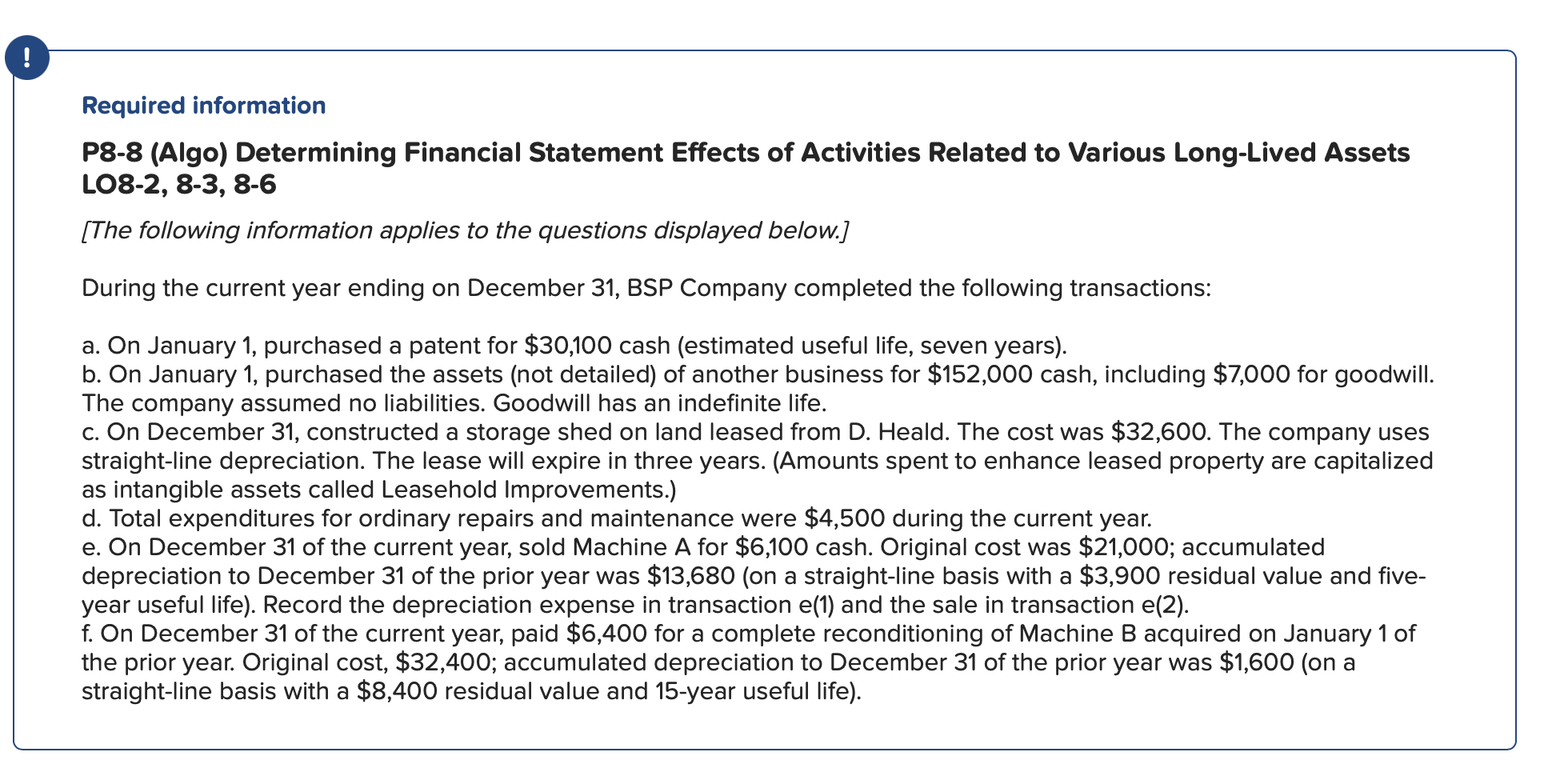

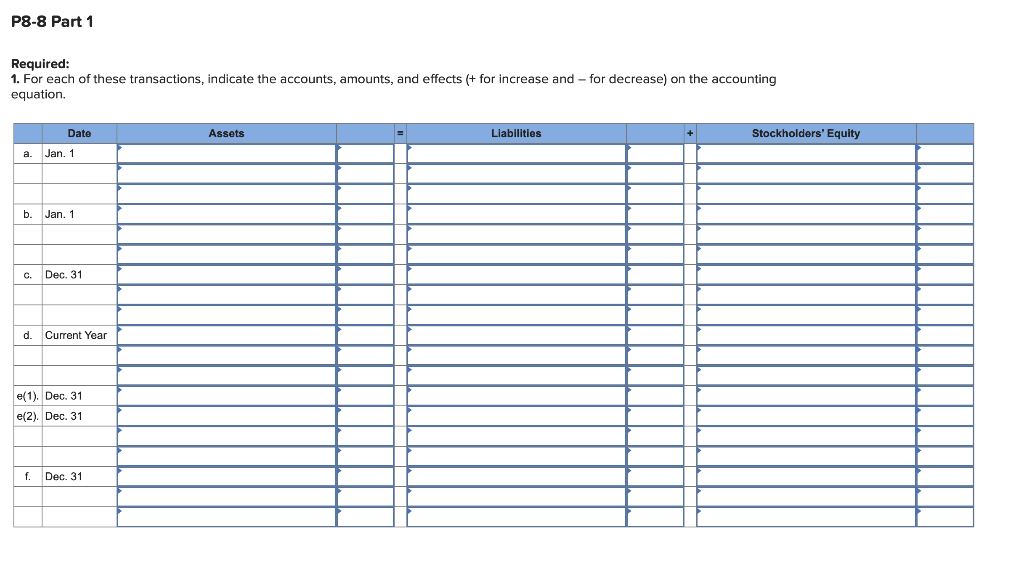

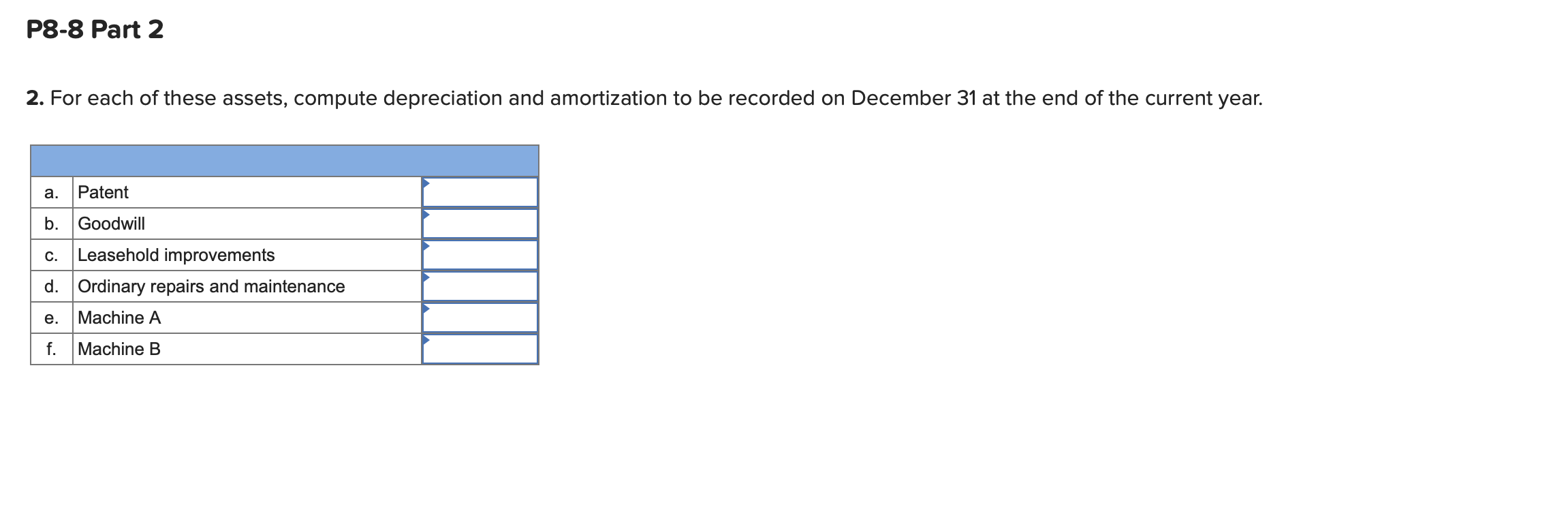

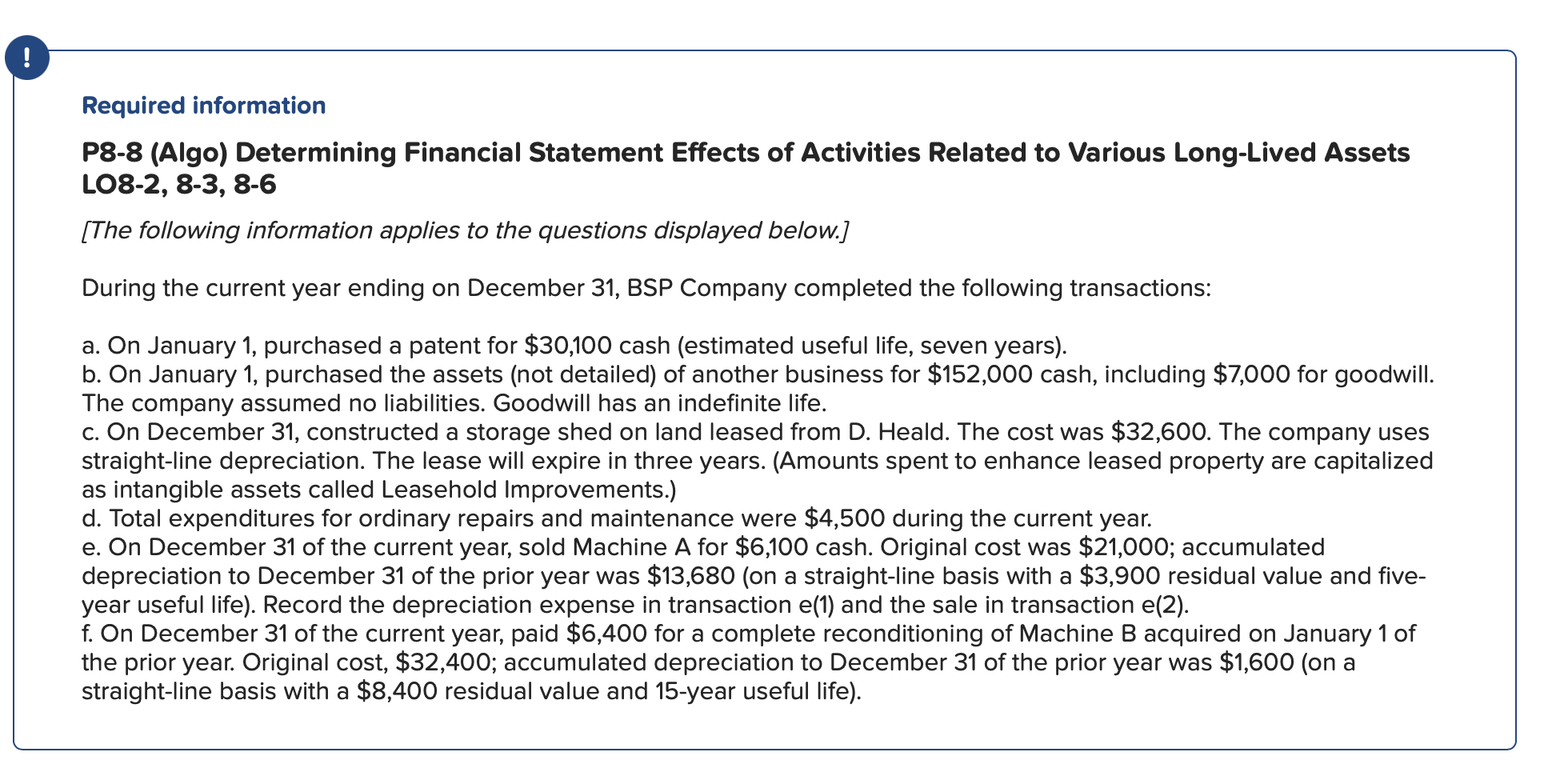

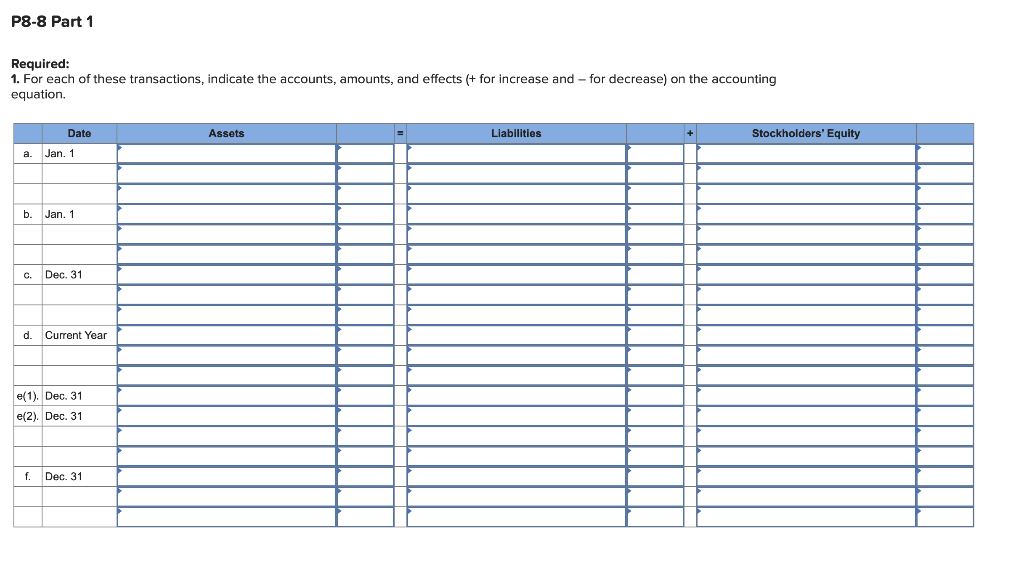

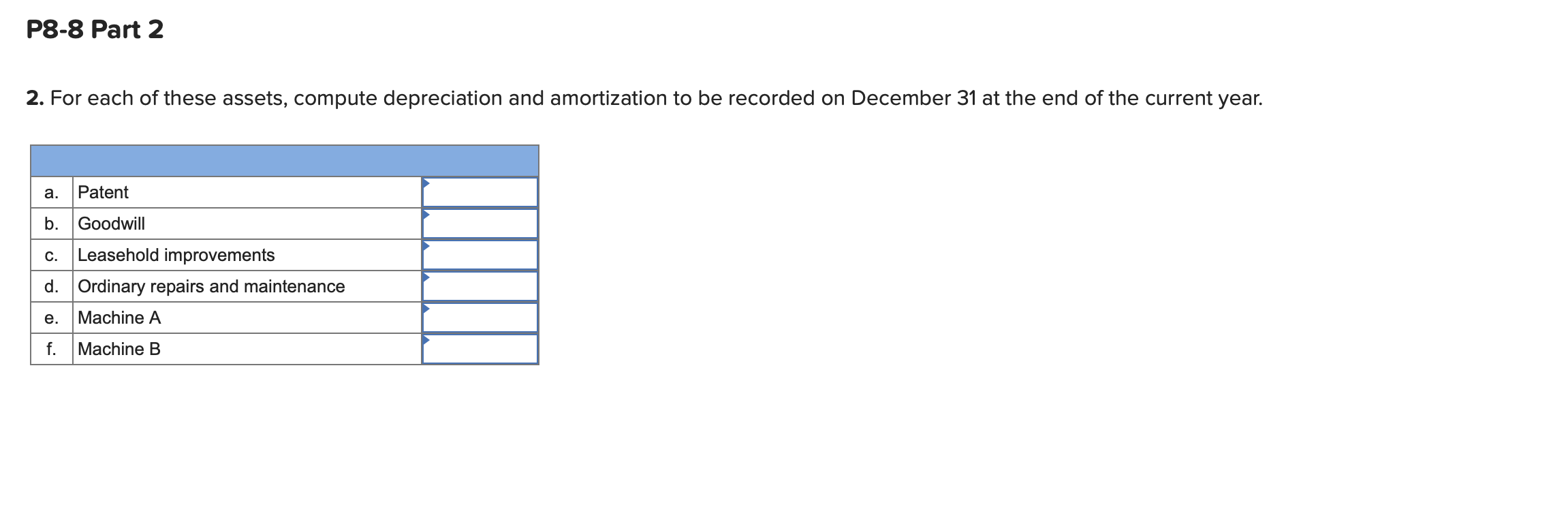

Required information P8-8 (Algo) Determining Financial Statement Effects of Activities Related to Various Long-Lived Assets LO8-2, 8-3, 8-6 [The following information applies to the questions displayed below.] During the current year ending on December 31, BSP Company completed the following transactions: a. On January 1, purchased a patent for $30,100 cash (estimated useful life, seven years). b. On January 1, purchased the assets (not detailed) of another business for $152,000 cash, including $7,000 for goodwill. The company assumed no liabilities. Goodwill has an indefinite life. c. On December 31, constructed a storage shed on land leased from D. Heald. The cost was $32,600. The company uses straight-line depreciation. The lease will expire in three years. (Amounts spent to enhance leased property are capitalized as intangible assets called Leasehold Improvements.) d. Total expenditures for ordinary repairs and maintenance were $4,500 during the current year. e. On December 31 of the current year, sold Machine A for $6,100 cash. Original cost was $21,000; accumulated depreciation to December 31 of the prior year was $13,680 (on a straight-line basis with a $3,900 residual value and fiveyear useful life). Record the depreciation expense in transaction e(1) and the sale in transaction e(2). f. On December 31 of the current year, paid $6,400 for a complete reconditioning of Machine B acquired on January 1 of the prior year. Original cost, $32,400; accumulated depreciation to December 31 of the prior year was $1,600 (on a straight-line basis with a $8,400 residual value and 15 -year useful life). Required: 1. For each of these transactions, indicate the accounts, amounts, and effects (+ for increase and - for decrease) on the accounting equation. P8-8 Part 2 2. For each of these assets, compute depreciation and amortization to be recorded on December 31 at the end of the current year. \begin{tabular}{|c|l|l|} \hline \multicolumn{2}{|l|}{} & \\ \hline a. & Patent & \\ \hline b. & Goodwill & \\ \hline c. & Leasehold improvements & \\ \hline d. & Ordinary repairs and maintenance & \\ \hline e. & Machine A & \\ \hline f. & Machine B & \\ \hline \end{tabular}