Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information Exercise 3-22A Recording events in the general journal, posting to T-accounts, and preparing closing entries LO 3-1, 3-2, 3-3, 3-4 Skip to question

Required information

Exercise 3-22A Recording events in the general journal, posting to T-accounts, and preparing closing entries LO 3-1, 3-2, 3-3, 3-4

Skip to question

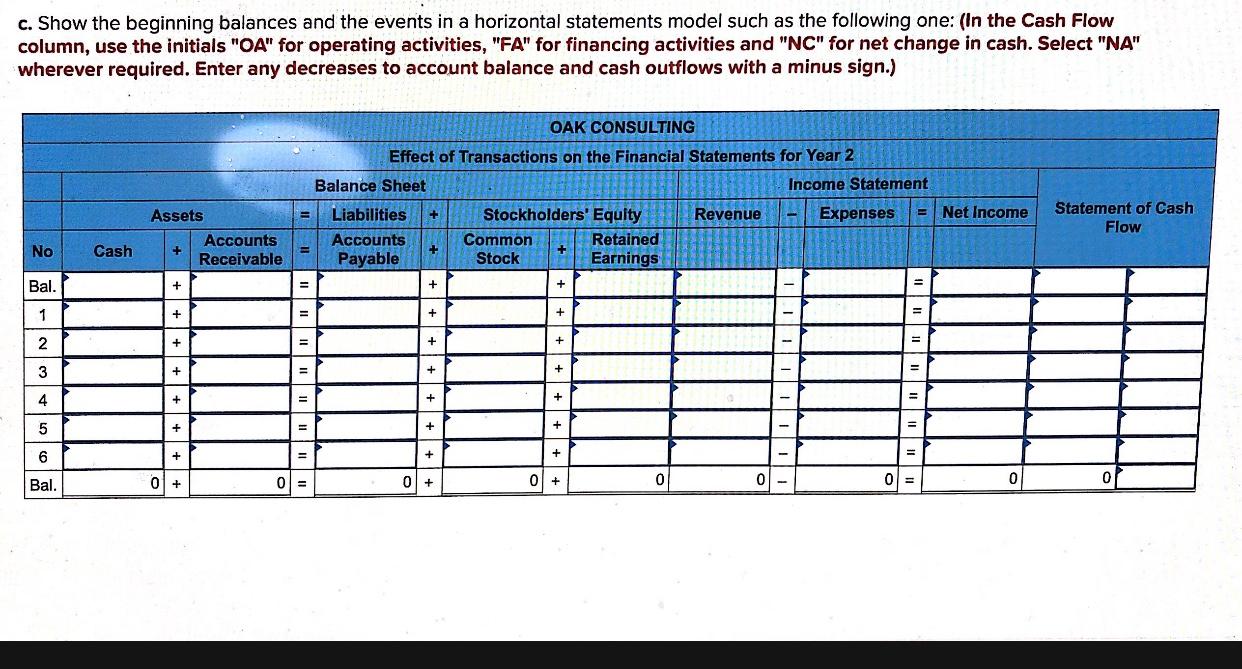

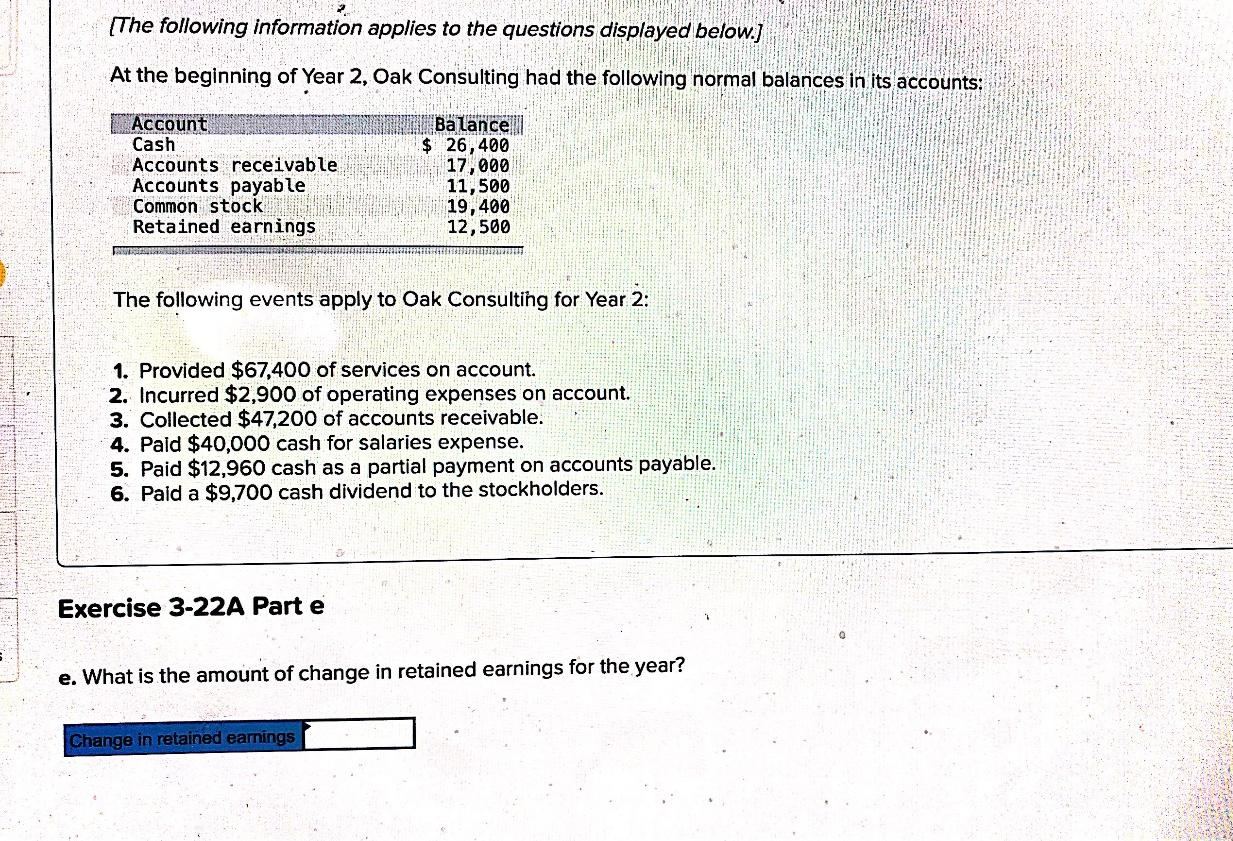

[The following information applies to the questions displayed below.] At the beginning of Year 2, Oak Consulting had the following normal balances in its accounts:

| Account | Balance | |

| Cash | $ | 26,400 |

| Accounts receivable | 17,000 | |

| Accounts payable | 11,500 | |

| Common stock | 19,400 | |

| Retained earnings | 12,500 | |

The following events apply to Oak Consulting for Year 2:

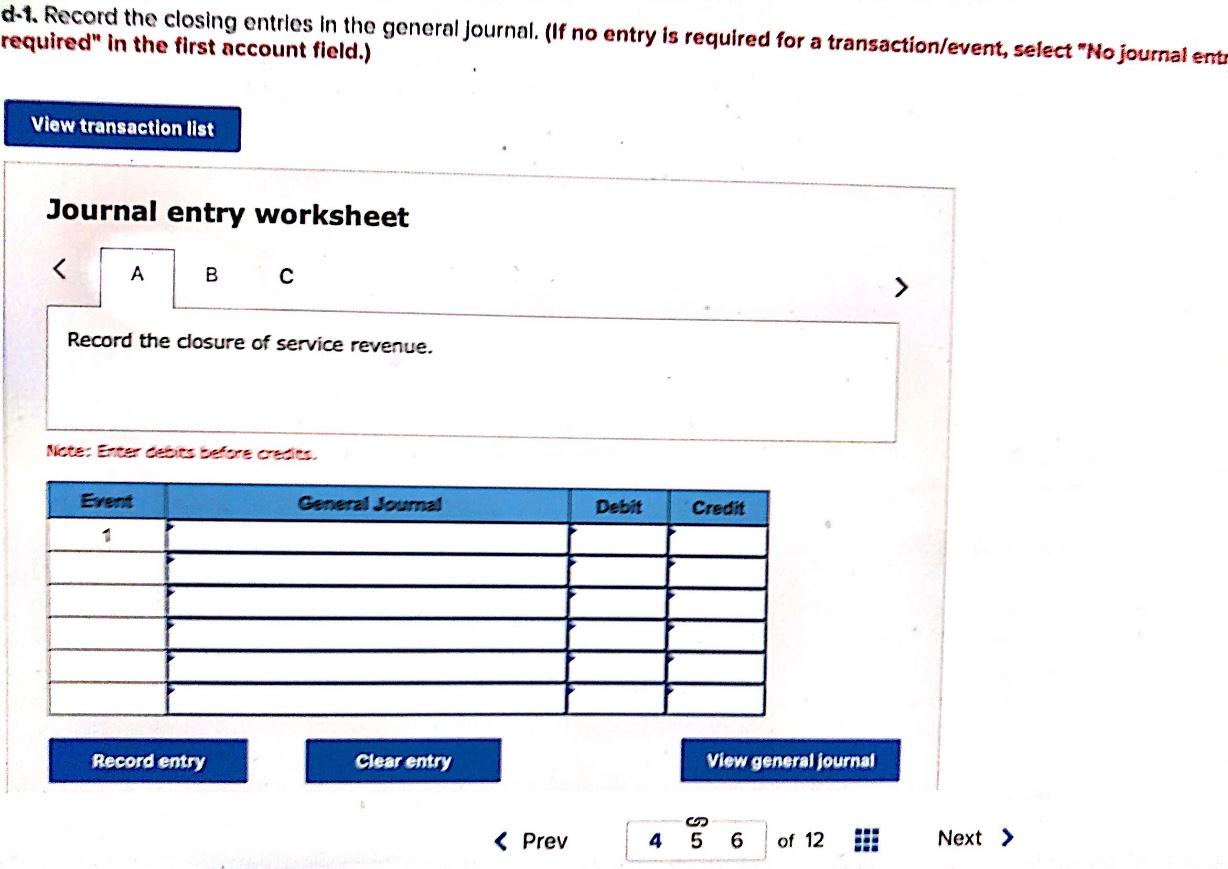

- Provided $67,400 of services on account.

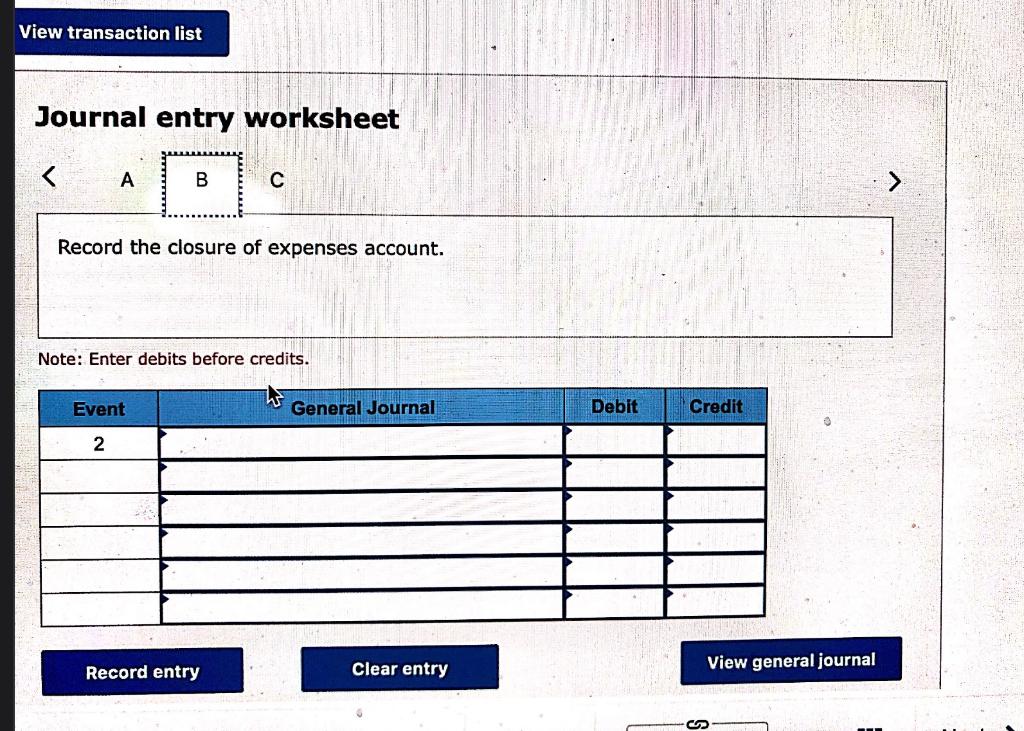

- Incurred $2,900 of operating expenses on account.

- Collected $47,200 of accounts receivable.

- Paid $40,000 cash for salaries expense.

- Paid $12,960 cash as a partial payment on accounts payable.

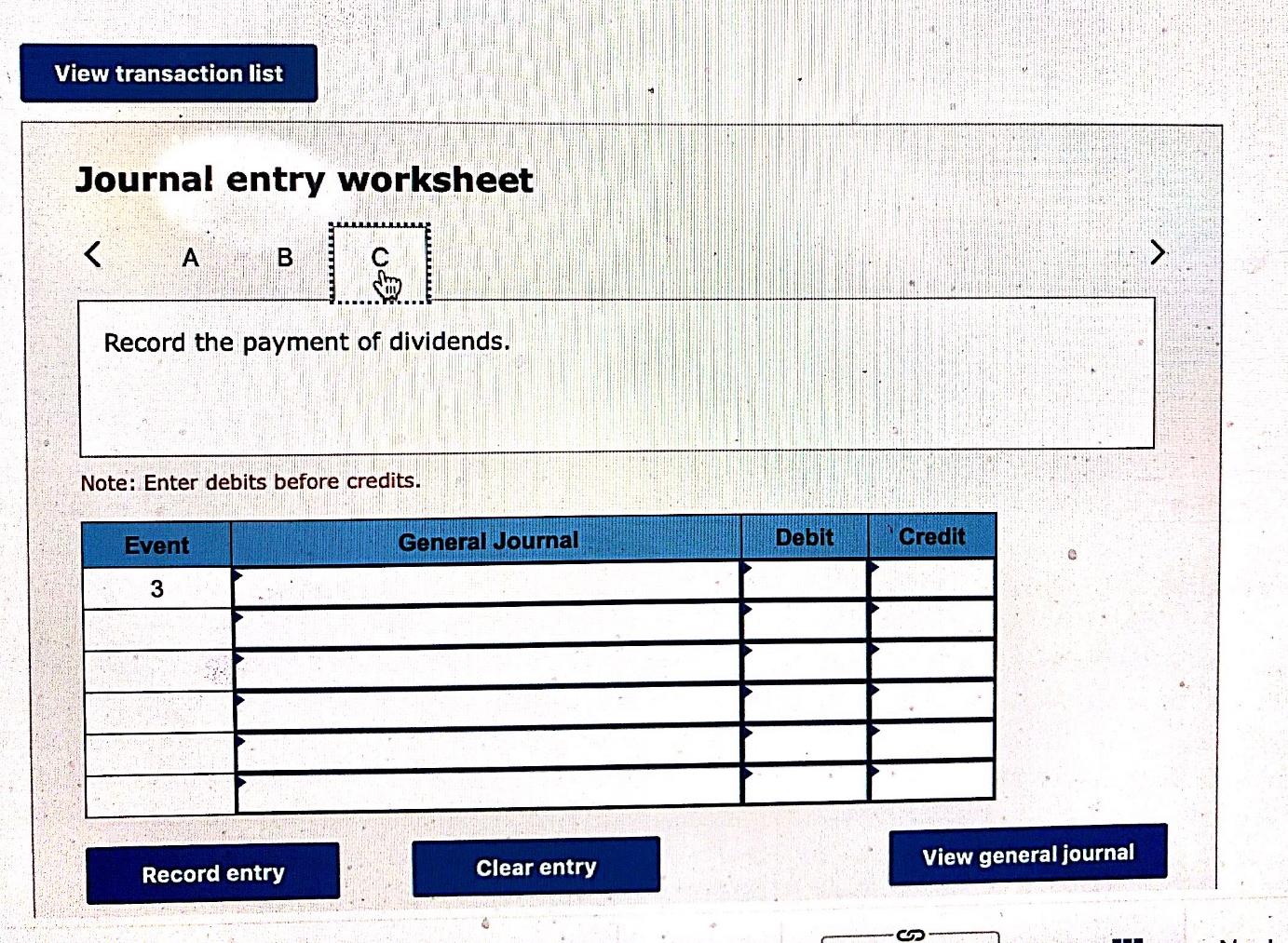

- Paid a $9,700 cash dividend to the stockholders.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started