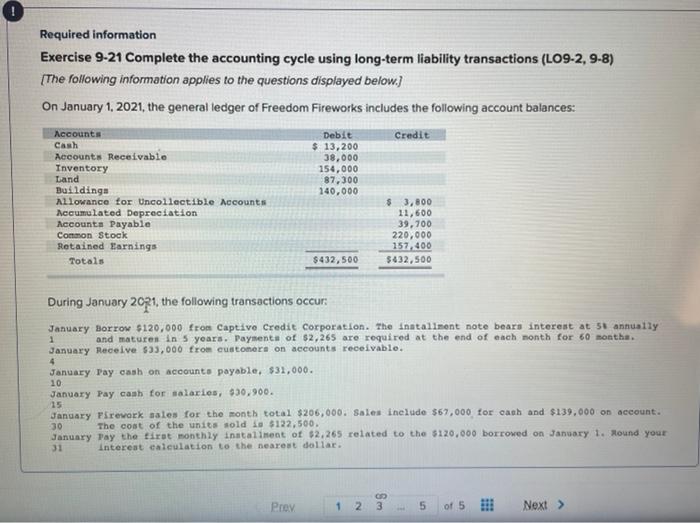

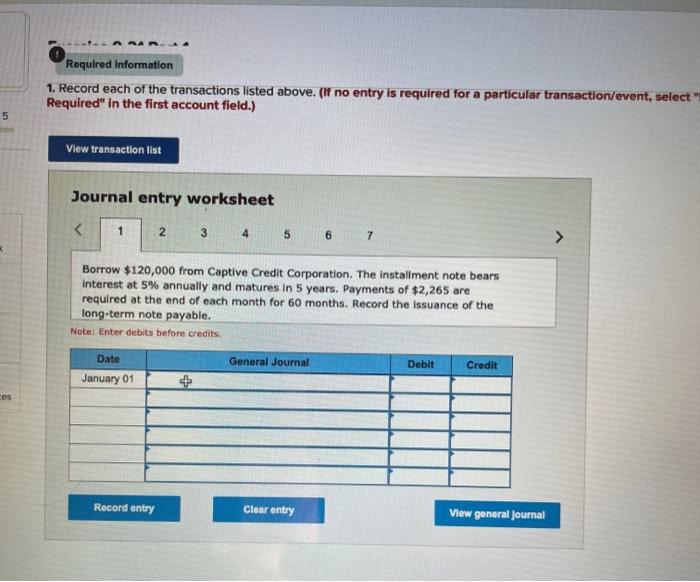

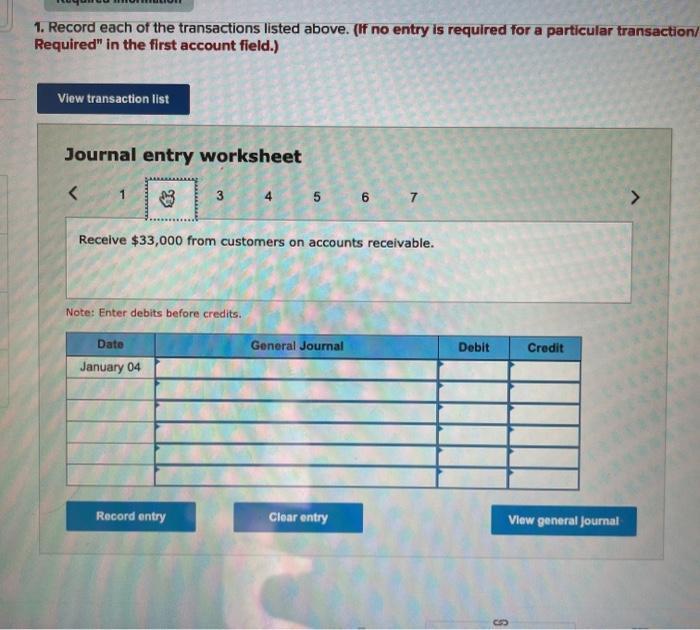

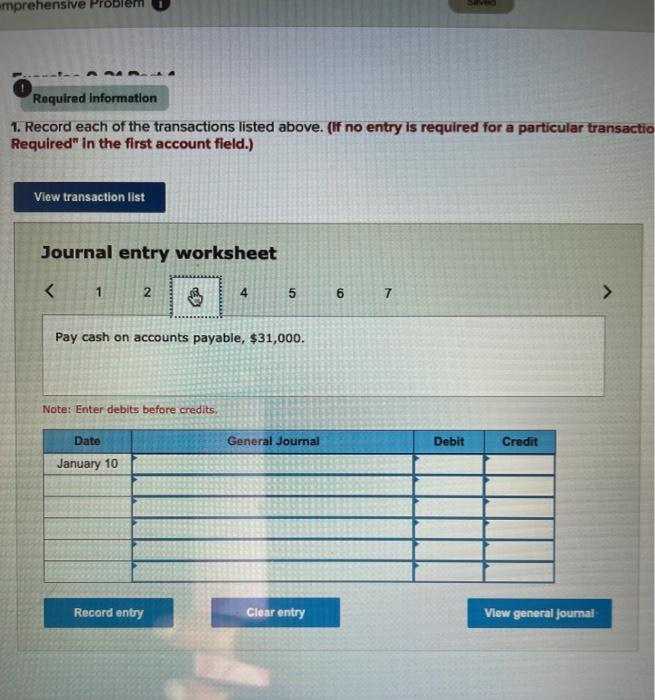

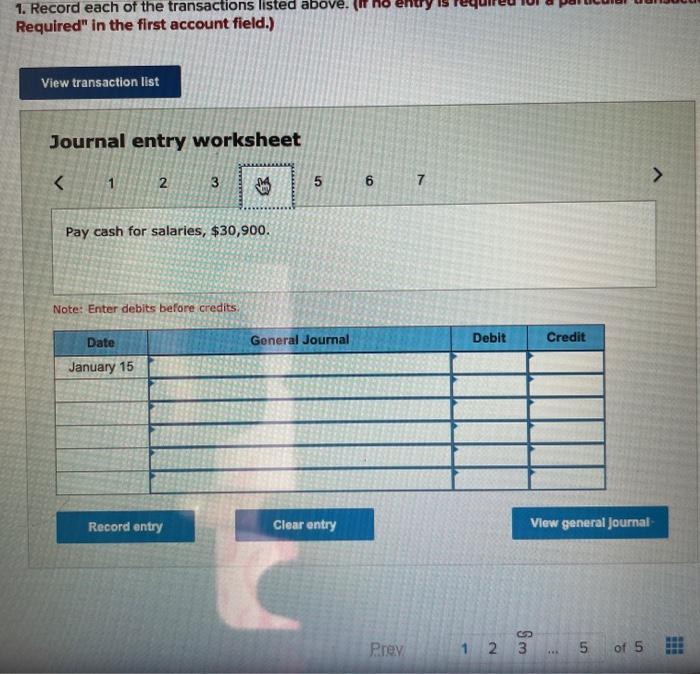

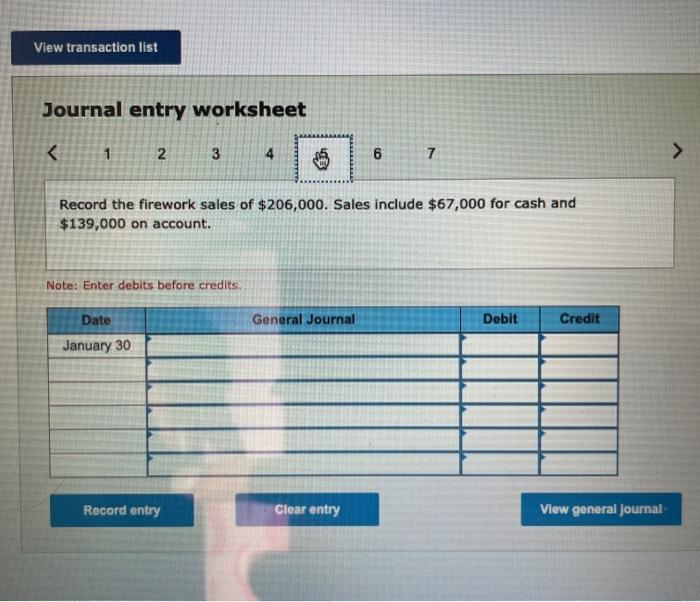

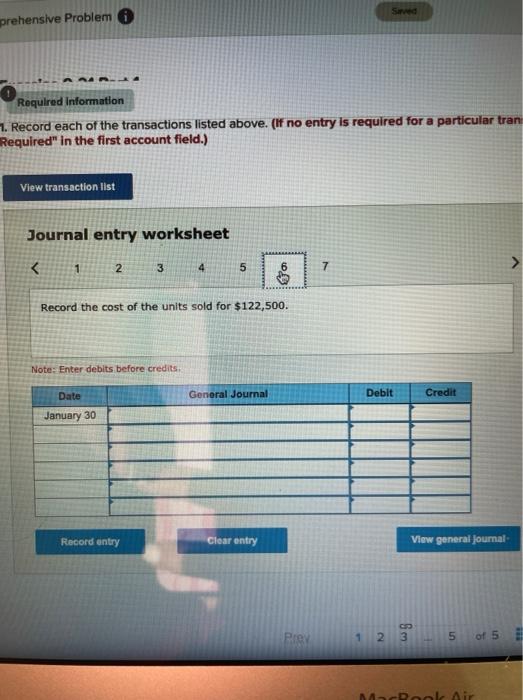

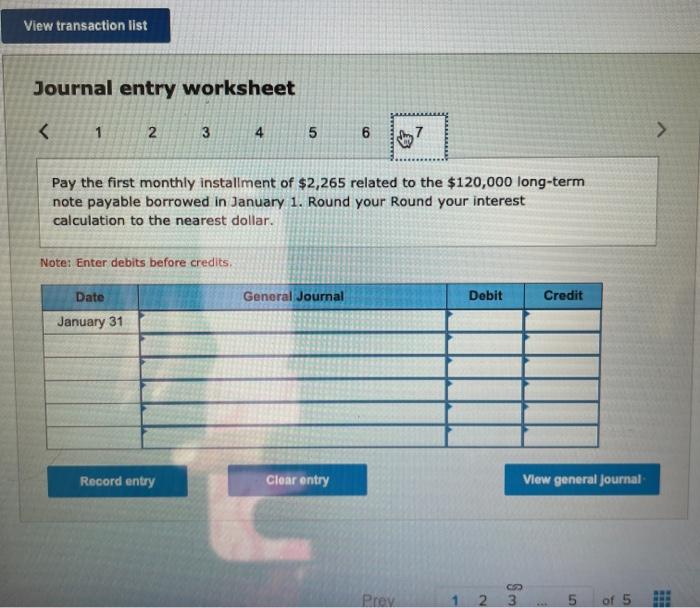

Required information Exercise 9-21 Complete the accounting cycle using long-term liability transactions (L09-2, 9-8) (The following information applies to the questions displayed below.) On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances: Credit Accounts Receivable Inventory 87,300 Accounts Cash Debit $ 13,200 38,000 154,000 140,000 Land Buildings Allowance for Uncollectible Accounts Accumulated Depreciation Accounts Payable Common Stock Retained Earnings Totals $ 3,800 11,600 39,700 220,000 157,400 5432,500 $432,500 1 During January 2021, the following transactions occur: January Borrow $120,000 from Captive Credit Corporation. The installment note bears interest at 51 annually and matures in 5 years. Payments of $2,265 are required at the end of each month for 60 sontha. January Receive $33,000 from customers on accounts receivable. 4 January Pay cash on accounts payable, $31,000. 10 January Pay cash for salaries, $50,900. January Pirevark sales for the month total $206,000. Sales include $67,000 for cash and $139.000 on account. The cost of the units sold is $122,500. January pay the tirst monthly installment of $2,265 related to the $120,000 borrowed on January 1. Round your 31 interest calculation to the nearest dollar. Prov 2 3 of 5 !!! Next > Required information 1. Record each of the transactions listed above. (If no entry is required for a particular transaction/event, select " Required" in the first account field.) 5 View transaction list Journal entry worksheet Receive $33,000 from customers on accounts receivable. Note: Enter debits before credits. General Journal Debit Date January 04 Credit Record entry Clear entry View general Journal S emprehensive Prol Required information 1. Record each of the transactions listed above. (if no entry is required for a particular transactio Required" in the first account field.) View transaction list Journal entry worksheet Pay cash on accounts payable, $31,000. Note: Enter debits before credits, Date General Journal Debit Credit January 10 Record entry Clear entry View general journal 1. Record each of the transactions listed above. It Required" in the first account field.) View transaction list Journal entry worksheet Record the firework sales of $206,000. Sales include $67,000 for cash and $139,000 on account. Note: Enter debits before credits. General Journal Debit Credit Date January 30 Record entry Clear entry View general Journal Snea prehensive Problem --A. Required information 1. Record each of the transactions listed above. (if no entry is required for a particular tran Required" in the first account field.) View transaction list Journal entry worksheet