Answered step by step

Verified Expert Solution

Question

1 Approved Answer

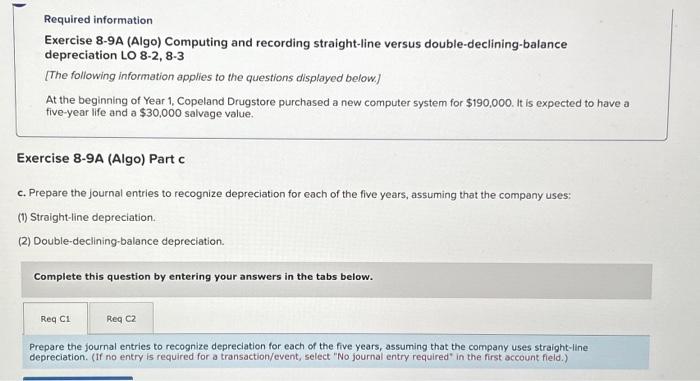

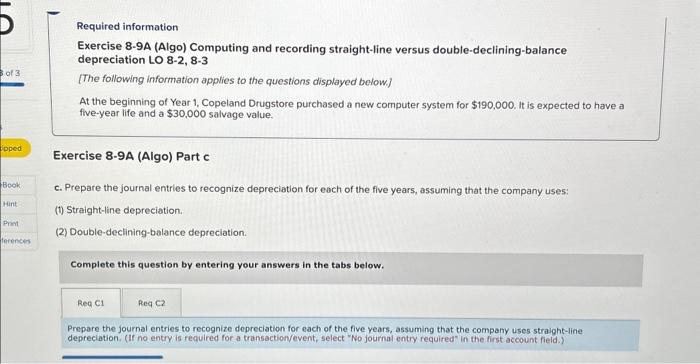

Required information Exercise 8-9A (Algo) Computing and recording straight-line versus double-declining-balance depreciation LO 8-2, 8-3 [The following information applies to the questions displayed below.] At

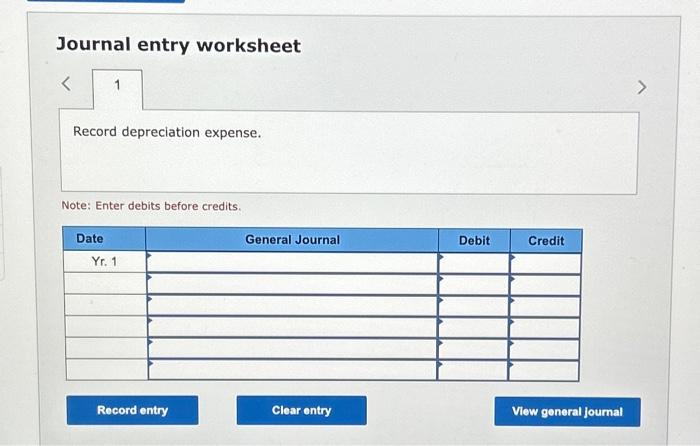

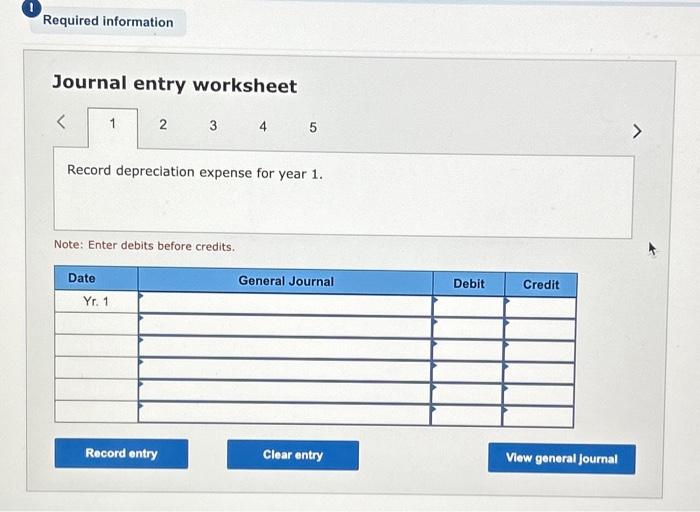

Required information Exercise 8-9A (Algo) Computing and recording straight-line versus double-declining-balance depreciation LO 8-2, 8-3 [The following information applies to the questions displayed below.] At the beginning of Year 1, Copeland Drugstore purchased a new computer system for $190,000. It is expected to have a five-year life and a $30,000 salvage value. Exercise 8-9A (Algo) Part c c. Prepare the journal entries to recognize depreciation for each of the five years, assuming that the company uses: (1) Straight-line depreciation. (2) Double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Req C1 Req C2 Prepare the journal entries to recognize depreciation for each of the five years, assuming that the company uses straight-line depreciation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started