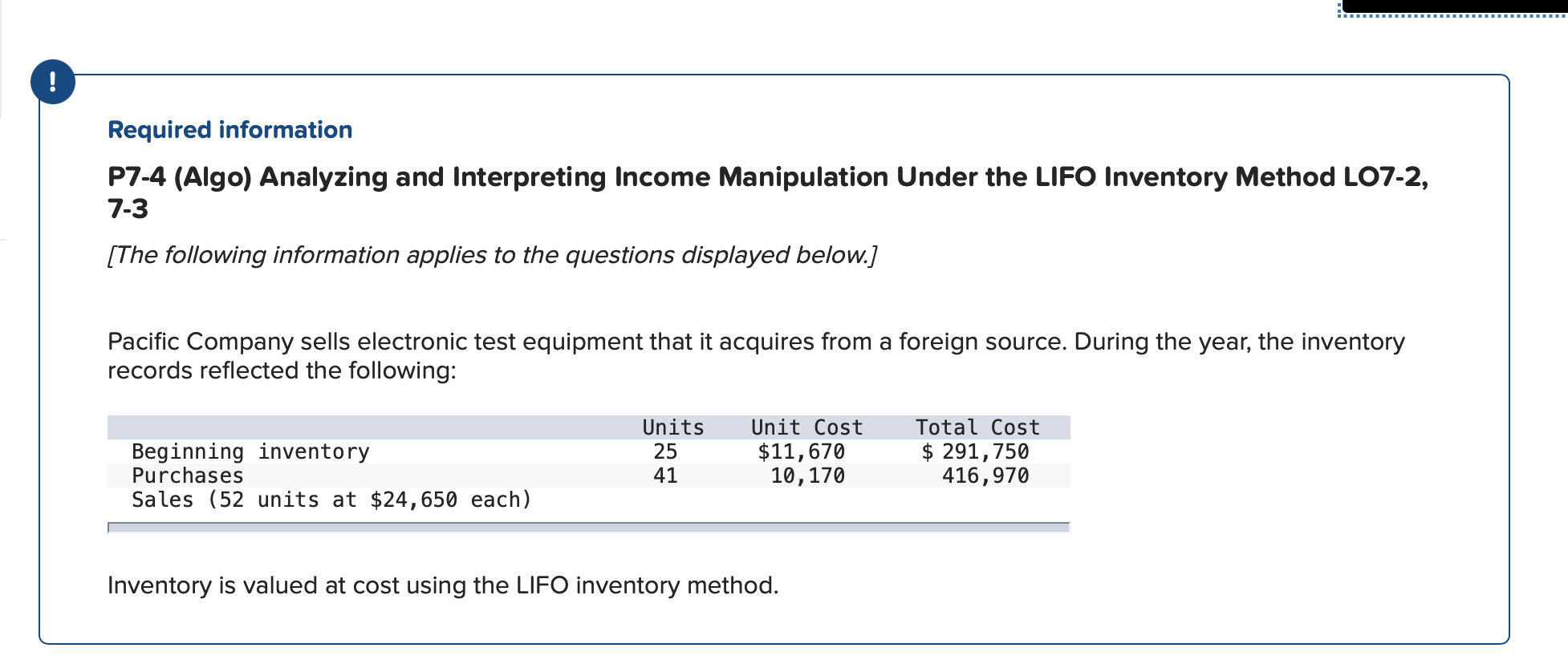

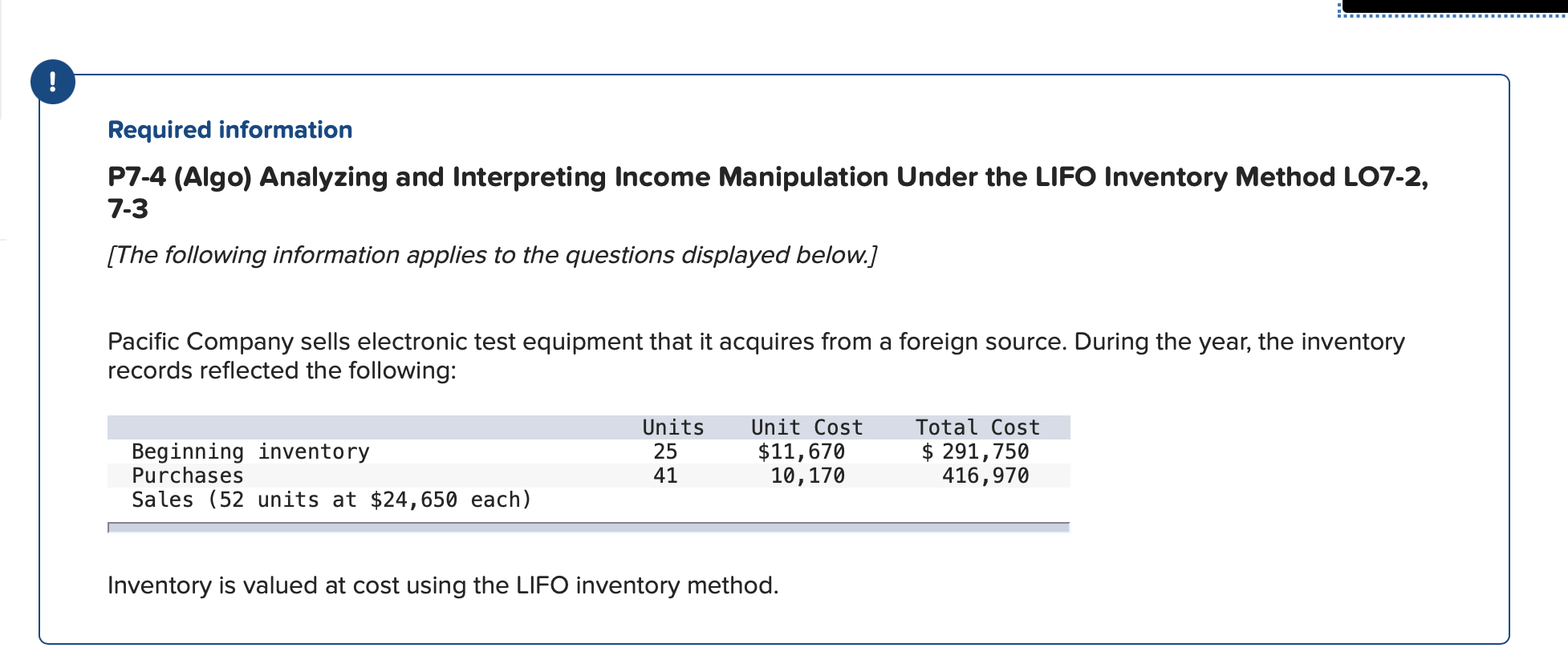

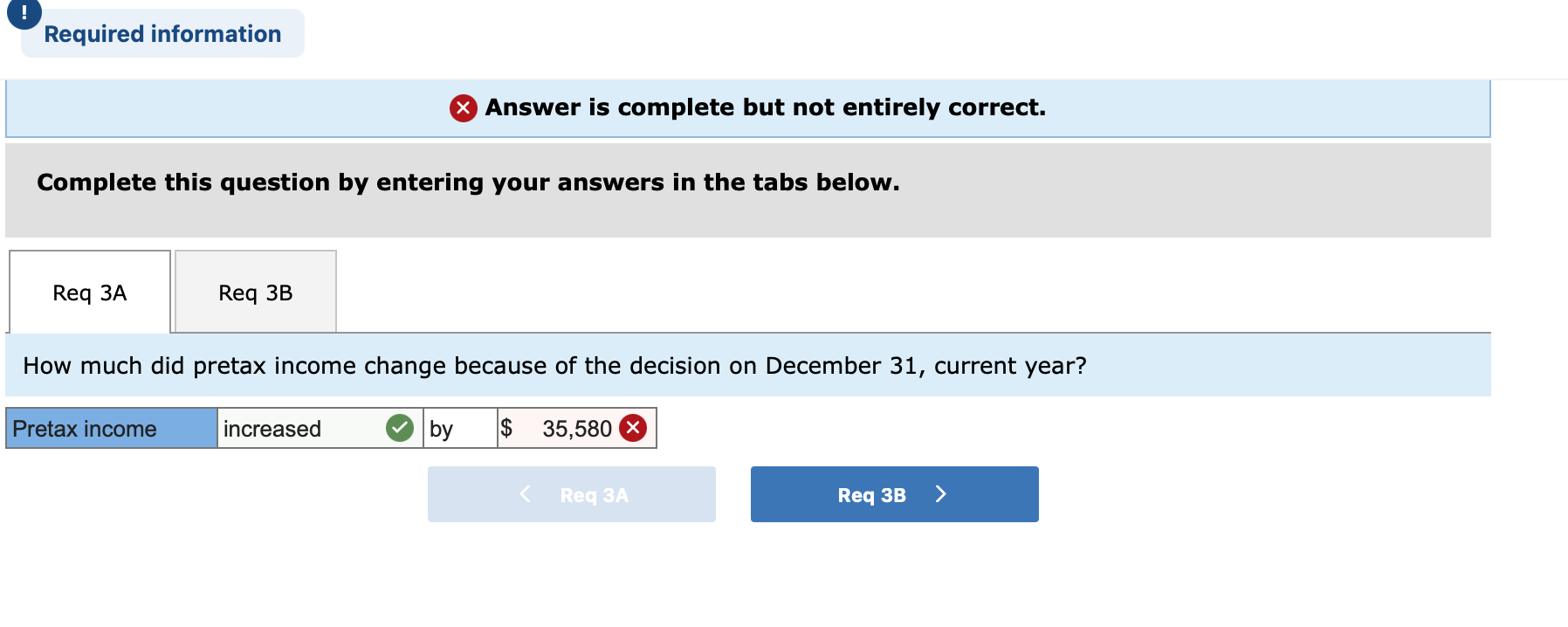

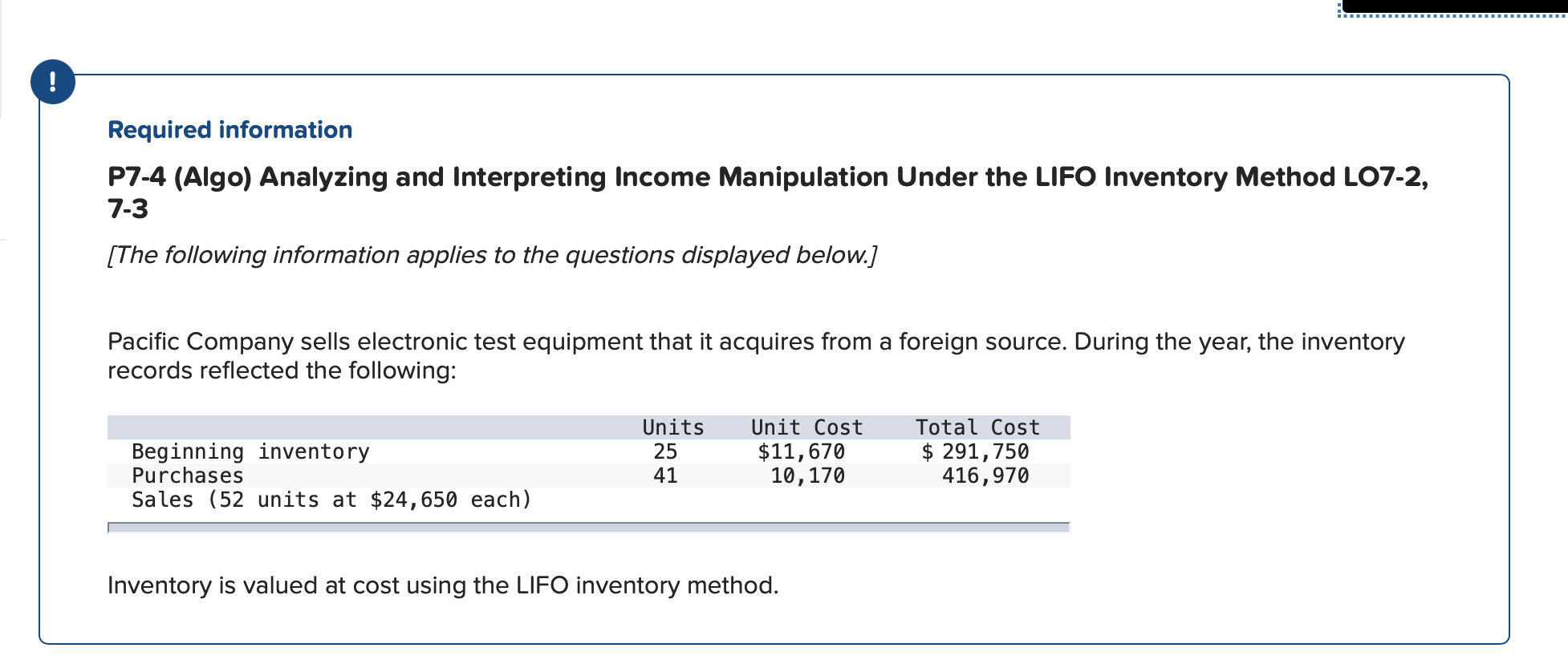

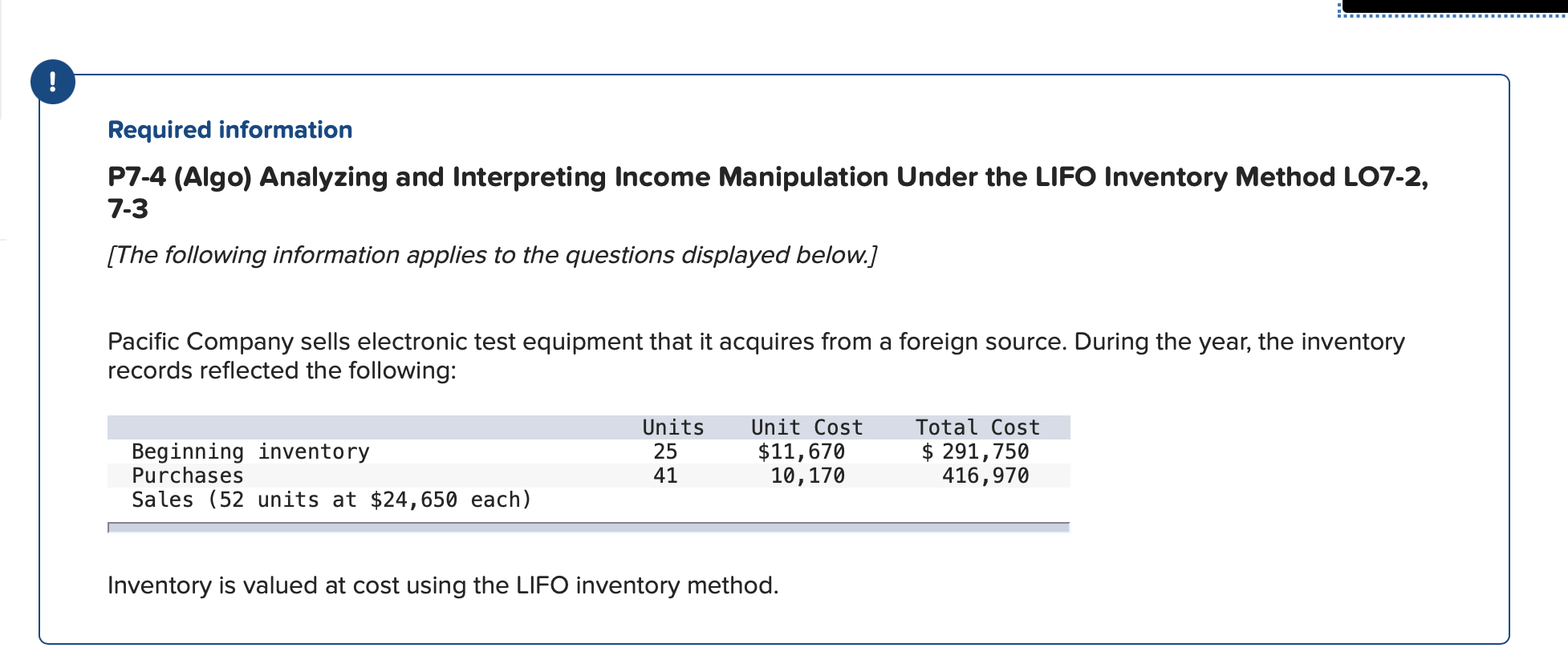

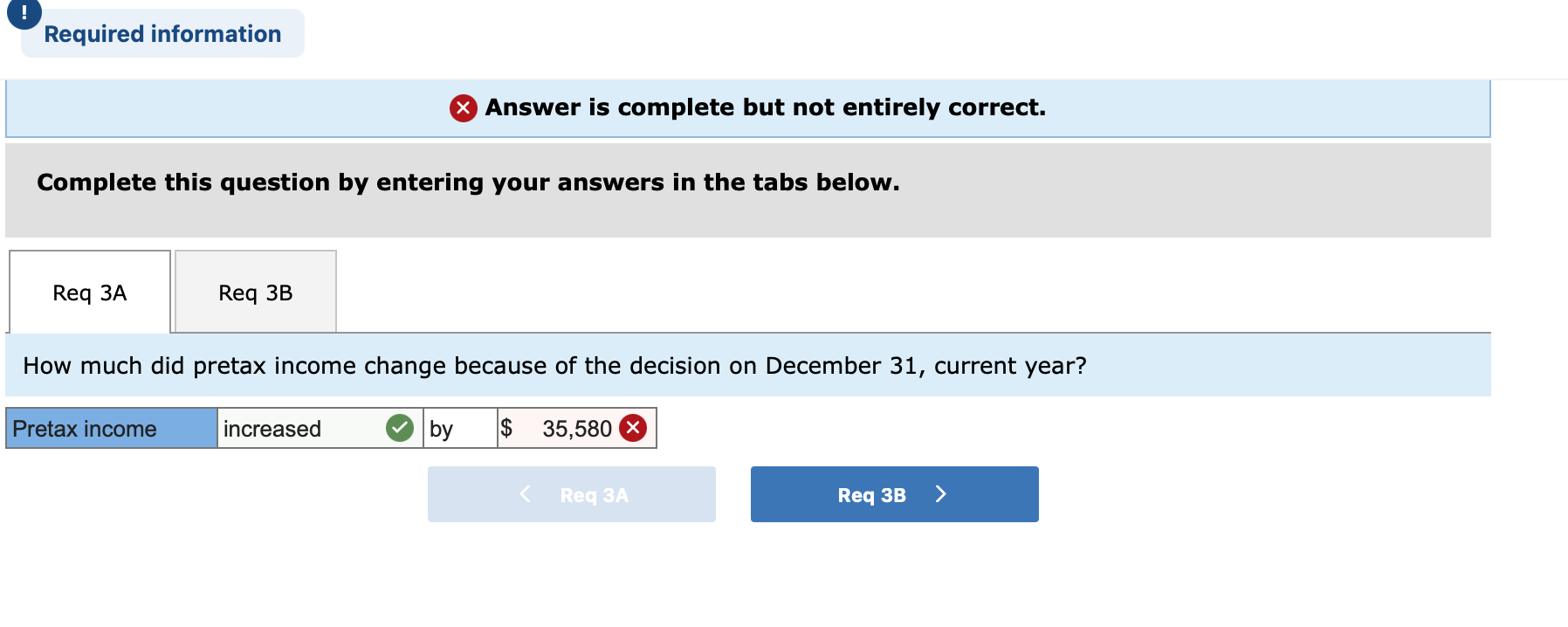

! Required information P7-4 (Algo) Analyzing and Interpreting Income Manipulation Under the LIFO Inventory Method LO7-2, 7-3 [The following information applies to the questions displayed below.] Pacific Company sells electronic test equipment that it acquires from a foreign source. During the year, the inventory records reflected the following: Beginning inventory Purchases Sales (52 units at $24,650 each) Units 25 41 Unit Cost $11,670 10,170 Total Cost $ 291,750 416,970 Inventory is valued at cost using the LIFO inventory method. ! Required information P7-4 (Algo) Analyzing and Interpreting Income Manipulation Under the LIFO Inventory Method LO7-2, 7-3 [The following information applies to the questions displayed below.] Pacific Company sells electronic test equipment that it acquires from a foreign source. During the year, the inventory records reflected the following: Beginning inventory Purchases Sales (52 units at $24,650 each) Units 25 41 Unit Cost $11,670 10,170 Total Cost $ 291,750 416,970 Inventory is valued at cost using the LIFO inventory method. ! Required information X Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req Req 3B How much did pretax income change because of the decision on December 31, current year? Pretax income increased by $ 35,580 Req 3A Req 3B > ! Required information P7-4 (Algo) Analyzing and Interpreting Income Manipulation Under the LIFO Inventory Method LO7-2, 7-3 [The following information applies to the questions displayed below.] Pacific Company sells electronic test equipment that it acquires from a foreign source. During the year, the inventory records reflected the following: Beginning inventory Purchases Sales (52 units at $24,650 each) Units 25 41 Unit Cost $11,670 10,170 Total Cost $ 291,750 416,970 Inventory is valued at cost using the LIFO inventory method. ! Required information P7-4 (Algo) Analyzing and Interpreting Income Manipulation Under the LIFO Inventory Method LO7-2, 7-3 [The following information applies to the questions displayed below.] Pacific Company sells electronic test equipment that it acquires from a foreign source. During the year, the inventory records reflected the following: Beginning inventory Purchases Sales (52 units at $24,650 each) Units 25 41 Unit Cost $11,670 10,170 Total Cost $ 291,750 416,970 Inventory is valued at cost using the LIFO inventory method. ! Required information X Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req Req 3B How much did pretax income change because of the decision on December 31, current year? Pretax income increased by $ 35,580 Req 3A Req 3B >