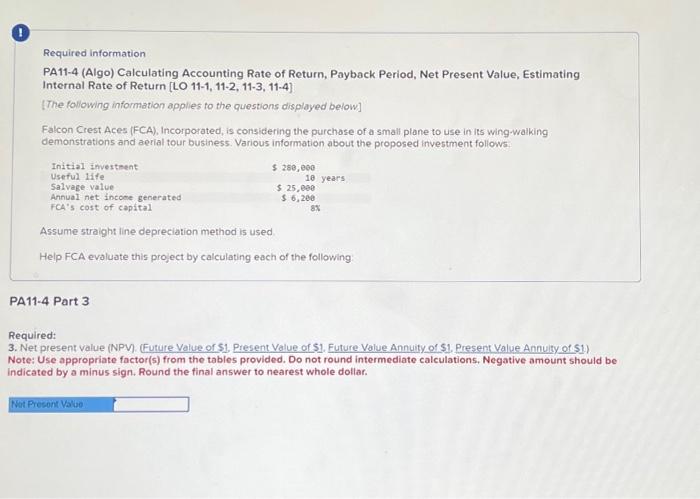

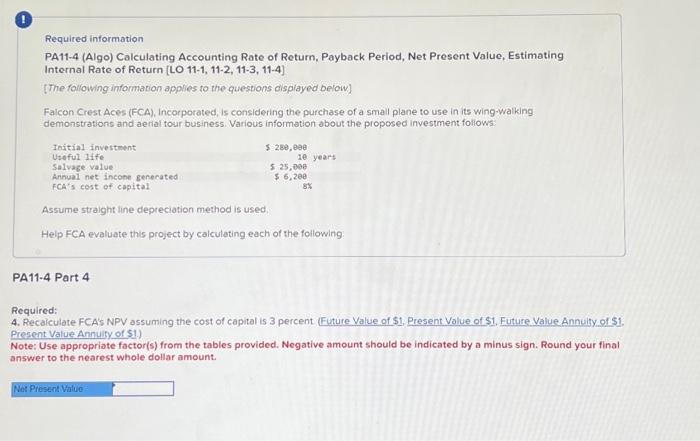

Required information PA11-4 (Algo) Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] [The following information applies to the questions displdyed below] Falcon Crest Aces (FCA), Incorporated, is considering the purchase of a small plane to use in its wing-walking demonstrations and aerial tour business. Various information about the proposed investment follows. Assume straight line depreciation method is used Help FCA evaluate this project by calculating each of the following PA11-4 Part 3 Required: 3. Net present value (NPV). (Future Value of \$1, Present Volue of \$1. Euture Volue Annuity of \$1, Present Value Annuity of \$1) Vote: Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Negative amount should be ndicated by a minus sign. Round the final answer to nearest whole dollar. Required information PA11-4 (Algo) Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] [The following information applies to the questions displayed below] Faicon Crest Aces (FCA), incorporated, is considering the purchase of a small plane to use in its wing-walking demonstrations and aetial tour business. Various information about the proposed investment foliows Assume straight line depreciation method is used. Help FCA evaluate this project by calculating each of the following: PA11.4 Part 4 Required: 4. Recaiculate FCA's NPV assuming the cost of capital is 3 percent (Future Value of S1. Present Volue of \$1. Future Value Annuisy of \$1. Present Value Annulfy of 51.) Note: Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Round your final answer to the nearest whole dollar amount. Required information PA11-4 (Algo) Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] [The following information applies to the questions displdyed below] Falcon Crest Aces (FCA), Incorporated, is considering the purchase of a small plane to use in its wing-walking demonstrations and aerial tour business. Various information about the proposed investment follows. Assume straight line depreciation method is used Help FCA evaluate this project by calculating each of the following PA11-4 Part 3 Required: 3. Net present value (NPV). (Future Value of \$1, Present Volue of \$1. Euture Volue Annuity of \$1, Present Value Annuity of \$1) Vote: Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Negative amount should be ndicated by a minus sign. Round the final answer to nearest whole dollar. Required information PA11-4 (Algo) Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] [The following information applies to the questions displayed below] Faicon Crest Aces (FCA), incorporated, is considering the purchase of a small plane to use in its wing-walking demonstrations and aetial tour business. Various information about the proposed investment foliows Assume straight line depreciation method is used. Help FCA evaluate this project by calculating each of the following: PA11.4 Part 4 Required: 4. Recaiculate FCA's NPV assuming the cost of capital is 3 percent (Future Value of S1. Present Volue of \$1. Future Value Annuisy of \$1. Present Value Annulfy of 51.) Note: Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Round your final answer to the nearest whole dollar amount