Answered step by step

Verified Expert Solution

Question

1 Approved Answer

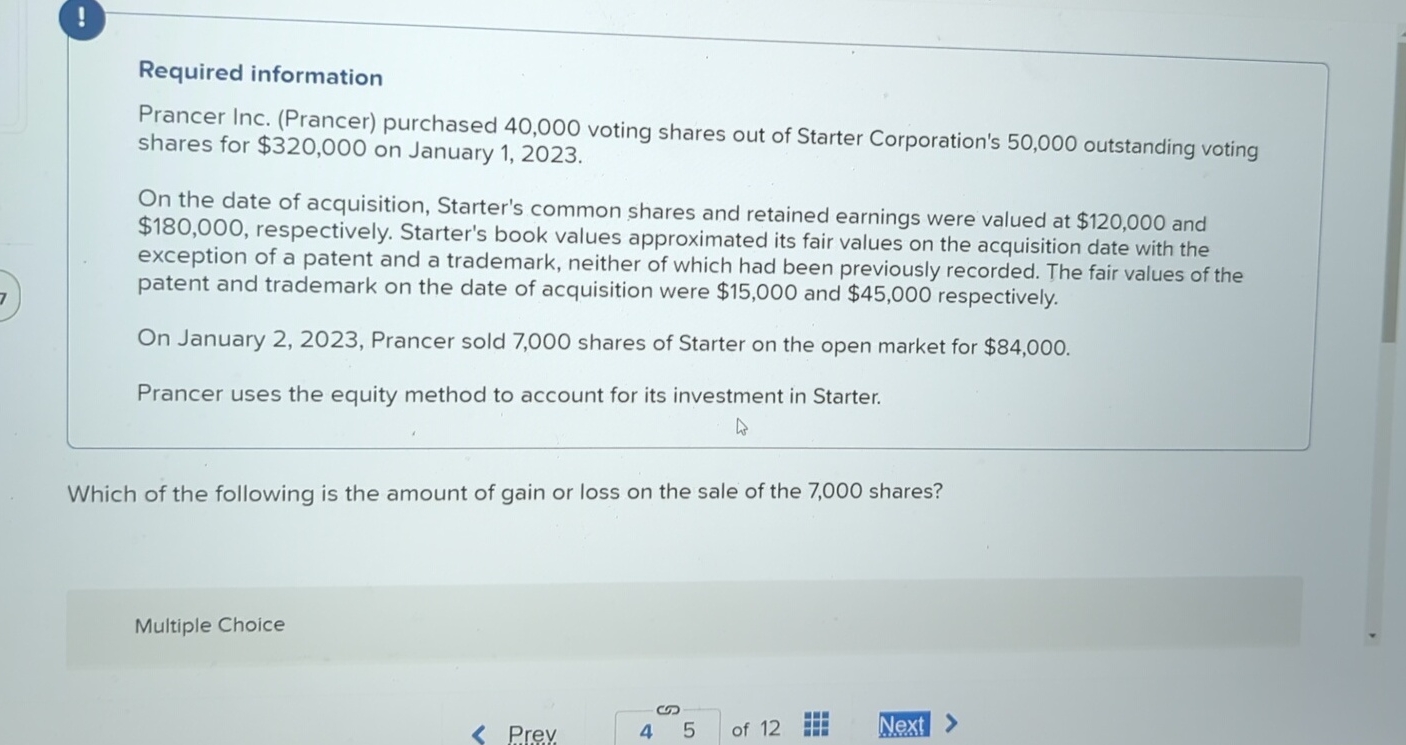

Required information Prancer Inc. ( Prancer ) purchased 4 0 , 0 0 0 voting shares out of Starter Corporation's 5 0 , 0 0

Required information

Prancer Inc. Prancer purchased voting shares out of Starter Corporation's outstanding voting shares for $ on January

On the date of acquisition, Starter's common shares and retained earnings were valued at $ and $ respectively. Starter's book values approximated its fair values on the acquisition date with the exception of a patent and a trademark, neither of which had been previously recorded. The fair values of the patent and trademark on the date of acquisition were $ and $ respectively.

On January Prancer sold shares of Starter on the open market for $

Prancer uses the equity method to account for its investment in Starter.

Which of the following is the amount of gain or loss on the sale of the shares?

Multiple Choice

Prey

of

Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started