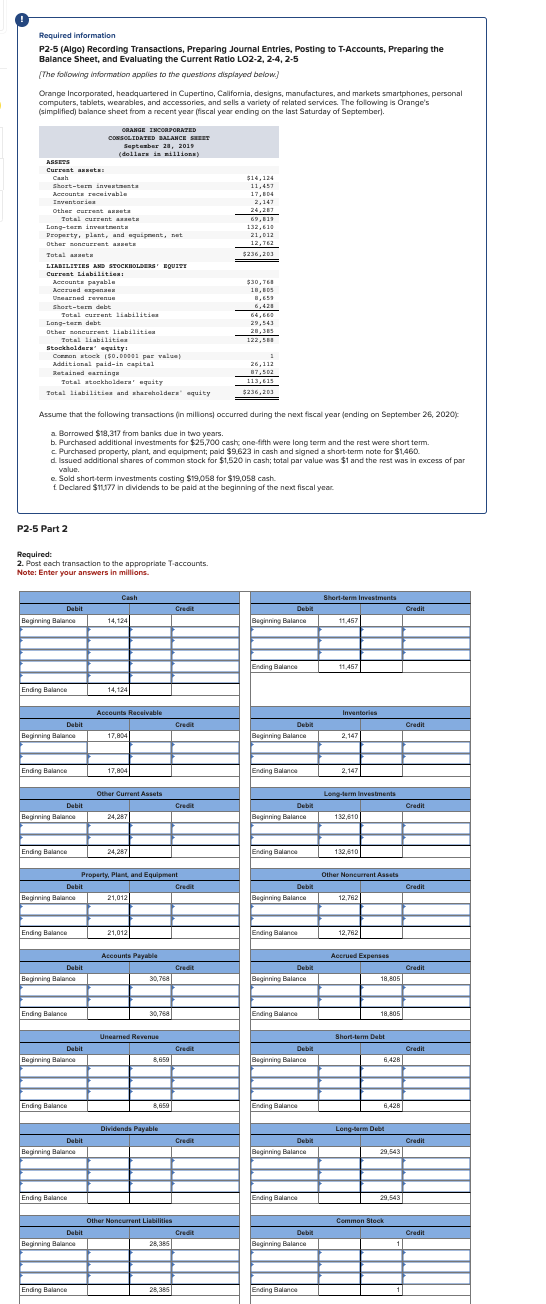

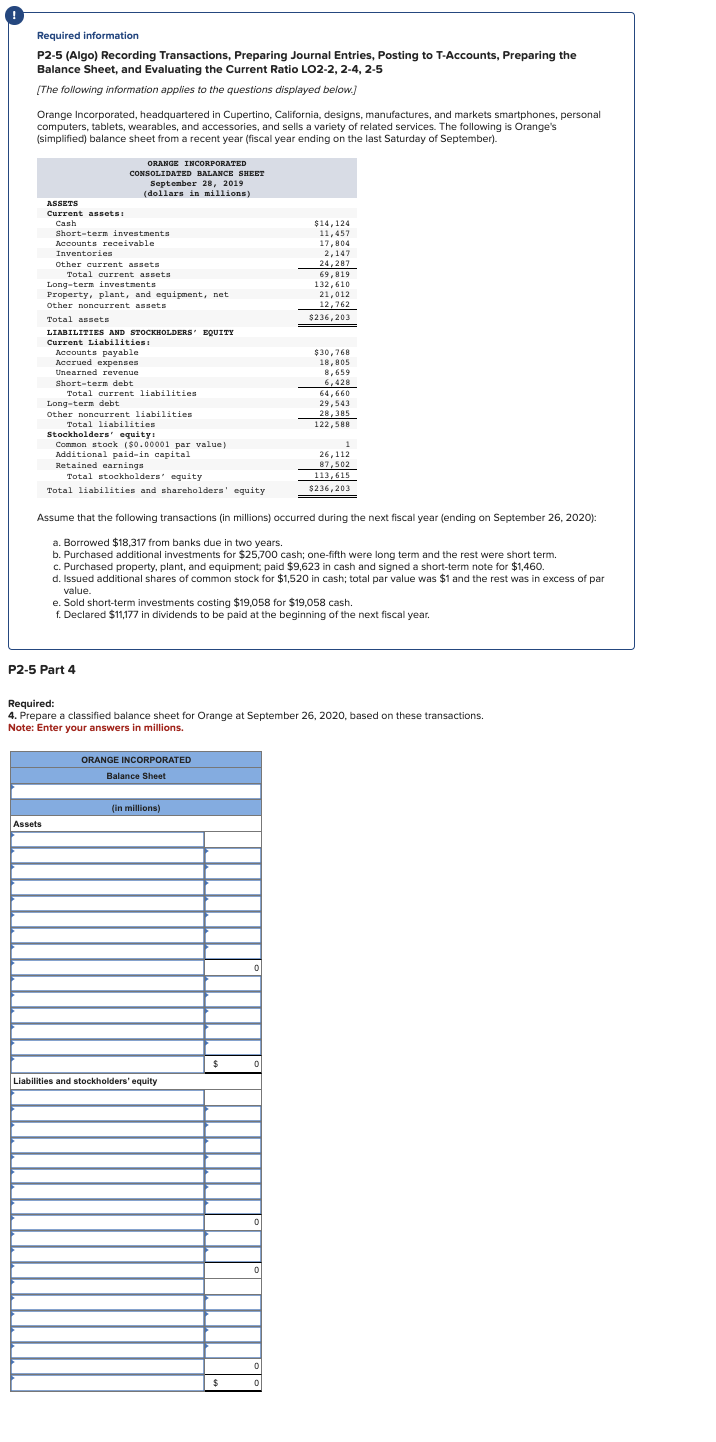

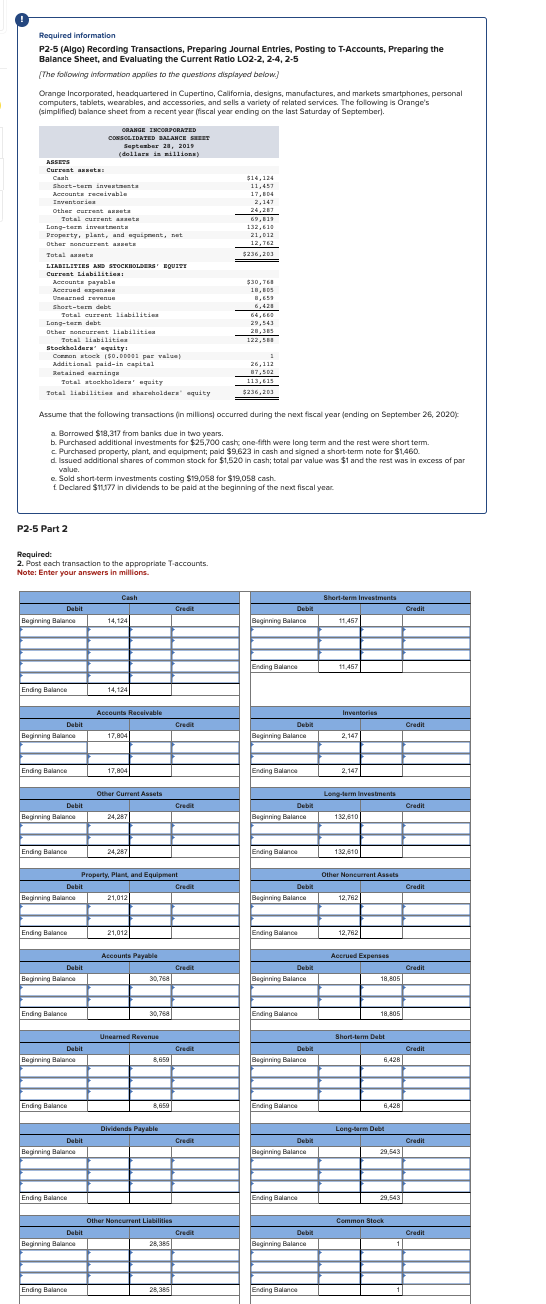

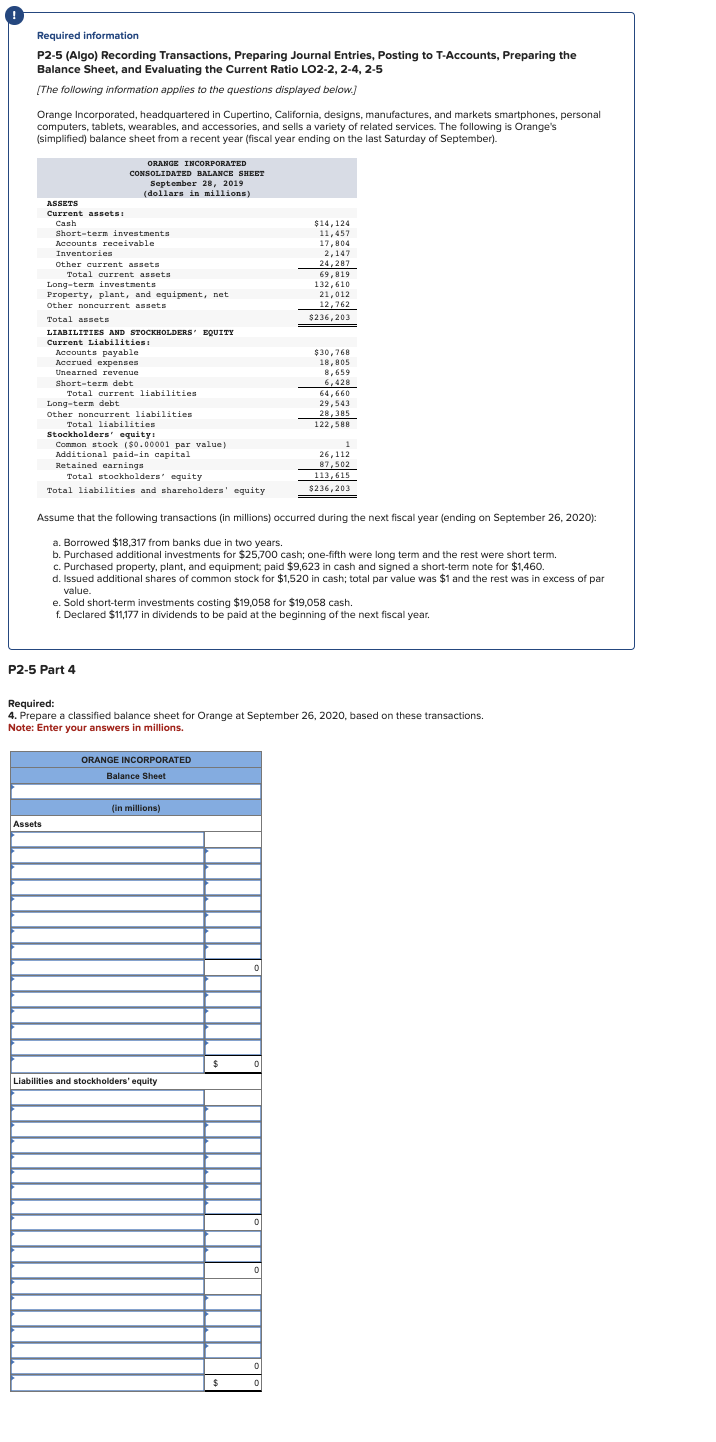

Required information P2-5 (Algo) Recording Transactions, Preparing Journal Entries, Posting to T-Accounts, Preparing the Balance Sheet, and Evaluating the Current Ratio LO2-2, 2-4, 2-5 [The following information applies to the questions dispiaynd beiow.] Orange Incorporated, headquartered in Cupertino, Califomia, designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories, and selts a variety of related serwices. The following is Orange's (simplified) bolance sheet from a recent year (fiscal year ending on the last Saturday of September). Assume that the following transactions (in millions) oncurred during the next fiscal year (ending on September 26,2020 ) a. Barrowed $19,317 from banks due in two years. b. Purchased additional investments for $25,700 casht ane-fifth were long term and the rest were short term. c. Purchased property, plant, and ecuipment; paid $9.623 in cash and signed a short term note for $1,460. d. Issued additional shares of common stock for $1,520 in cash; total par value was $1 and the rest was in cocess of par value. e. Sold short.term irwestments casting $19,058 for $19,059 cash. t Declared $1177 in didends to be paid at the beginning of the next fiscal year. P2-5 Part 2 Required: 2. Post cach transaction to the appropriate T-accounts. Note: Enter wour answers in millions. Required information P2-5 (Algo) Recording Transactions, Preparing Journal Entries, Posting to T-Accounts, Preparing the Balance Sheet, and Evaluating the Current Ratio LO2-2, 2-4, 2-5 [The following information applies to the questions displayed below.] Orange Incorporated, headquartered in Cupertino, California, designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories, and sells a variety of related services. The following is Orange's (simplified) balance sheet from a recent year (fiscal year ending on the last Saturday of September). Assume that the following transactions (in millions) occurred during the next fiscal year (ending on September 26, 2020): a. Borrowed $18,317 from banks due in two years. b. Purchased additional investments for $25,700 cash; one-fifth were long term and the rest were short term. c. Purchased property, plant, and equipment, paid $9,623 in cash and signed a short-term note for $1,460. d. Issued additional shares of common stock for $1,520 in cash; total par value was $1 and the rest was in excess of par value. e. Sold short-term investments costing $19,058 for $19,058 cash. f. Declared $11,177 in dividends to be paid at the beginning of the next fiscal year. P2-5 Part 4 Required: 4. Prepare a classified balance sheet for Orange at September 26,2020 , based on these transactions. Note: Enter your answers in millions. Required information P2-5 (Algo) Recording Transactions, Preparing Journal Entries, Posting to T-Accounts, Preparing the Balance Sheet, and Evaluating the Current Ratio LO2-2, 2-4, 2-5 [The following information applies to the questions dispiaynd beiow.] Orange Incorporated, headquartered in Cupertino, Califomia, designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories, and selts a variety of related serwices. The following is Orange's (simplified) bolance sheet from a recent year (fiscal year ending on the last Saturday of September). Assume that the following transactions (in millions) oncurred during the next fiscal year (ending on September 26,2020 ) a. Barrowed $19,317 from banks due in two years. b. Purchased additional investments for $25,700 casht ane-fifth were long term and the rest were short term. c. Purchased property, plant, and ecuipment; paid $9.623 in cash and signed a short term note for $1,460. d. Issued additional shares of common stock for $1,520 in cash; total par value was $1 and the rest was in cocess of par value. e. Sold short.term irwestments casting $19,058 for $19,059 cash. t Declared $1177 in didends to be paid at the beginning of the next fiscal year. P2-5 Part 2 Required: 2. Post cach transaction to the appropriate T-accounts. Note: Enter wour answers in millions. Required information P2-5 (Algo) Recording Transactions, Preparing Journal Entries, Posting to T-Accounts, Preparing the Balance Sheet, and Evaluating the Current Ratio LO2-2, 2-4, 2-5 [The following information applies to the questions displayed below.] Orange Incorporated, headquartered in Cupertino, California, designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories, and sells a variety of related services. The following is Orange's (simplified) balance sheet from a recent year (fiscal year ending on the last Saturday of September). Assume that the following transactions (in millions) occurred during the next fiscal year (ending on September 26, 2020): a. Borrowed $18,317 from banks due in two years. b. Purchased additional investments for $25,700 cash; one-fifth were long term and the rest were short term. c. Purchased property, plant, and equipment, paid $9,623 in cash and signed a short-term note for $1,460. d. Issued additional shares of common stock for $1,520 in cash; total par value was $1 and the rest was in excess of par value. e. Sold short-term investments costing $19,058 for $19,058 cash. f. Declared $11,177 in dividends to be paid at the beginning of the next fiscal year. P2-5 Part 4 Required: 4. Prepare a classified balance sheet for Orange at September 26,2020 , based on these transactions. Note: Enter your answers in millions