Answered step by step

Verified Expert Solution

Question

1 Approved Answer

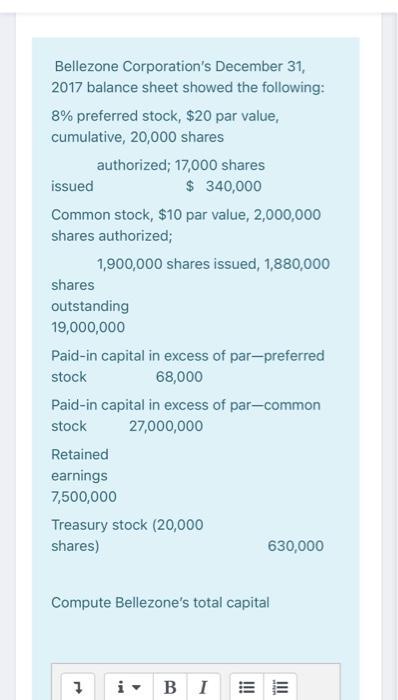

Bellezone Corporation's December 31, 2017 balance sheet showed the following: 8% preferred stock, $20 par value, cumulative, 20,000 shares authorized; 17,000 shares $ 340,000

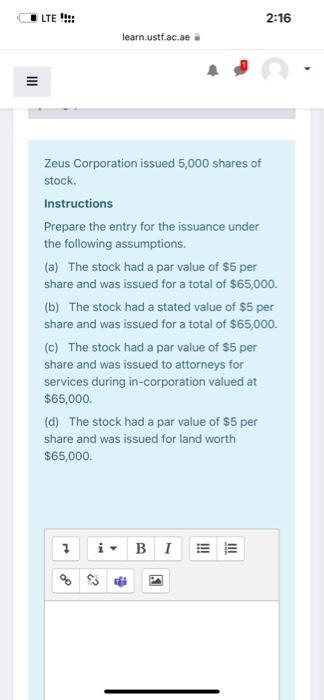

Bellezone Corporation's December 31, 2017 balance sheet showed the following: 8% preferred stock, $20 par value, cumulative, 20,000 shares authorized; 17,000 shares $ 340,000 issued Common stock, $10 par value, 2,000,000 shares authorized; 1,900,000 shares issued, 1,880,000 shares outstanding 19,000,000 Paid-in capital in excess of par-preferred stock 68,000 Paid-in capital in excess of par-common stock 27,000,000 Retained earnings 7,500,000 Treasury stock (20,000 shares) 7 Compute Bellezone's total capital BI 630,000 !!! !!! LTE learn.ustf.ac.ae Zeus Corporation issued 5,000 shares of stock. Instructions Prepare the entry for the issuance under the following assumptions. (a) The stock had a par value of $5 per share and was issued for a total of $65,000. (b) The stock had a stated value of $5 per share and was issued for a total of $65,000. (c) The stock had a par value of $5 per share and was issued to attorneys for services during in-corporation valued at $65,000. (d) The stock had a par value of $5 per share and was issued for land worth $65,000. 7 i BI E !!! 2:16

Step by Step Solution

★★★★★

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Bellezone Corporations Total Capital Preferred Stock Face value 20 per share Issued shares 17000 Tot...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started