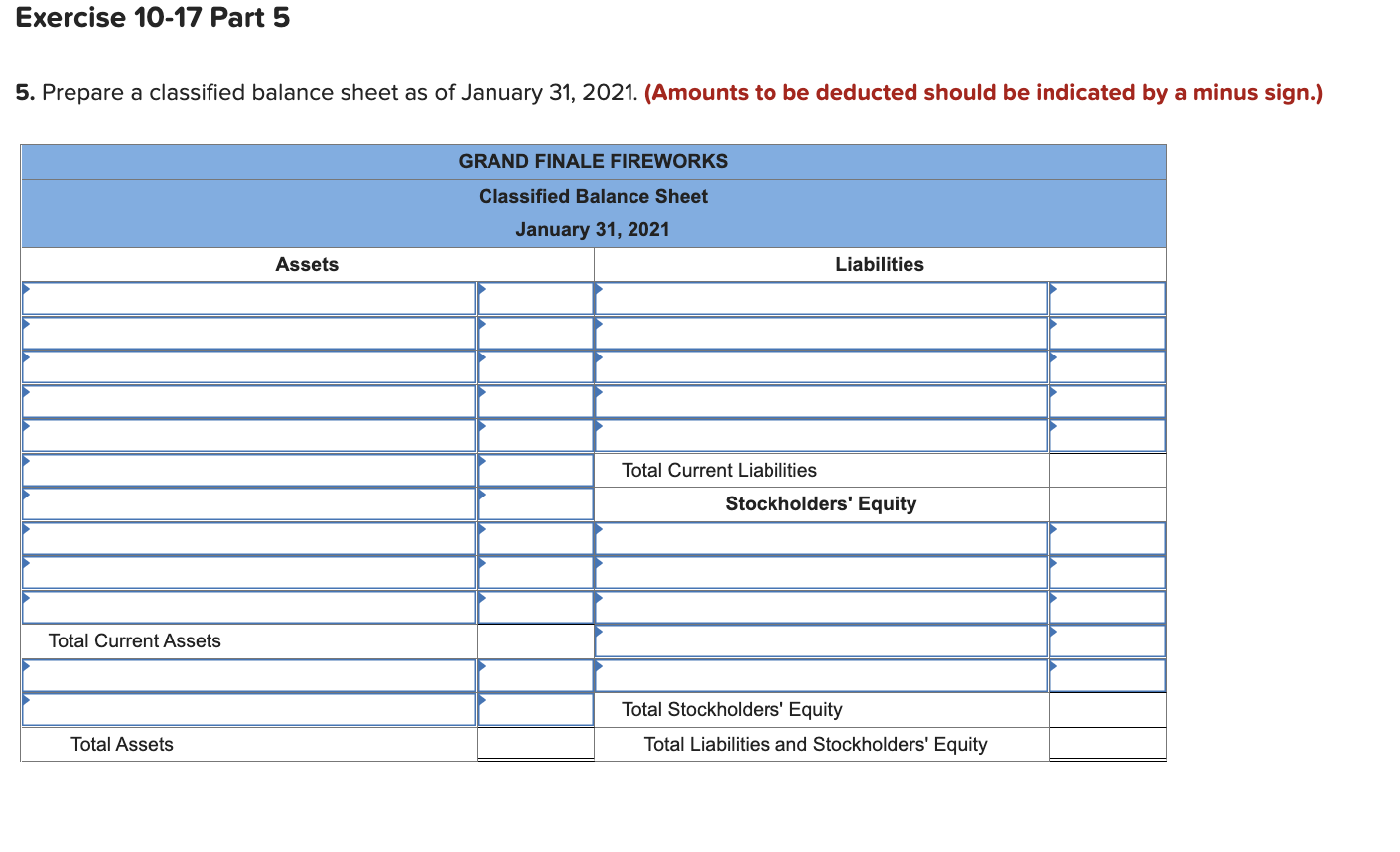

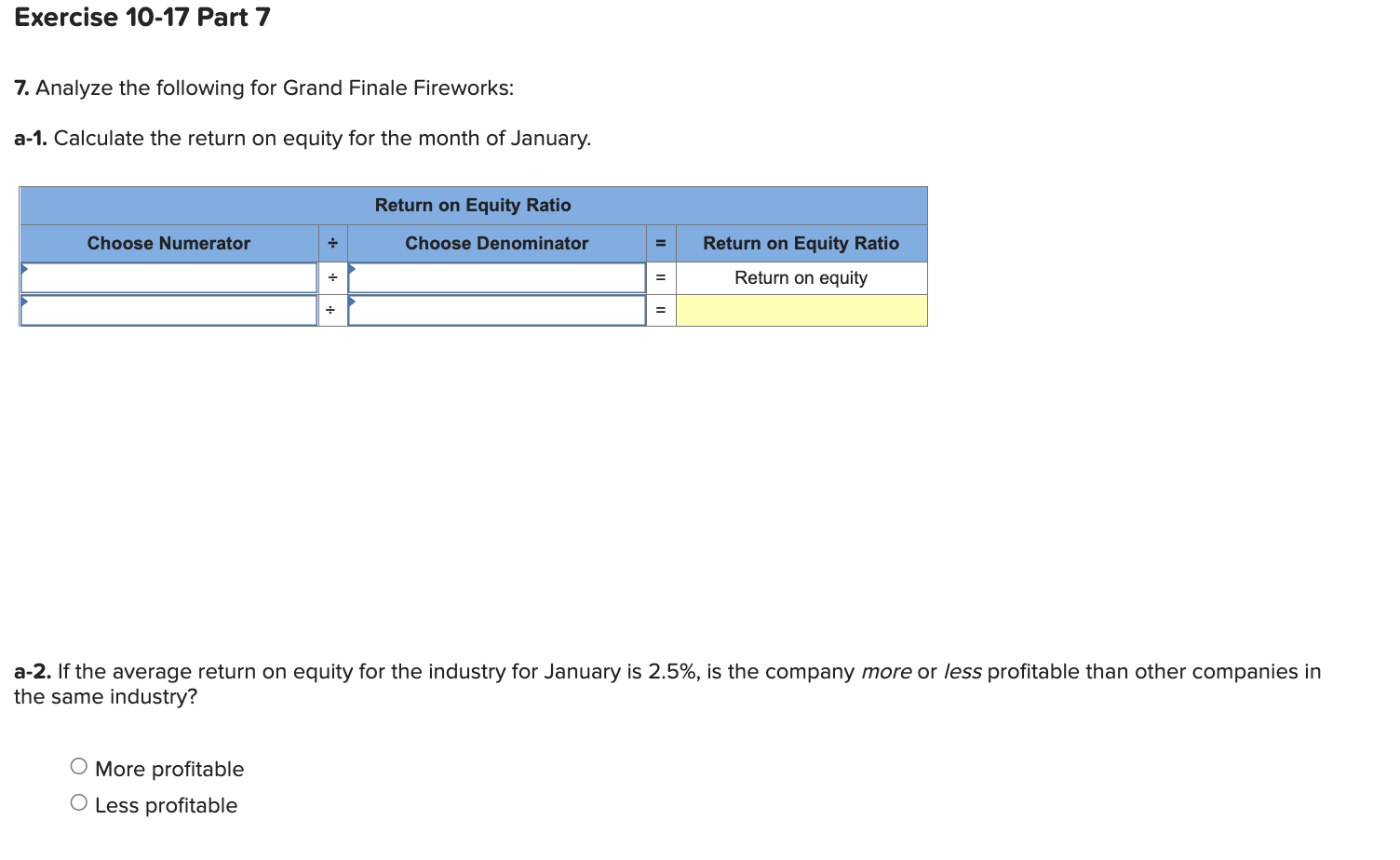

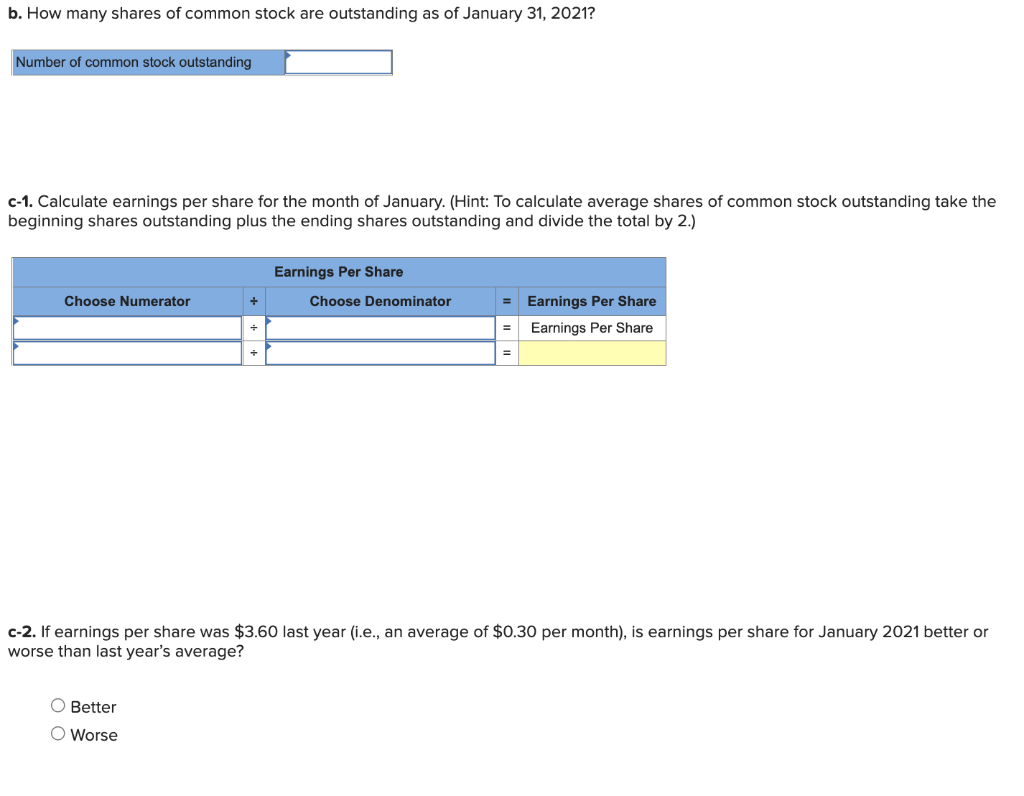

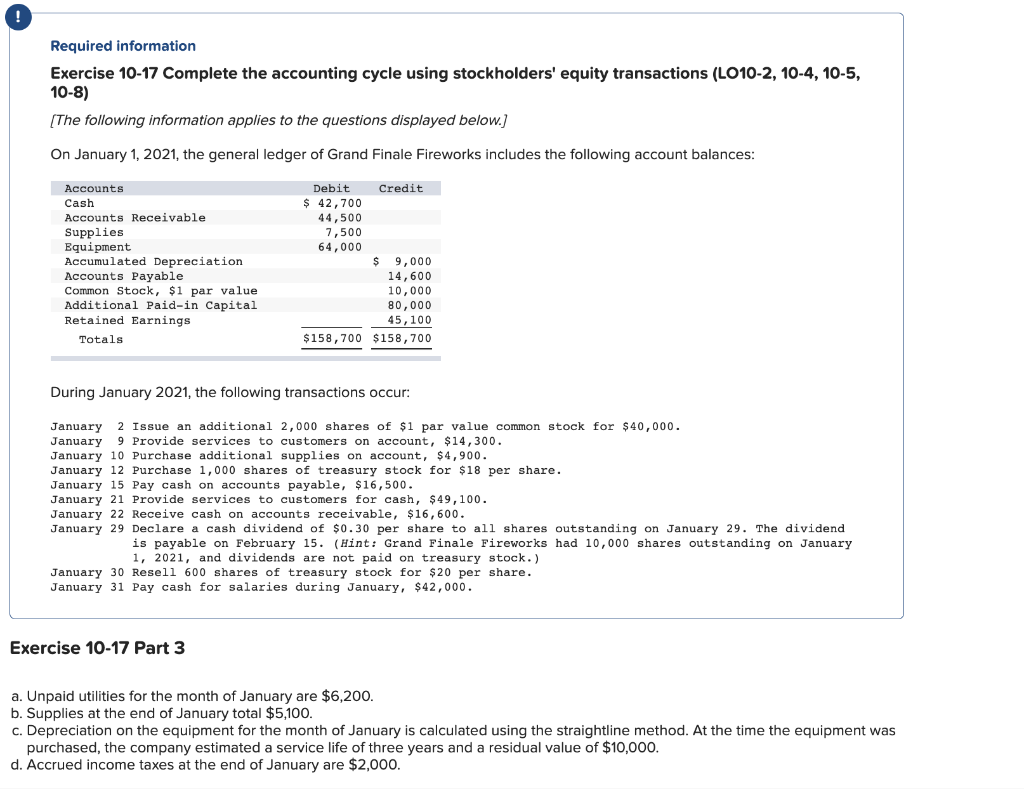

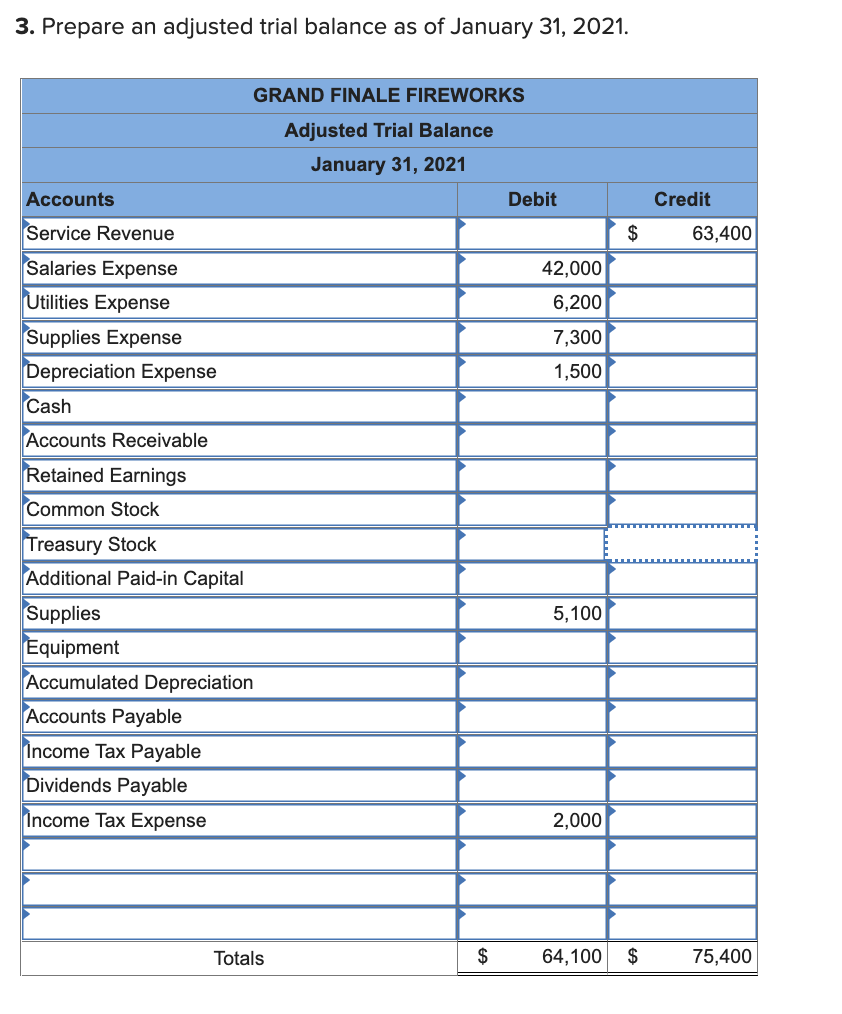

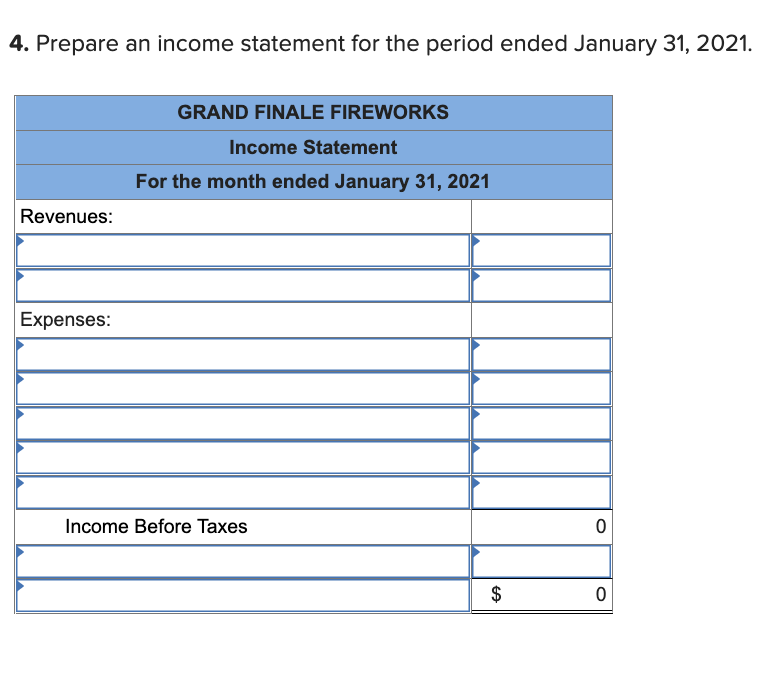

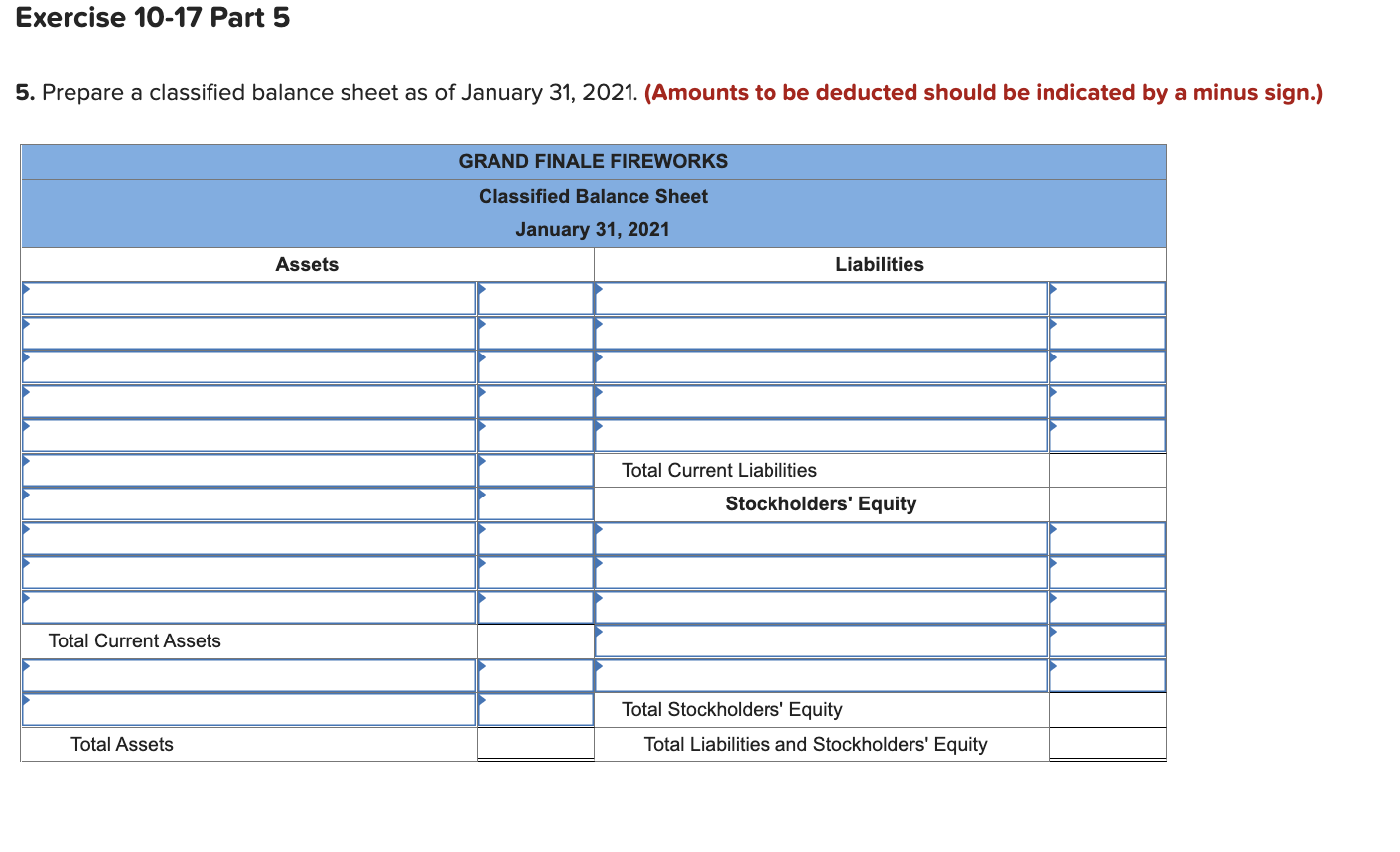

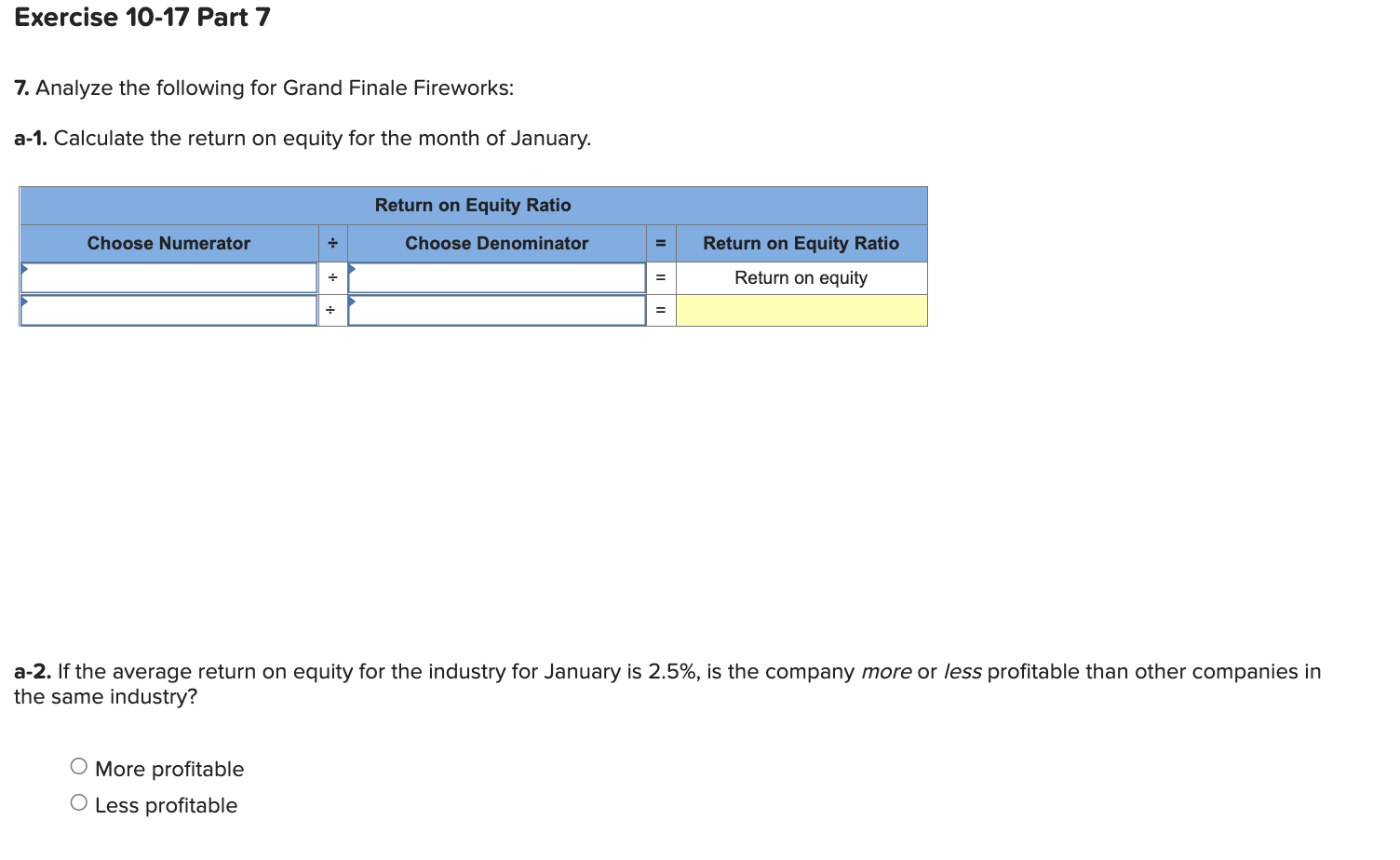

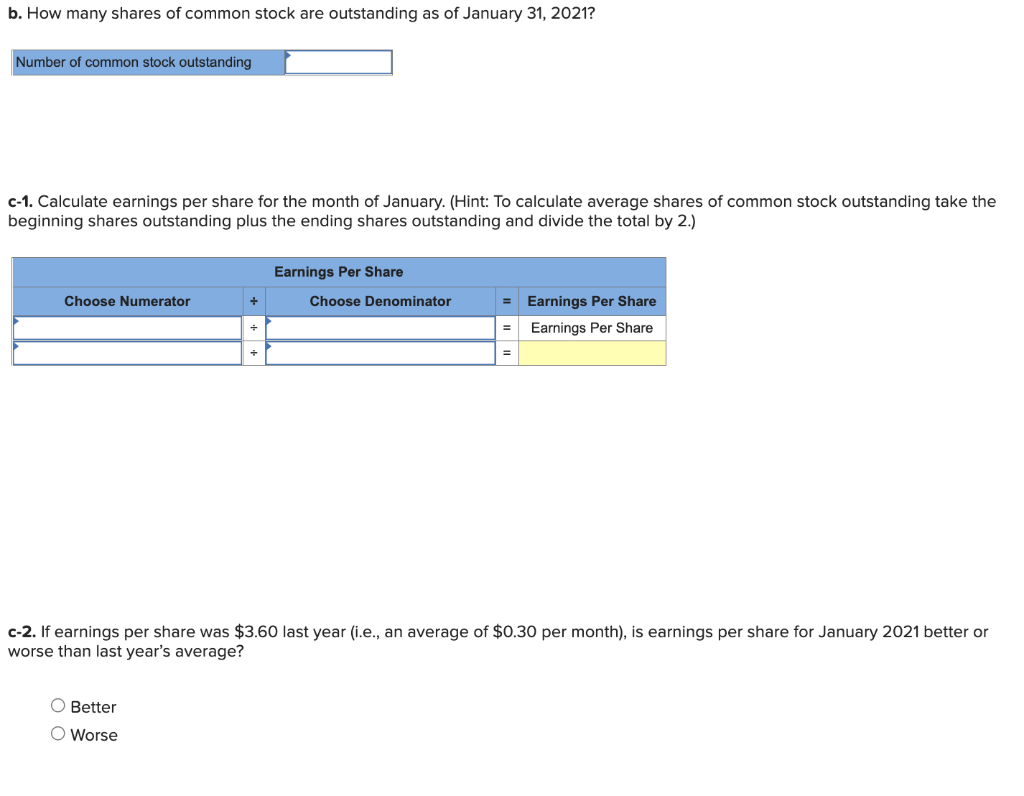

Required information Exercise 10-17 Complete the accounting cycle using stockholders' equity transactions (LO10-2, 10-4, 10-5, 10-8) [The following information applies to the questions displayed below.] On January 1, 2021, the general ledger of Grand Finale Fireworks includes the following account balances: During January 2021 , the following transactions occur: January 2 Issue an additional 2,000 shares of $1 par value common stock for $40,000. January 9 Provide services to customers on account, $14,300. January 10 Purchase additional supplies on account, $4,900. January 12 Purchase 1,000 shares of treasury stock for $18 per share. January 15 Pay cash on accounts payable, $16,500. January 21 Provide services to customers for cash, $49,100. January 22 Receive cash on accounts receivable, $16,600. January 29 Declare a cash dividend of $0.30 per share to all shares outstanding on January 29 . The dividend is payable on February 15. (Hint: Grand Finale Fireworks had 10,000 shares outstanding on January 1,2021 , and dividends are not paid on treasury stock.) January 30 Resell 600 shares of treasury stock for $20 per share. January 31 Pay cash for salaries during January, $42,000. Exercise 10-17 Part 3 a. Unpaid utilities for the month of January are $6,200. b. Supplies at the end of January total $5,100. c. Depreciation on the equipment for the month of January is calculated using the straightline method. At the time the equipment was purchased, the company estimated a service life of three years and a residual value of $10,000. d. Accrued income taxes at the end of January are $2,000. 3 Dronara an adiuctad trial halanco ac nf lanary 21 ?n1 4. Prepare an income statement for the period ended January 31, 2021. Exercise 10-17 Part 5 5. Prepare a classified balance sheet as of January 31, 2021. (Amounts to be deducted should be indicated by a minus sign.) 7. Analyze the following for Grand Finale Fireworks: a-1. Calculate the return on equity for the month of January. a-2. If the average return on equity for the industry for January is 2.5%, is the company more or less profitable than other companies in the same industry? More profitable Less profitable b. How many shares of common stock are outstanding as of January 31,2021? c-1. Calculate earnings per share for the month of January. (Hint: To calculate average shares of common stock outstanding take the beginning shares outstanding plus the ending shares outstanding and divide the total by 2 .) c-2. If earnings per share was $3.60 last year (i.e., an average of $0.30 per month), is earnings per share for January 2021 better or worse than last year's average? Better Worse Required information Exercise 10-17 Complete the accounting cycle using stockholders' equity transactions (LO10-2, 10-4, 10-5, 10-8) [The following information applies to the questions displayed below.] On January 1, 2021, the general ledger of Grand Finale Fireworks includes the following account balances: During January 2021 , the following transactions occur: January 2 Issue an additional 2,000 shares of $1 par value common stock for $40,000. January 9 Provide services to customers on account, $14,300. January 10 Purchase additional supplies on account, $4,900. January 12 Purchase 1,000 shares of treasury stock for $18 per share. January 15 Pay cash on accounts payable, $16,500. January 21 Provide services to customers for cash, $49,100. January 22 Receive cash on accounts receivable, $16,600. January 29 Declare a cash dividend of $0.30 per share to all shares outstanding on January 29 . The dividend is payable on February 15. (Hint: Grand Finale Fireworks had 10,000 shares outstanding on January 1,2021 , and dividends are not paid on treasury stock.) January 30 Resell 600 shares of treasury stock for $20 per share. January 31 Pay cash for salaries during January, $42,000. Exercise 10-17 Part 3 a. Unpaid utilities for the month of January are $6,200. b. Supplies at the end of January total $5,100. c. Depreciation on the equipment for the month of January is calculated using the straightline method. At the time the equipment was purchased, the company estimated a service life of three years and a residual value of $10,000. d. Accrued income taxes at the end of January are $2,000. 3 Dronara an adiuctad trial halanco ac nf lanary 21 ?n1 4. Prepare an income statement for the period ended January 31, 2021. Exercise 10-17 Part 5 5. Prepare a classified balance sheet as of January 31, 2021. (Amounts to be deducted should be indicated by a minus sign.) 7. Analyze the following for Grand Finale Fireworks: a-1. Calculate the return on equity for the month of January. a-2. If the average return on equity for the industry for January is 2.5%, is the company more or less profitable than other companies in the same industry? More profitable Less profitable b. How many shares of common stock are outstanding as of January 31,2021? c-1. Calculate earnings per share for the month of January. (Hint: To calculate average shares of common stock outstanding take the beginning shares outstanding plus the ending shares outstanding and divide the total by 2 .) c-2. If earnings per share was $3.60 last year (i.e., an average of $0.30 per month), is earnings per share for January 2021 better or worse than last year's average? Better Worse