Answered step by step

Verified Expert Solution

Question

1 Approved Answer

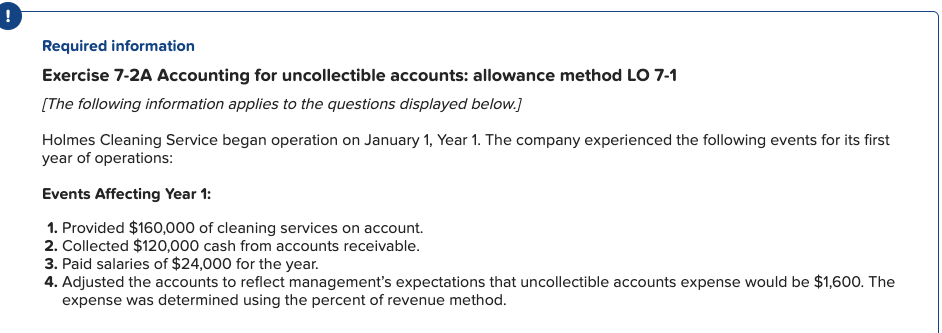

Required information Exercise 7-2A Accounting for uncollectible accounts: allowance method LO 7-1 [The following information applies to the questions displayed below.] Holmes Cleaning Service began

Required information

Exercise 7-2A Accounting for uncollectible accounts: allowance method LO 7-1

[The following information applies to the questions displayed below.] Holmes Cleaning Service began operation on January 1, Year 1. The company experienced the following events for its first year of operations: Events Affecting Year 1:

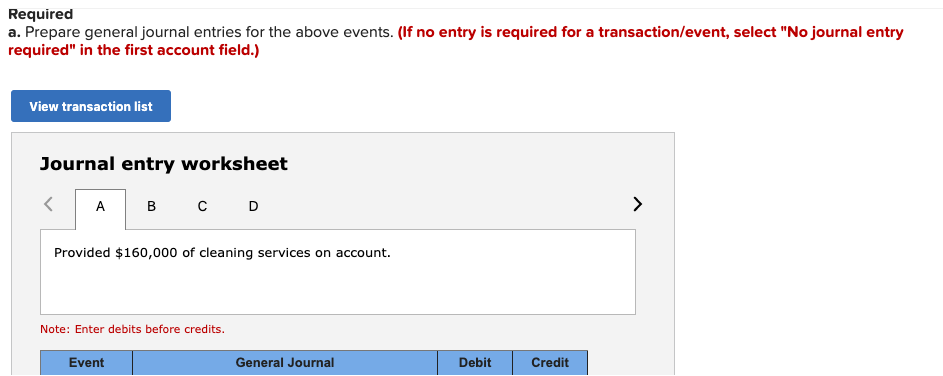

- Provided $160,000 of cleaning services on account.

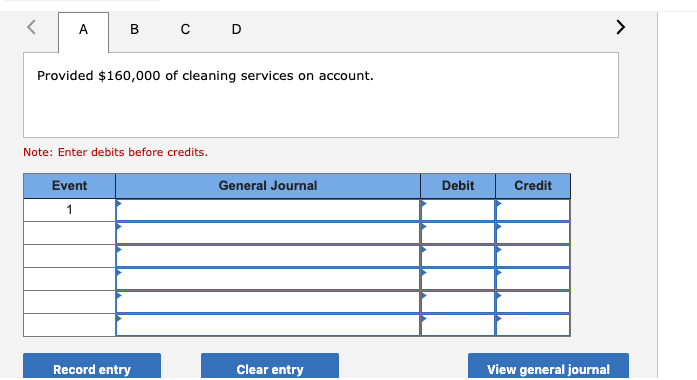

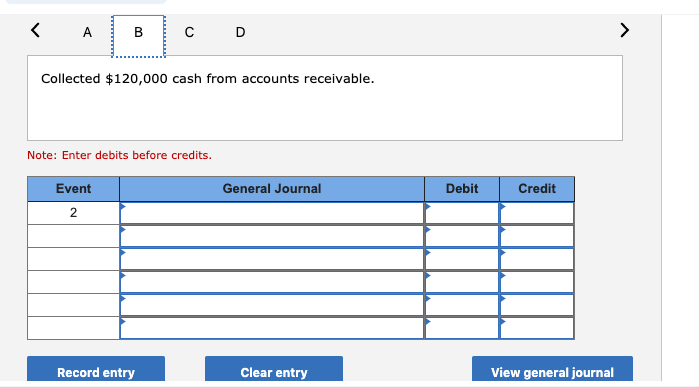

- Collected $120,000 cash from accounts receivable.

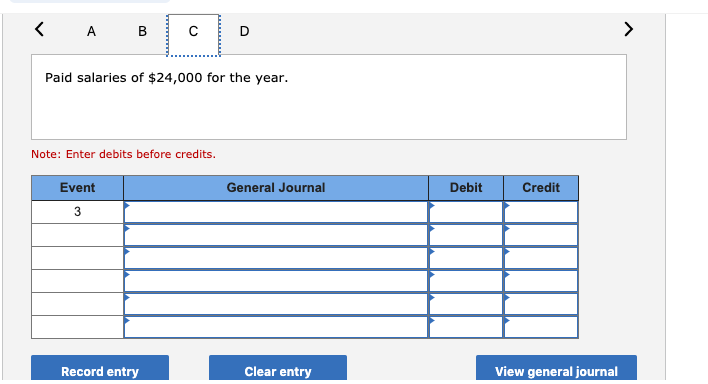

- Paid salaries of $24,000 for the year.

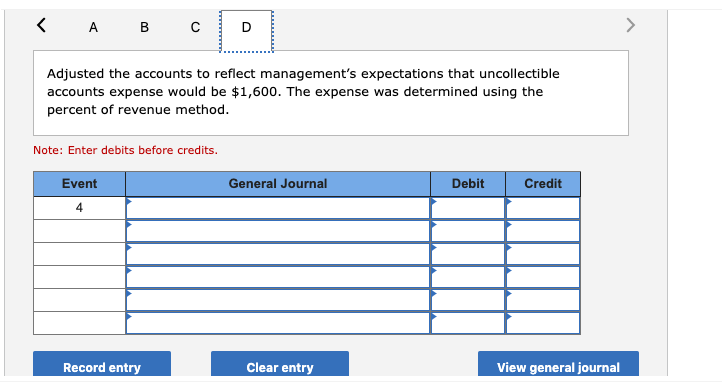

- Adjusted the accounts to reflect managements expectations that uncollectible accounts expense would be $1,600. The expense was determined using the percent of revenue method.

Exercise 7-2A Part a

Required a. Prepare general journal entries for the above events. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started