Answered step by step

Verified Expert Solution

Question

1 Approved Answer

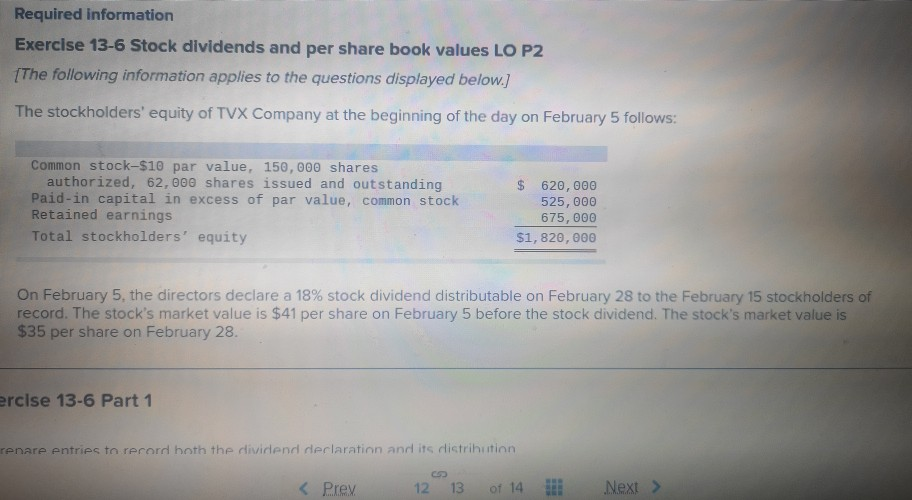

Required information Exercise 13-6 Stock dividends and per share book values LO P2 [The following information applies to the questions displayed below The stockholders' equity

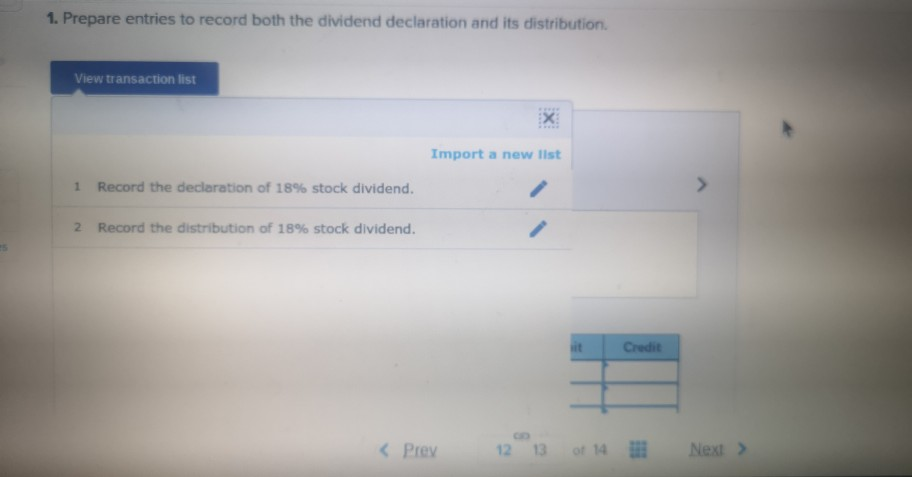

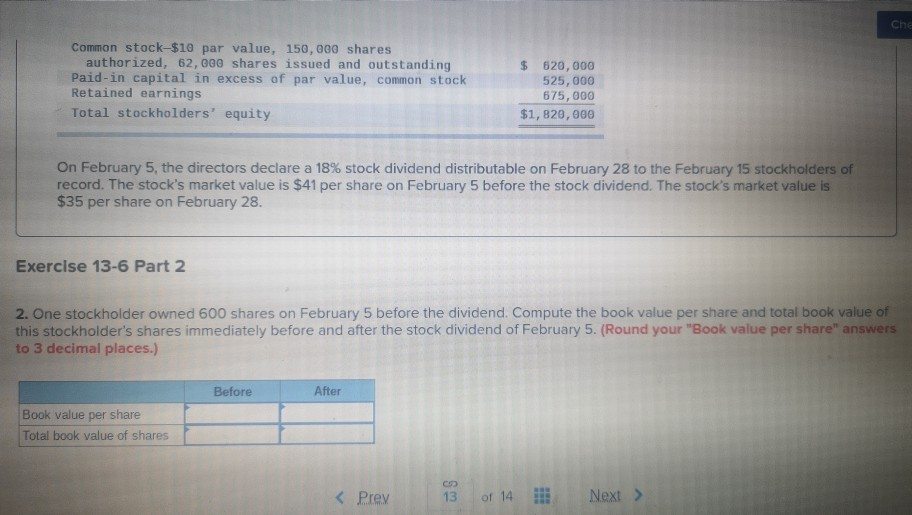

Required information Exercise 13-6 Stock dividends and per share book values LO P2 [The following information applies to the questions displayed below The stockholders' equity of TVX Company at the beginning of the day on February 5 follows: Common stock-$10 par value, 150, 000 shares authorized, 62,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $ 620,000 525, 000 675, 000 $1, 820, 000 On February 5, the directors declare a 18% stock dividend distributable on February 28 to the February 15 stockholders of record. The stock's market value is $41 per share on February 5 before the stock dividend. The stock's market value is $35 per share on February 28. rcise 13-6 Part1 renare entries to rerord hoth the dividend derlaration and its distrihatinn 12 13 of 14 Next > K Prex 1. Prepare entries to record both the dividend declaration and its distribution. View transaction list Import a new Ilst 1 Record the declaration of 18% stock dividend 2 Record the distribution of 18% stock dividend Credit Prey 12 13 ot 14 Next > Che Common stock-$10 par value, 150, 000 shares authorized, 62, 000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $ 620,000 525, 000 675,000 $1, 820, 000 On February 5, the directors declare a 18% stock dividend distributable on February 28 to the February 15 stockholders of record. The stock's market value is $41 per share on February 5 before the stock dividend. The stock's market value is $35 per share on February 28 Exercise 13-6 Part 2 2. One stockholder owned 600 shares on February 5 before the dividend. Compute the book value per share and total book value of this stockholder's shares immediately before and after the stock dividend of February 5. (Round your "Book value per share" answers to 3 decimal places.) After Before Book value per share Total book value of shares of 14 . Next >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started